UX CASE STUDY

Payment SDK

Transforming the Payment Acceptance SDK Framework for a Seamless Merchant Experience

Introduction

A Voyage of

Transformation

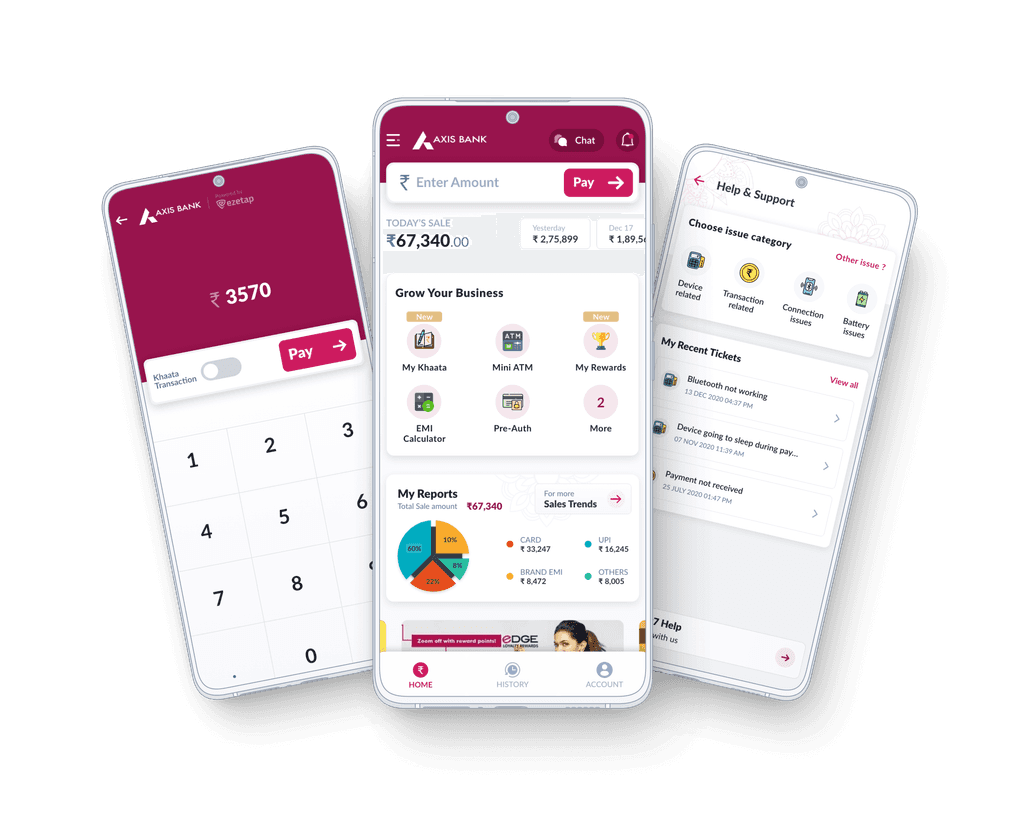

Ezetap, a prominent omni-channel payment solution provider, embarked on a comprehensive redesign of its Payment SDK (Service App) to address user experience challenges and anticipate future advancements in payment technologies.

This case study explores the motivations, design goals, and outcomes of the Ezetap Payment SDK redesign, incorporating additional objectives for a holistic approach.

Client:

Ezetap (Now Razorpay POS)

Duration:

2019

|

3 Months

Platform:

Android Mobile SDK

Team Members:

Sachin Thumbarathy

(Sole Designer)

Industry

Fin-Tech | Payments | PoS

What is Ezetap?

A Glimpse of

Ezetap's Symphony

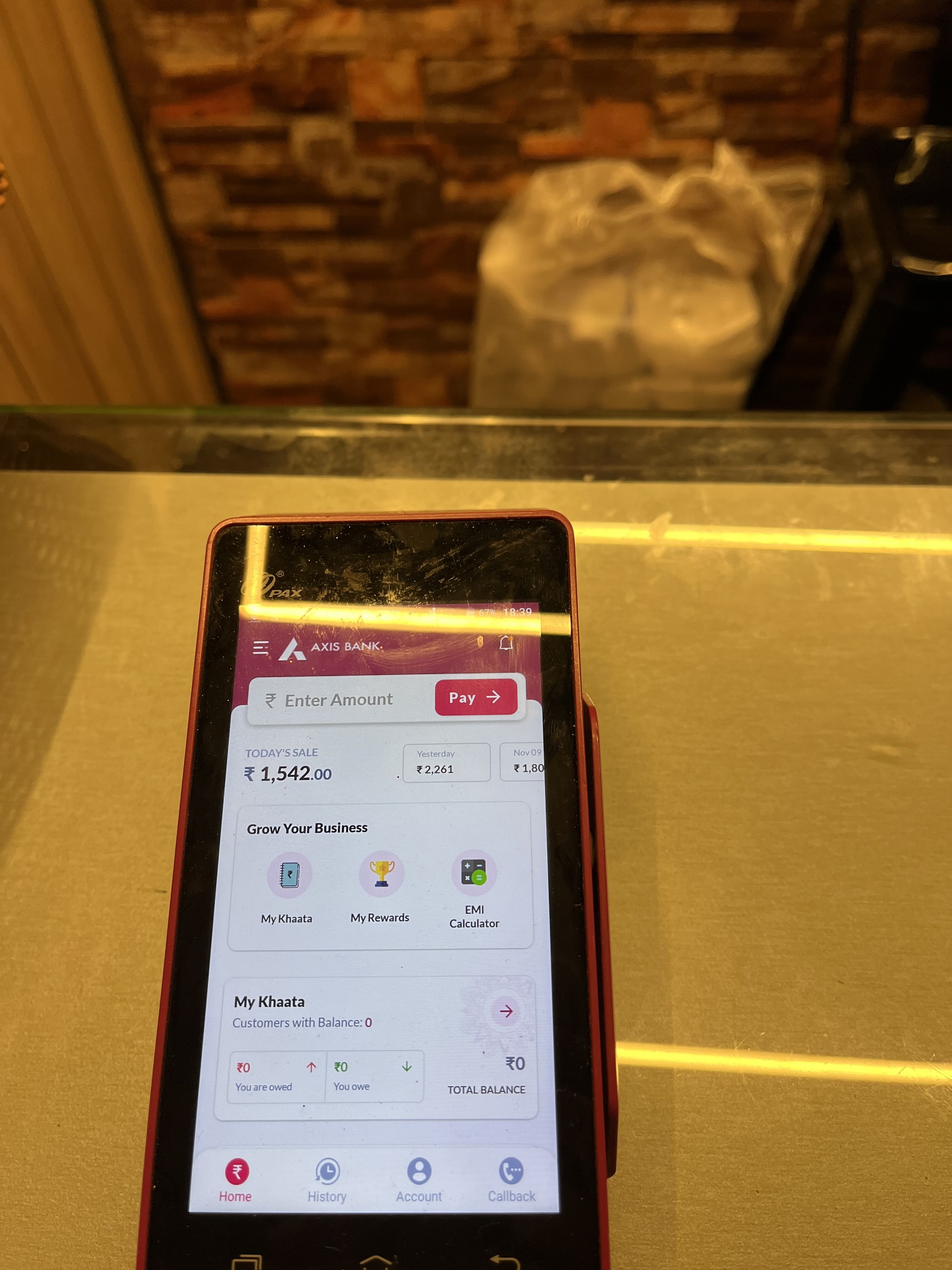

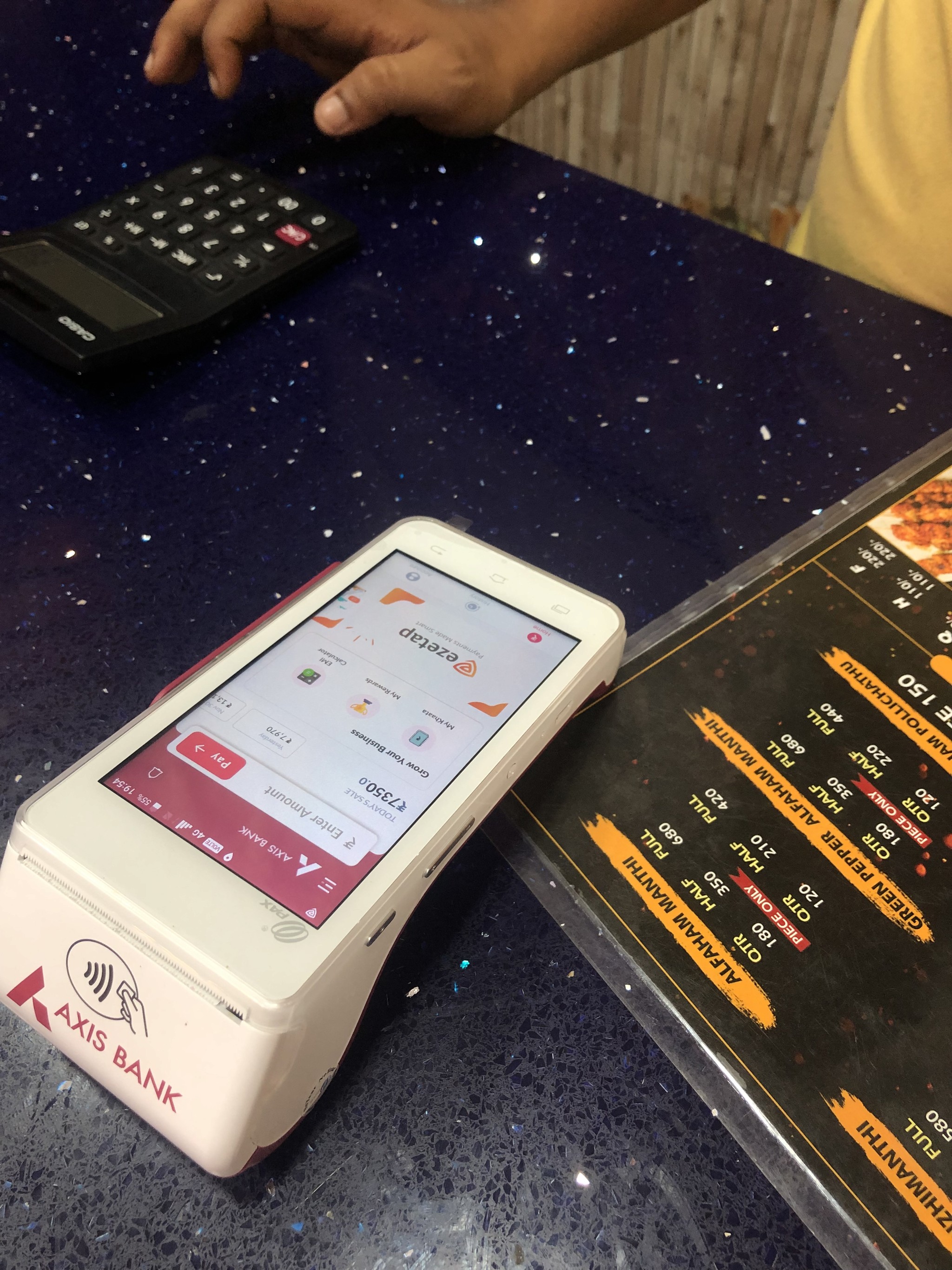

Imagine a stage where 500,000 POS terminals across India and the Middle East create a symphony of smart payments. Ezetap by Razorpay is a smart payment platform designed exclusively for businesses.

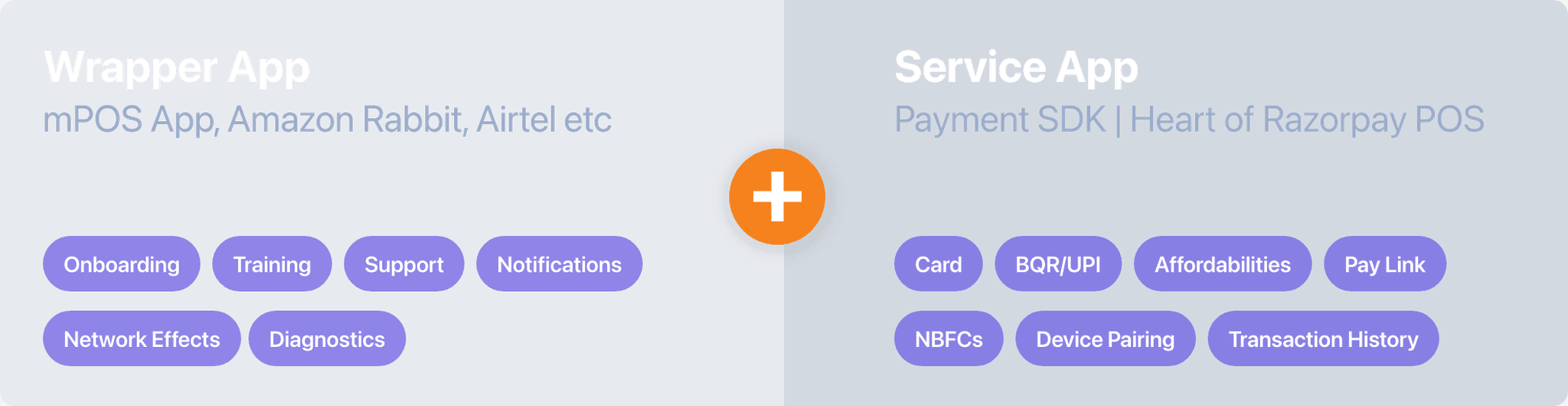

Enter the mPOS app, an avant-garde creation redefining merchant solution on top of offline payment acceptance for merchants.

With a kaleidoscope of payment solutions, ezetap empowers merchants to orchestrate seamless transactions across various channels.

Lets get into the action

Why the Encore?

The Calling of Redesign

The decision to revamp the mPOS-X app stemmed from a crucial realization:

The original version lacked dedicated UX design input, resulting in an unsatisfactory user experience.

The redesign aimed to rectify this by incorporating best UX practices and ensuring user needs and workflows were at the forefront.

It aimed to create a cohesive and user-centered design that enhances every aspect of the app's functionality, ensuring a seamless and enjoyable payment experience.

The decision was clear:

A redesign that would harmonize UX practices, elevate user experience, and weave merchant needs into every pixel.

Design Goals & Objectives

The redesign aimed to achieve the following objectives

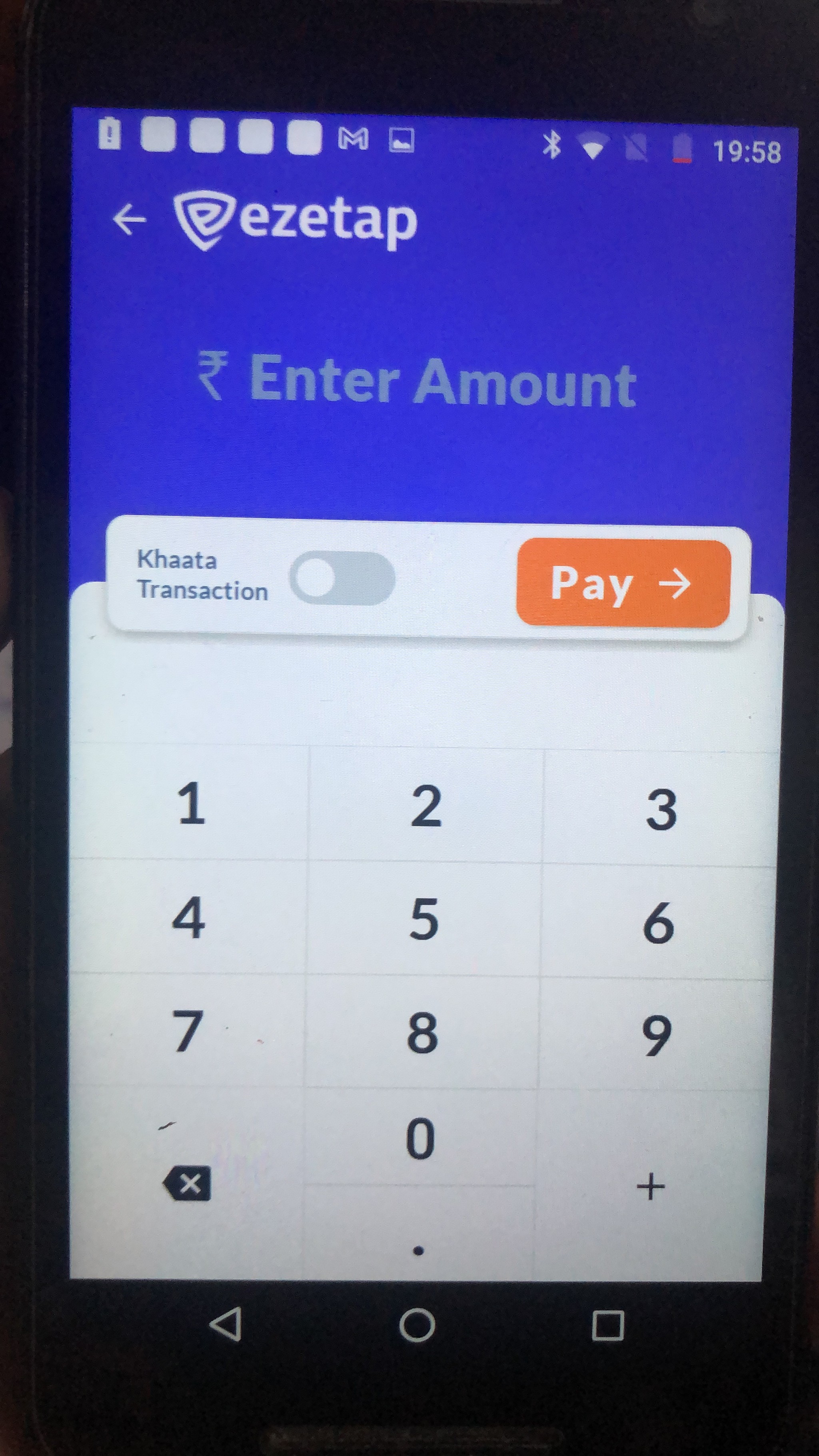

Streamlined User Flow

Reimagine the user flow to simplify the payment acceptance process, ensuring a seamless journey for both merchants and customers.

Future-Ready Framework

Creating a framework adaptable to emerging payment technologies and future features

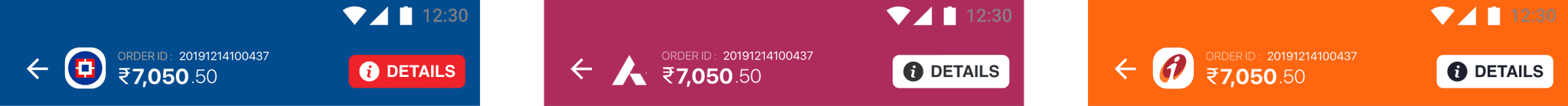

Bank Branding Elegance

Introduce a customisable branding solution for partners to align the app’s appearance with their unique brand identity.

Modernized Identity

Enhance the app’s identity to reflect growth, attract engagement, and entice potential users.

Constraints & Design Considerations

Roadblocks we faced along the way

Addressing challenges like the SDK nature, SaaS model, diverse payment methods, regulations, dual use cases, and varying POS device specifications required a careful balance in design decisions.

SDK Nature

SaaS Personality

Diverse Payment Methods

Regulations & Certification

Bank Branding and Interface Tidiness

Diverse Payment Methods

Designing for dual use cases

Various Screen Sizes

Managing app size and feature prioritisation.

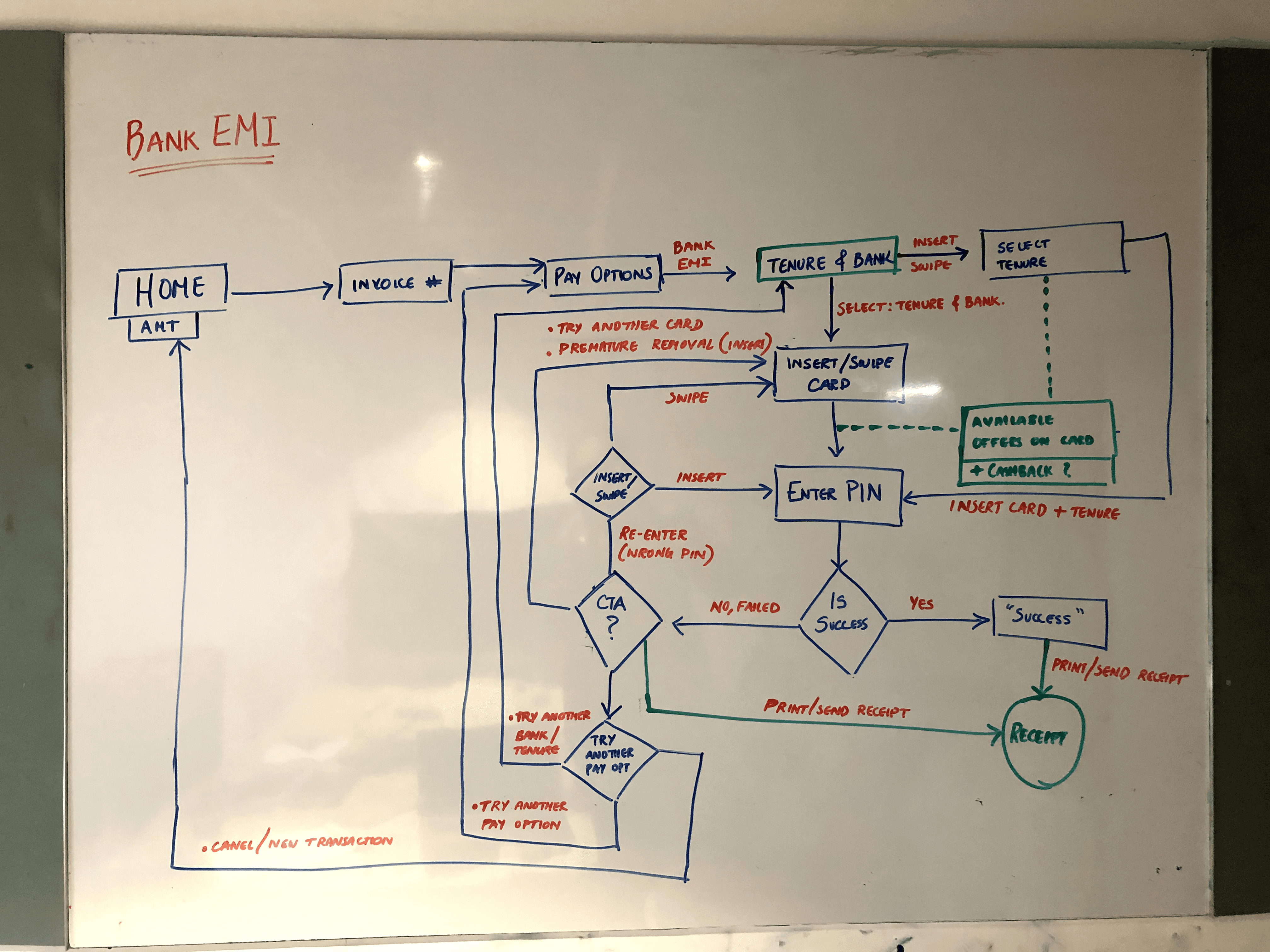

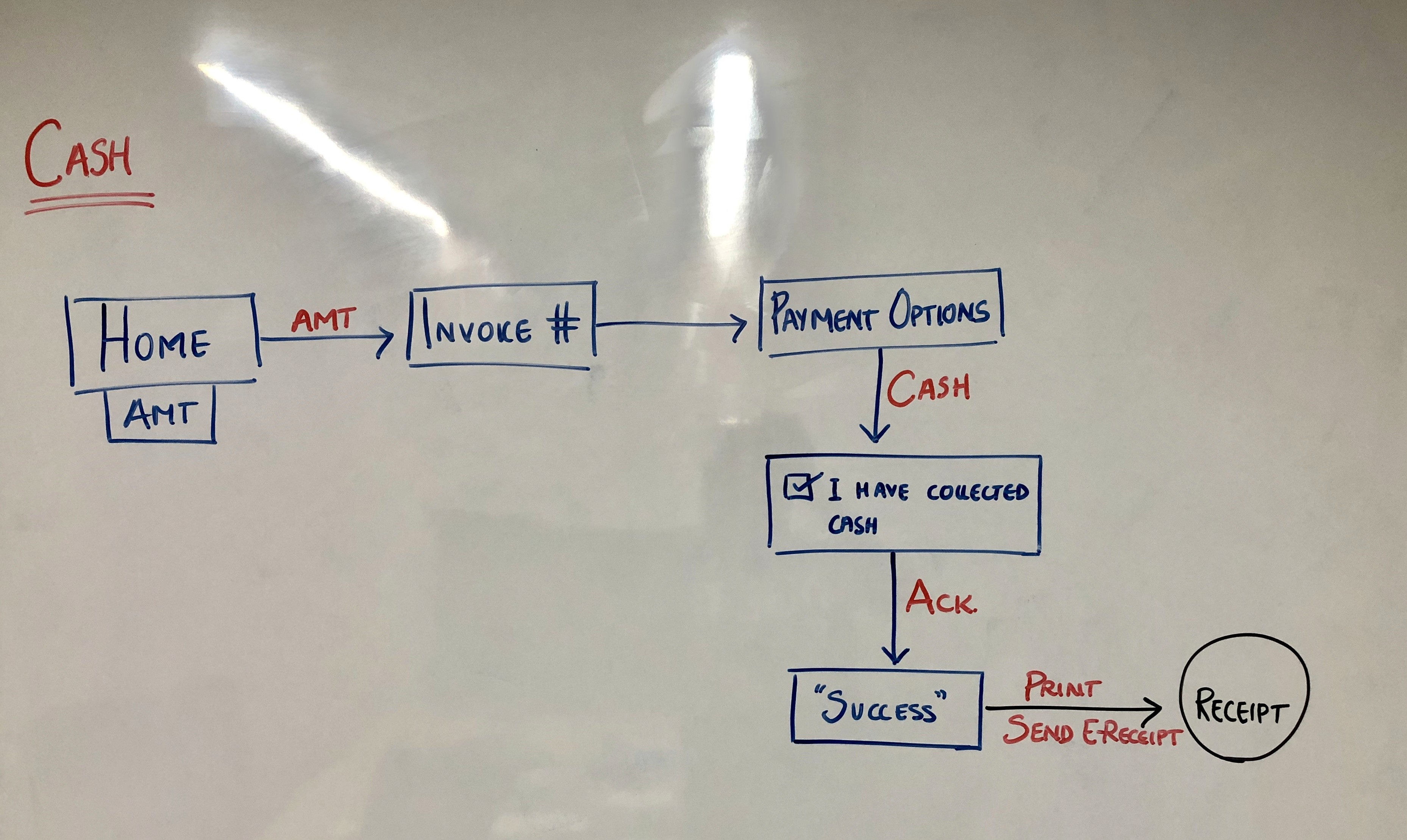

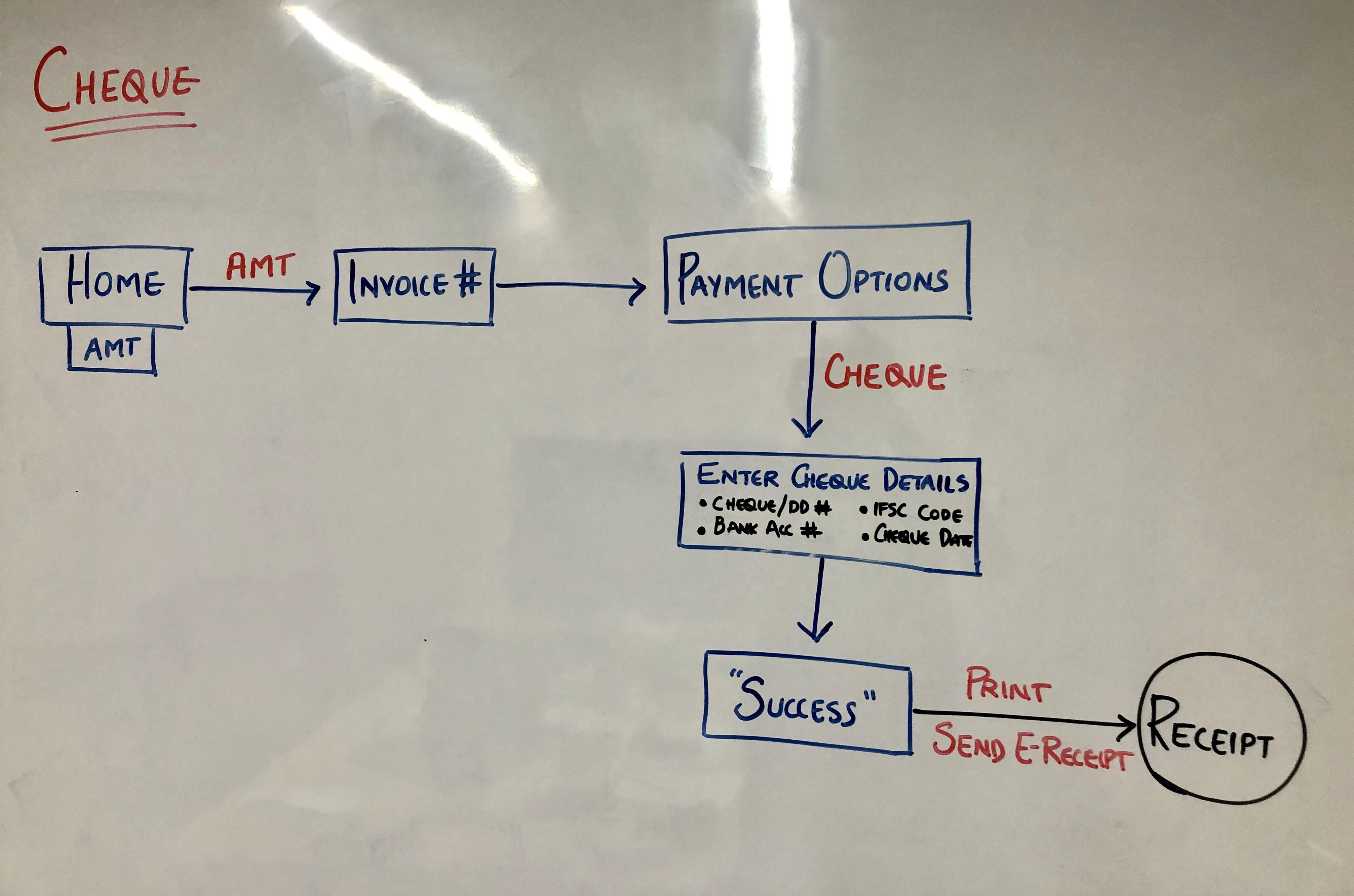

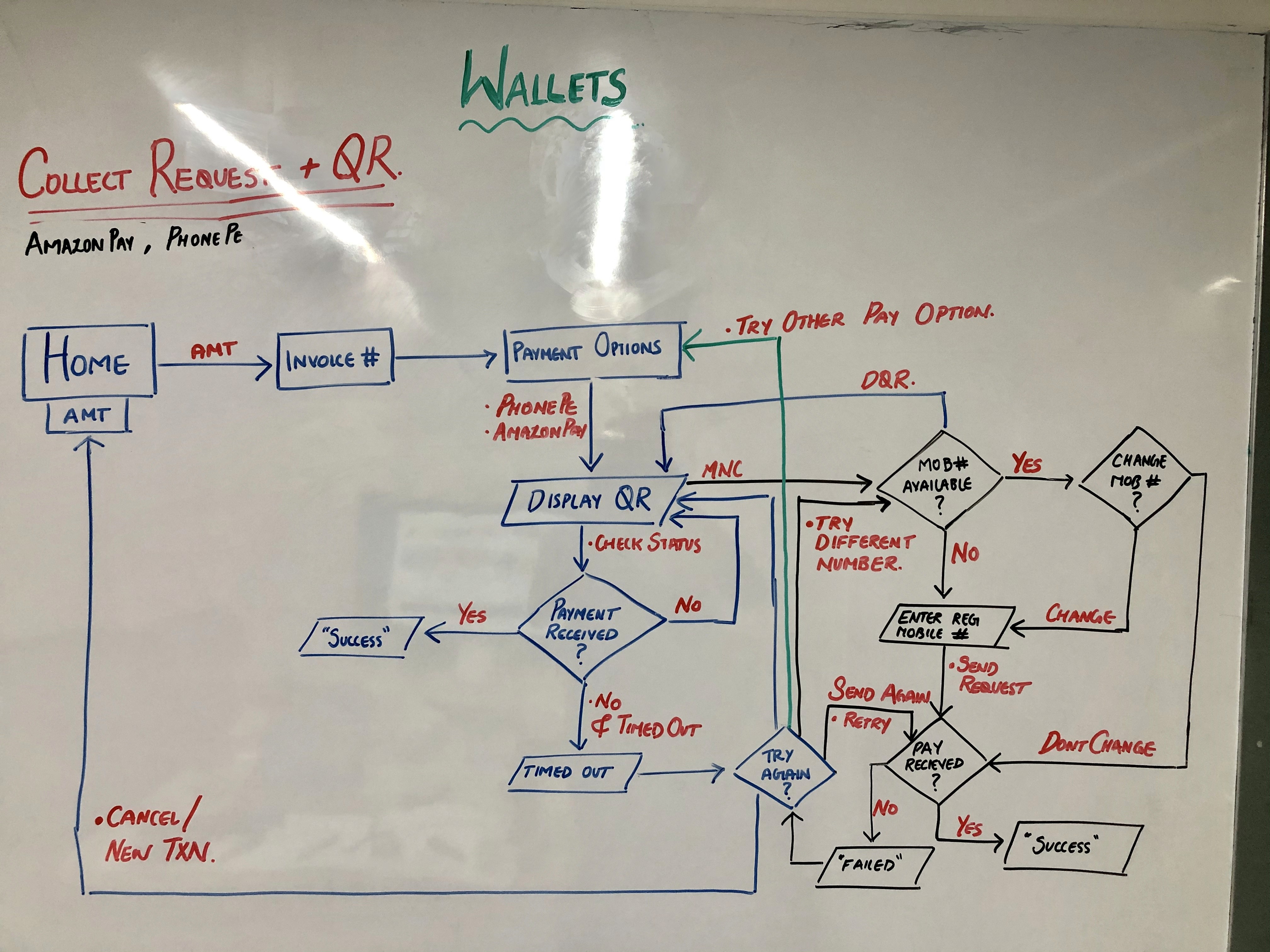

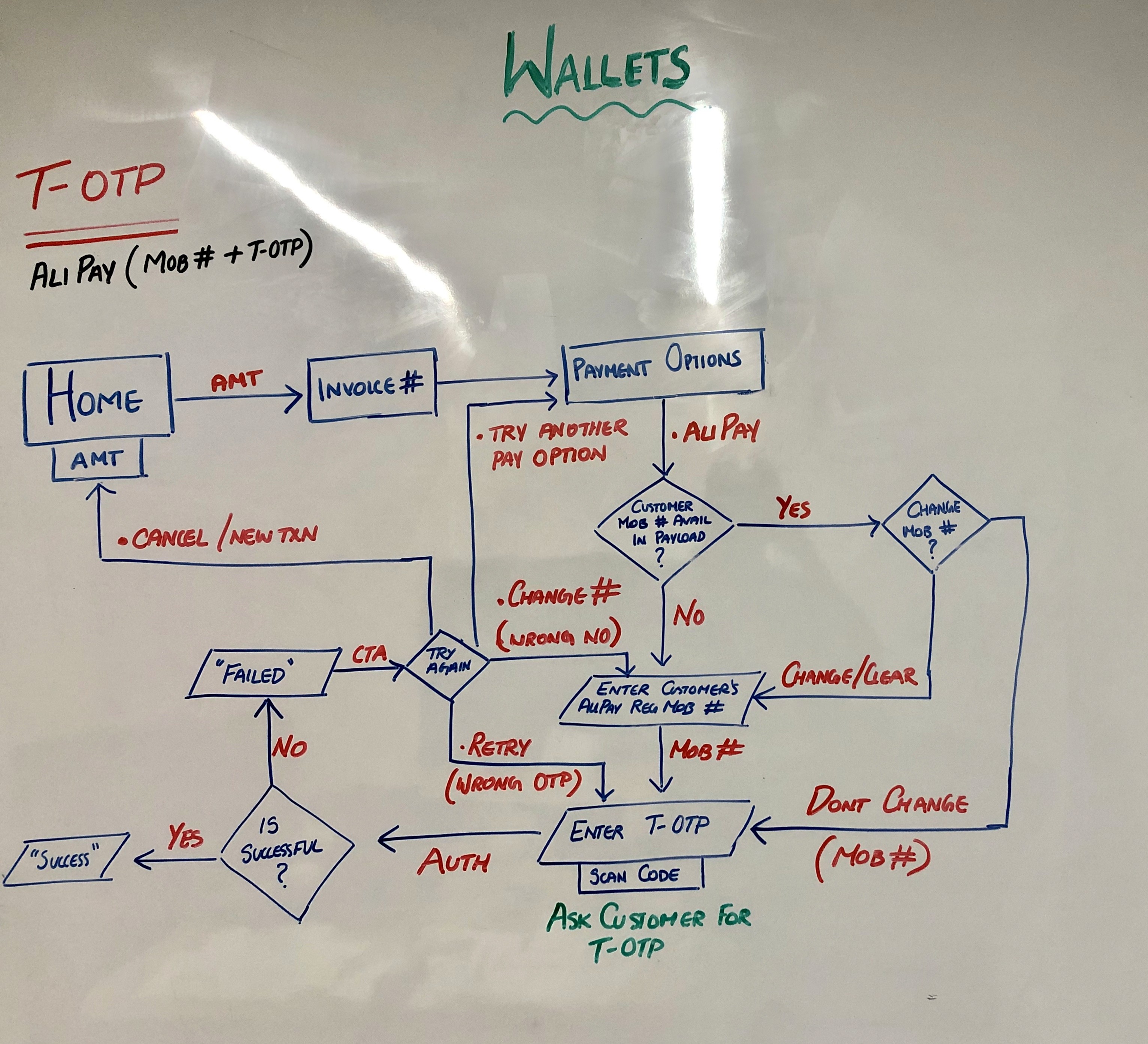

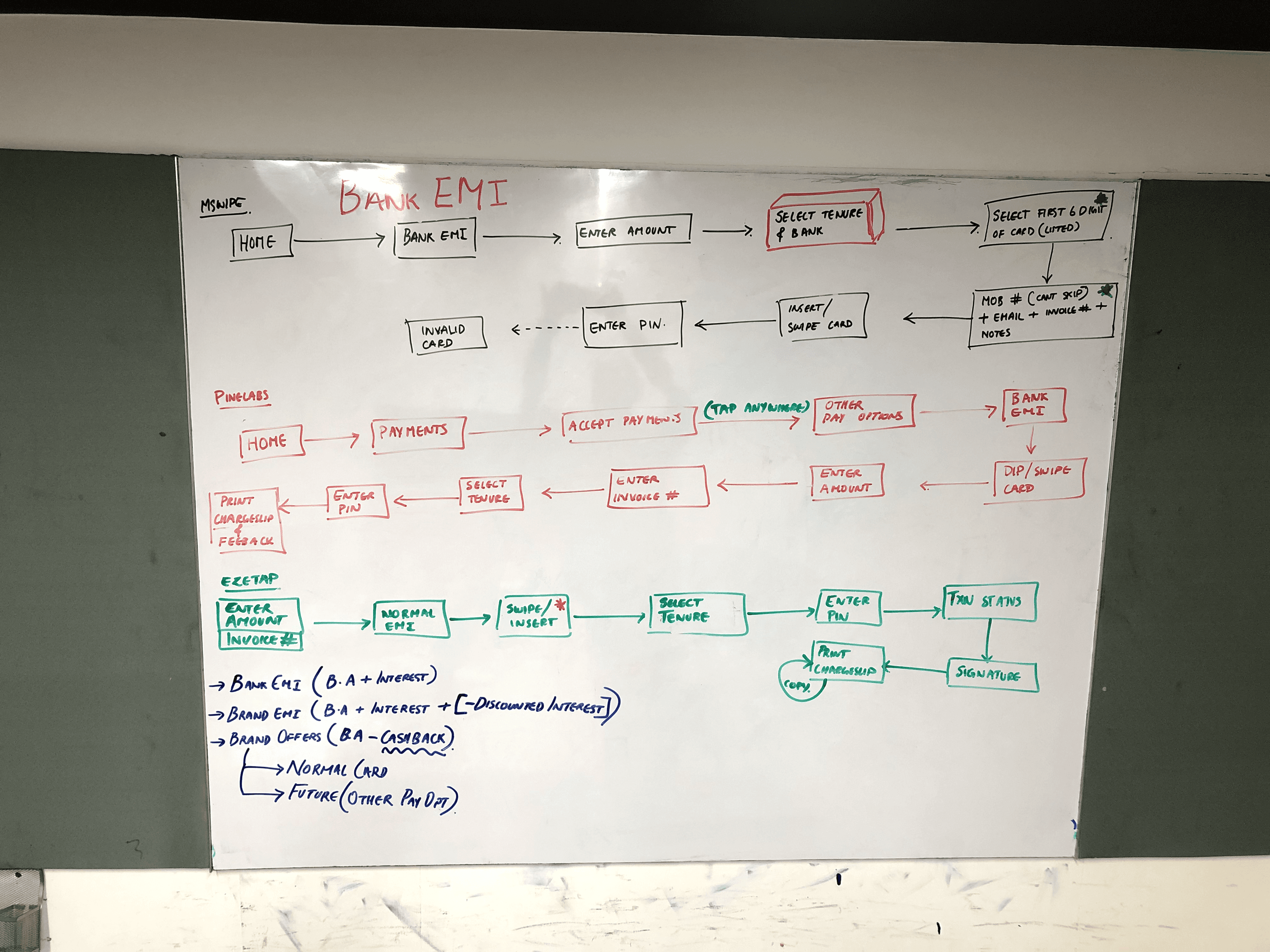

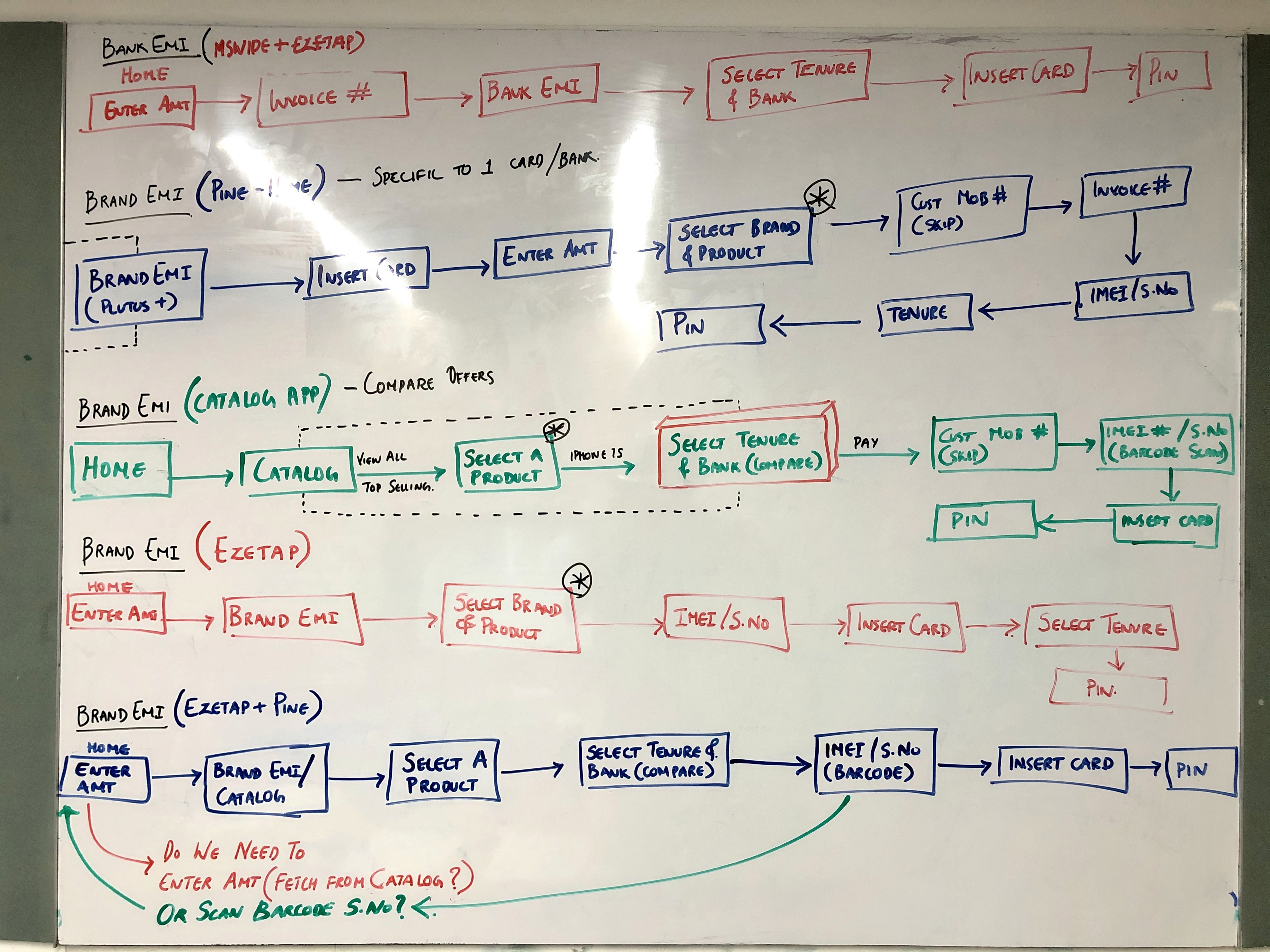

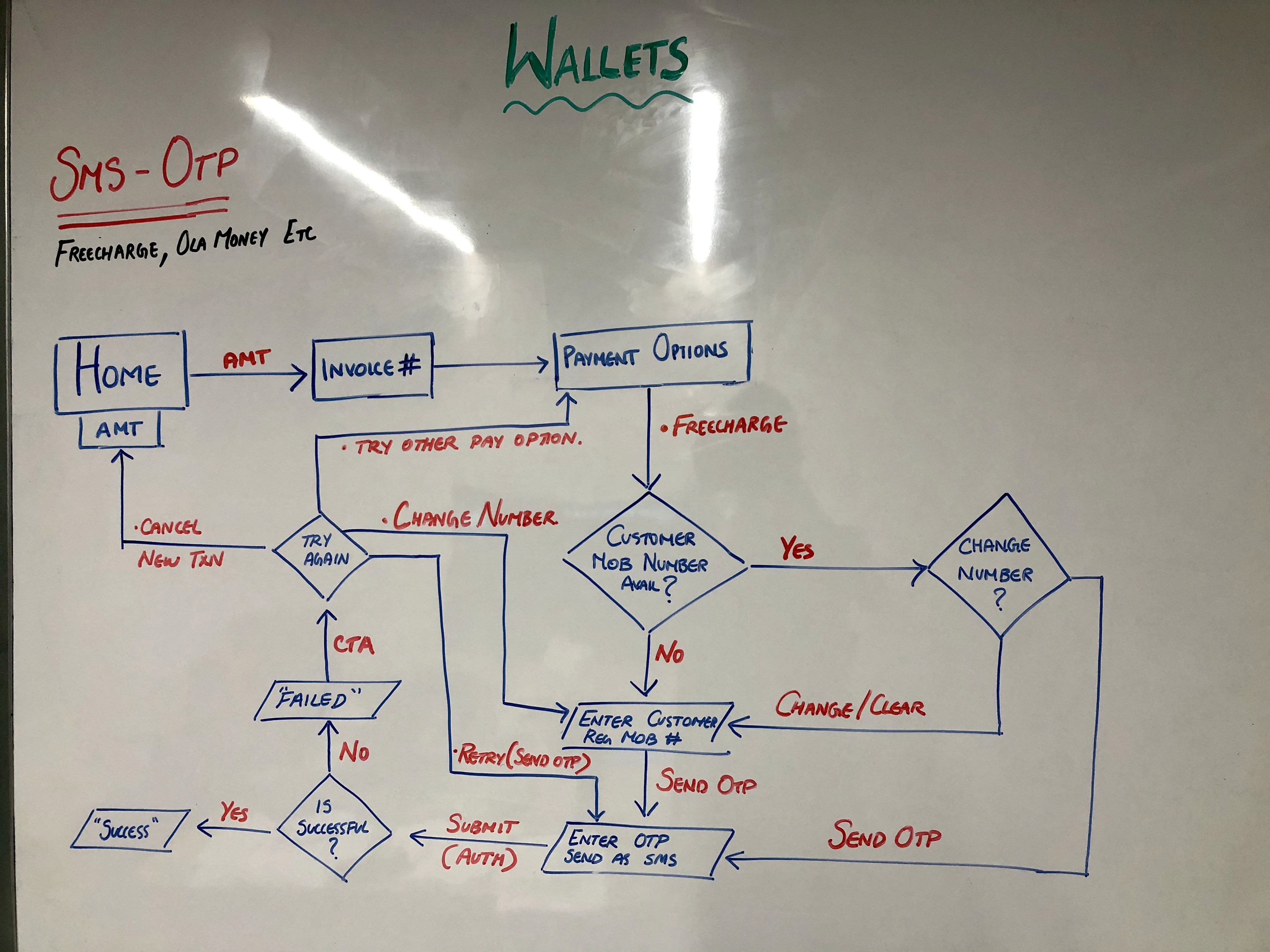

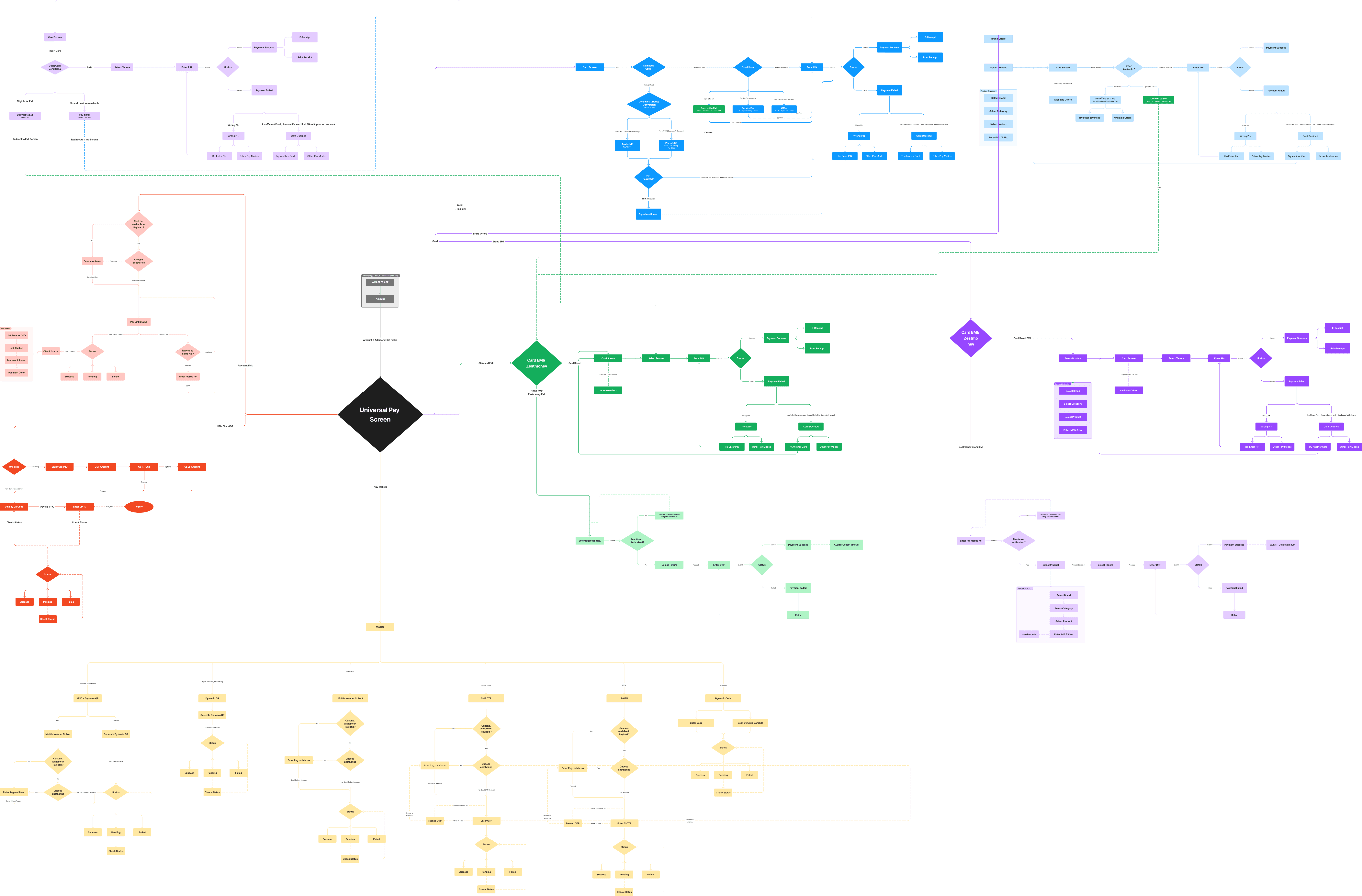

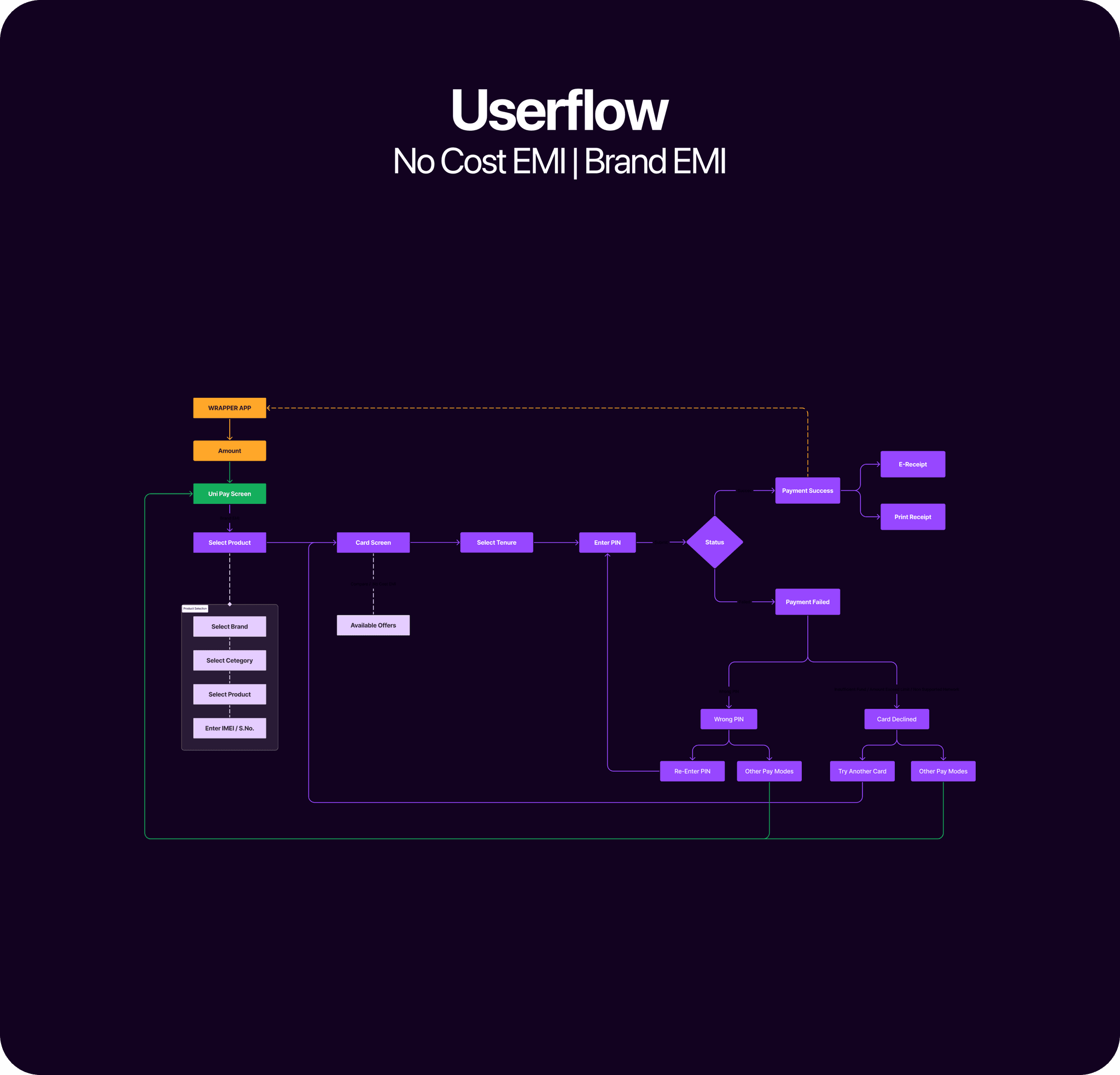

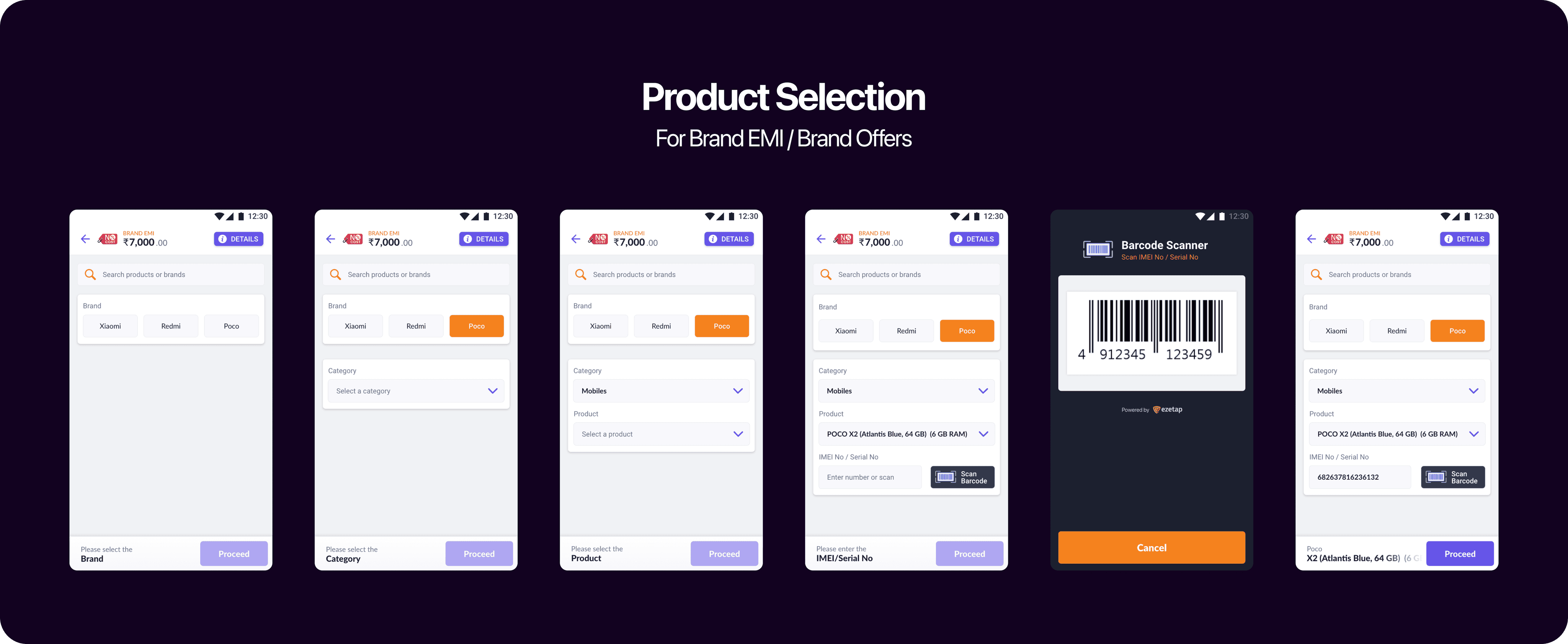

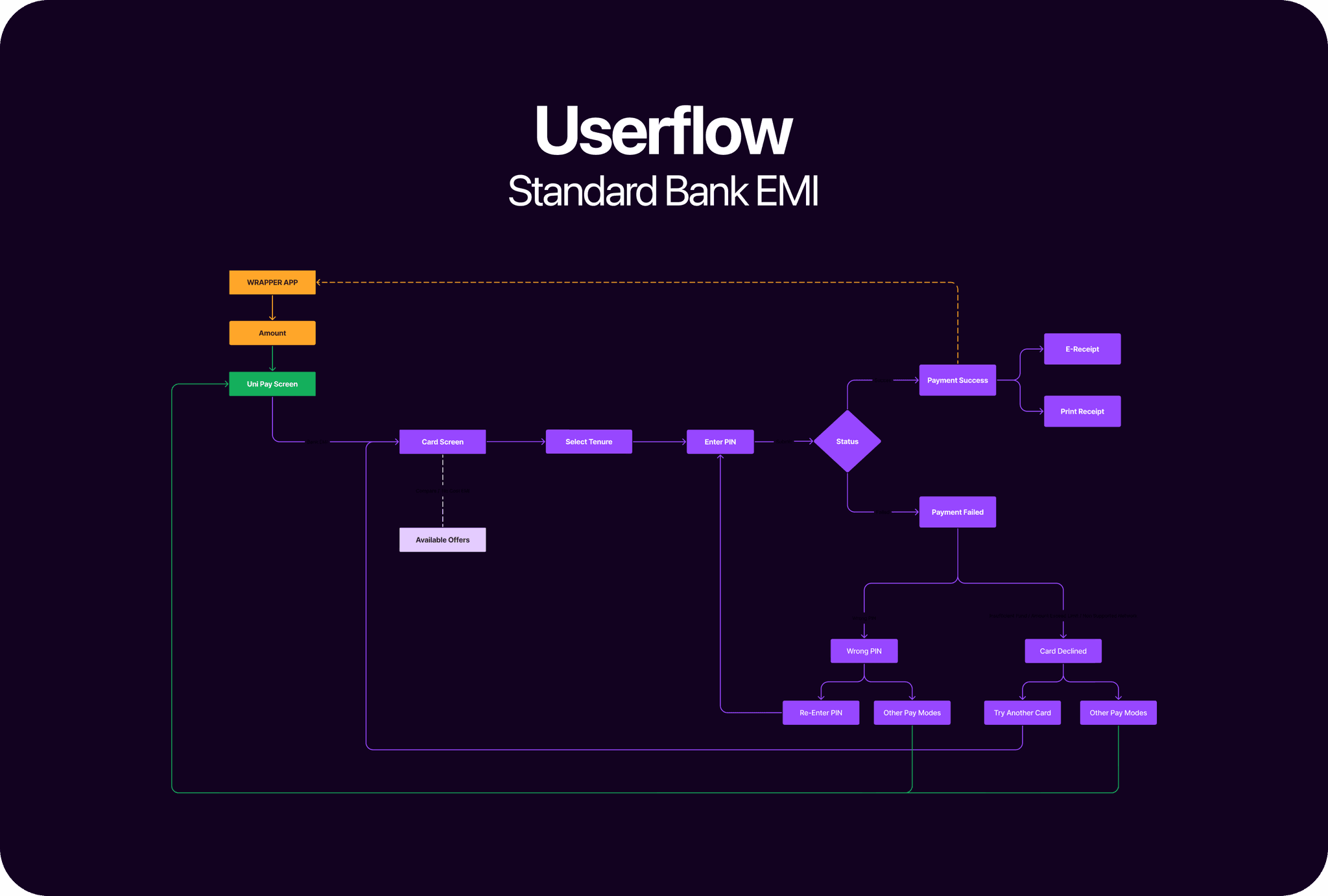

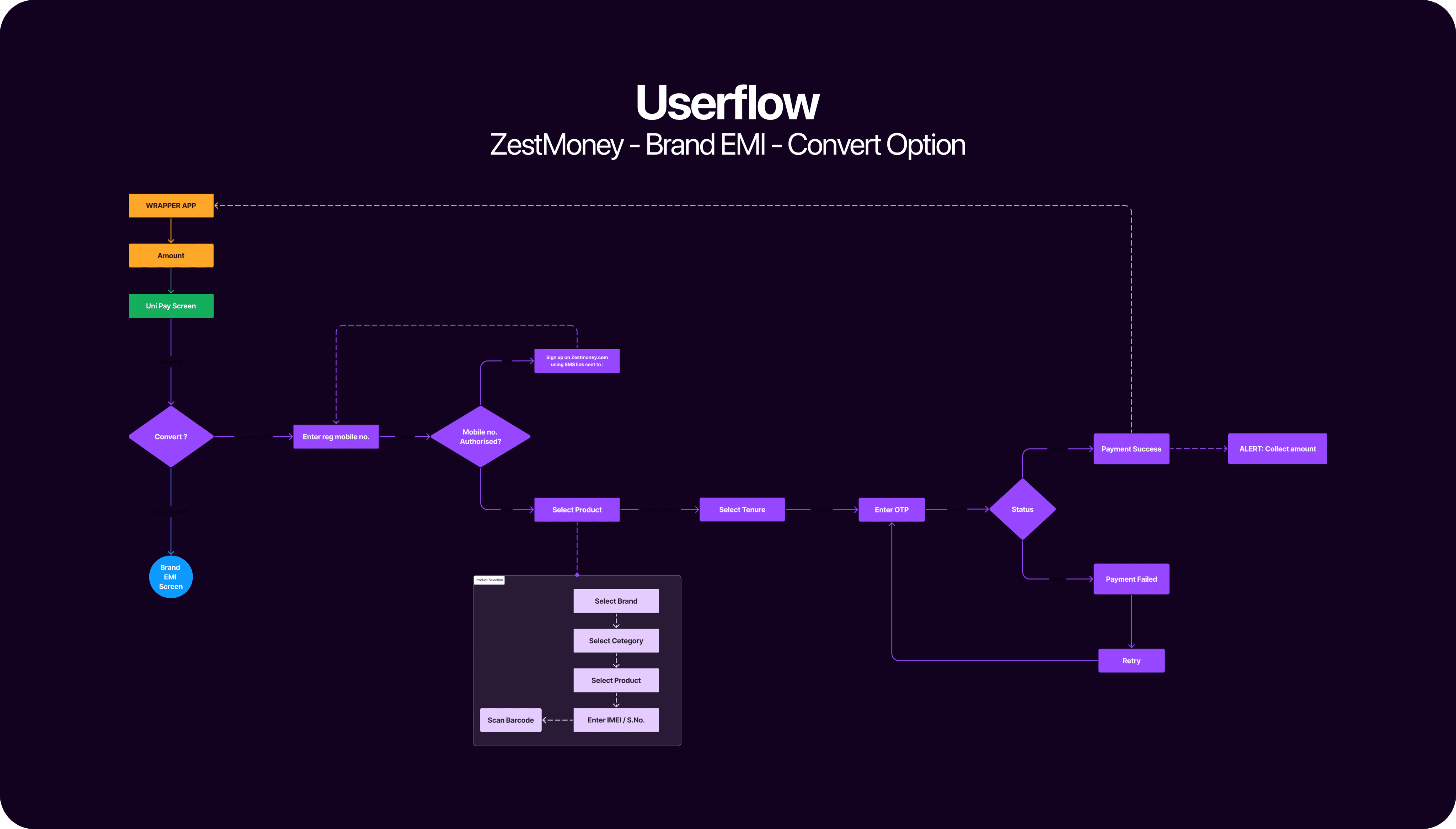

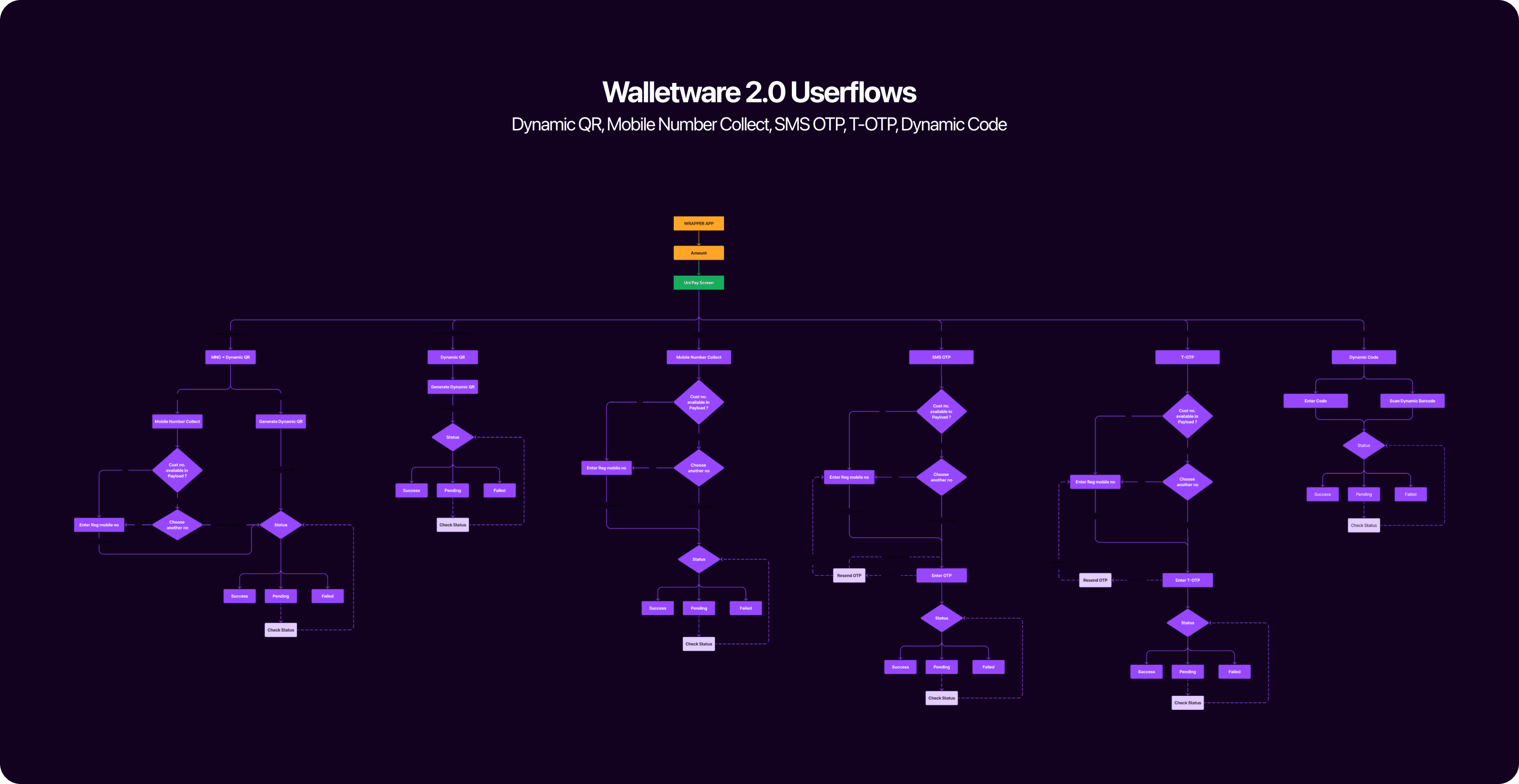

IA & User Flows

Weaving the Magic

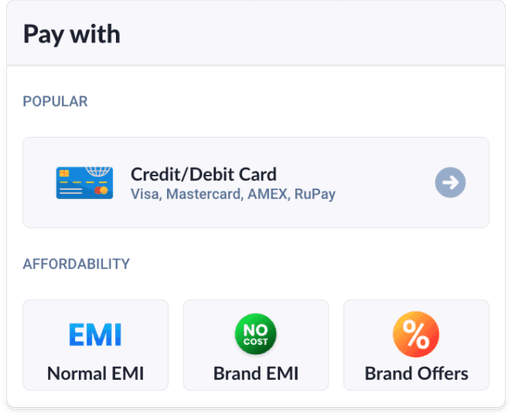

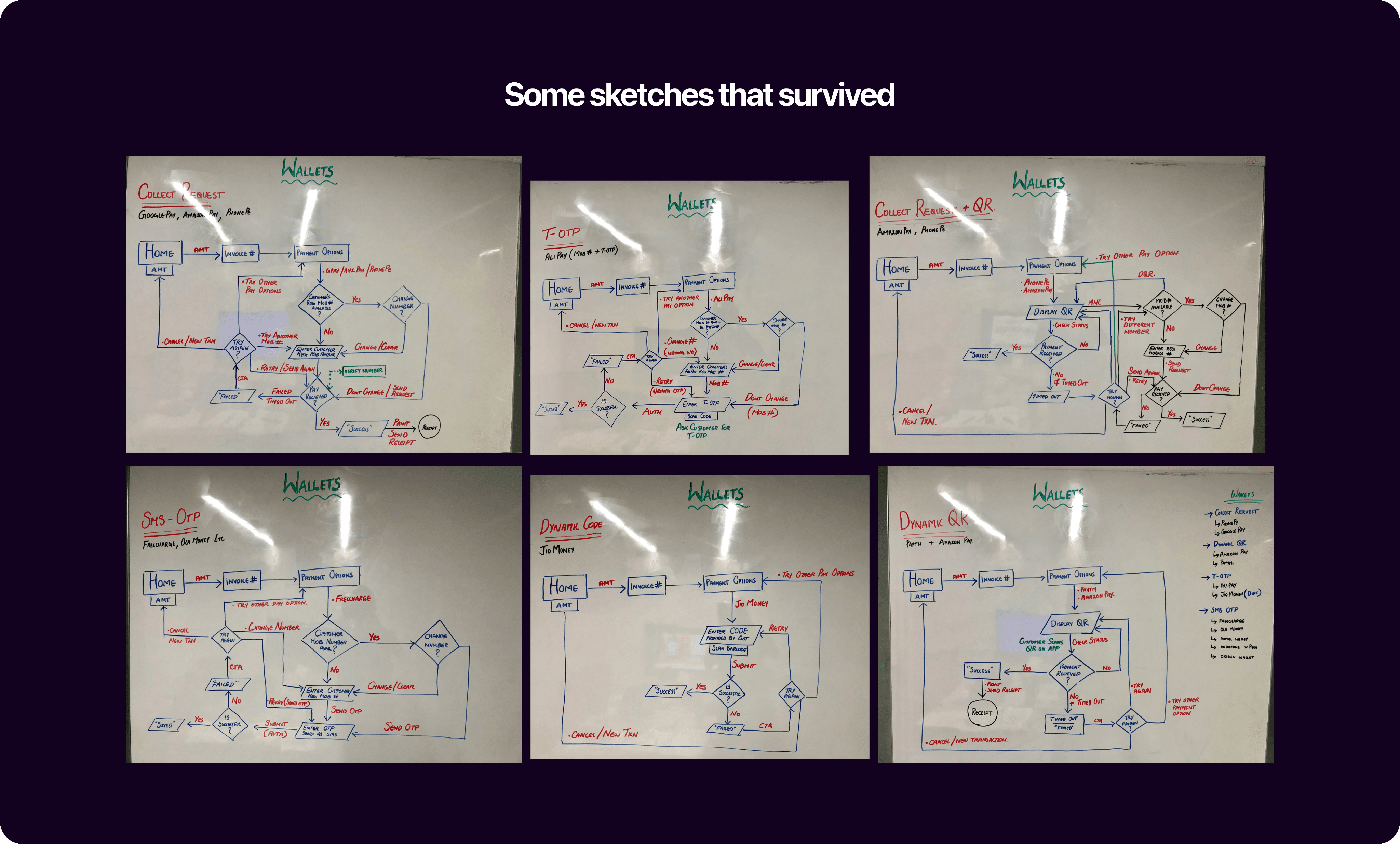

After a lot of talks with engineering team, analysing competitors and hundreds of iterations, the revamped user-flows for SA-X is finally ready.

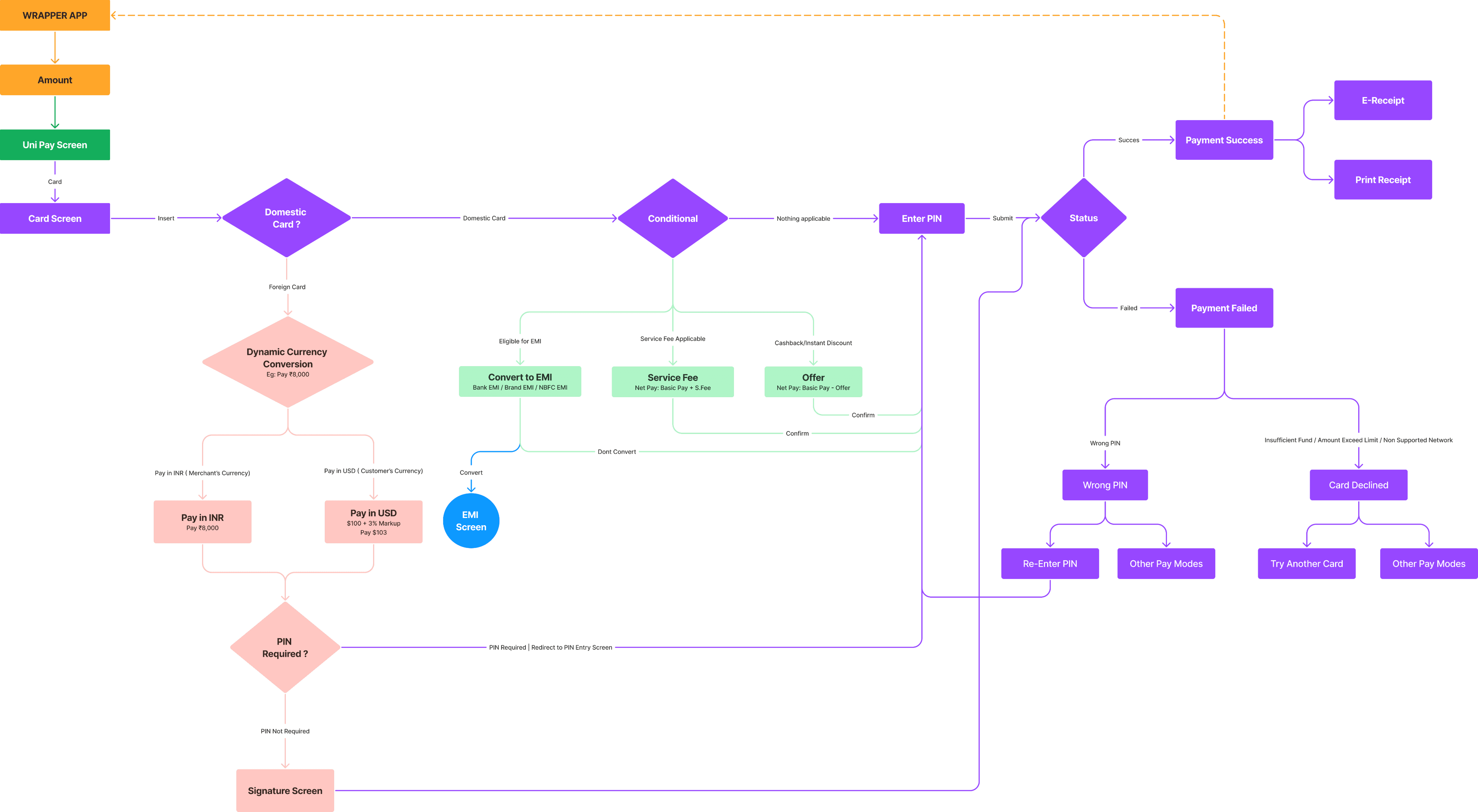

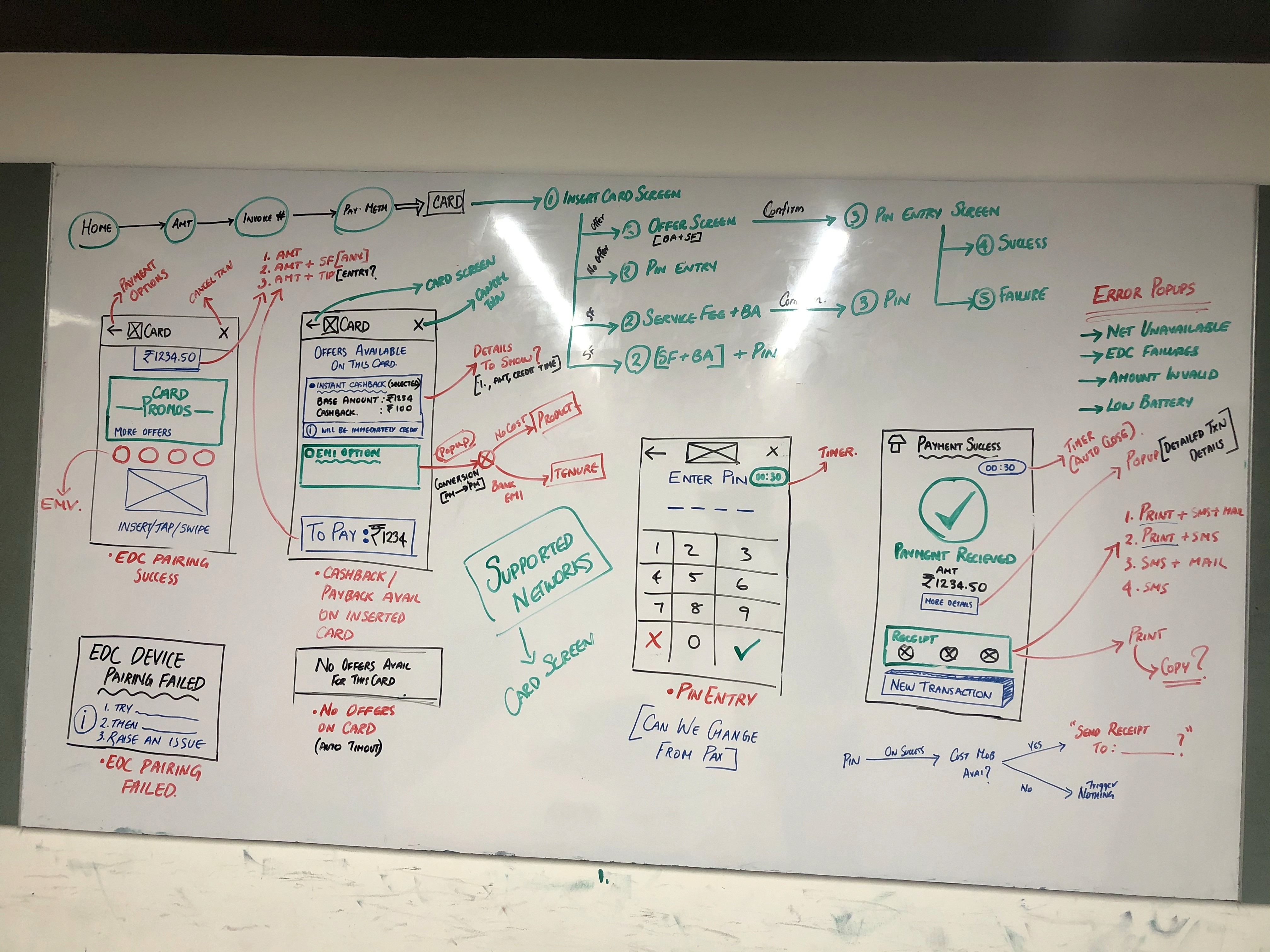

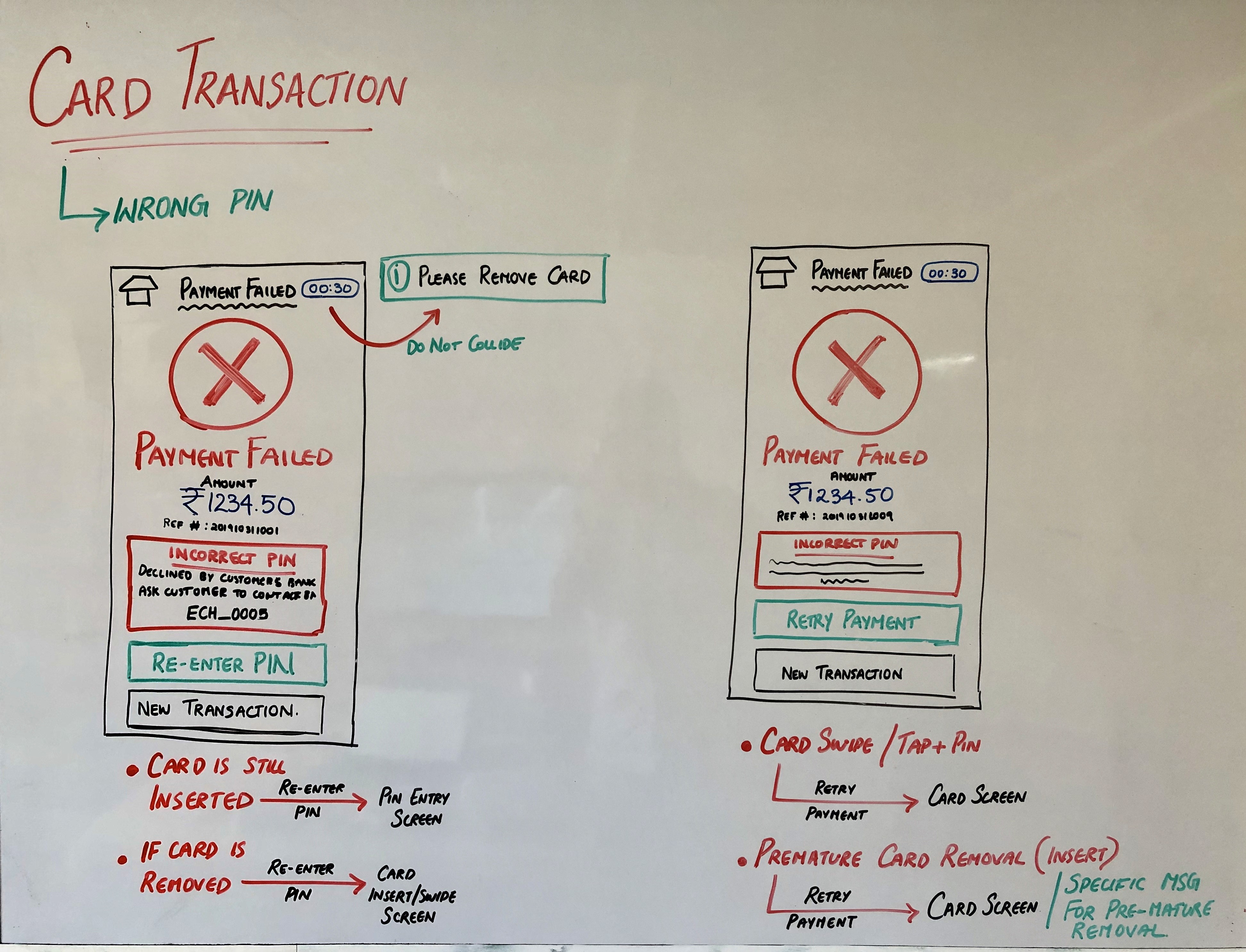

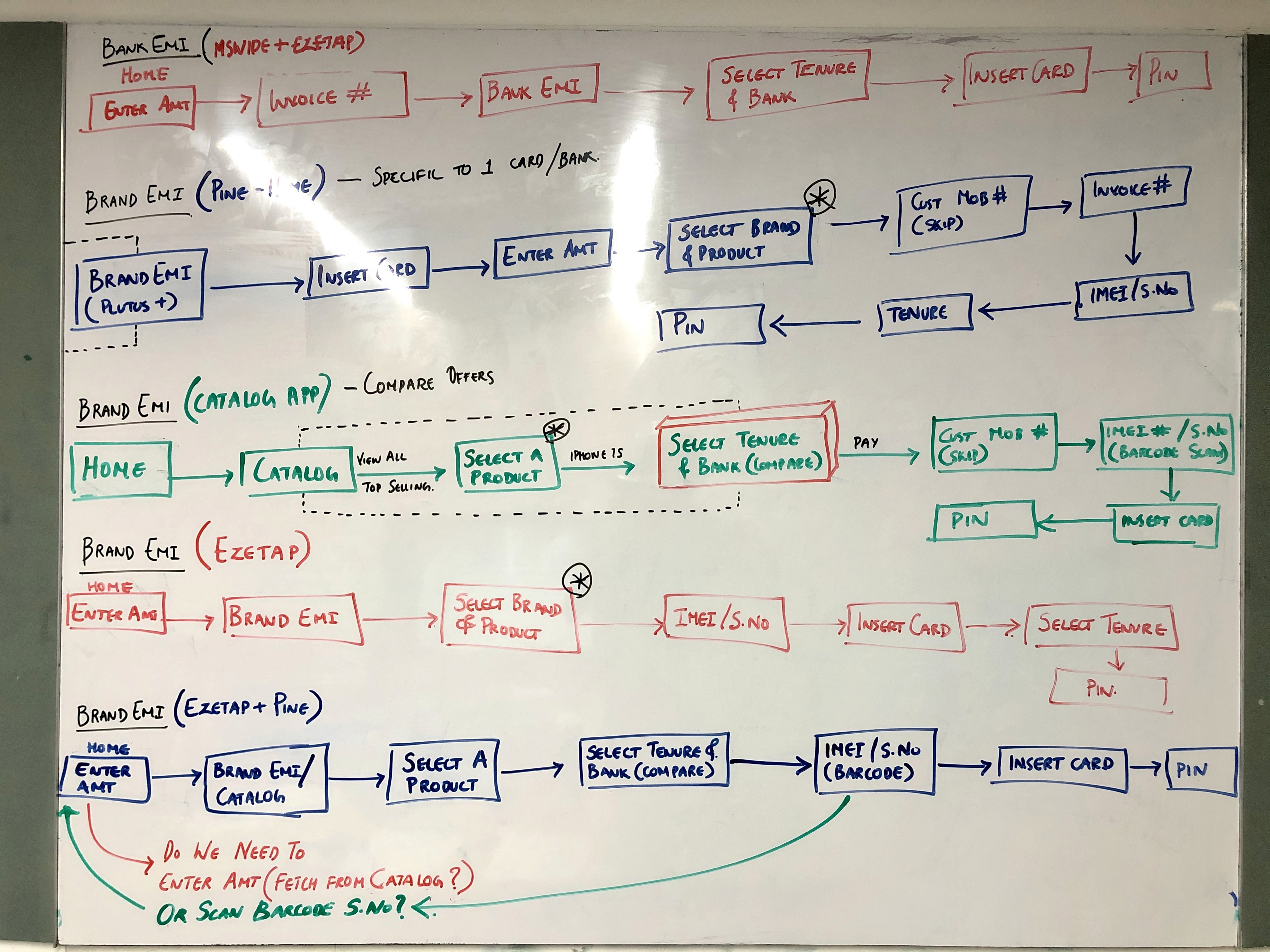

To me, this was the most crucial UX design process for a Payment System. Thats why the app’s behaviour was integrated into the Userflows from the groundup.

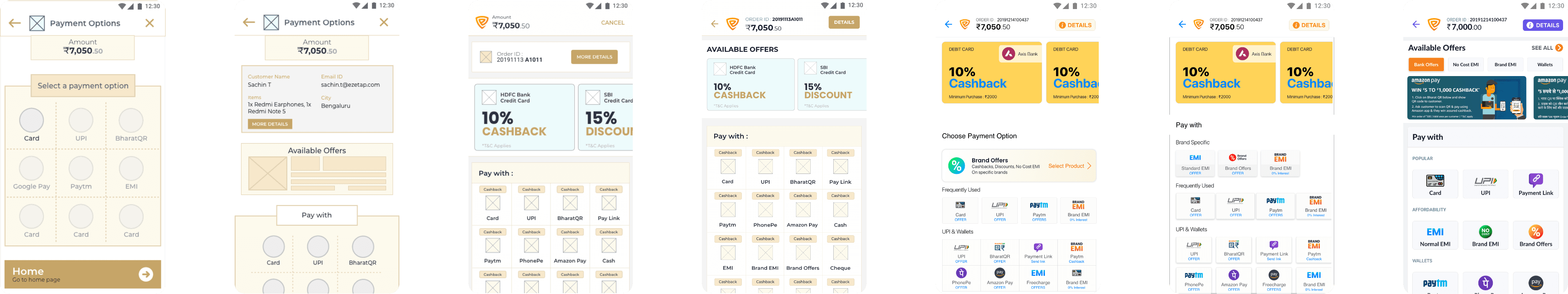

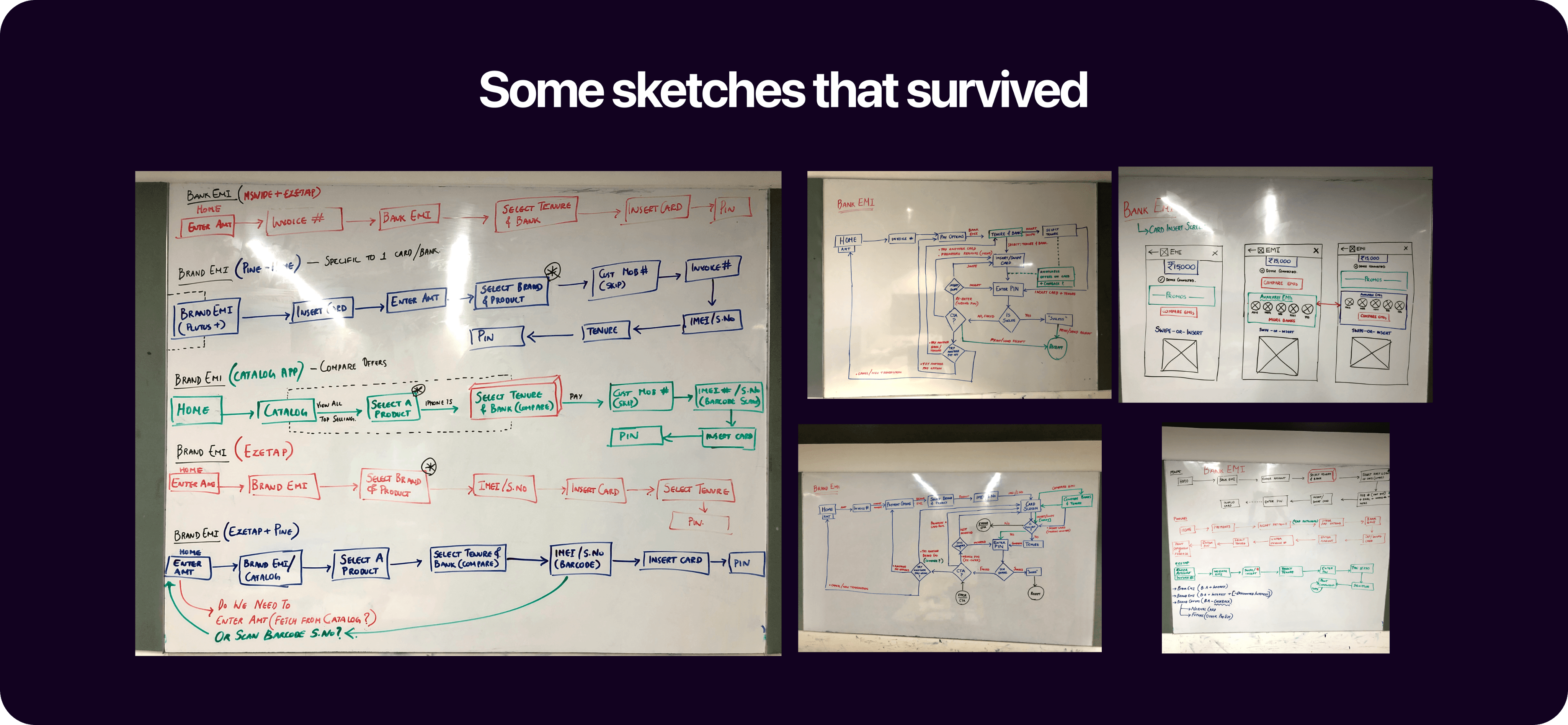

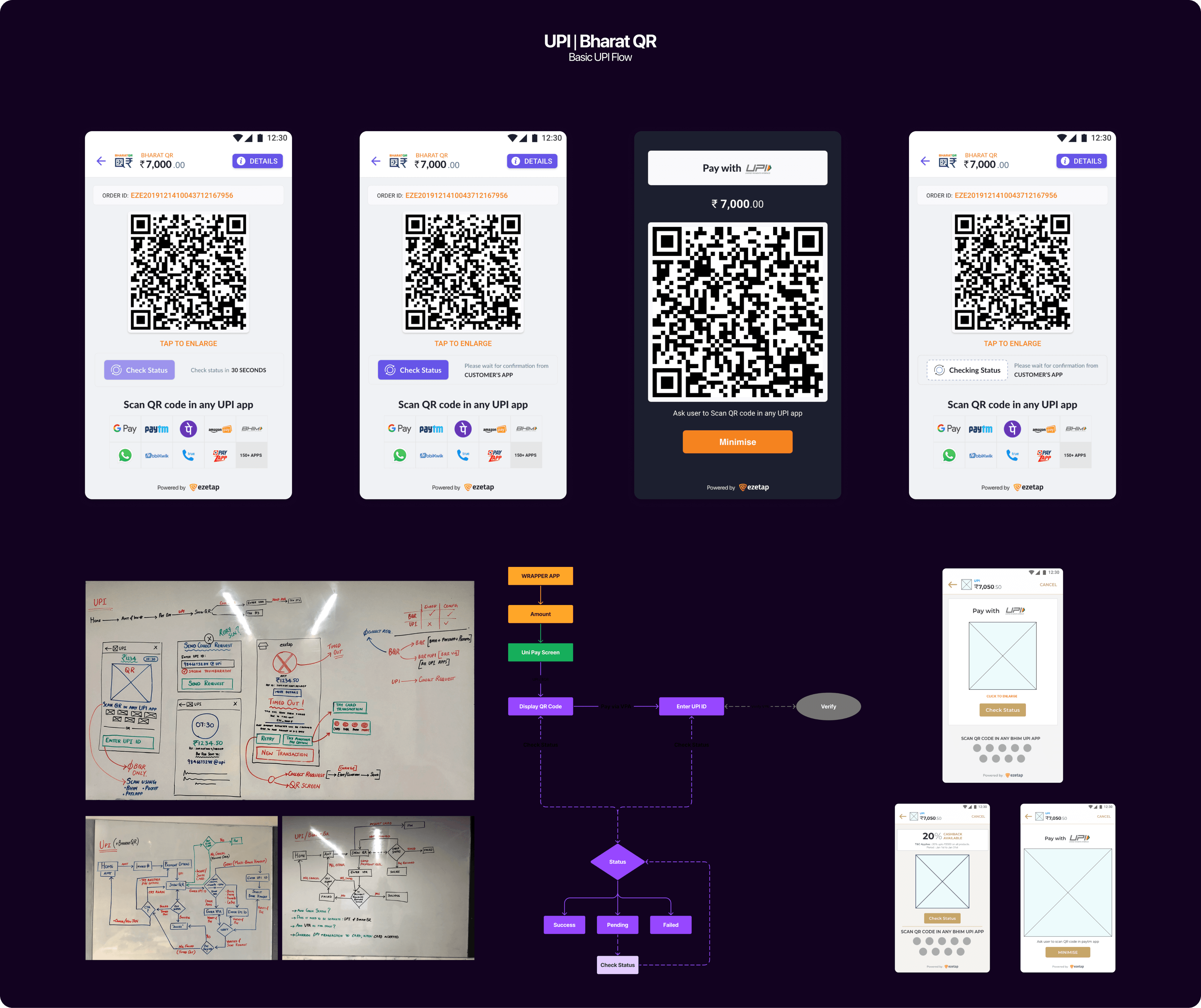

Streamlining the userflow

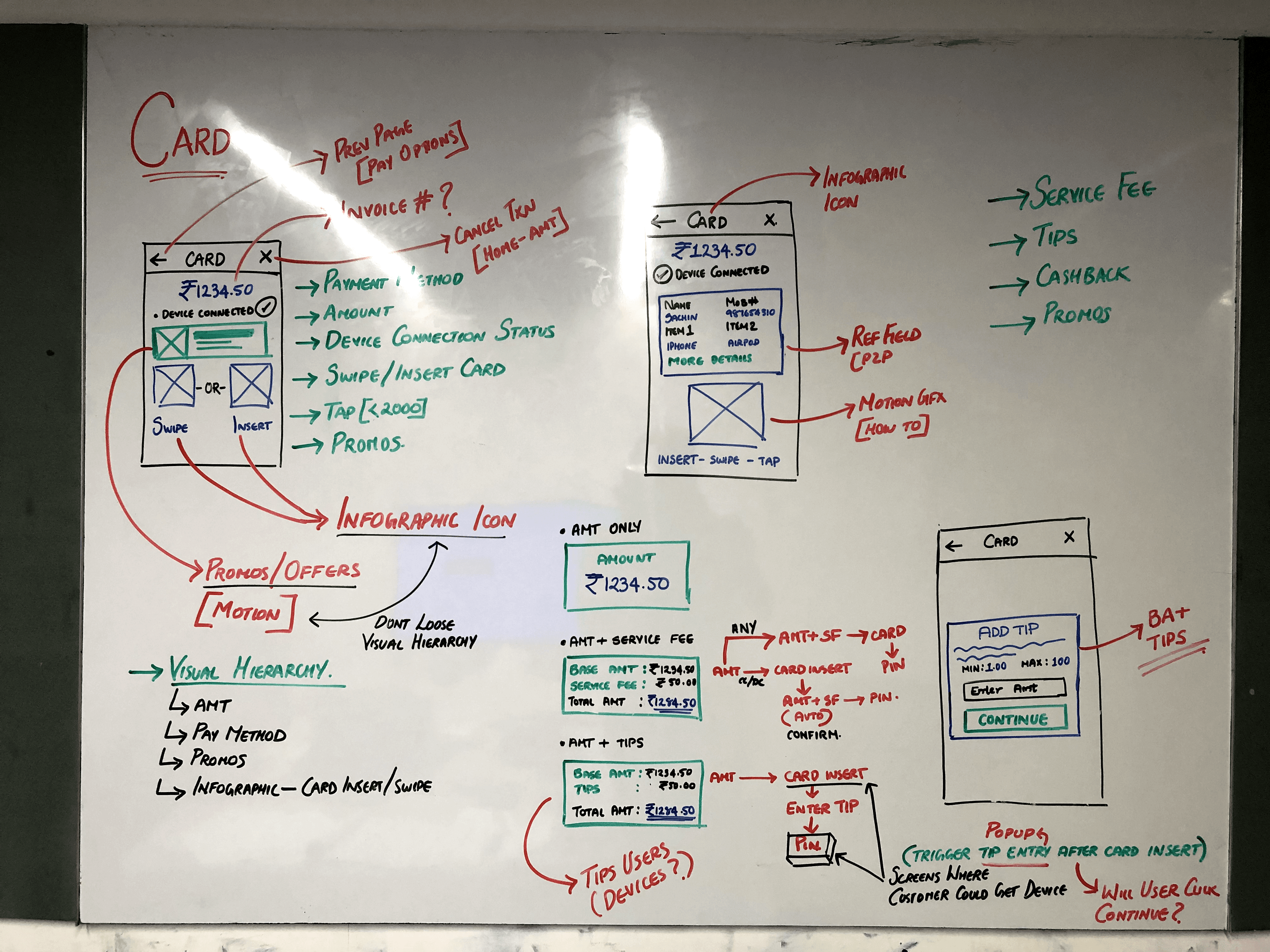

I started by sketching diverse layouts and organizing them into a structured Information Architecture (IA). This formed the blueprint for an intuitive user journey.

Revamped the app’s information architecture to prioritise key features and provide easy access to essential functions while ensuring flexibility for future integrations.

Speed in Transaction

Revamping user flows involved fine-tuning from the ground up, removing complexities, and simplifying navigation

Design Process

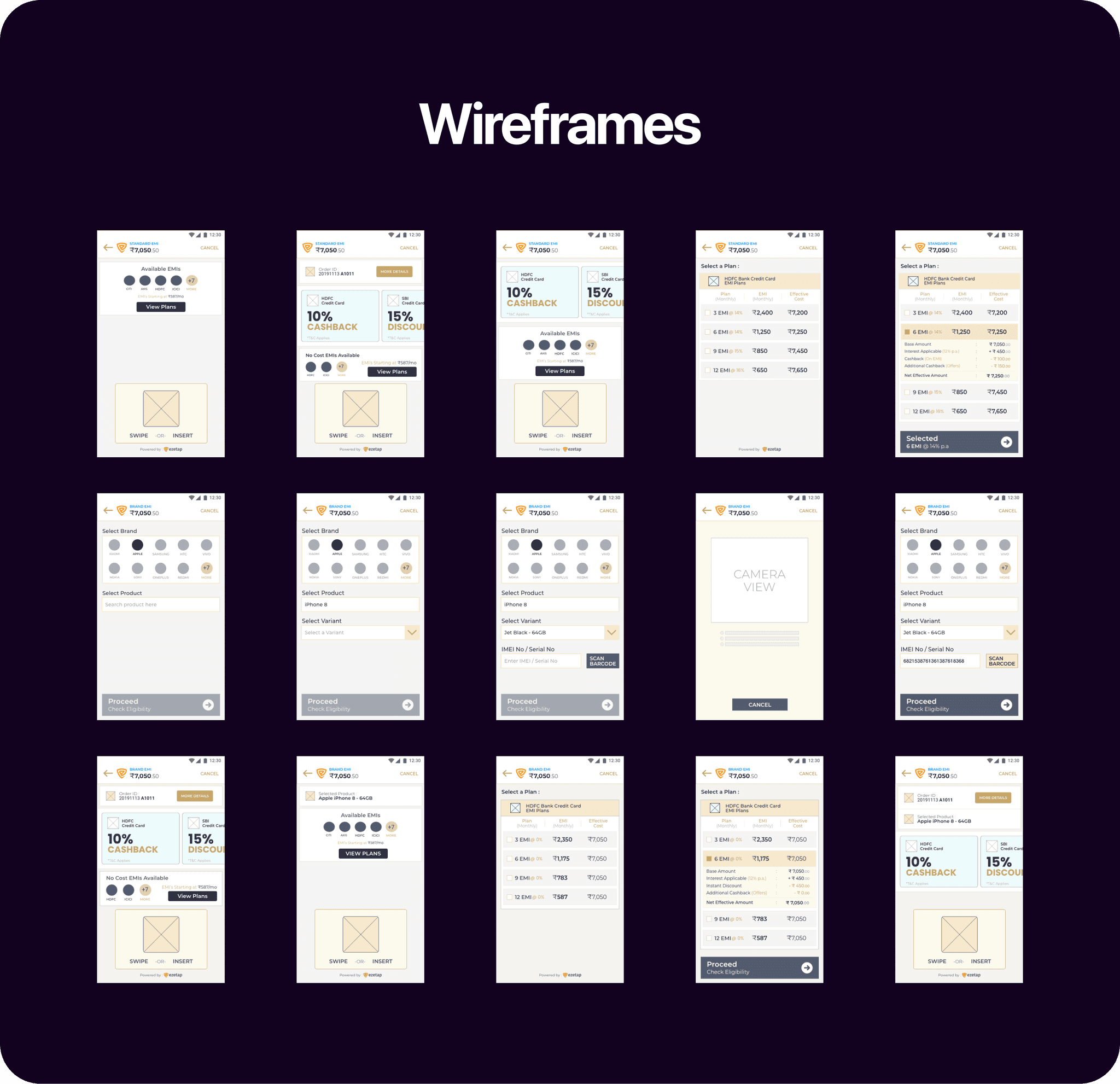

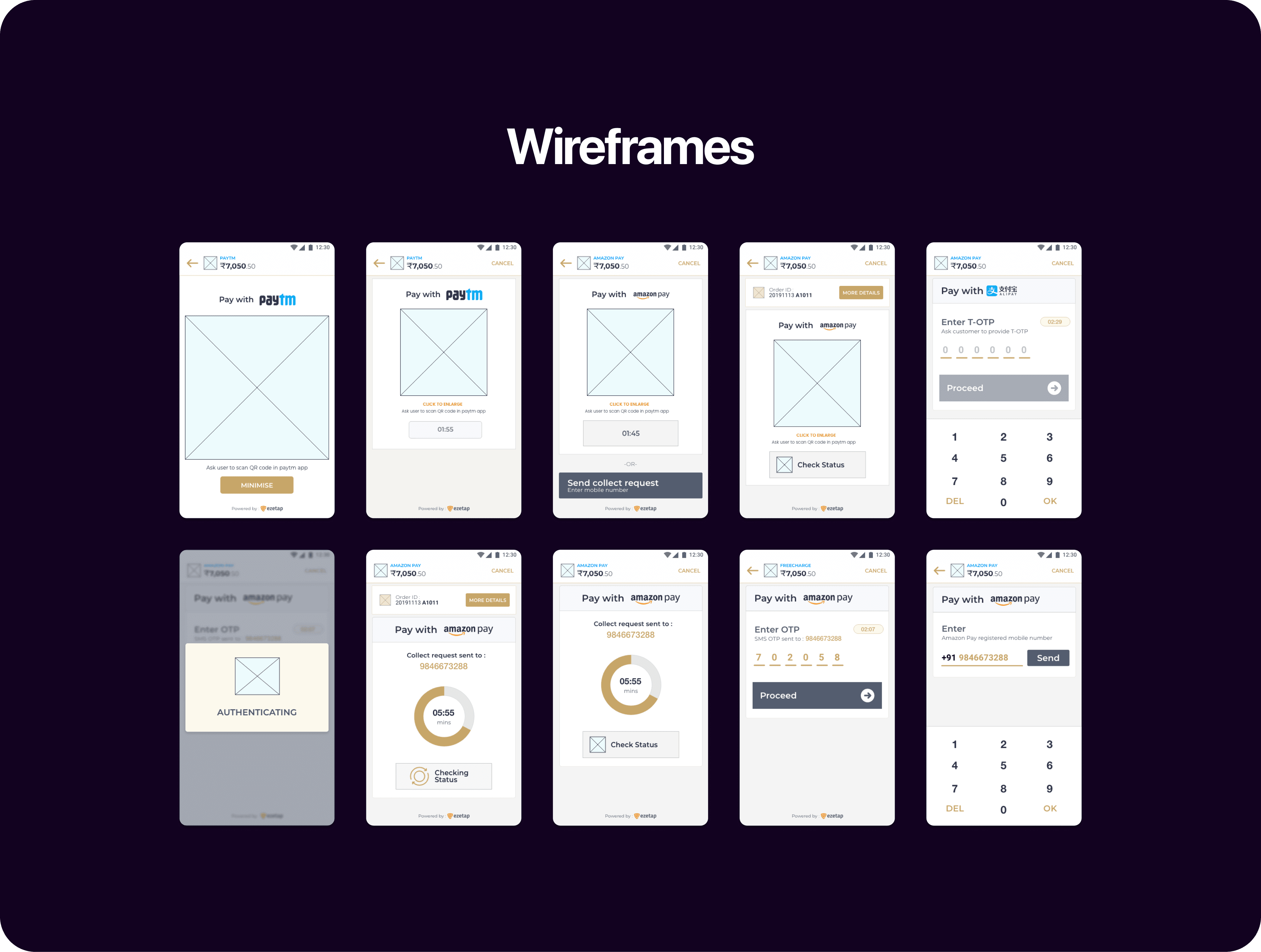

Sketches & Wireframes

The transformation of the mPOS-X Framework hinged on the meticulous process of wireframing and continuous iteration.

Here’s a concise journey into how I shaped the app’s interface to create a seamless user experience:

Wireframe Prototype

These were iteratively tested and refined based on feedback from internal stakeholders and users.

Visual Identity

Dynamic

Design

System

One of the core objectives of the redesign was to incorporate custom dynamic bank branding, harmonising the app’s appearance with each bank’s unique identity. Balancing branding elements while maintaining a clean interface posed a significant challenge

Firstly, we created a Design System that caters to our specific needs.

Balancing branding elements while preserving a clean interface presented a significant challenge.

Lato

Lato Typography

Lato offers a clean, modern feel that improves readability, which is critical in fintech for clear communication of financial information. It’s also multi-lingual and versatile across headers, body text, and labels. It provides a sense of professionalism and trustworthiness.

Header 1

Lato Heavy - 36pt

Freedom of thought, conscience

Header 2

Lato Regular - 36pt

Freedom of thought, conscience

Title 1

Lato Bold - 32pt

Freedom of thought, conscience

Title 2

Lato Regular - 32pt

Freedom of thought, conscience

Headline 1

Lato Bold - 24pt

Freedom of thought, conscience

Headline 2

Lato Bold - 20pt

Freedom of thought, conscience

Body

Lato Regular - 24pt

Freedom of thought, conscience

Caption

Lato Heavy - 20pt

Freedom of thought, conscience

Dynamic Fields

Primary

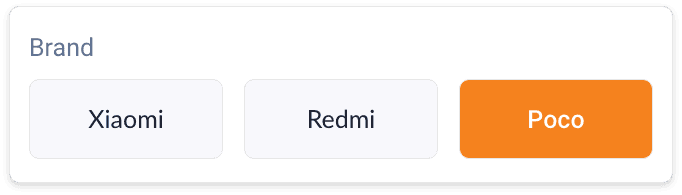

#6655E8

Secondary

#F5821E

TitleBarTheme

Light

TitleBar

#FFFFFF

Static Fields

White

#FFFFFF

Black Mirage

#1C202F

Background

#F0F2F5

Container

#F8F8FC

Border 1

#E6E6E6

Border 2

#D6D6D6

Caption 1

#5C7397

Caption 2

#99ABCA

Yellow

#FFC93E

Green

#55A94F

Orange

#F5821E

Red

#C65151

Through a detailed analysis, we identified primary and secondary colors unique to each bank's identity.

This insight guided our approach to strategically assign colours across the app's interface.

Bank

Primary

Secondary

HDFC Bank

ICICI Bank

Kotak Bank

Yes Bank

Network International

SBI Payments

Axis Bank

IDFC First Bank

#004C8F

#004A7F

#003874

#0062A8

#003366

#292075

#AE275F

#9D1D27

#ED232A

#F5821F

#ED1C24

#D71920

#FF6666

#00B5EF

#EB1165

#BD7061

New Fields for Customization

To accommodate bank-specific branding, we introduced new fields. These offered precise control over the app's appearance for each bank.

Primary Color

#0D4A86

Secondary Color

#F37E20

Home Titlebar Color

#232323

Home Titlebar Theme

dark

Specific fields like titlebarColor and titlebarTheme were created to assign colors to non-home screen title bars.

This allowed for a darker bank identity representation on the home screen while maintaining a lighter theme on others.

Minimal Fields, Maximum Impact

To accommodate bank-specific branding, we introduced new fields. These offered precise control over the app's appearance for each bank.

Primary Color

#AE275F

Secondary Color

#EB1165

Titlebar Color

#FFFFFF

Titlebar Theme

light

Home Titlebar Color

#AE275F

Home Titlebar Theme

dark

Unified Design

Customized Branding

The solution seamlessly integrated custom bank branding while maintaining design minimalism. Banks could now harmonise their branding with the app's interface, enhancing the SAAS model and offering a consistent, personalised experience to users.

Pay Mode Icons

On Light TitleBar

On Dark TitleBar

Other Icons

On Light Container

On Dark Container

Icon Style

Our design includes bespoke, realistically styled, colorful icons that echo real-world payment methods and fit a light theme. To match darker titlebars, we also created a collection of monochrome white icons. Their purpose is to facilitate user behaviour guidance and assist with optical navigation.

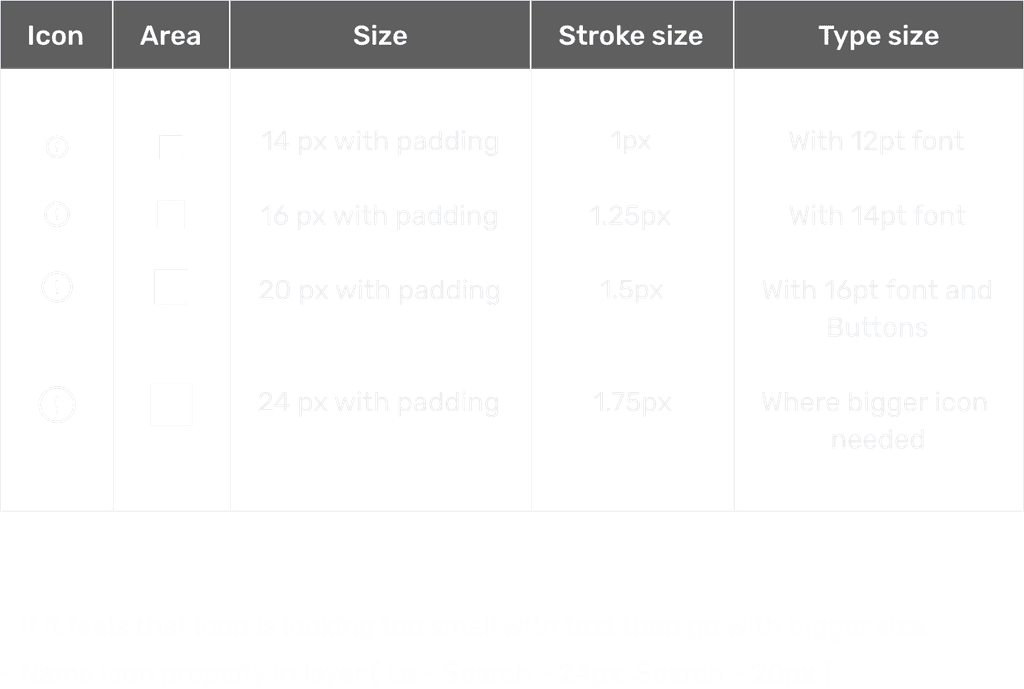

Icon Guideline

Scalable icons, with standard sizes at 20px, ensuring they are noticeable without overwhelming other elements.

4 px

Small 1

8 px

Small 2

12 px

Small 3

16 px

Medium 1

20 px

Medium 2

24 px

Medium 3

32 px

Large 1

40 px

Large 2

48

Large 3

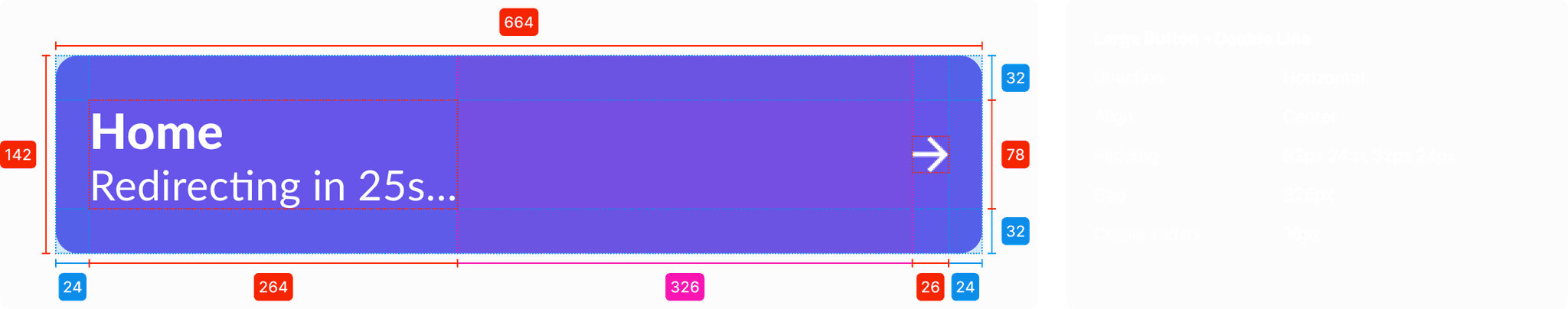

Layout Spacing

The design employs a 4-point grid schema, enabling uniform, versatile and scalable gaps that ensure balance on all display sizes of POS Devices which has very low resolution and low PPI.

Above example is displaced at xxhdpi resolution

Padding and Margins

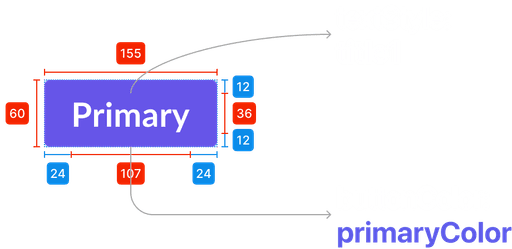

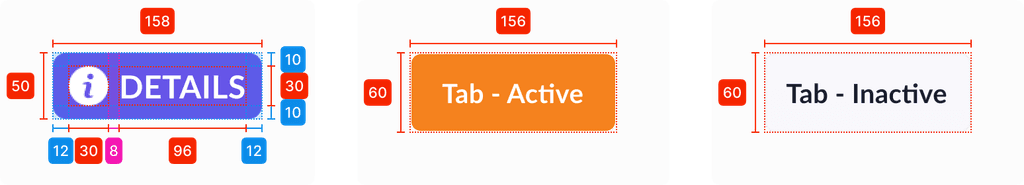

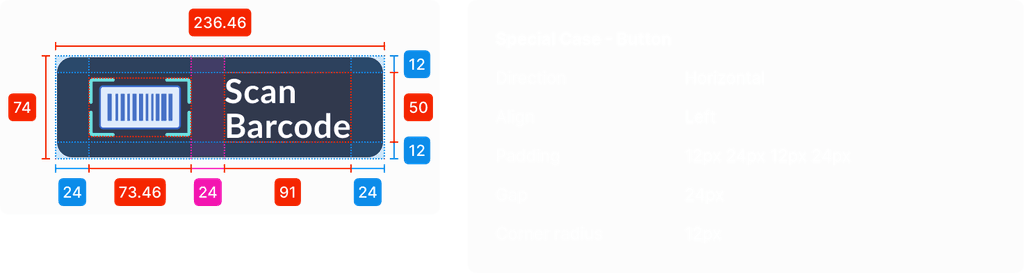

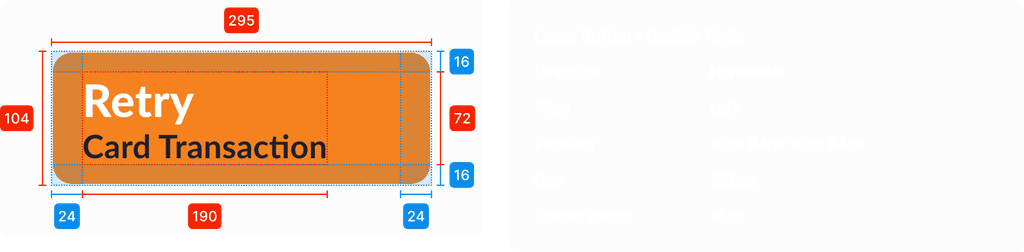

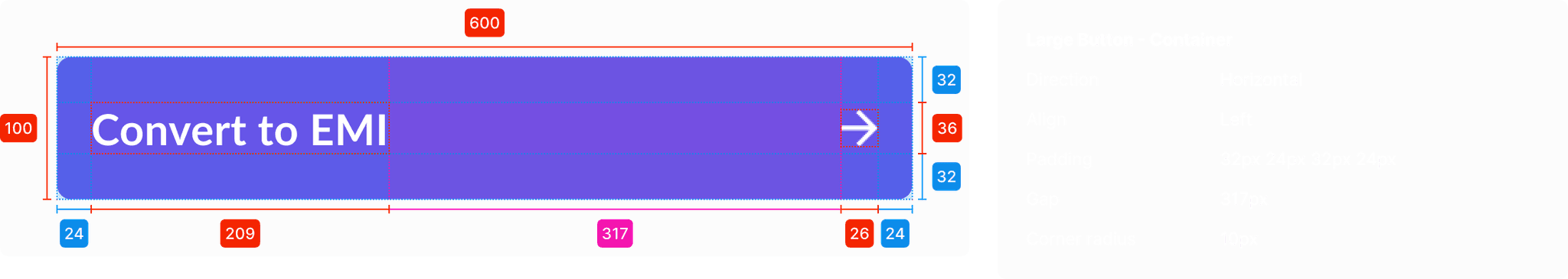

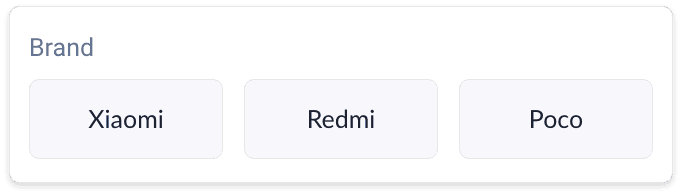

Various Buttons

Filled with Primary or Secondary Colors with white text, rounded corners to maintain a modern look. Used for main actions like “Submit,” “Save,” and “Continue.” Subtle animations with slightly darkened shades, providing feedback on interactivity.

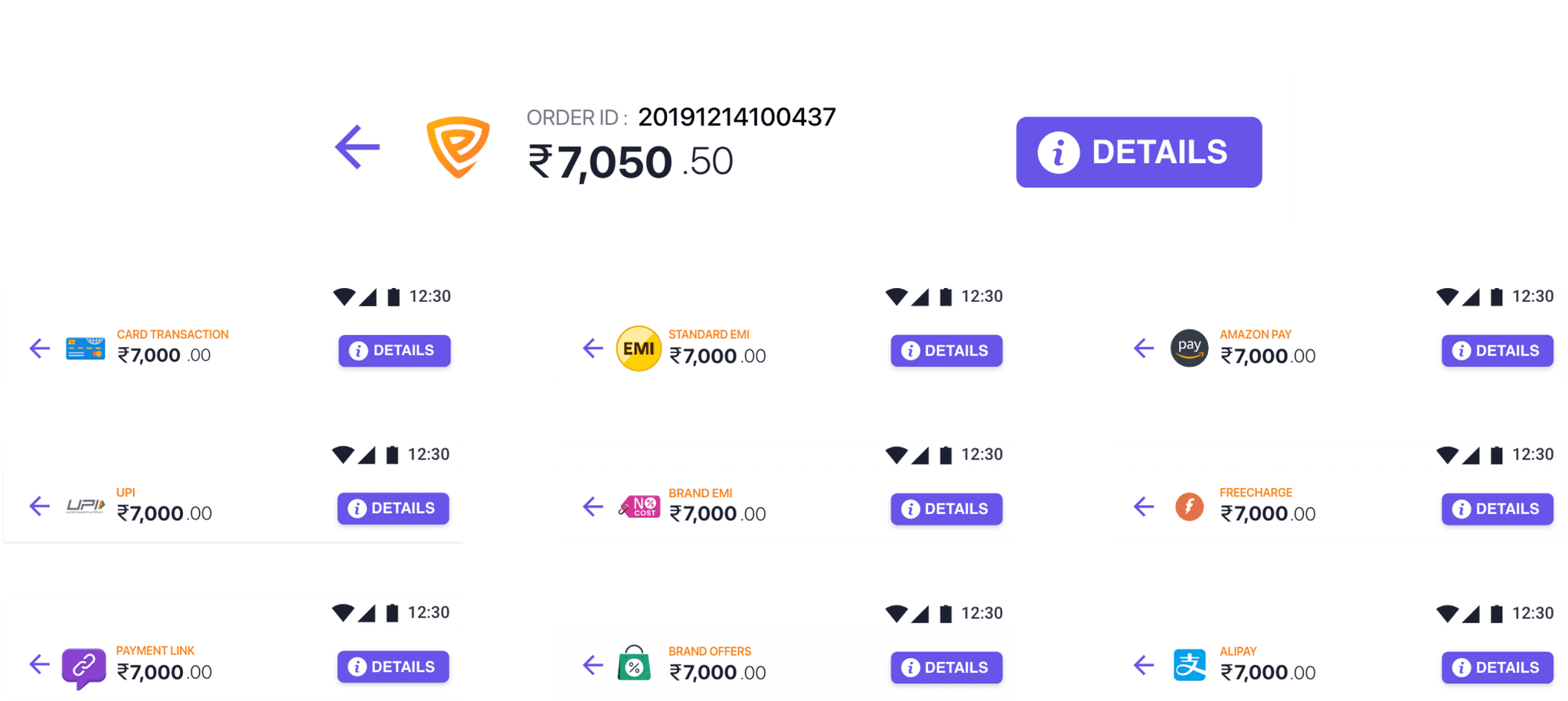

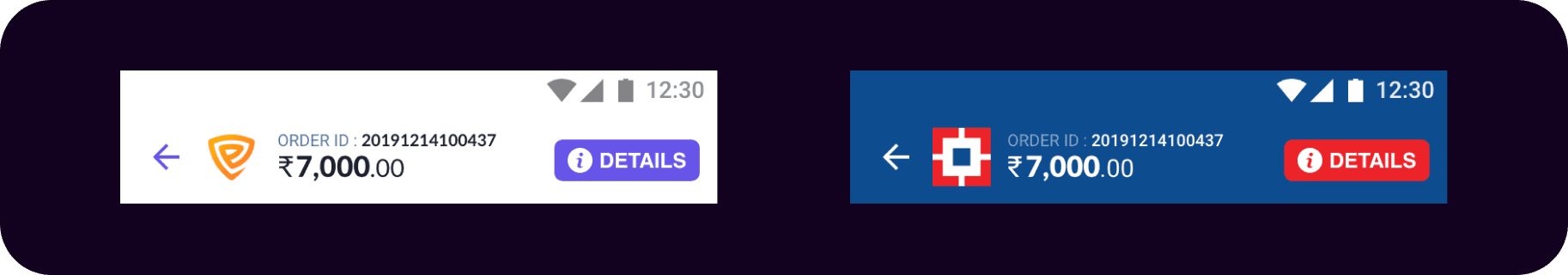

Titlebar on various payment modes

Titlebar on various dark themed bank branding

Title Bar

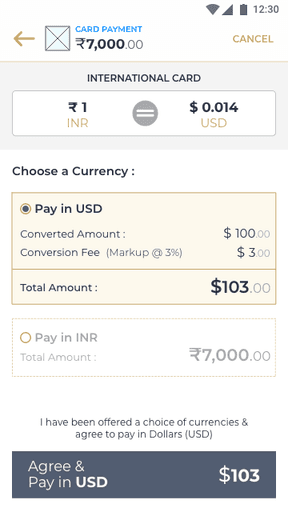

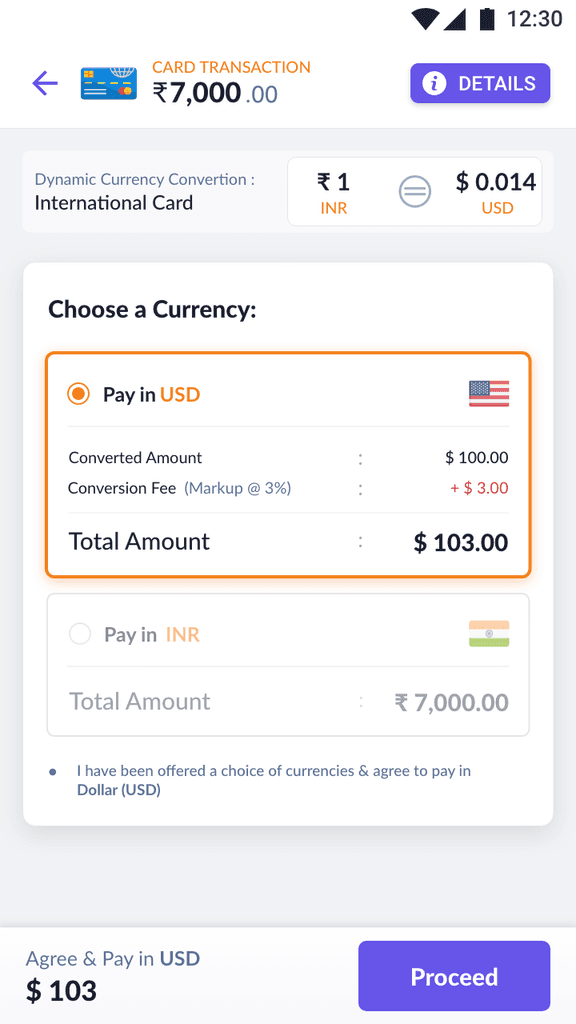

Variations of titlebar on various payment mode screen. Currency symbol (₹/$) is used everywhere instead of currency code (if available)

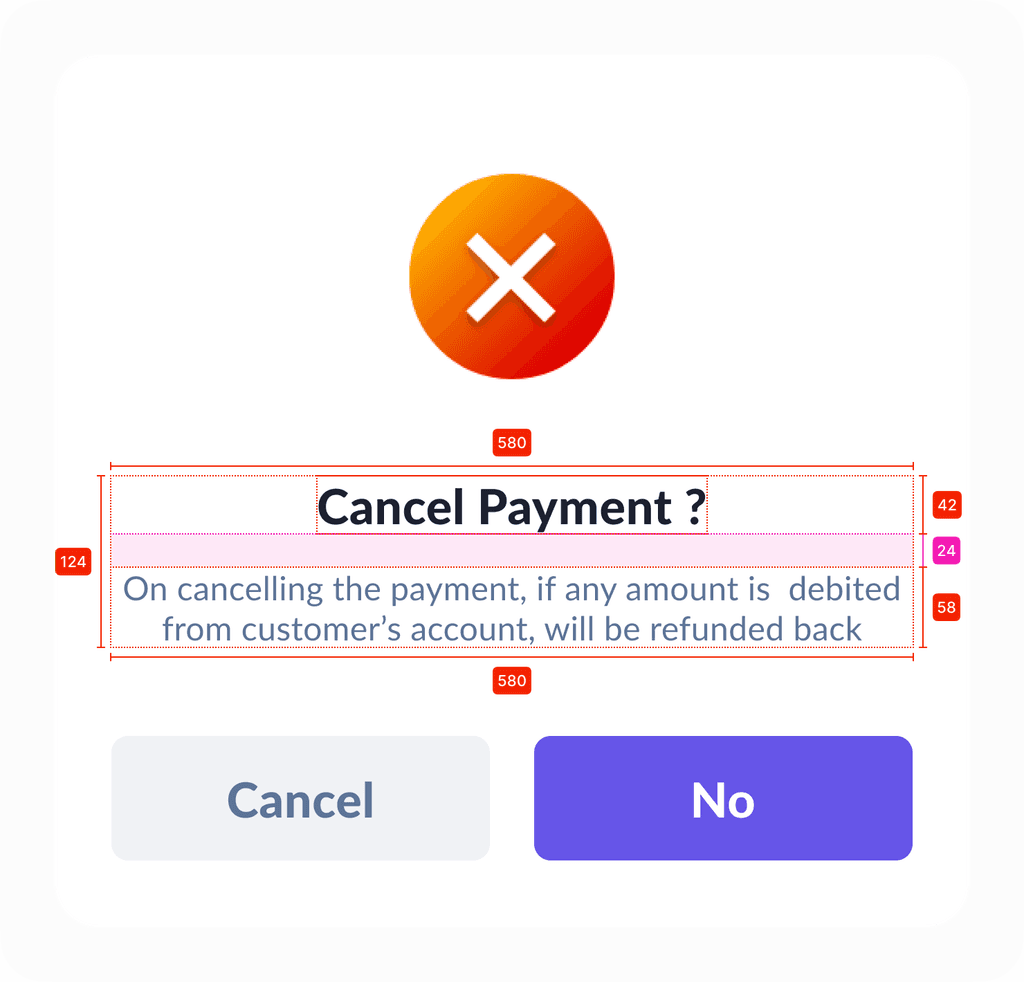

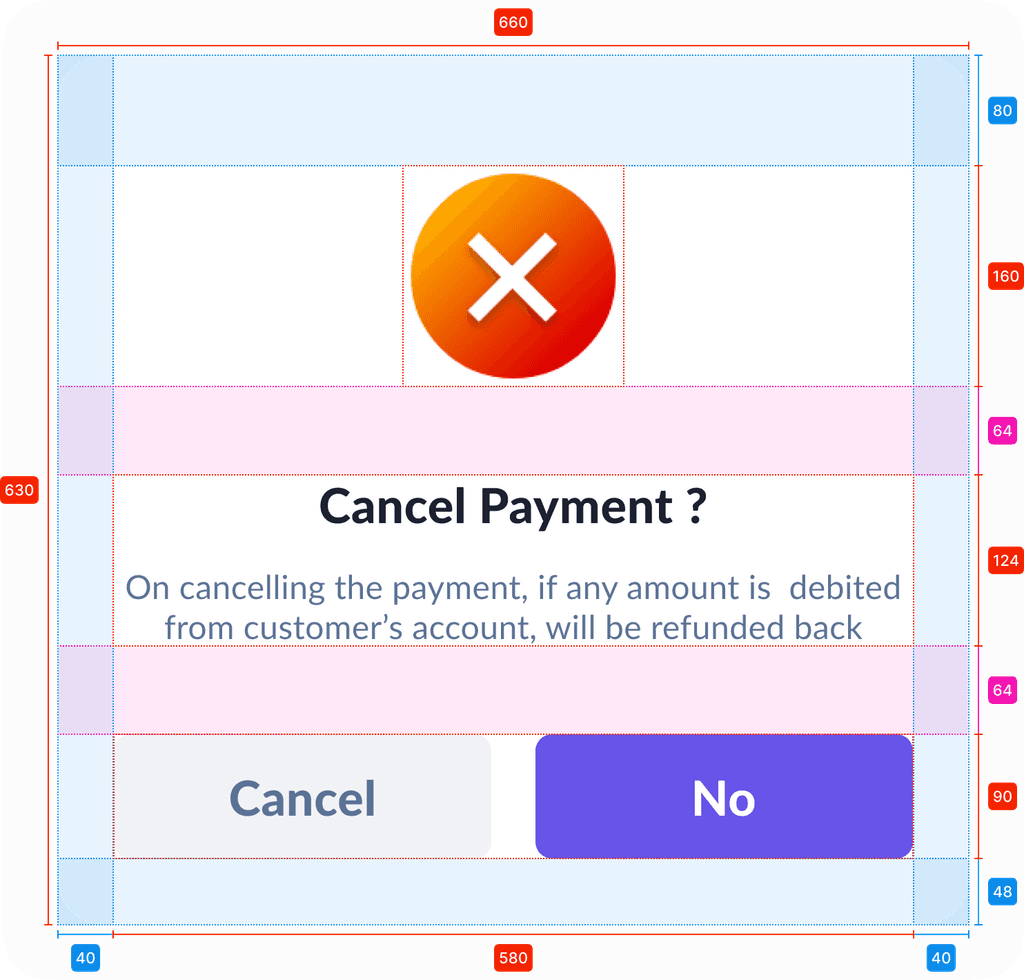

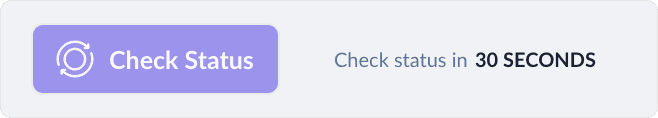

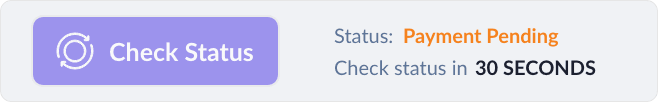

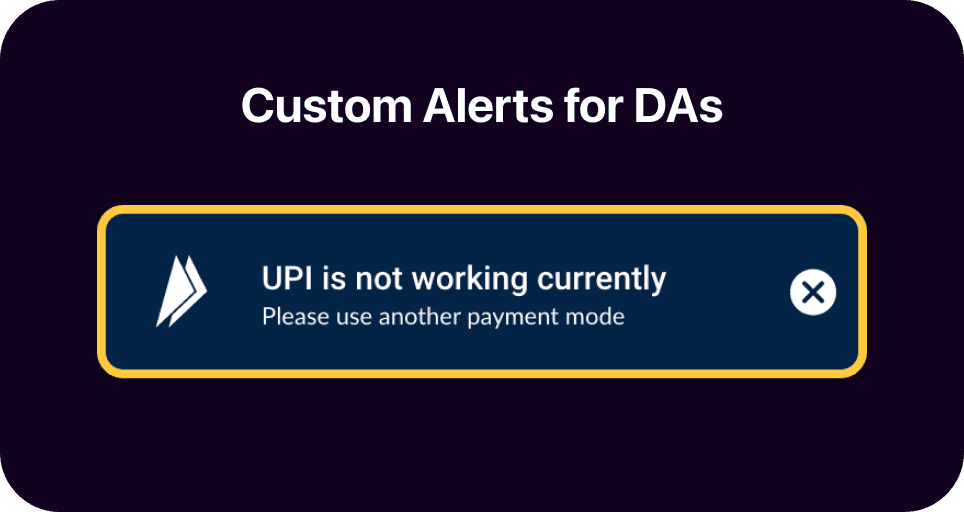

Other Components

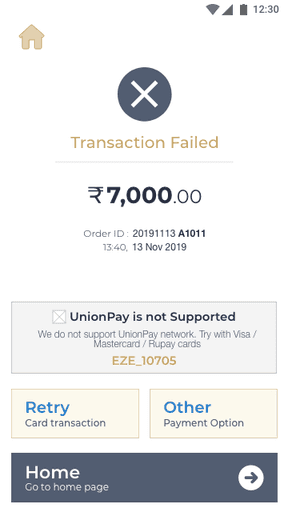

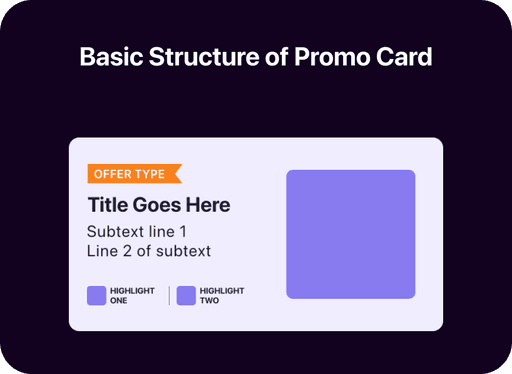

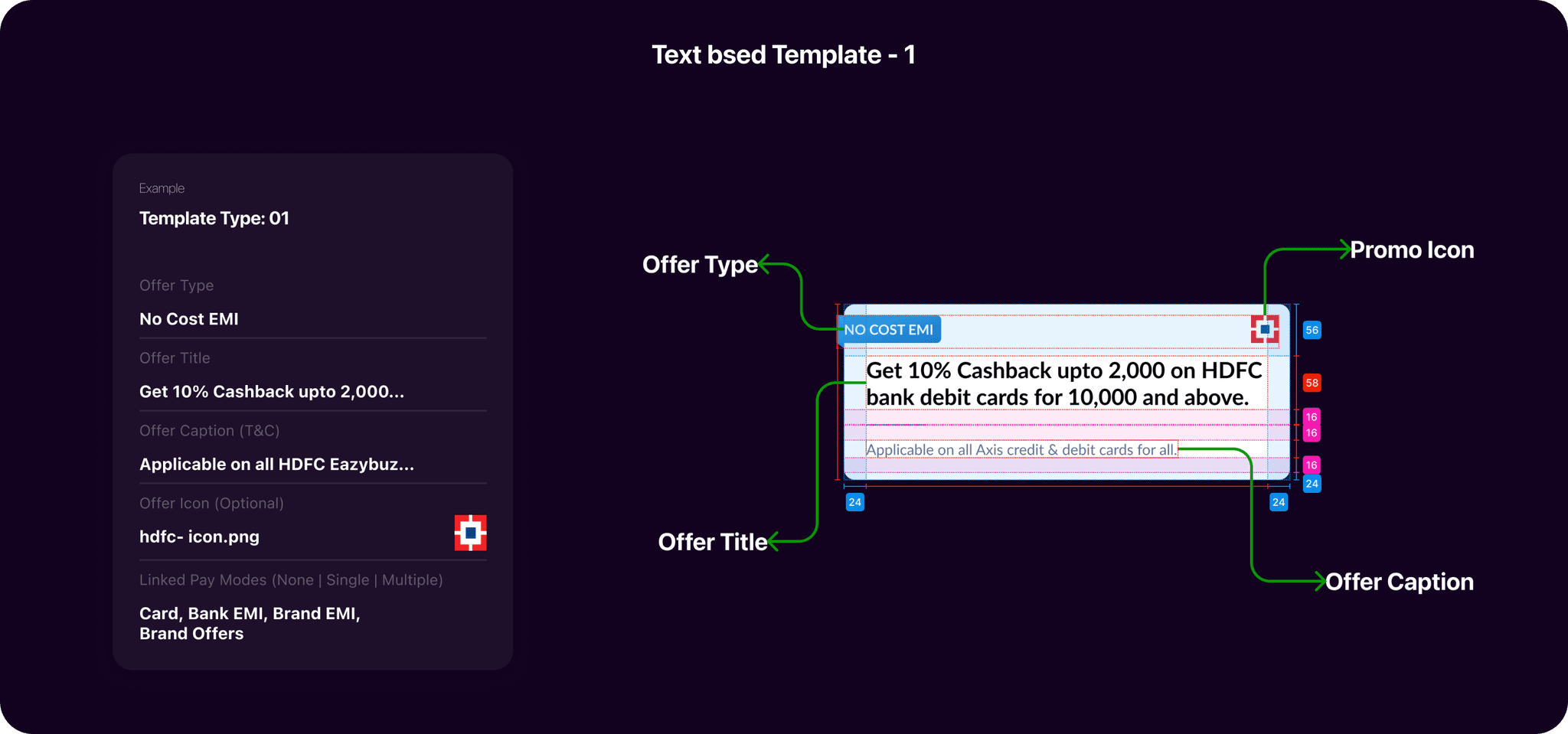

A variety of card templates have been established with different states (conditions). What we refer to as 'card components' may also be seen as templates, given they incorporate multiple base elements. Used alerts to give quick feedback on performed tasks.

Alerts / Toast Messages

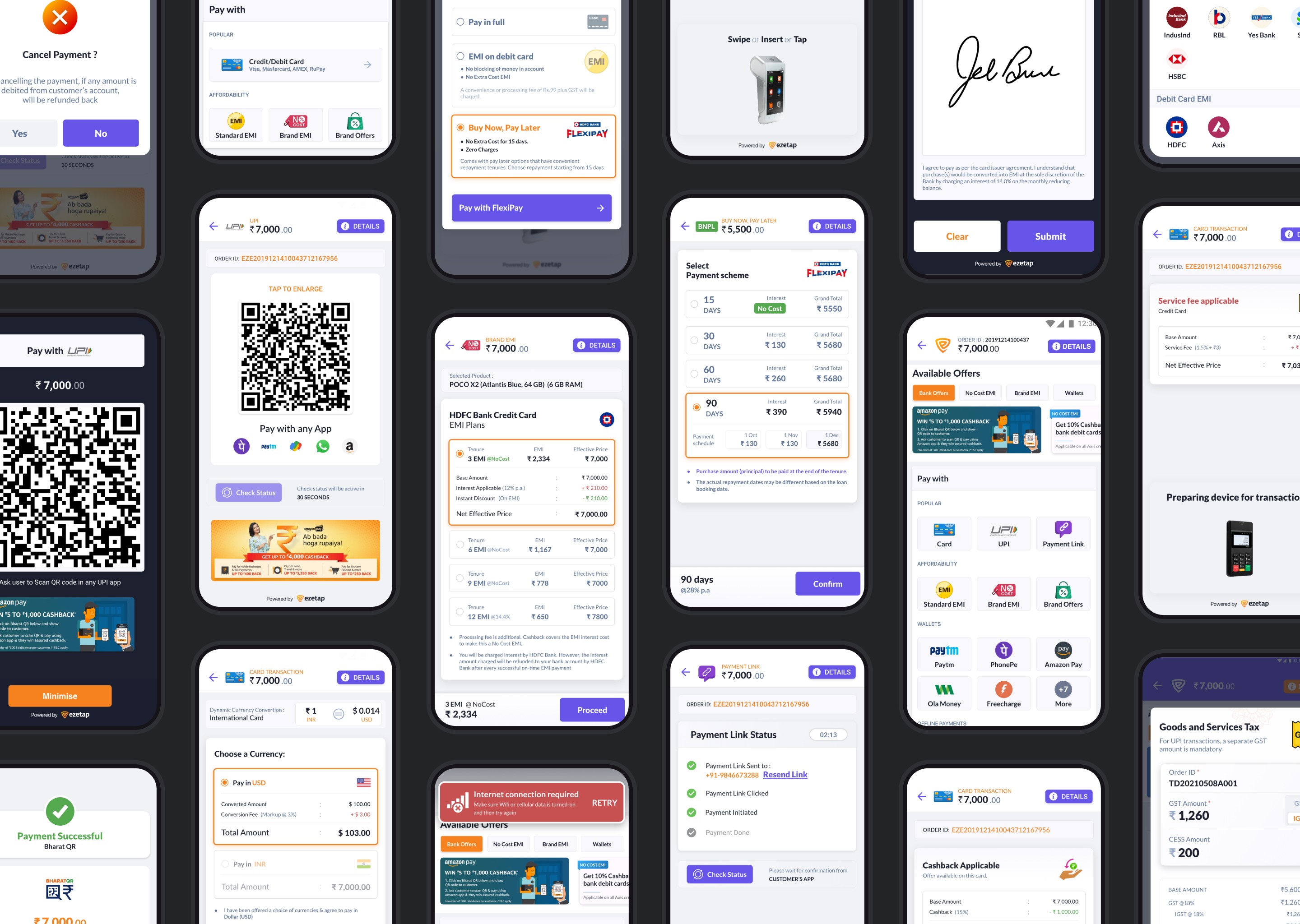

150+ unique screens of

UI Designs

Total 500+ screens based on various conditions and solutions

Balancing Functionality and Innovation

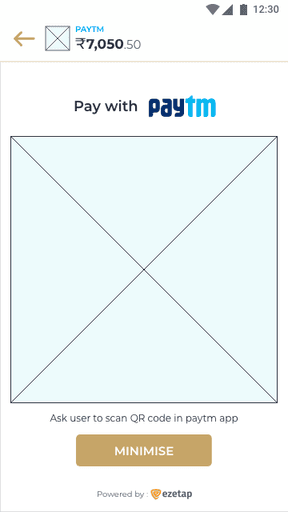

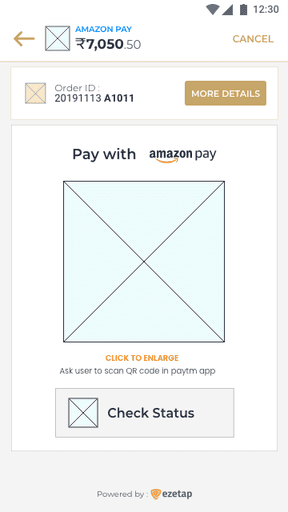

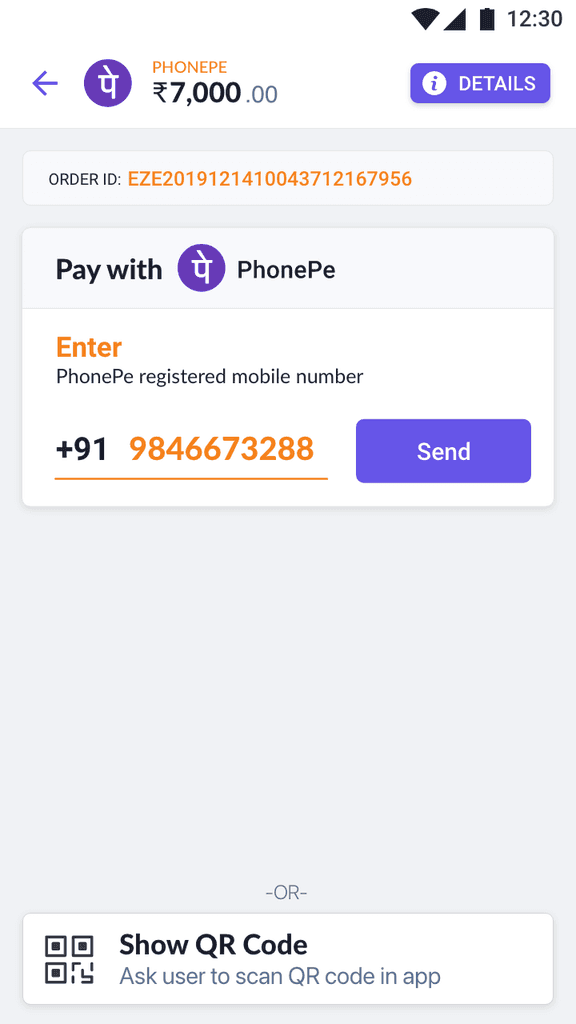

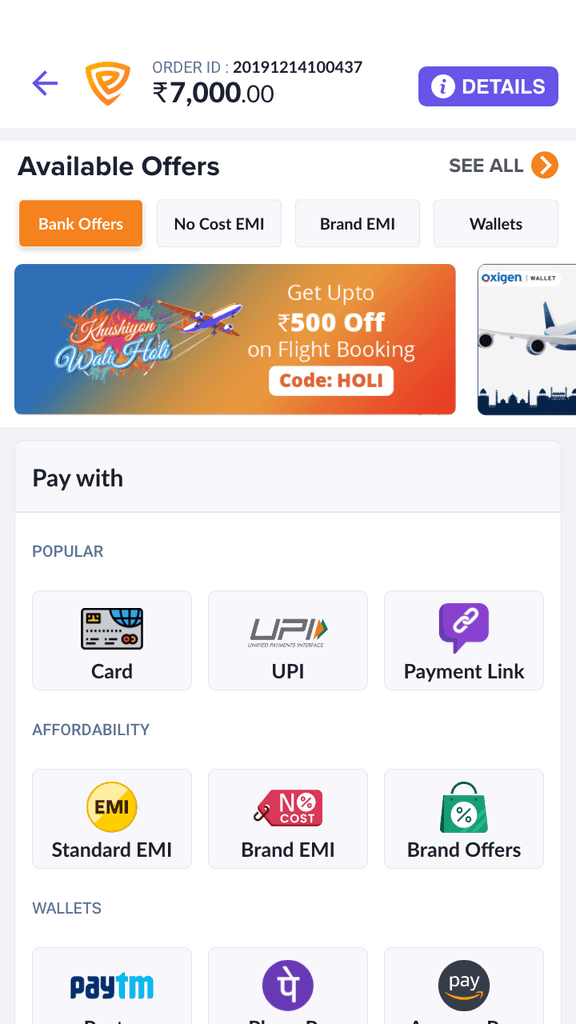

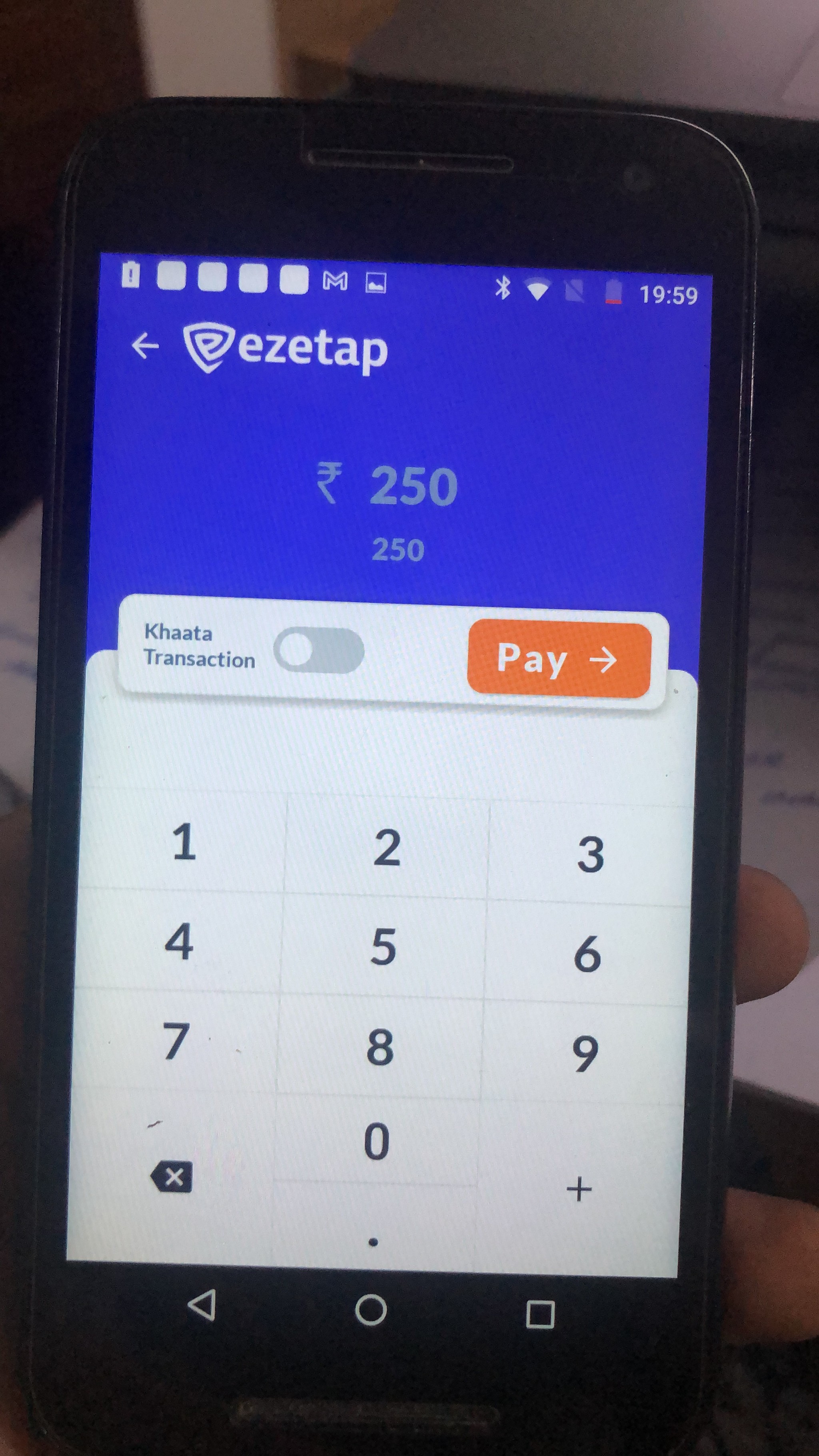

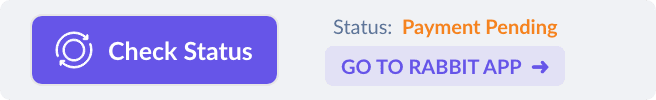

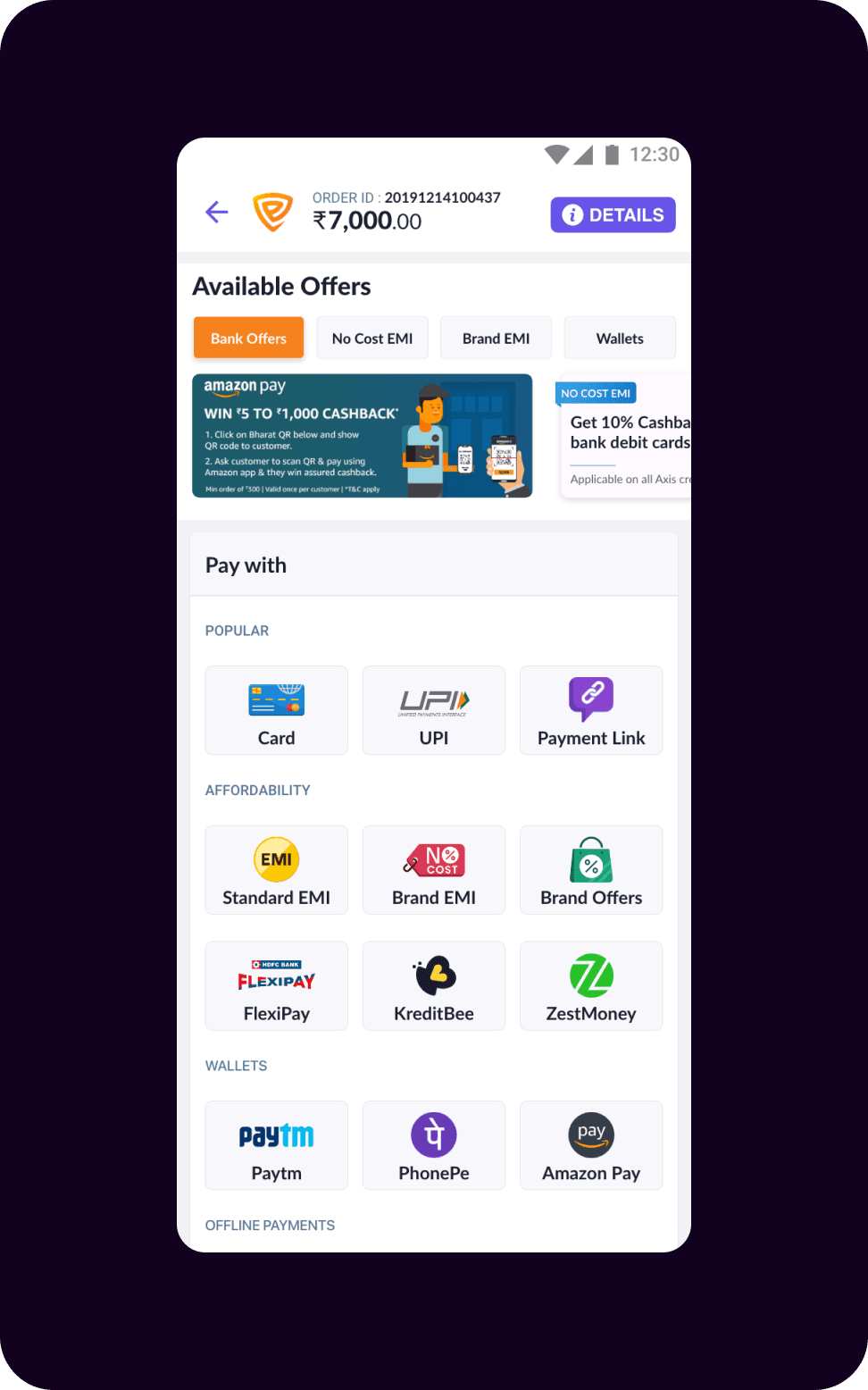

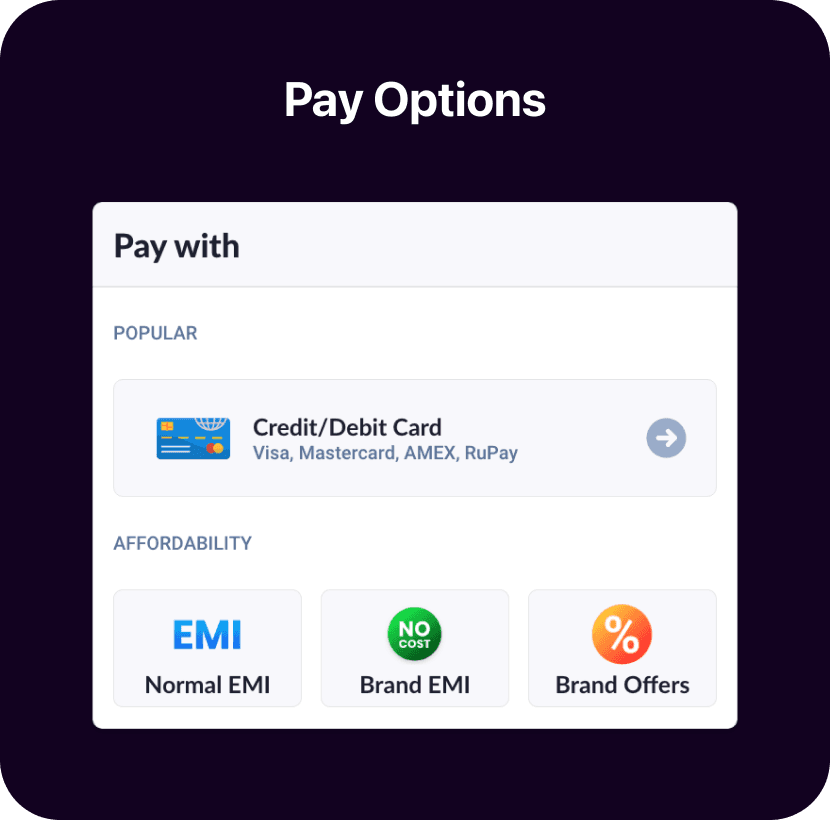

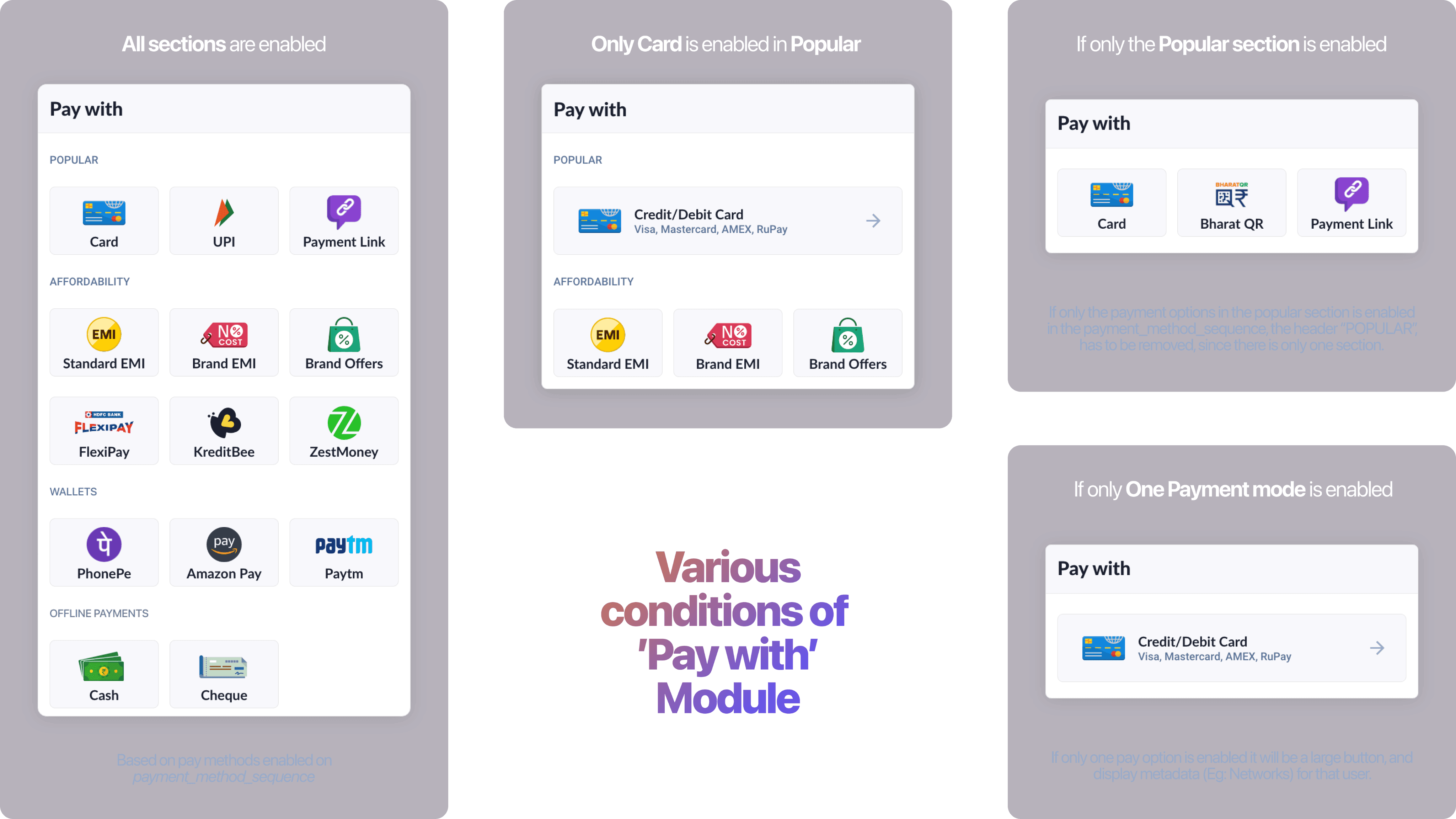

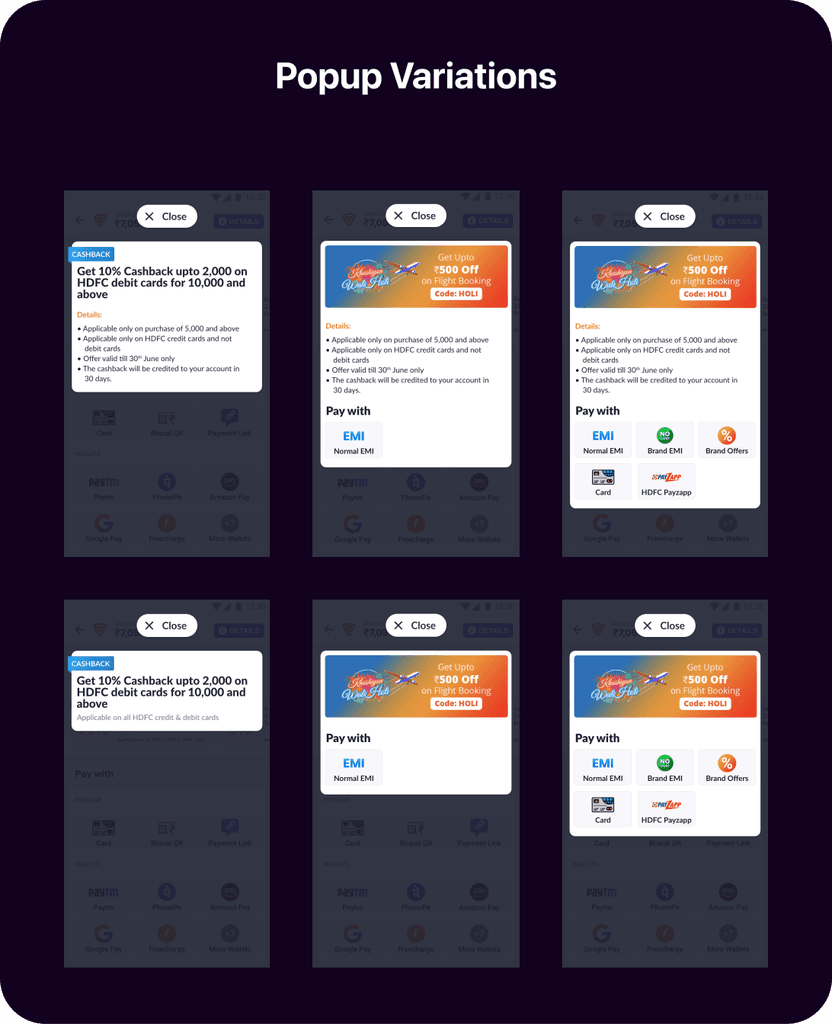

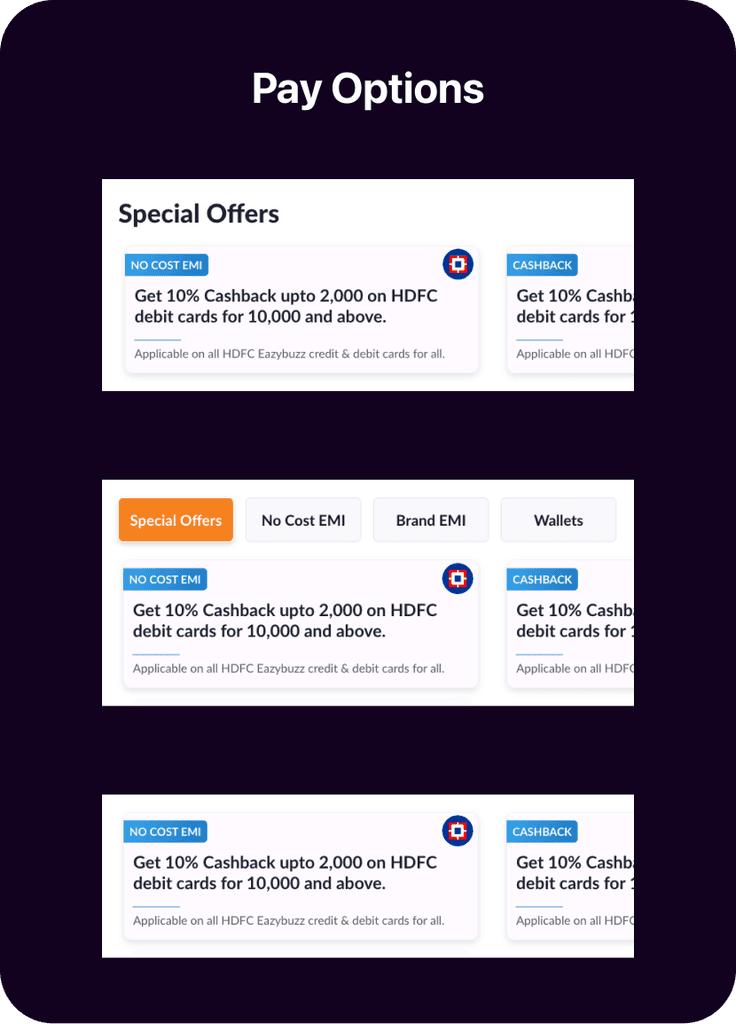

Pay with

Screen

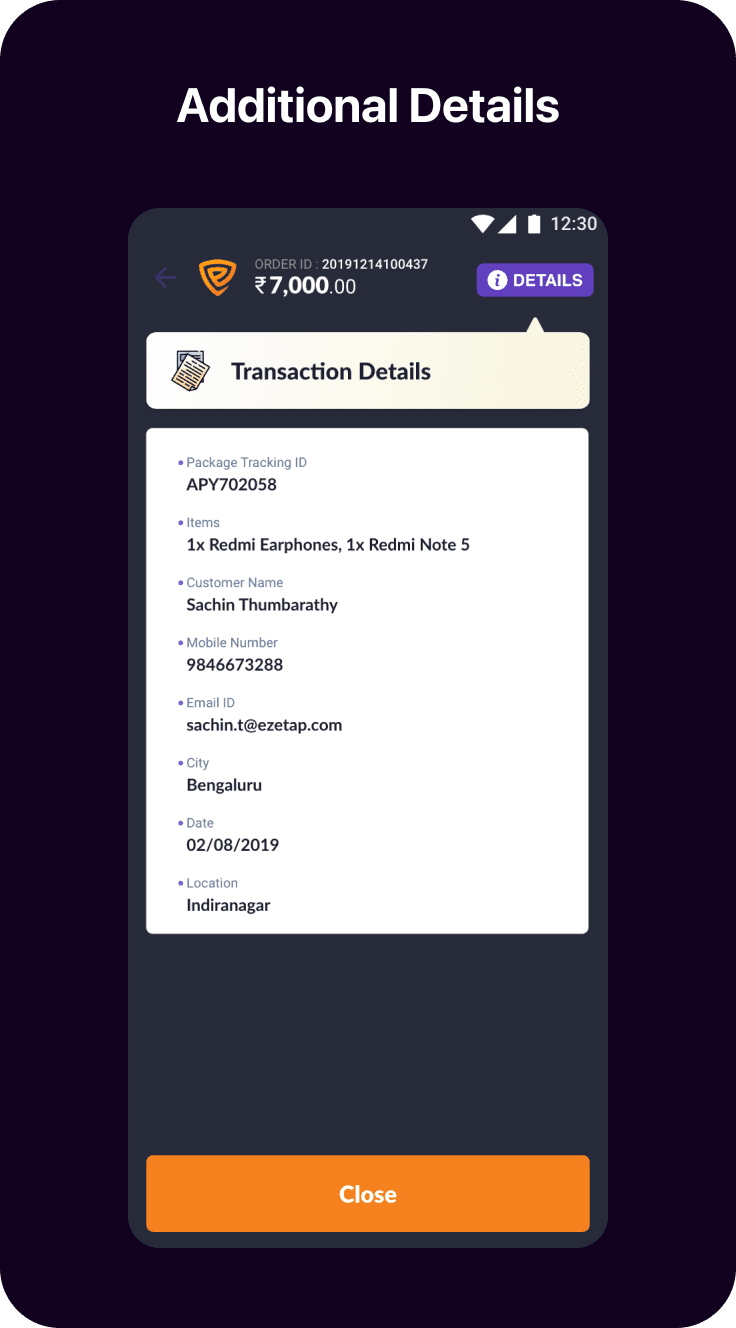

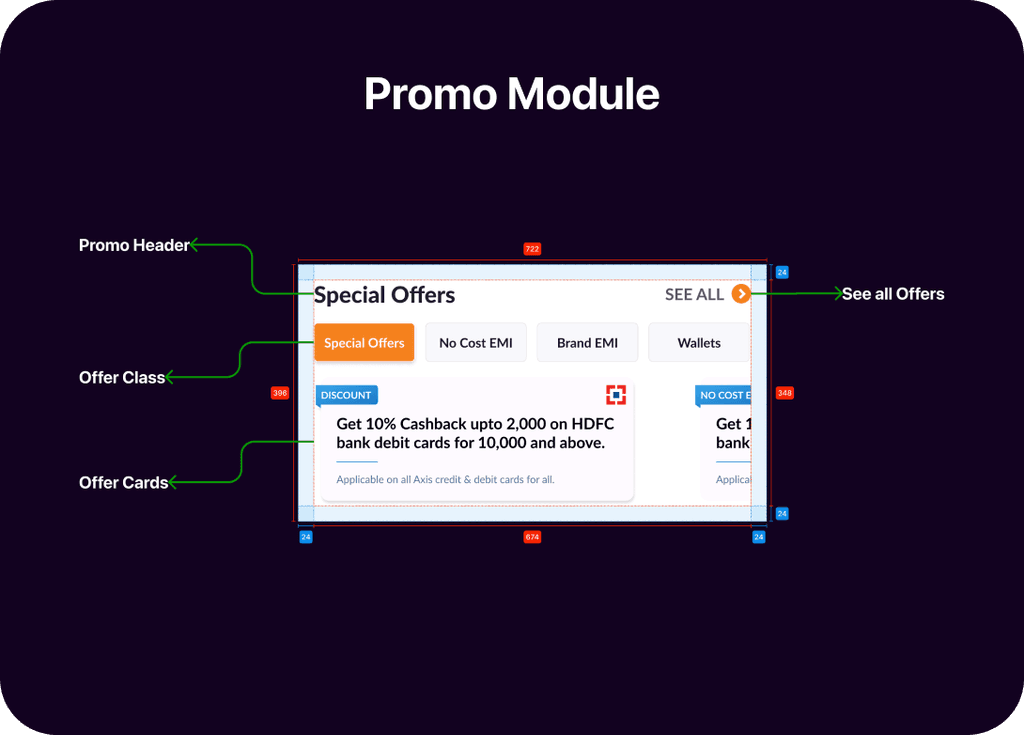

Universal Payment Screen or 'Pay with' screen is the screen in which the user chooses the payment mode. This screen also displays additional details about the order and payment offers if available.

Solution

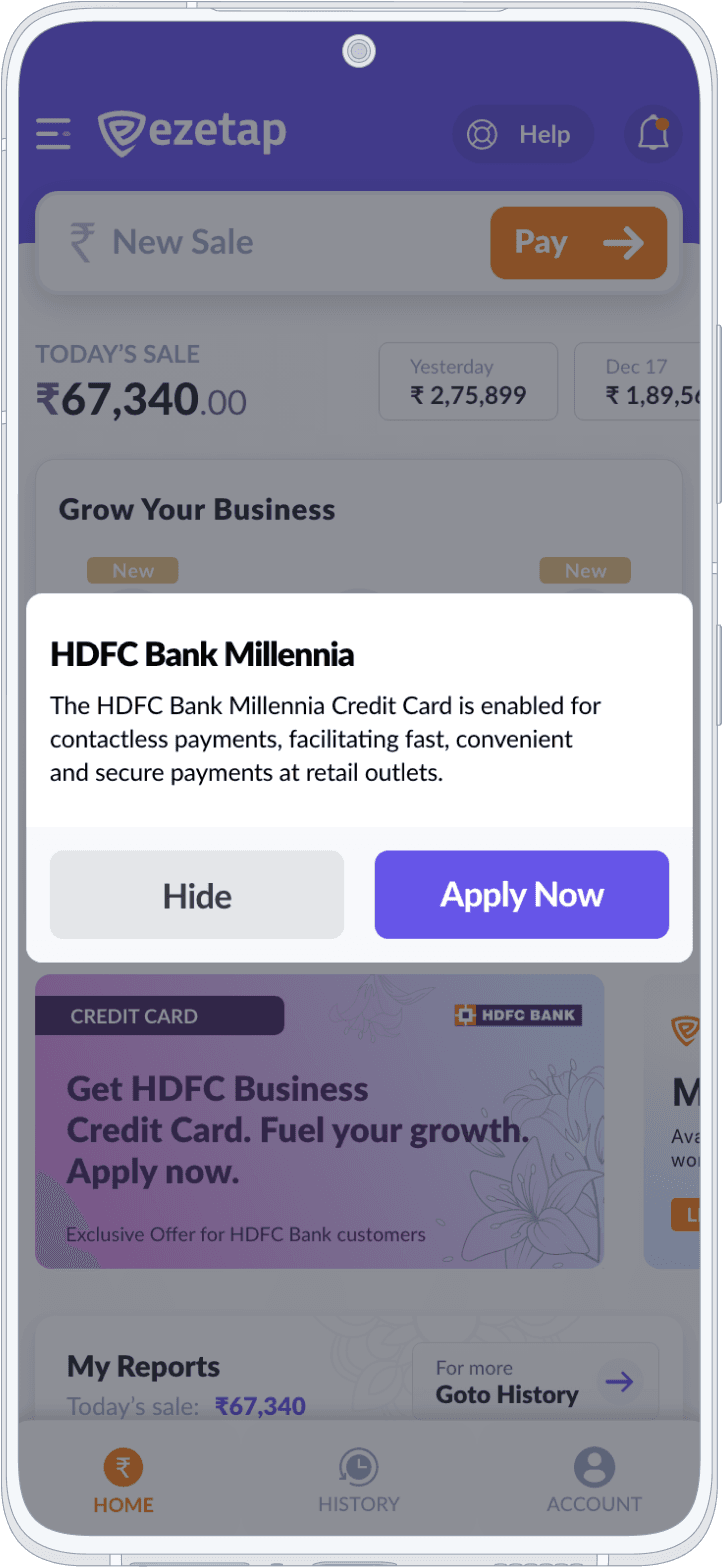

To address this, we revolutionised the Home Screen into a dynamic dashboard.

Universal

Payment Screen

This strategic redesign prioritised a holistic view of all features, empowering merchants with an "at a glance" experience.

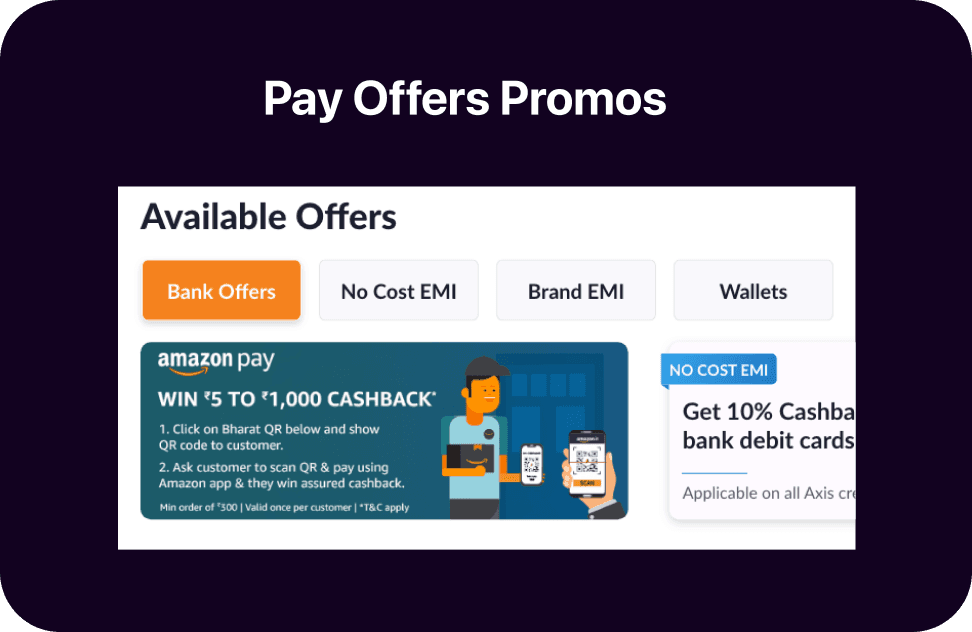

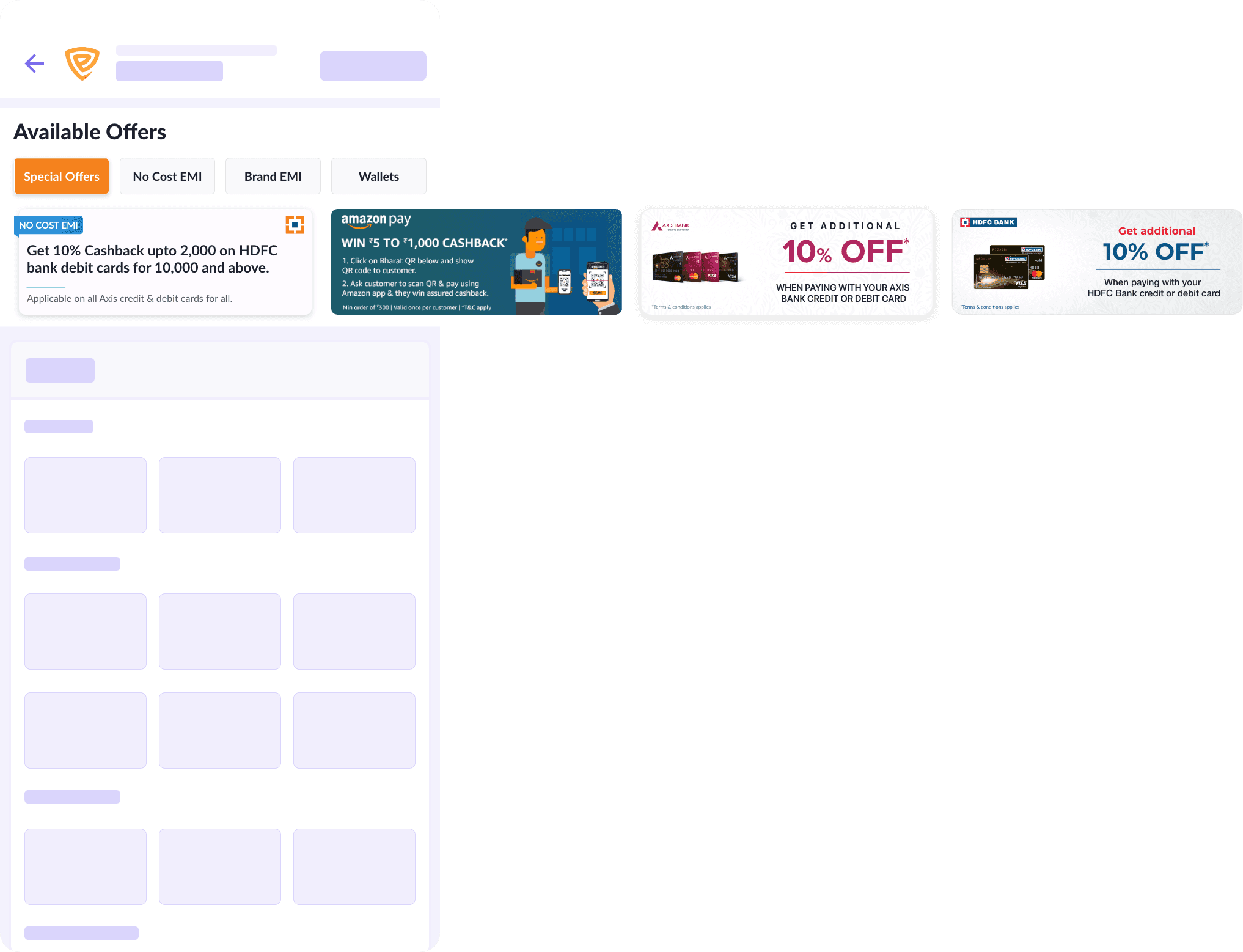

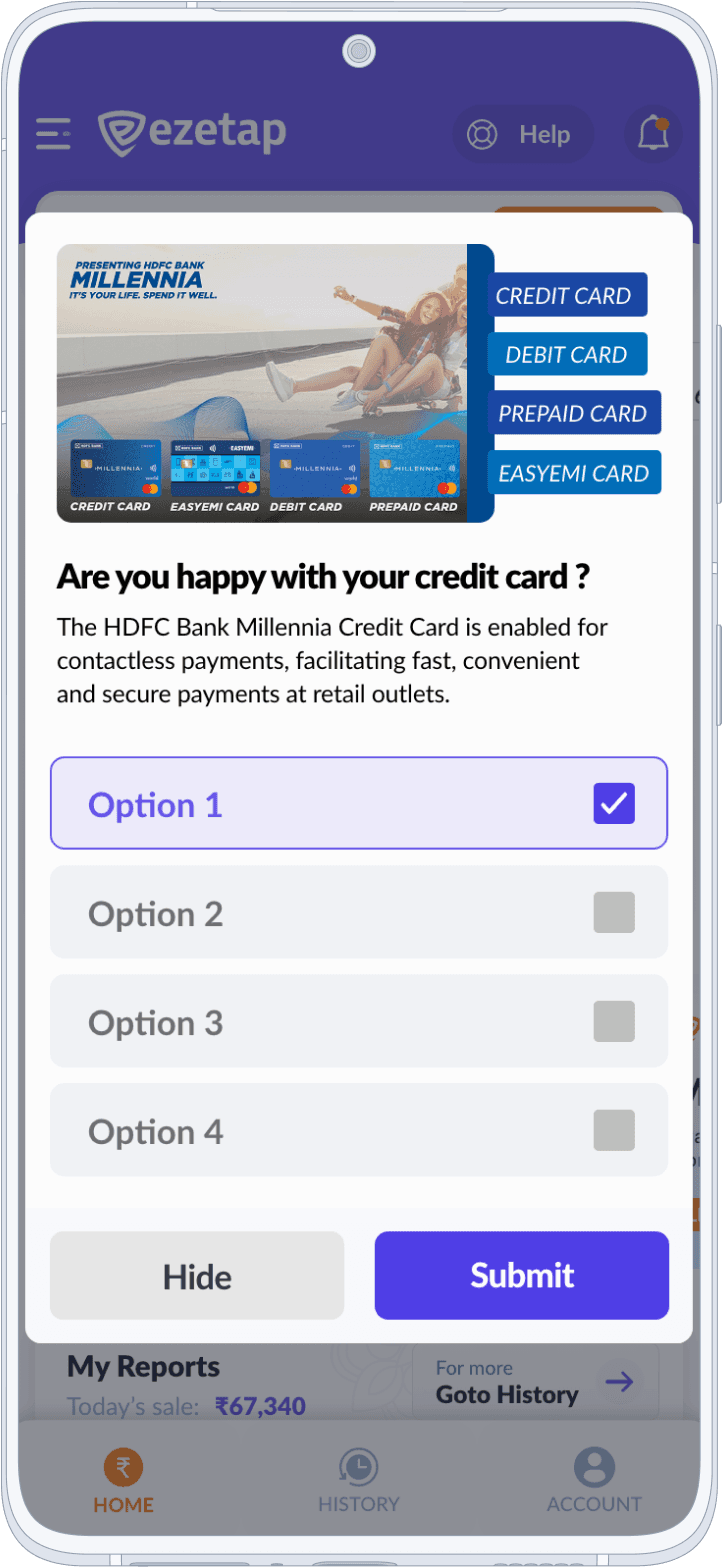

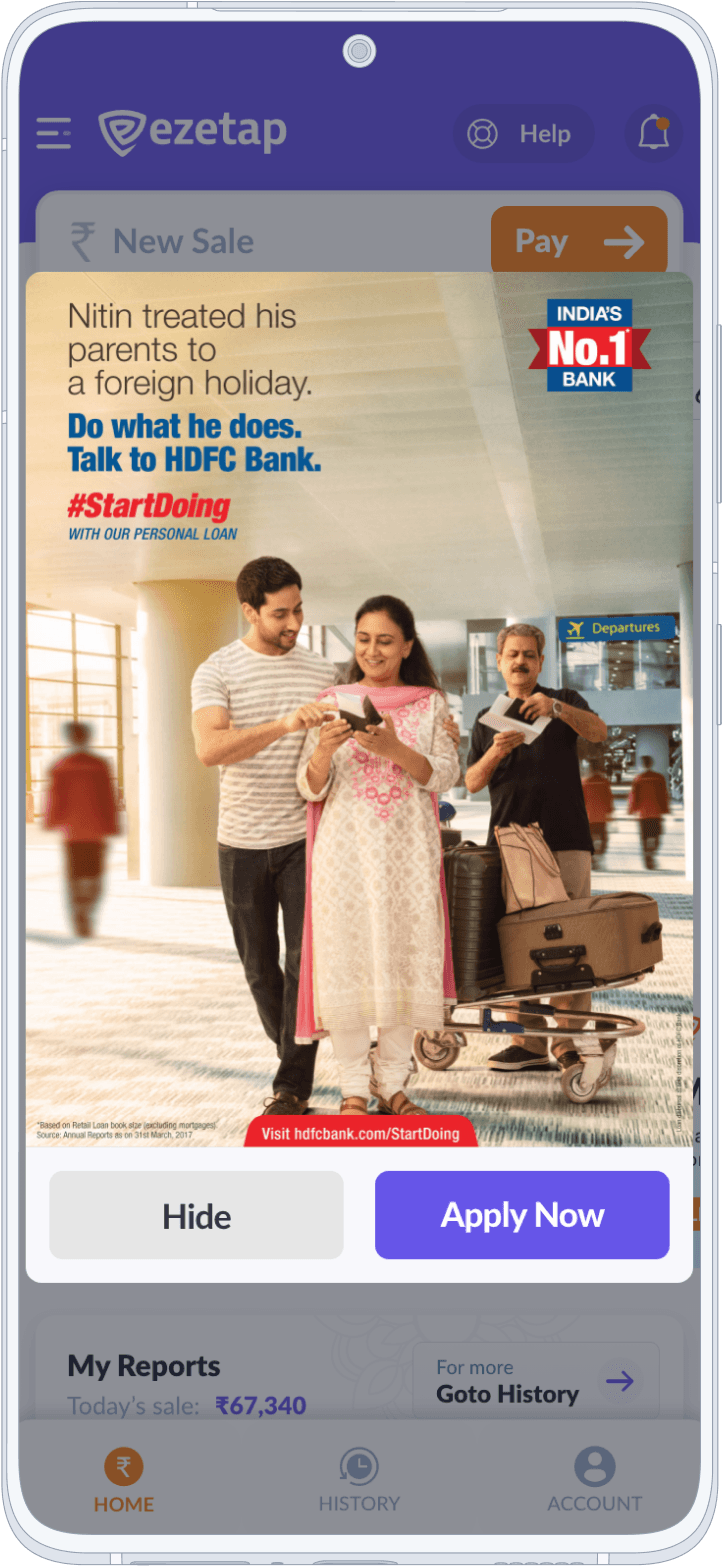

Payment Promos

JSON-based

Template Generator

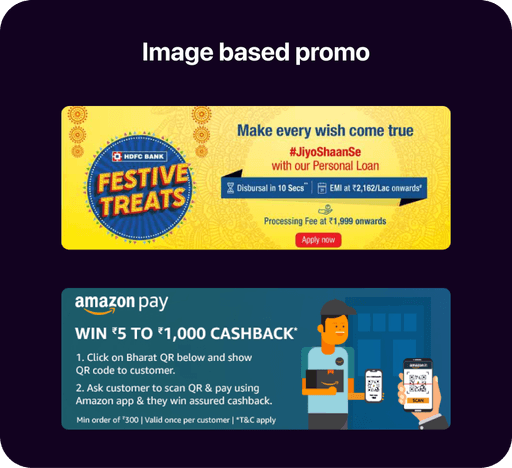

A JSON-based template generator was introduced to enable promo configuration. Banks/NBFCs could easily add text or image promos to the configurations for display on the main screen.

Created a JSON-based template generator allowing banks to configure promos easily.

Payment Offer Promos

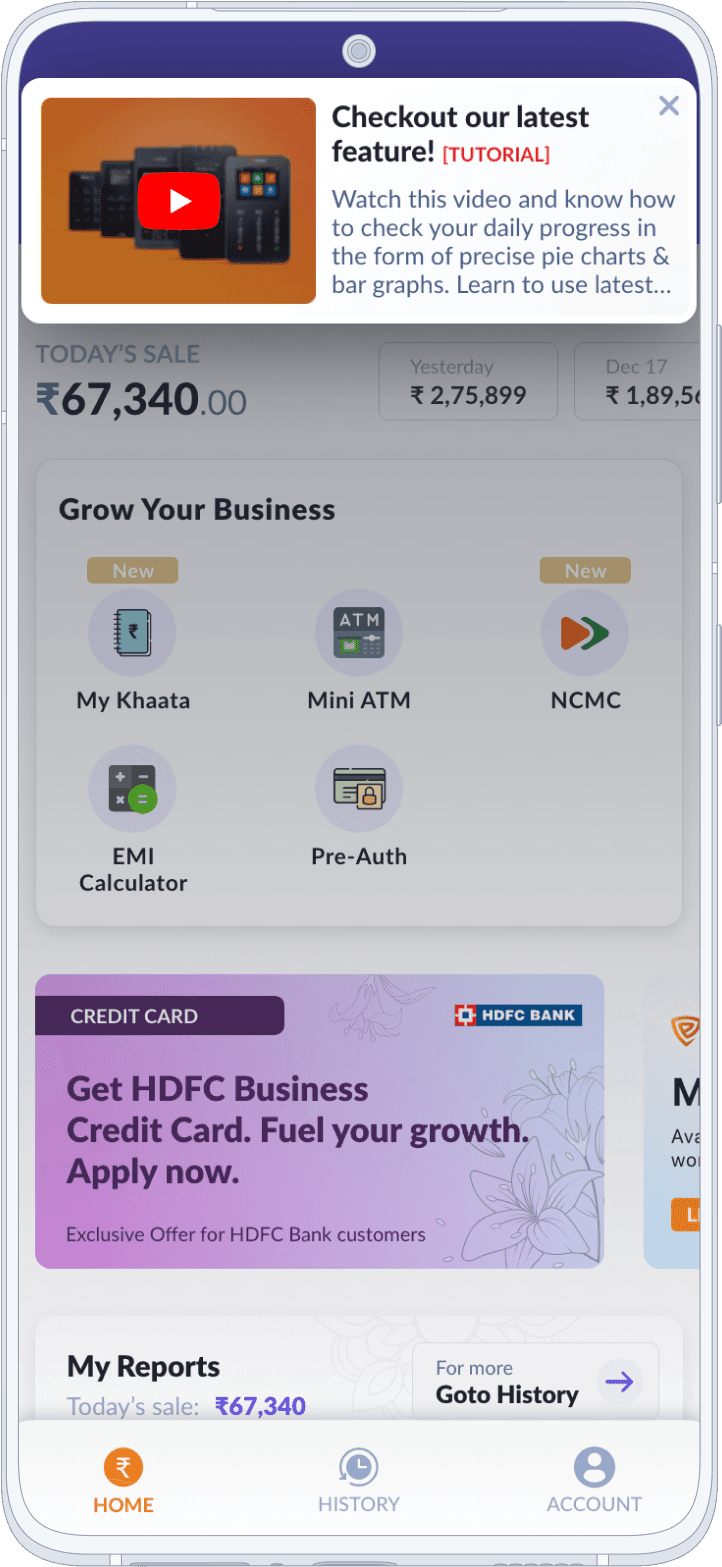

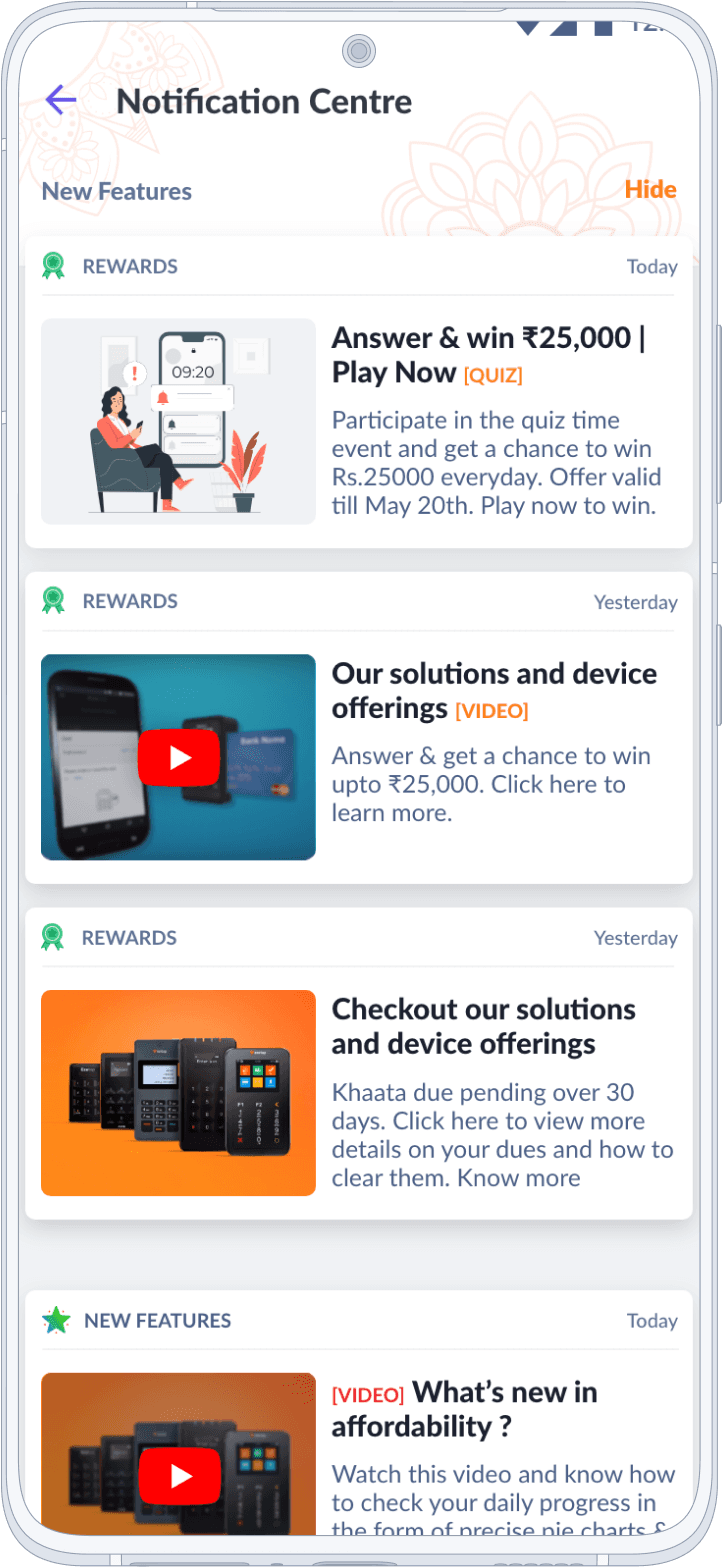

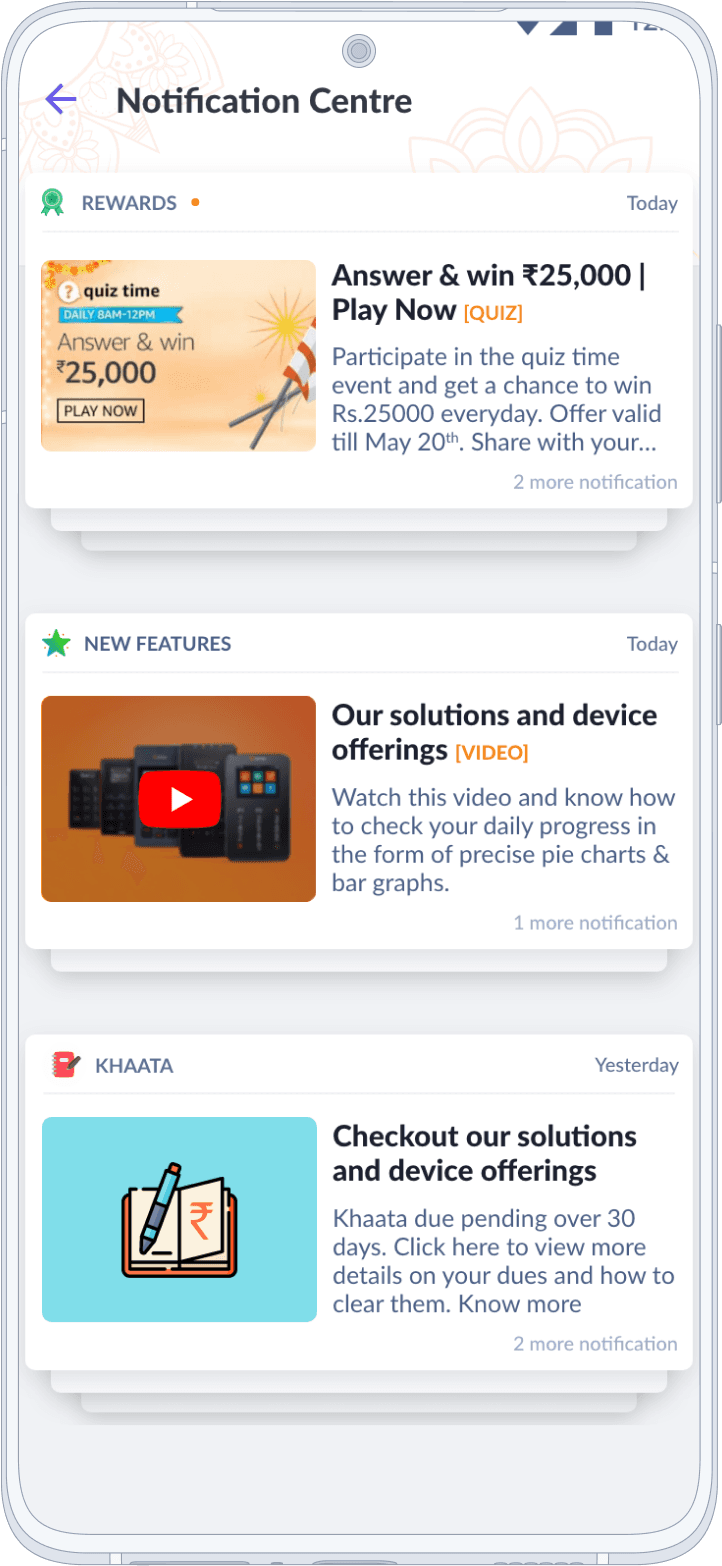

Notification Centre

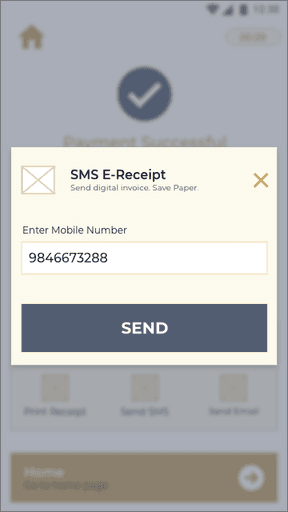

Where merchants receive alerts, triggers, and updates about critical information. Whether it's about their Khaata, rewards, or new features, merchants can effortlessly stay informed and make well-informed decisions.

In-App Messaging

Establishing direct communication between merchants and providers through personalized messages and offers

Promo 2.0

The Promo 2.0 comprising of a powerful Promo generator, IAM & Notification Centre became an integral part of the app, providing an effective way to engage users with offers, deals, and promotions, ultimately enhancing the app's value to both merchants and banks.

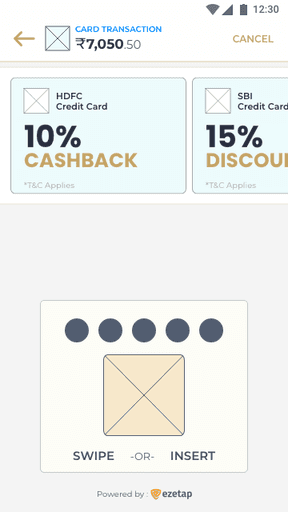

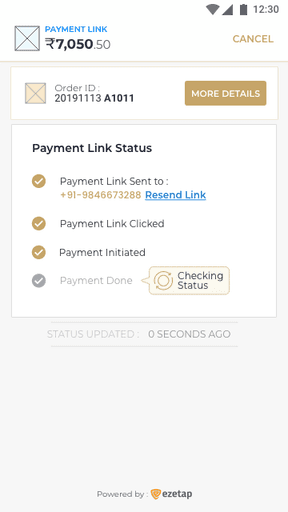

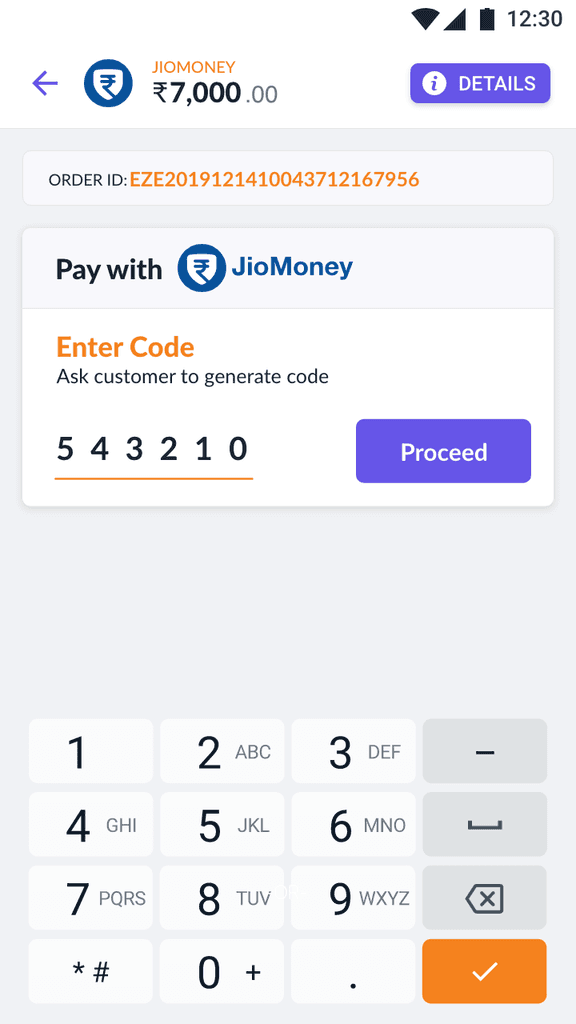

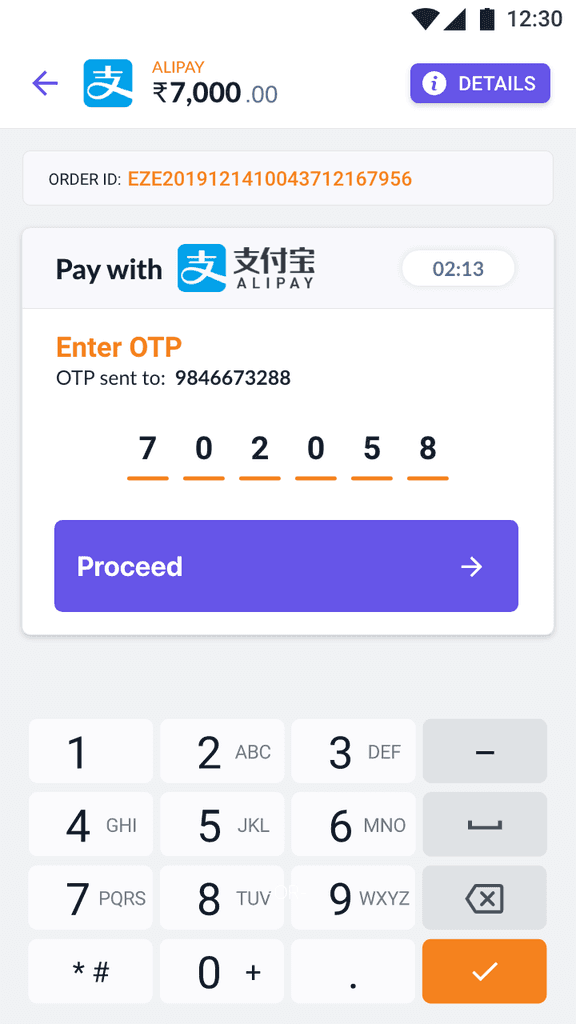

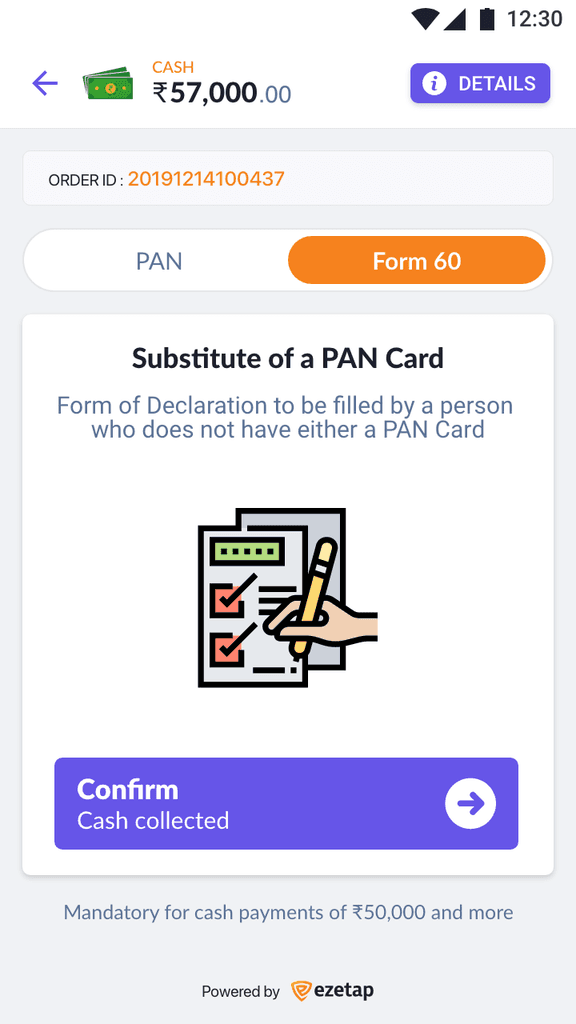

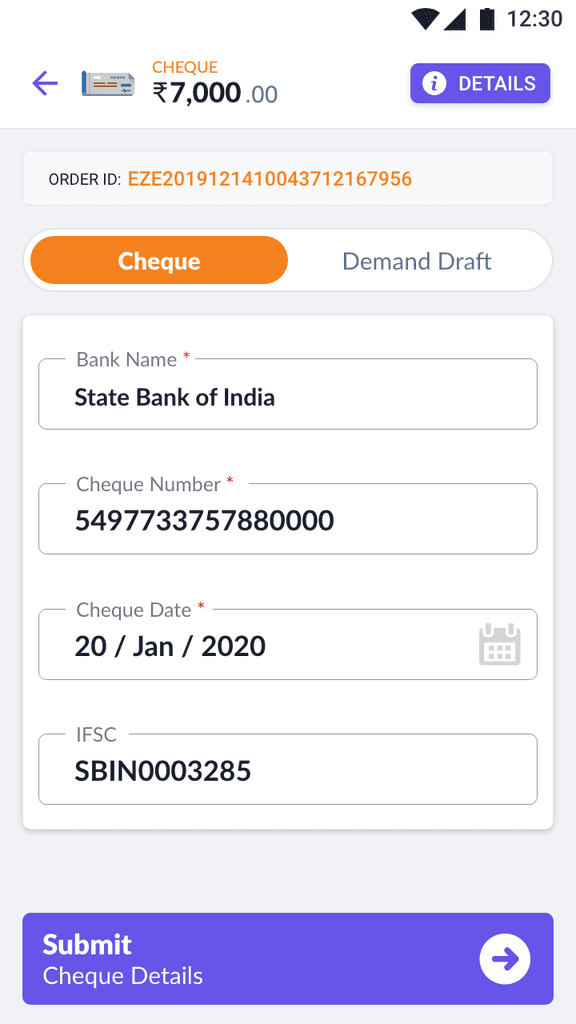

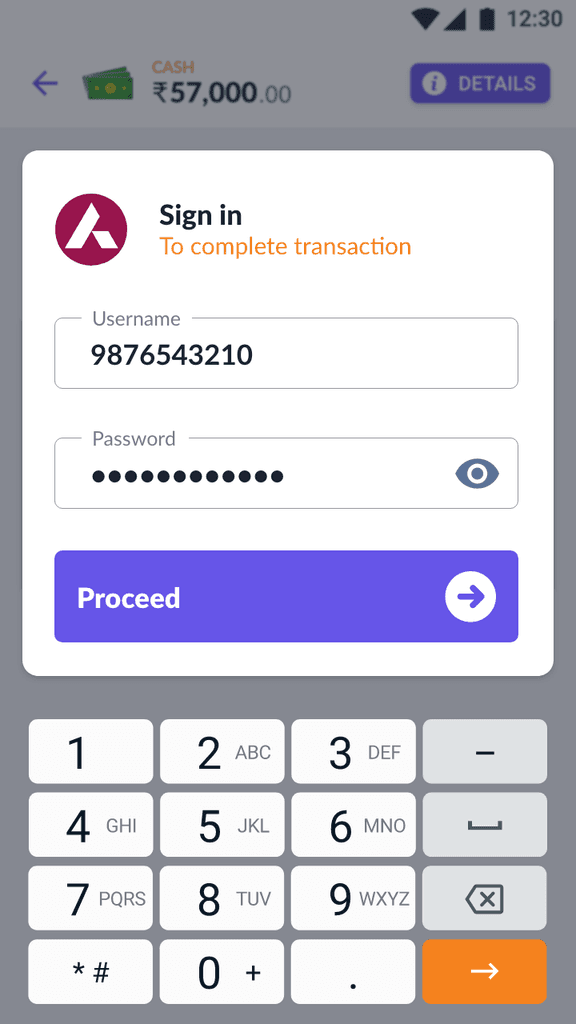

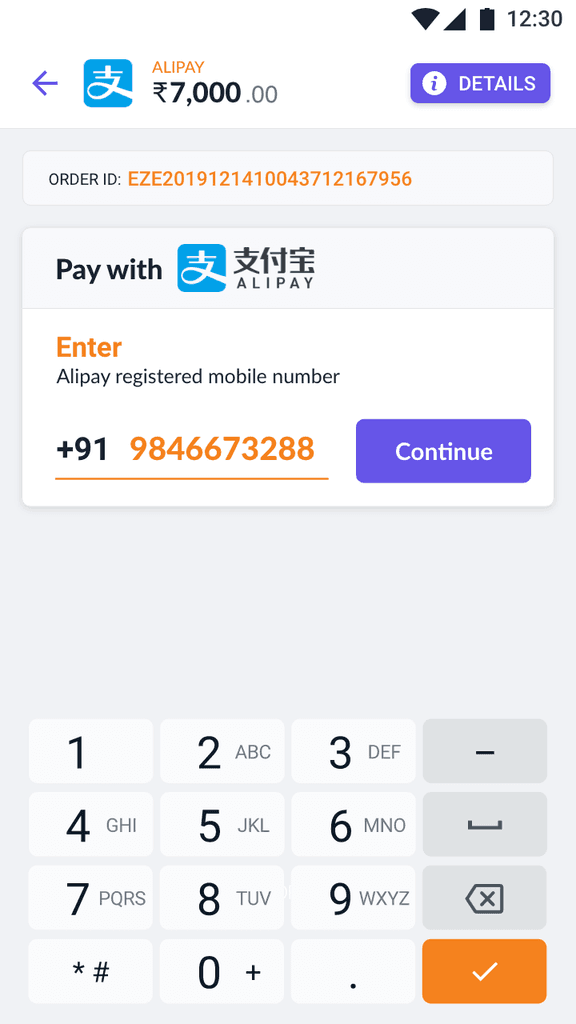

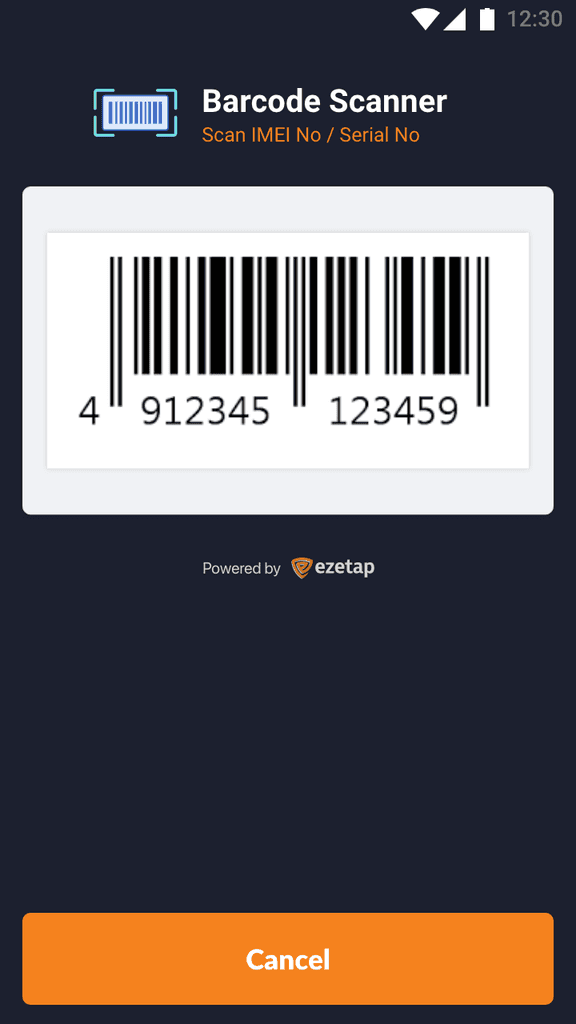

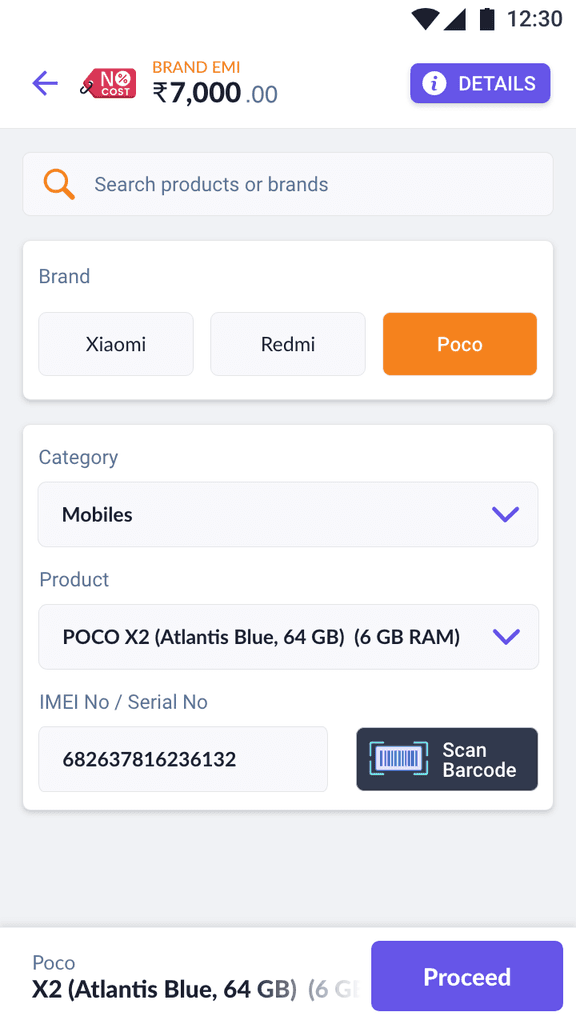

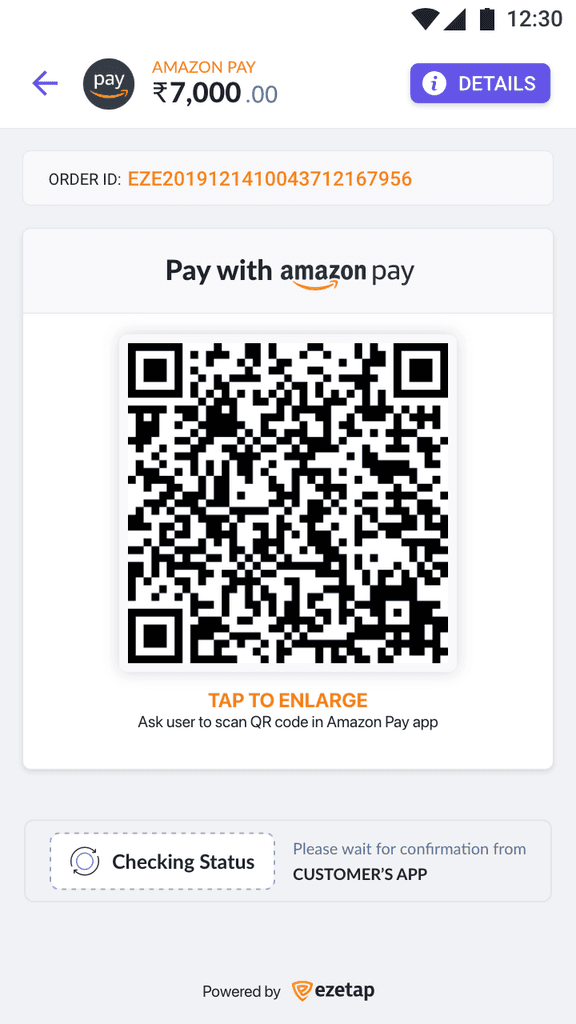

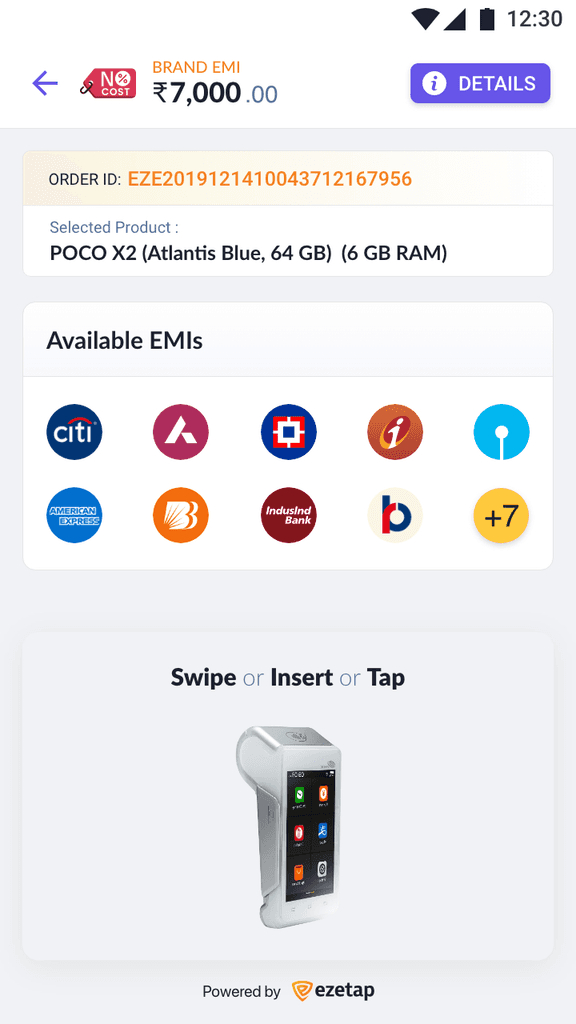

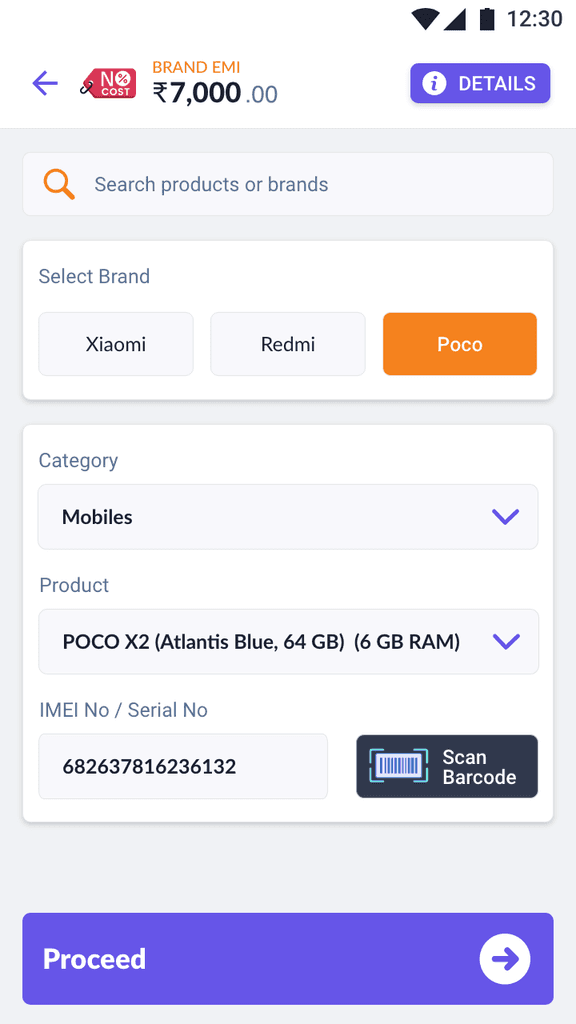

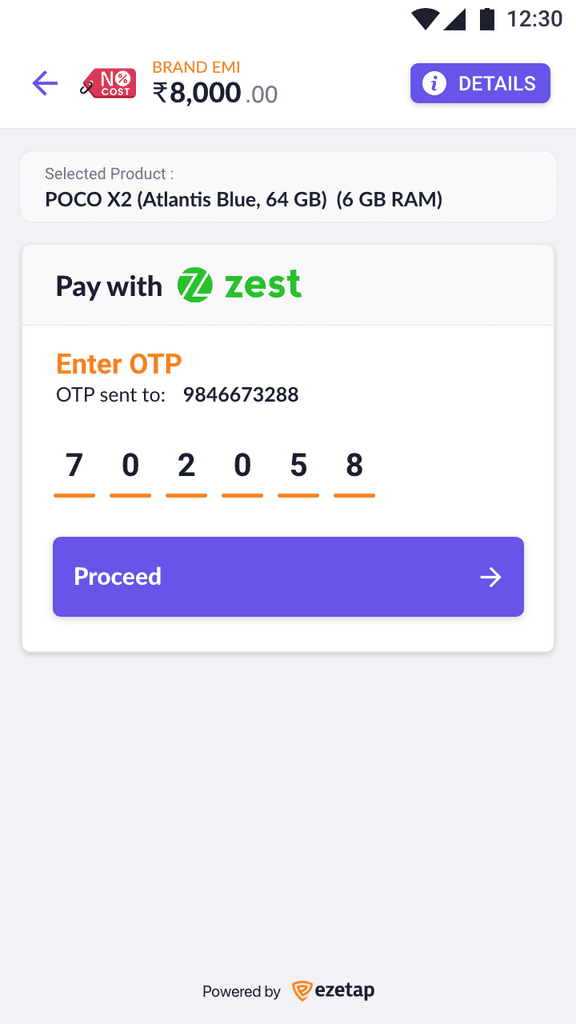

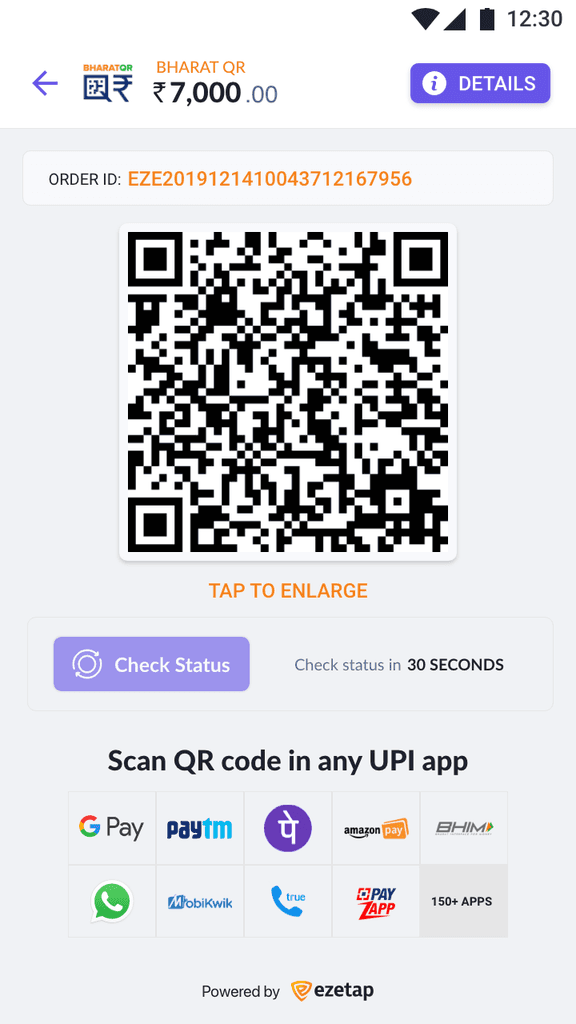

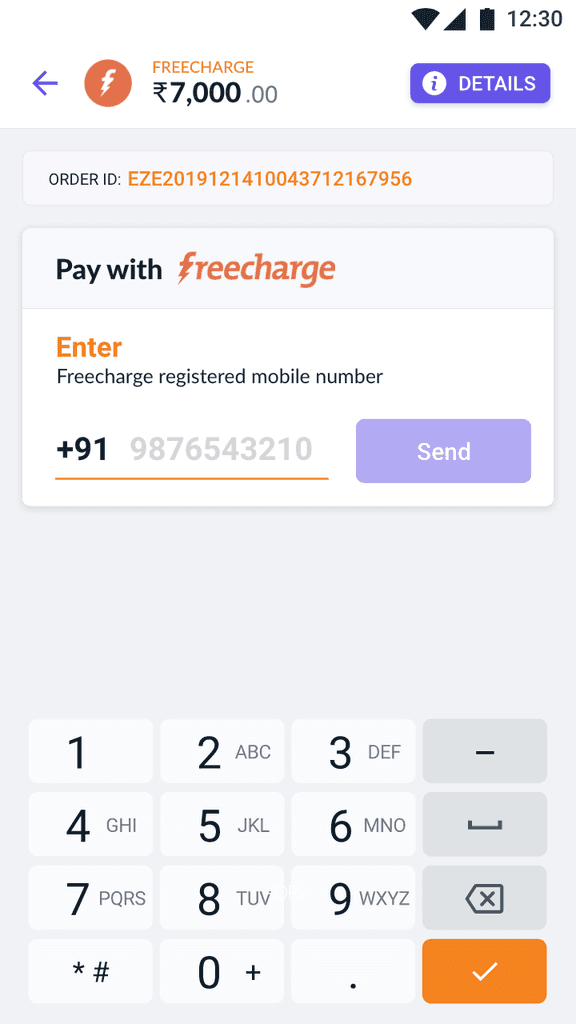

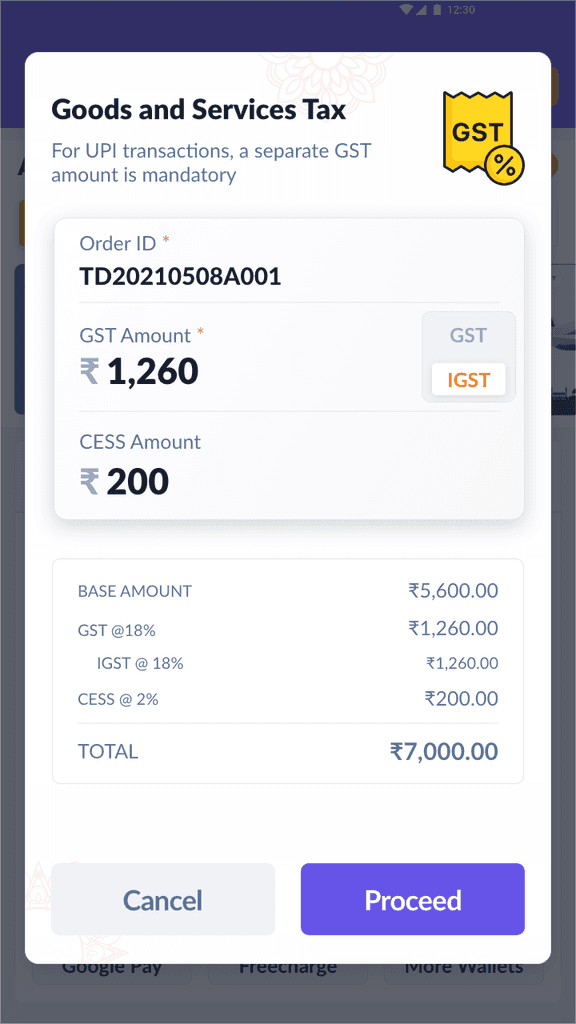

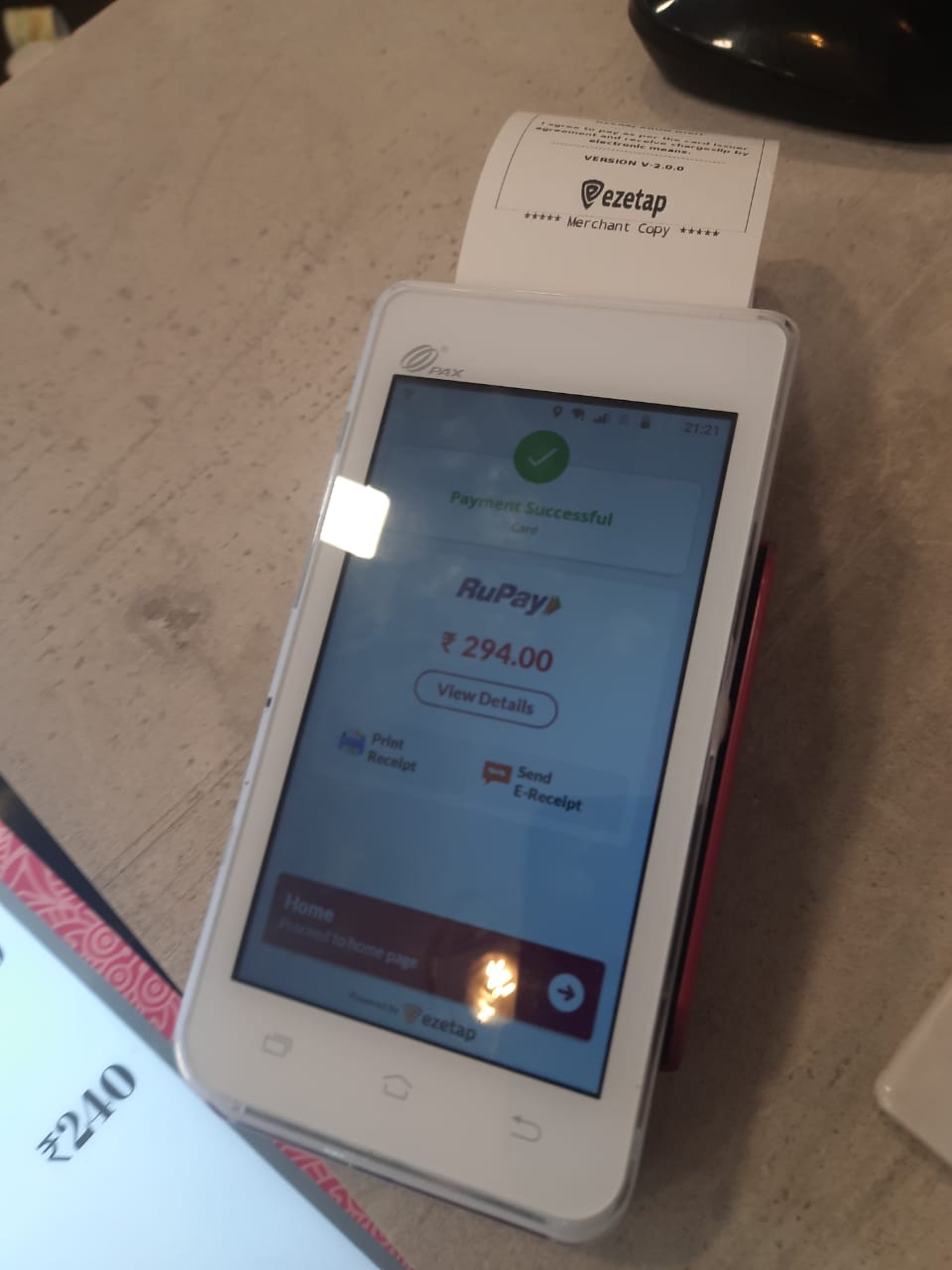

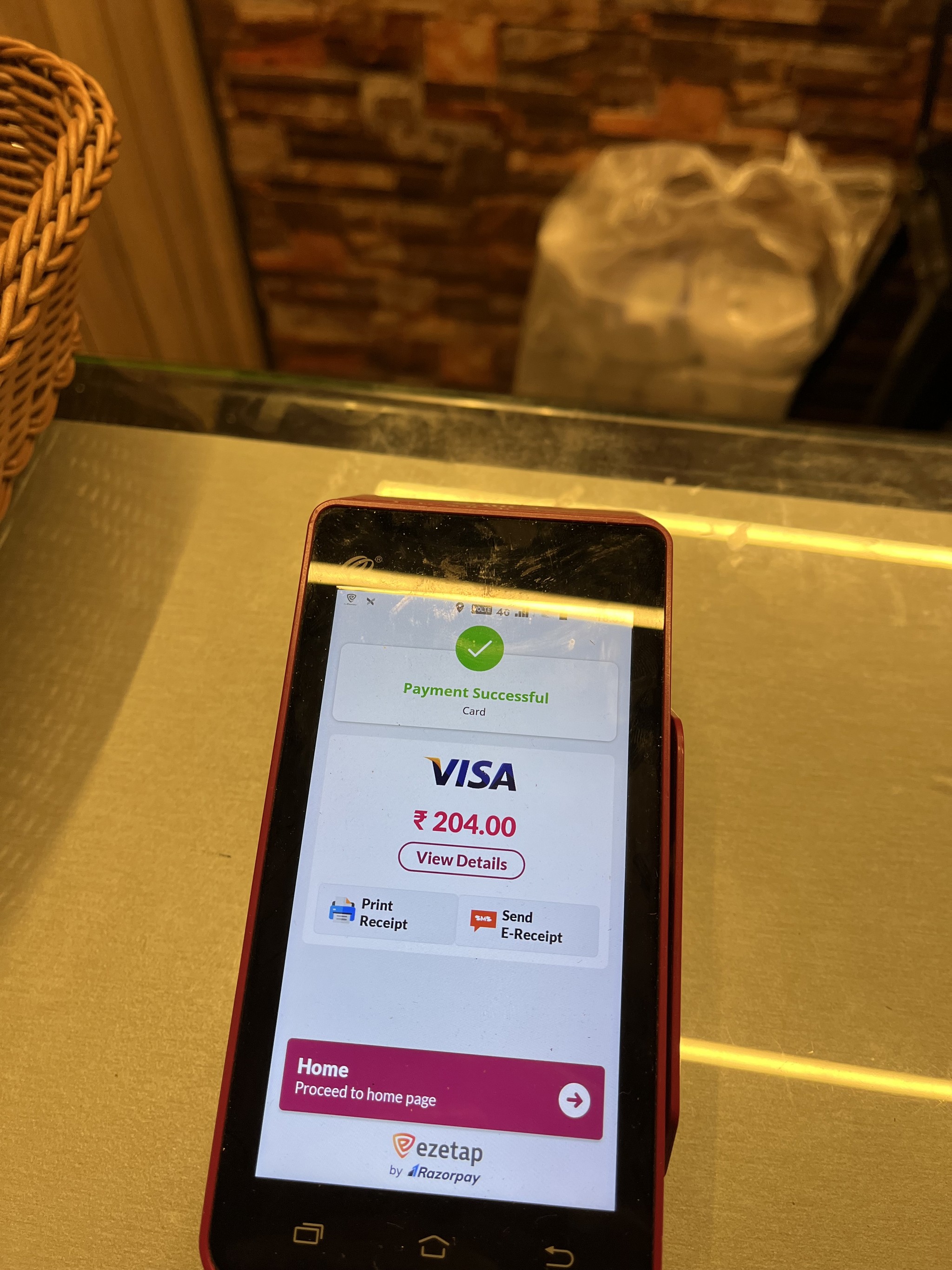

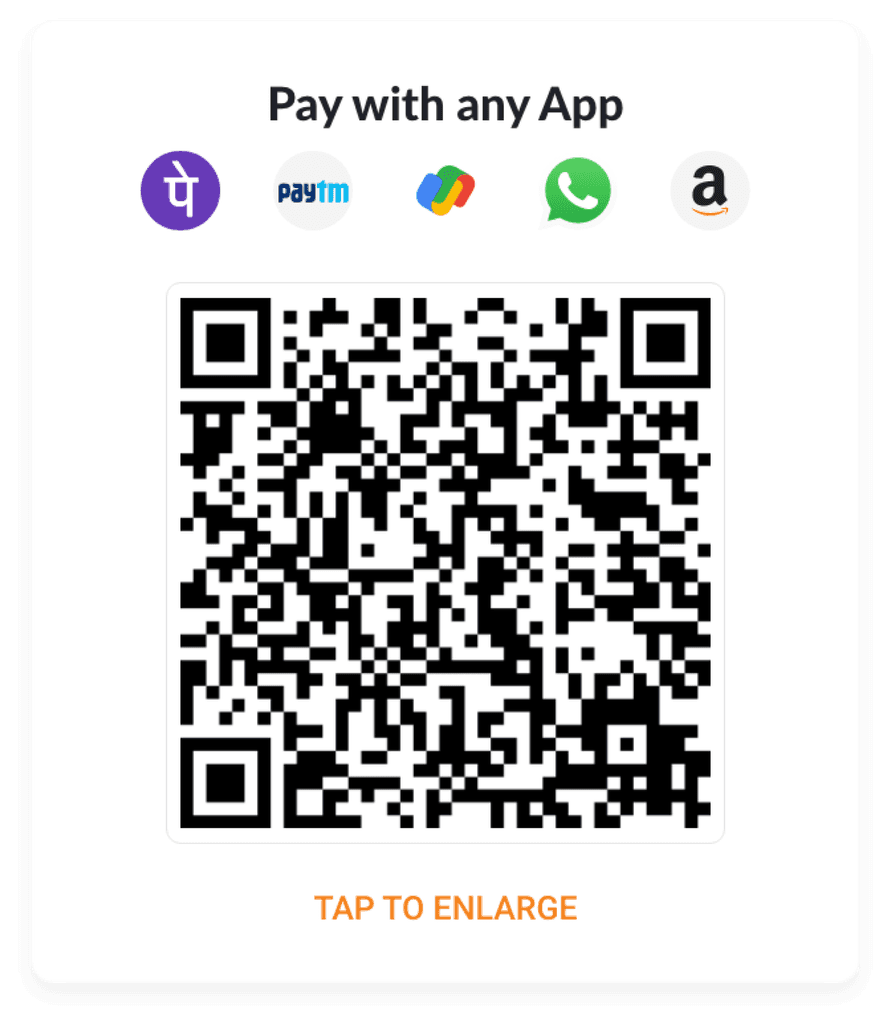

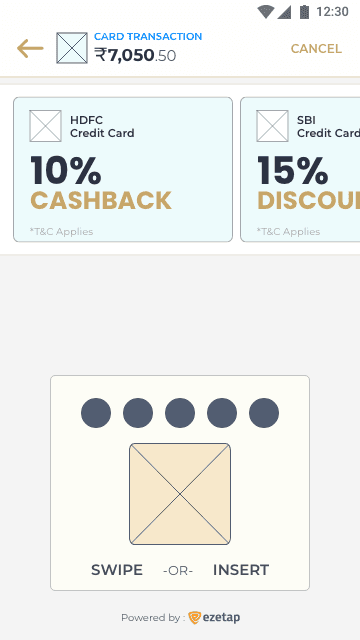

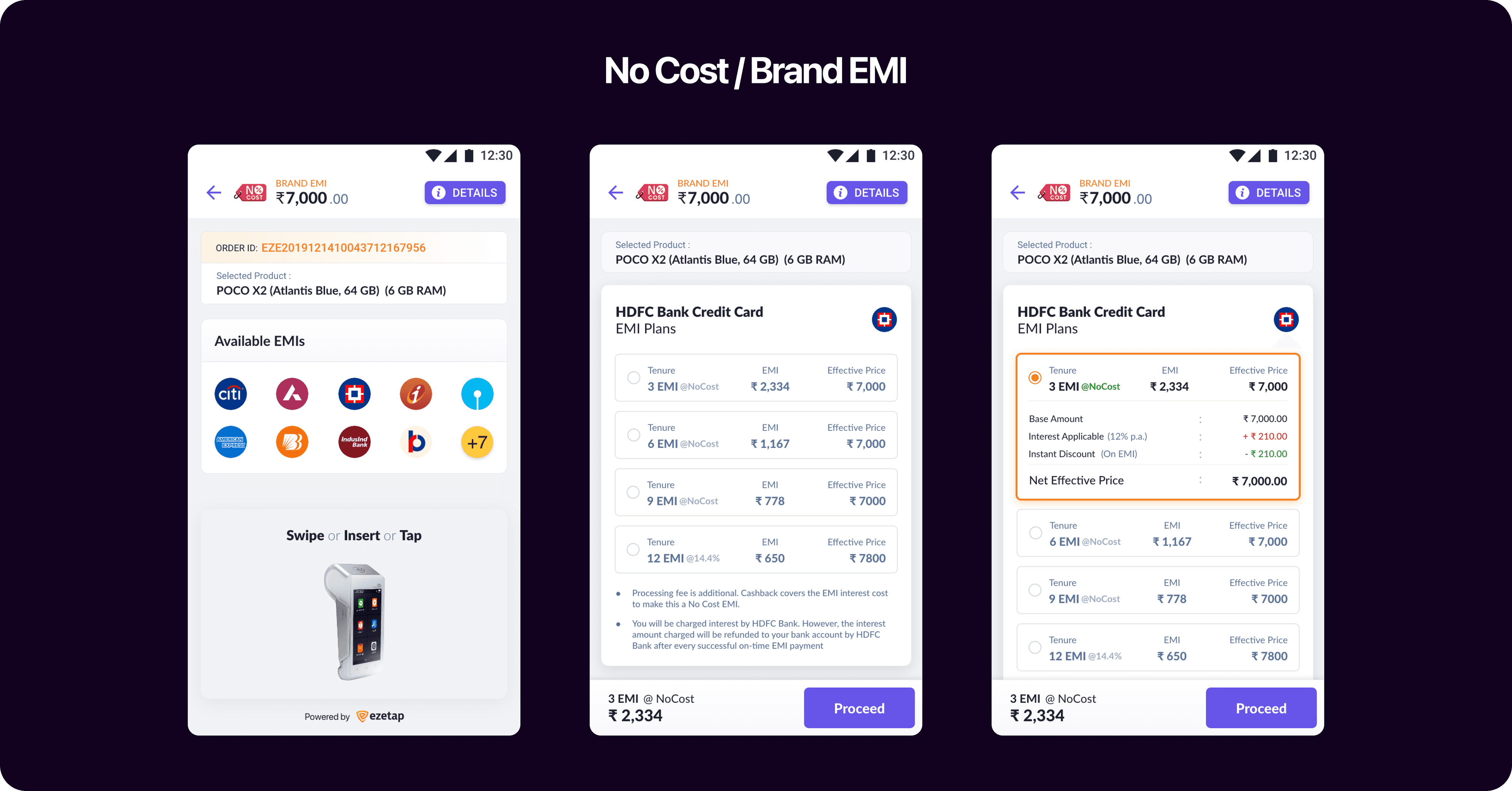

Simplified for Diverse Payments

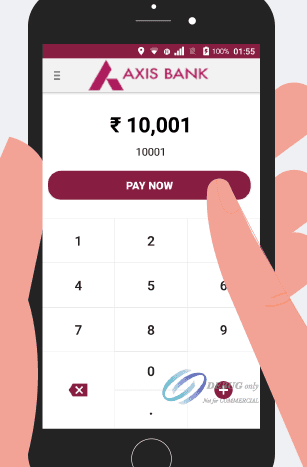

Payment Modes

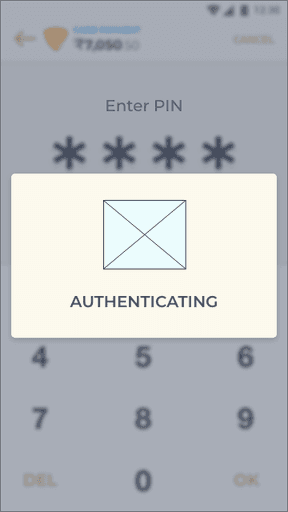

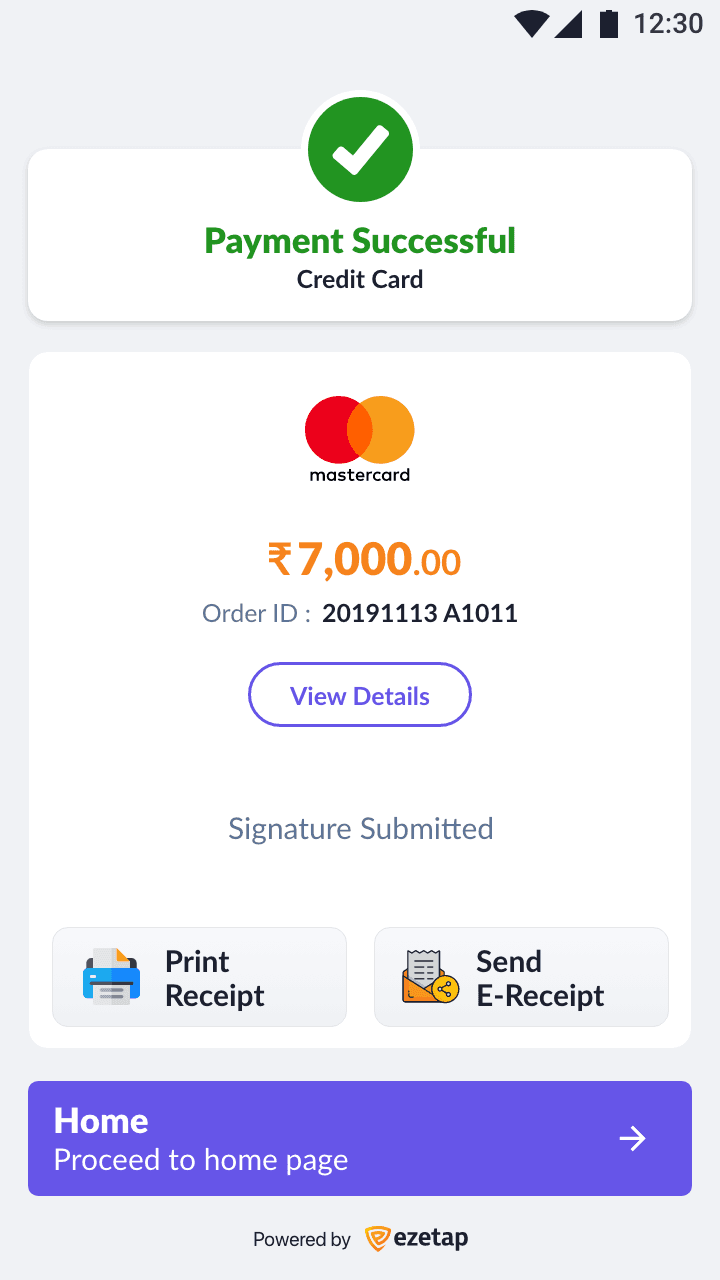

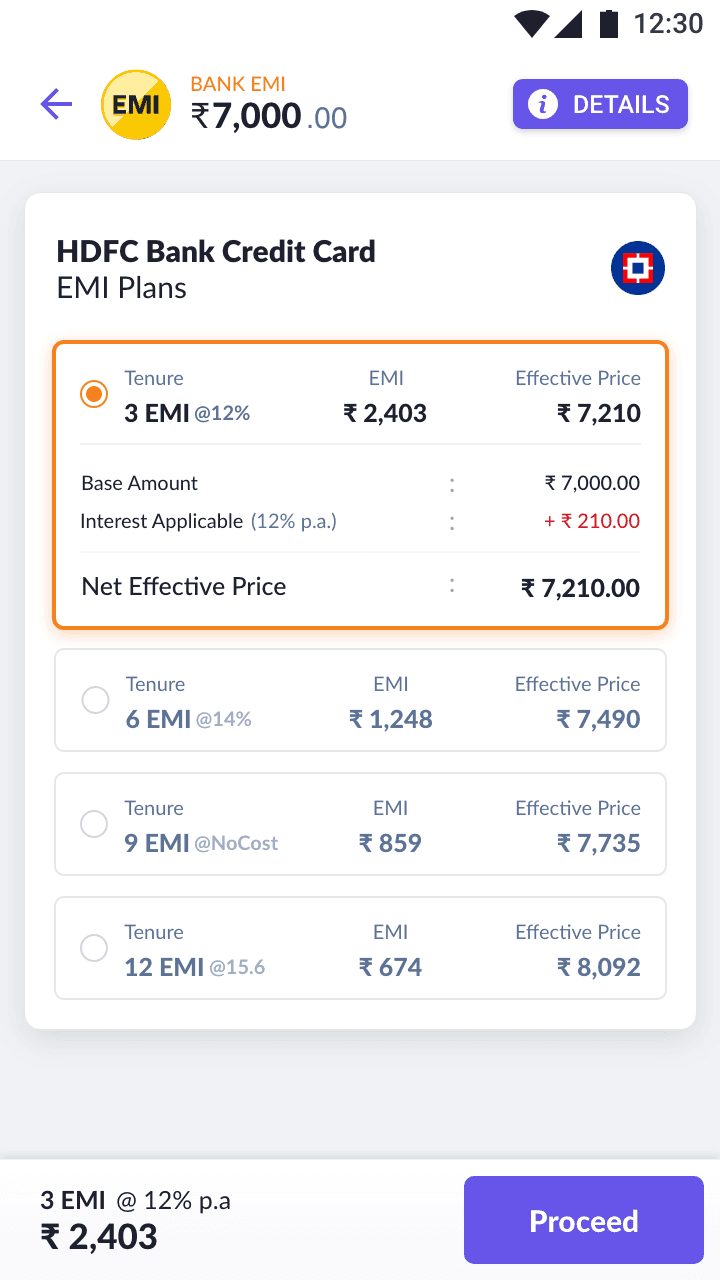

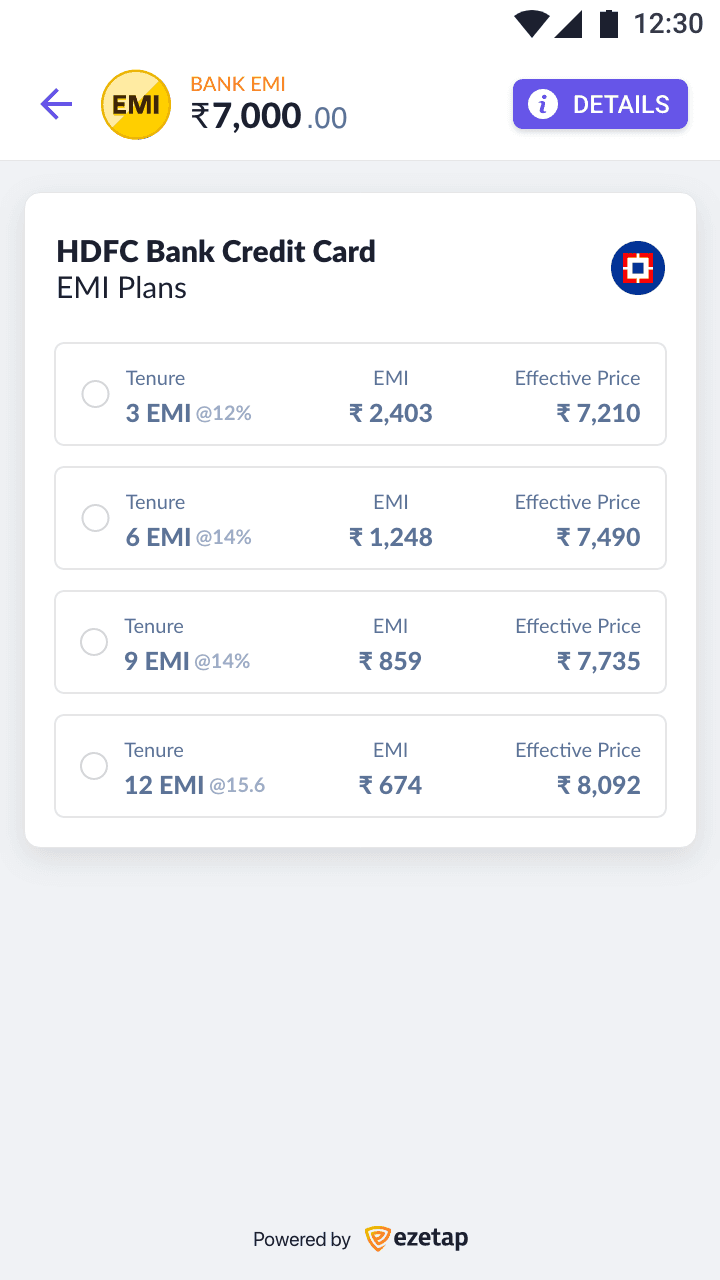

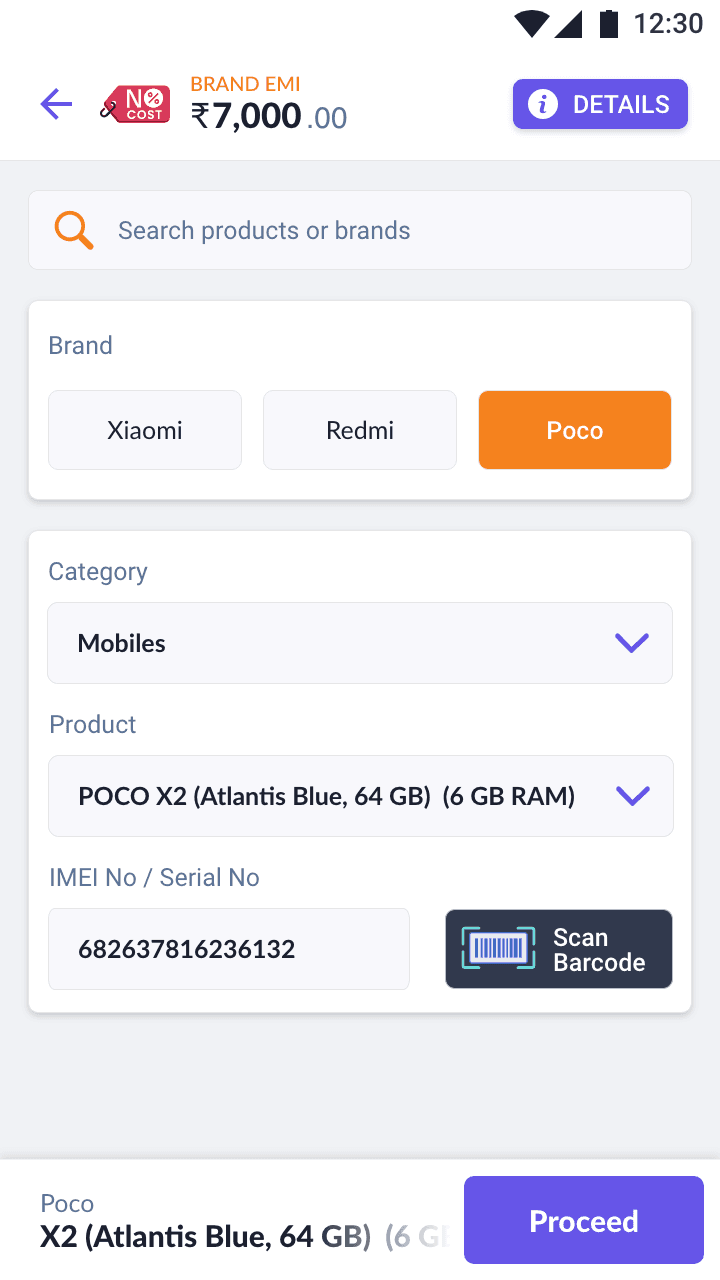

Various payment options/modes that Ezetap has such as Card, EMI, QR Code, Wallets, etc

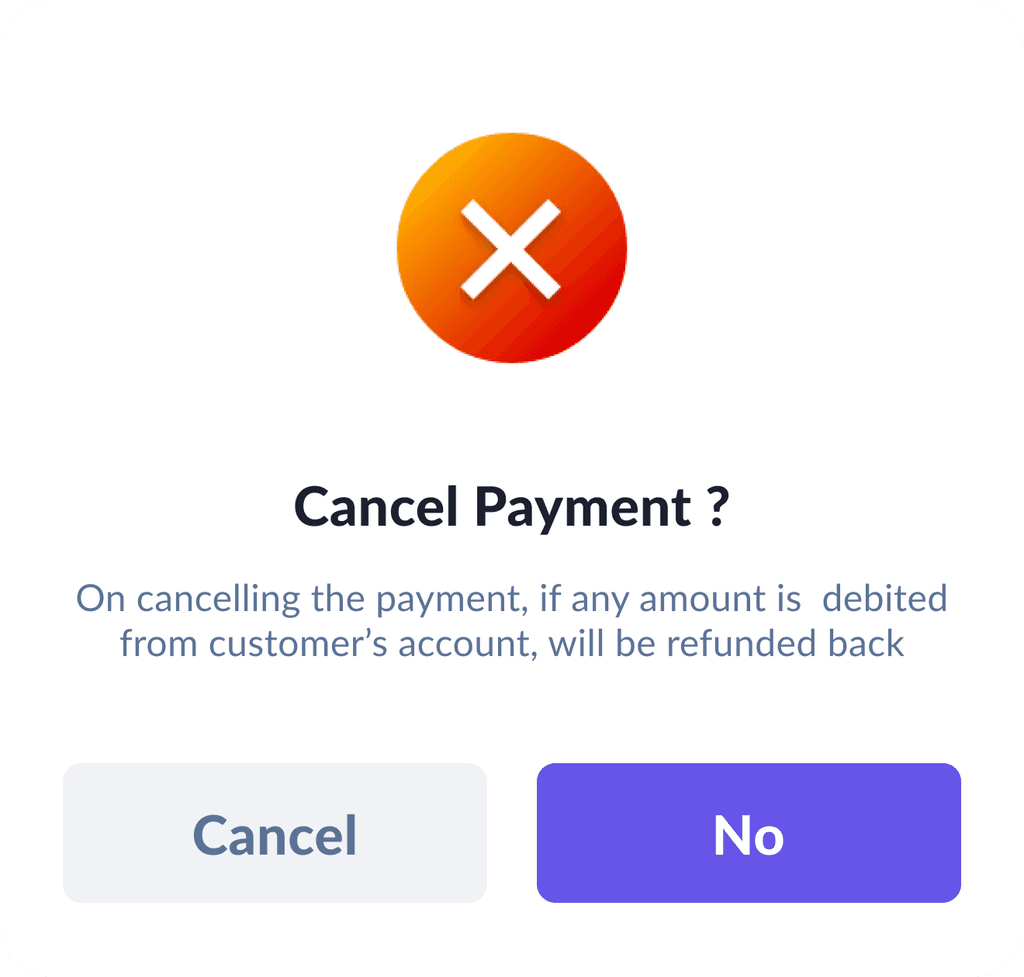

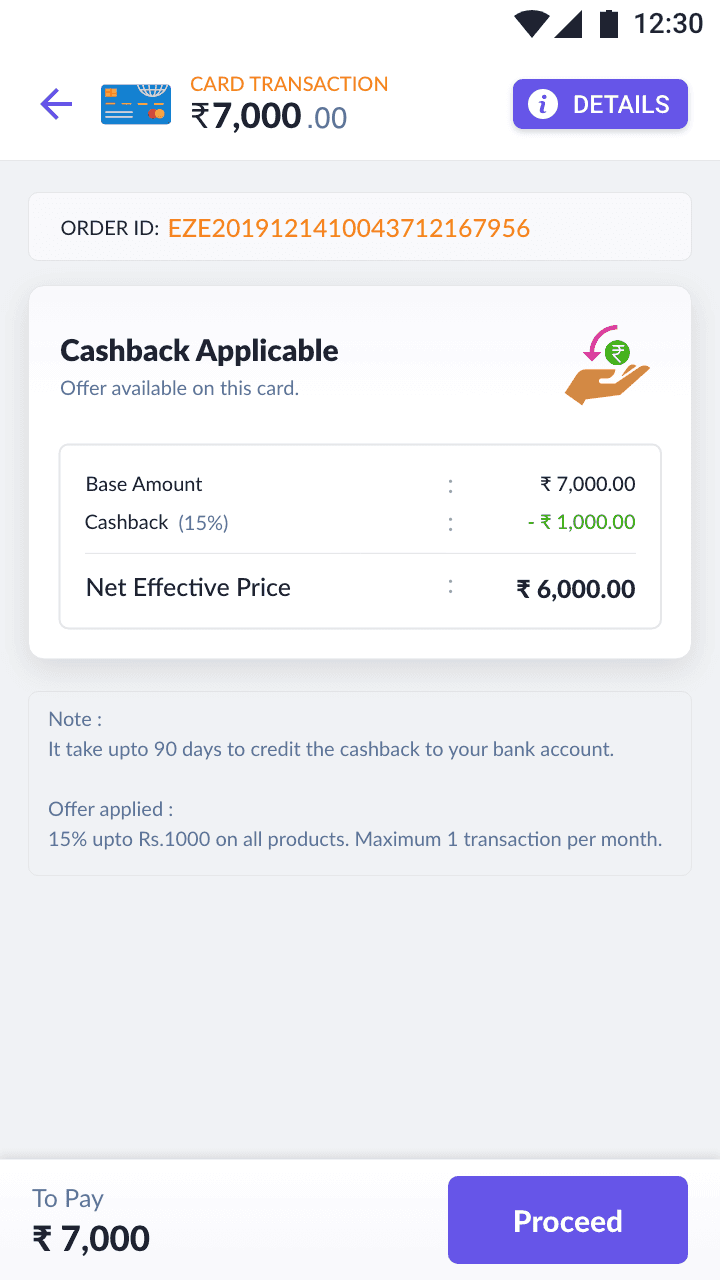

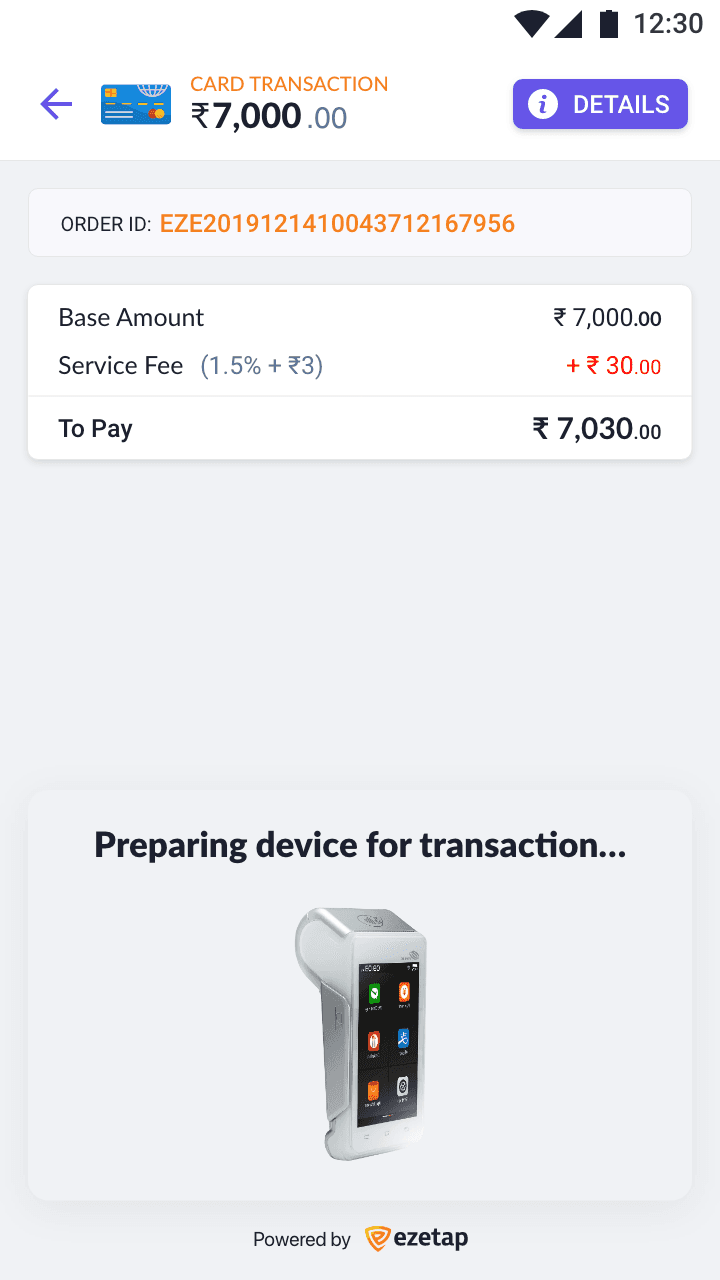

The solution included a unified layout, intuitive categories, and detailed transaction views.

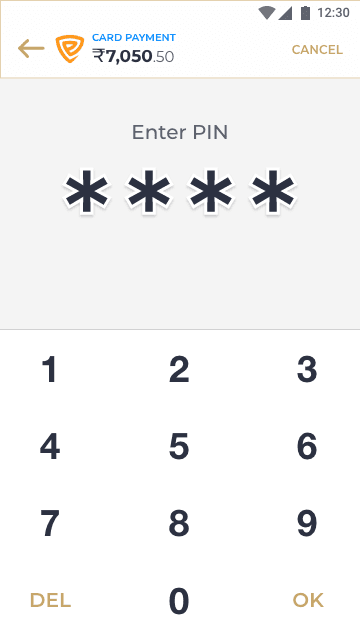

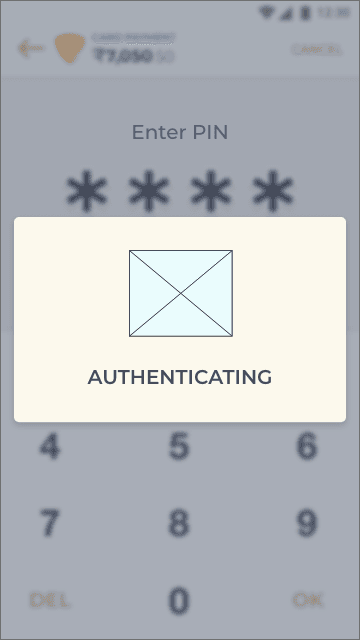

Payment Mode

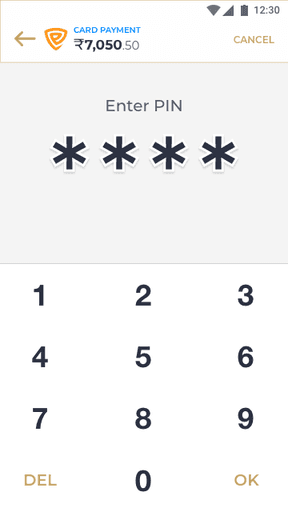

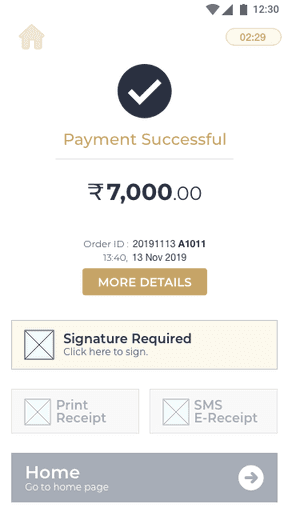

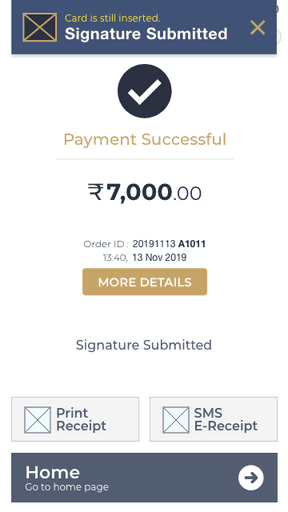

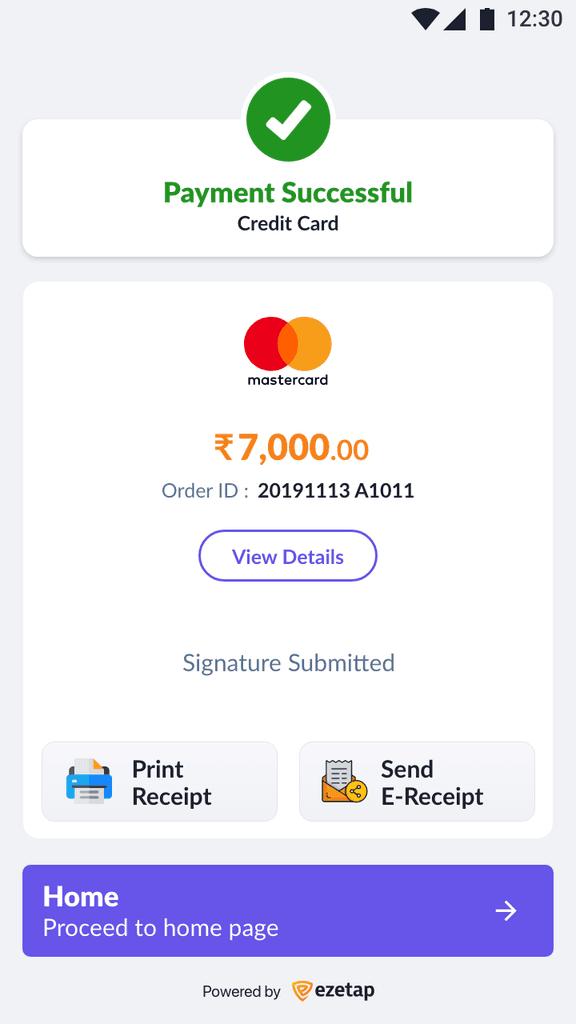

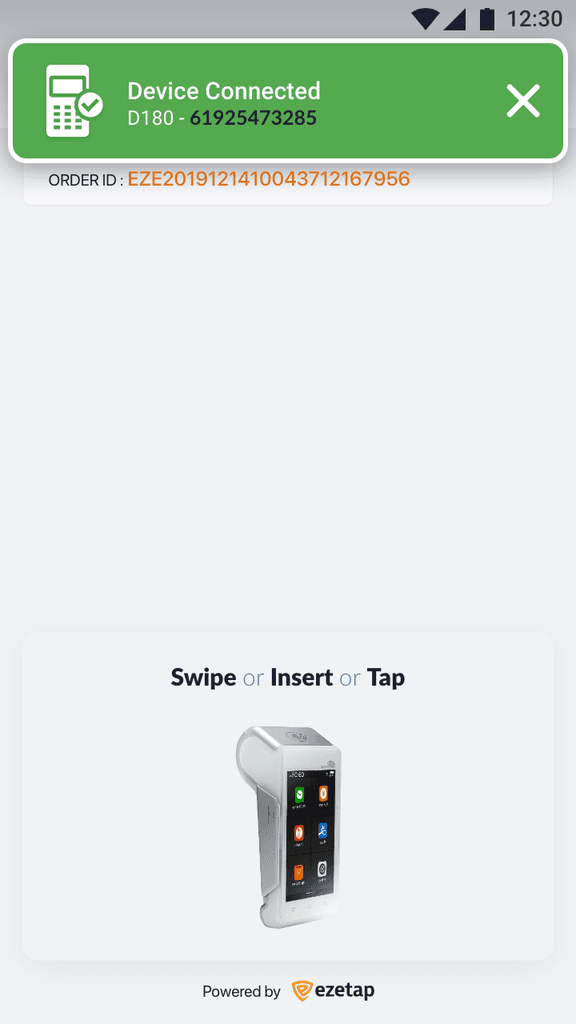

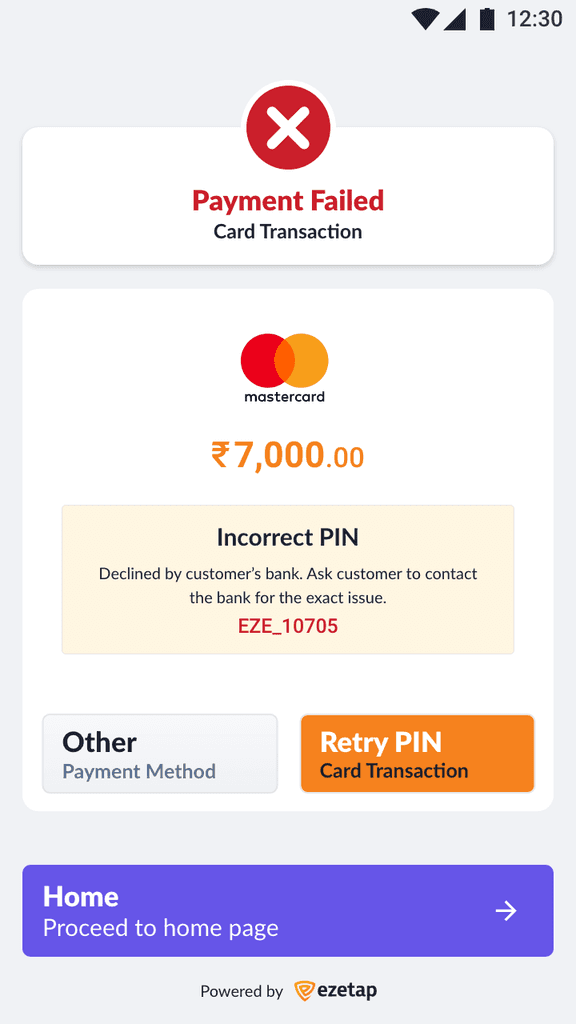

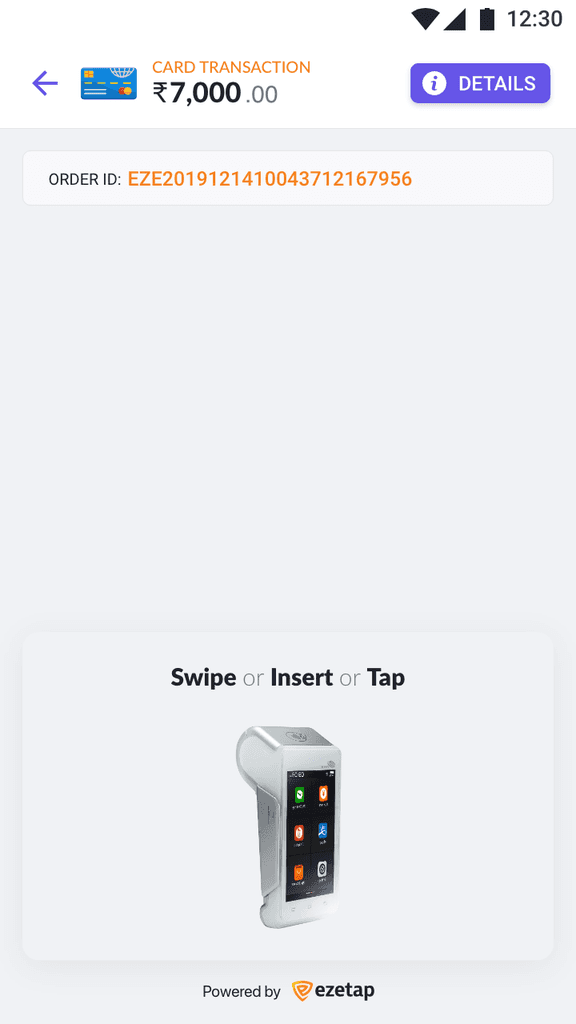

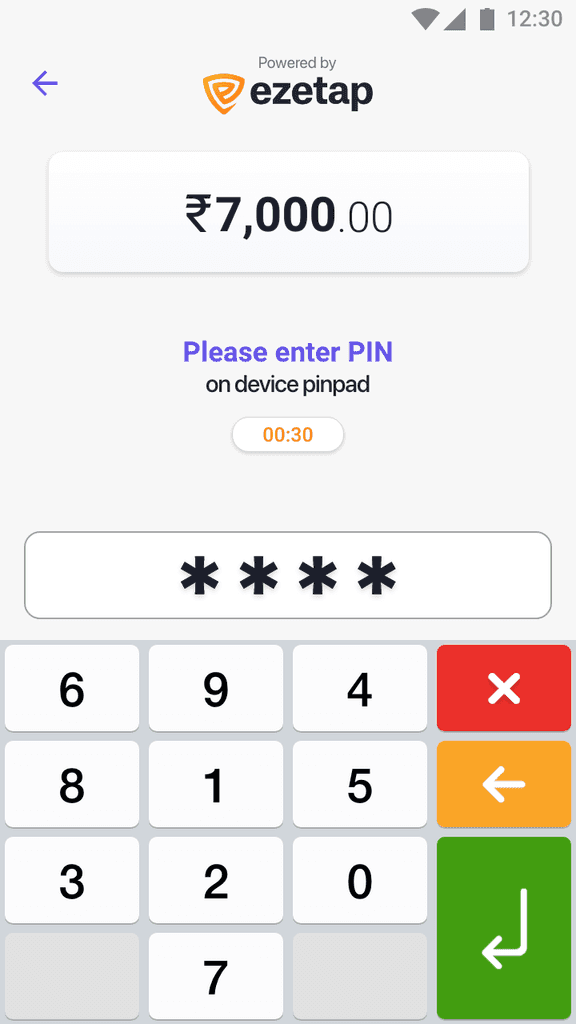

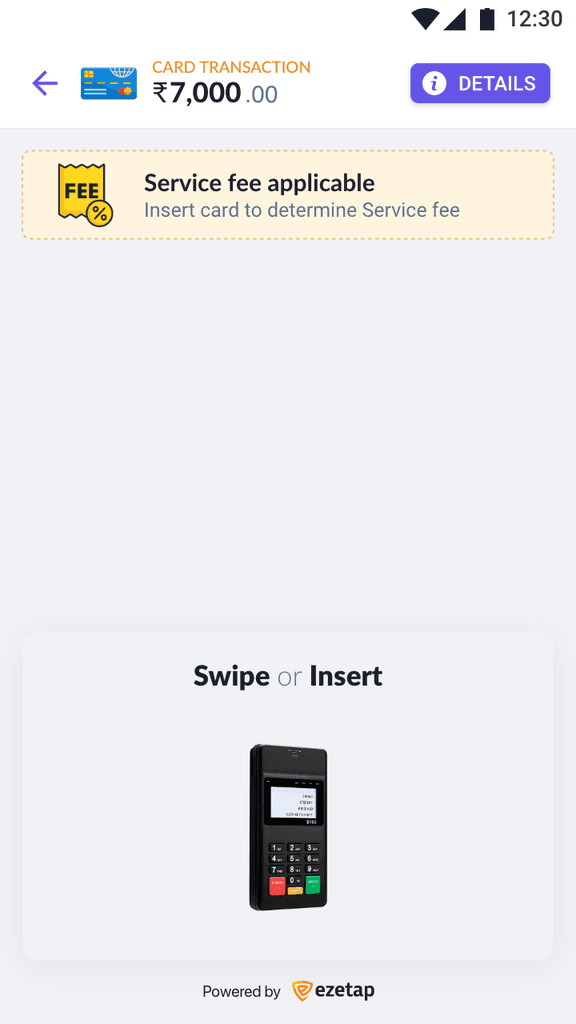

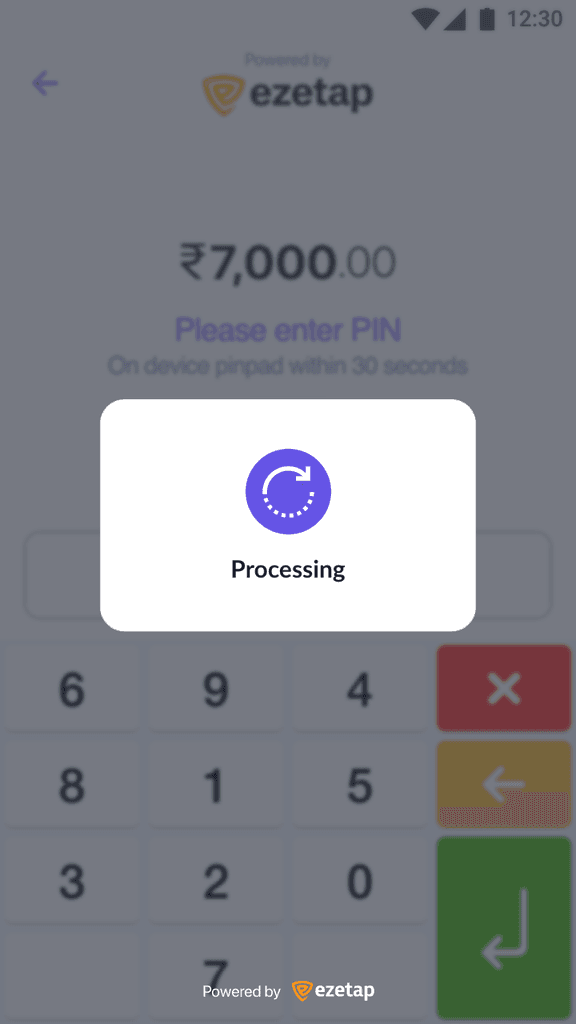

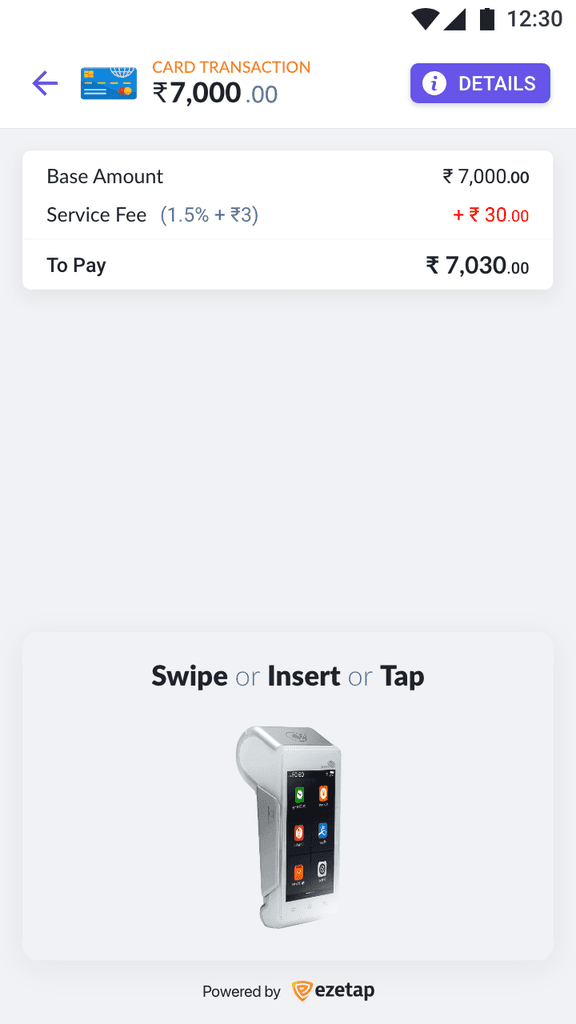

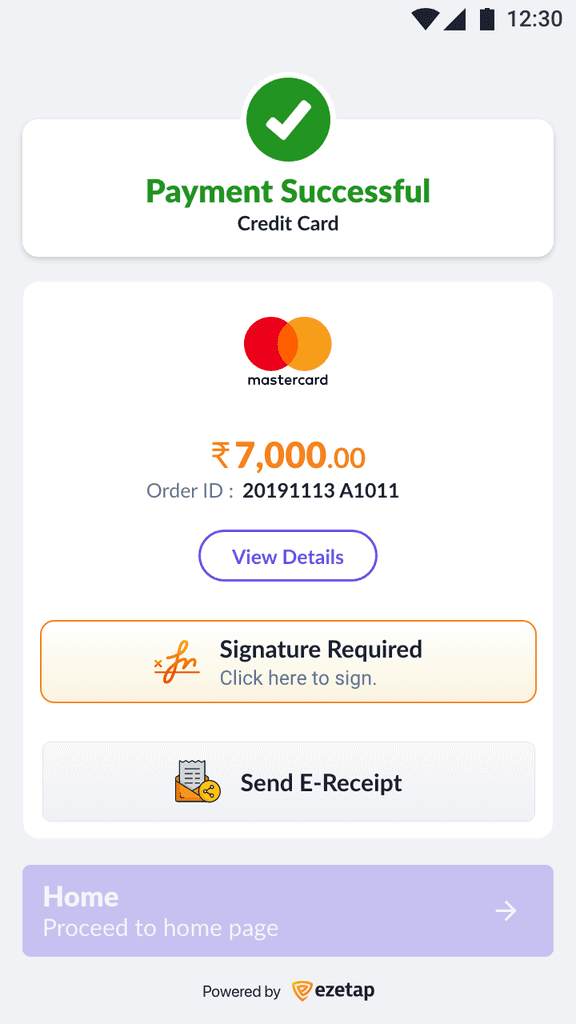

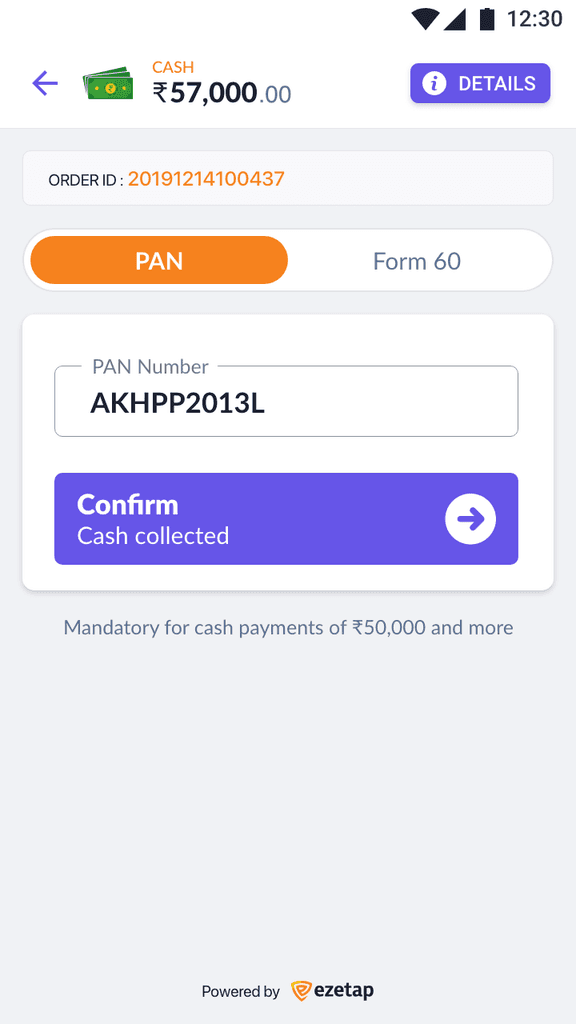

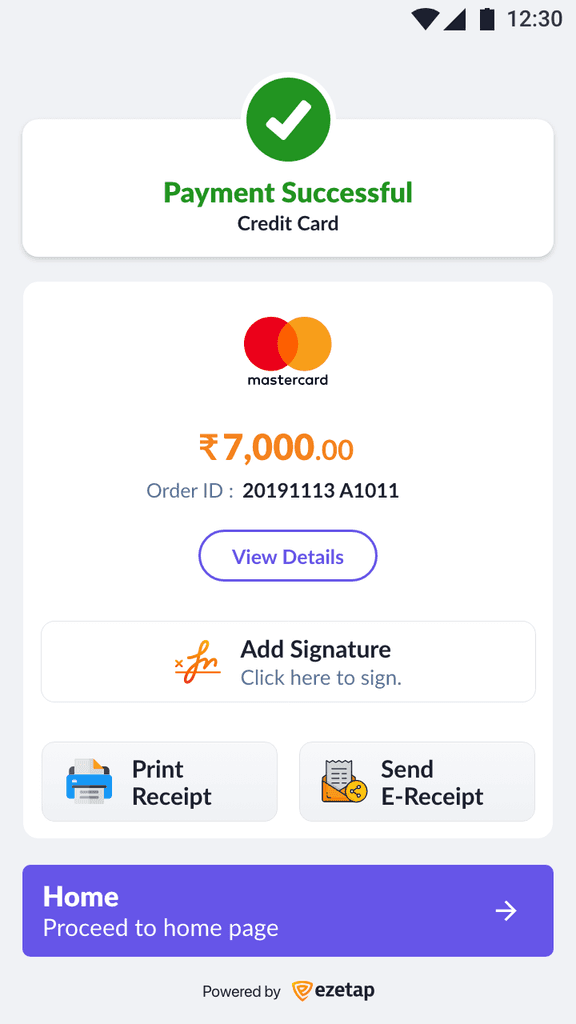

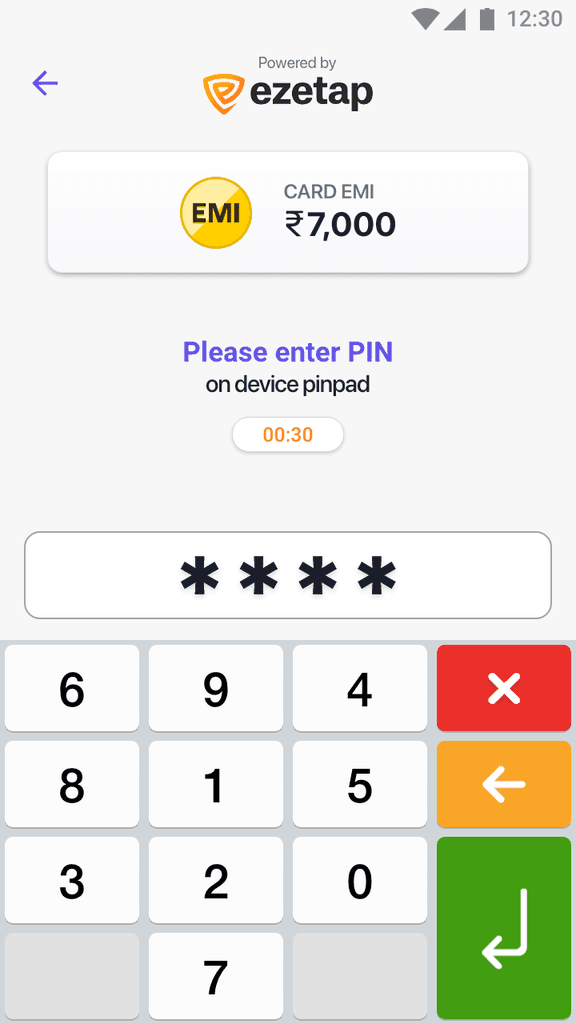

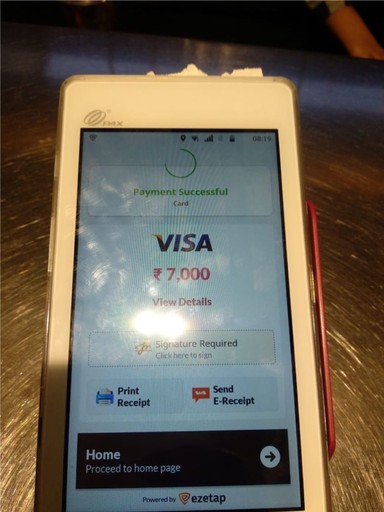

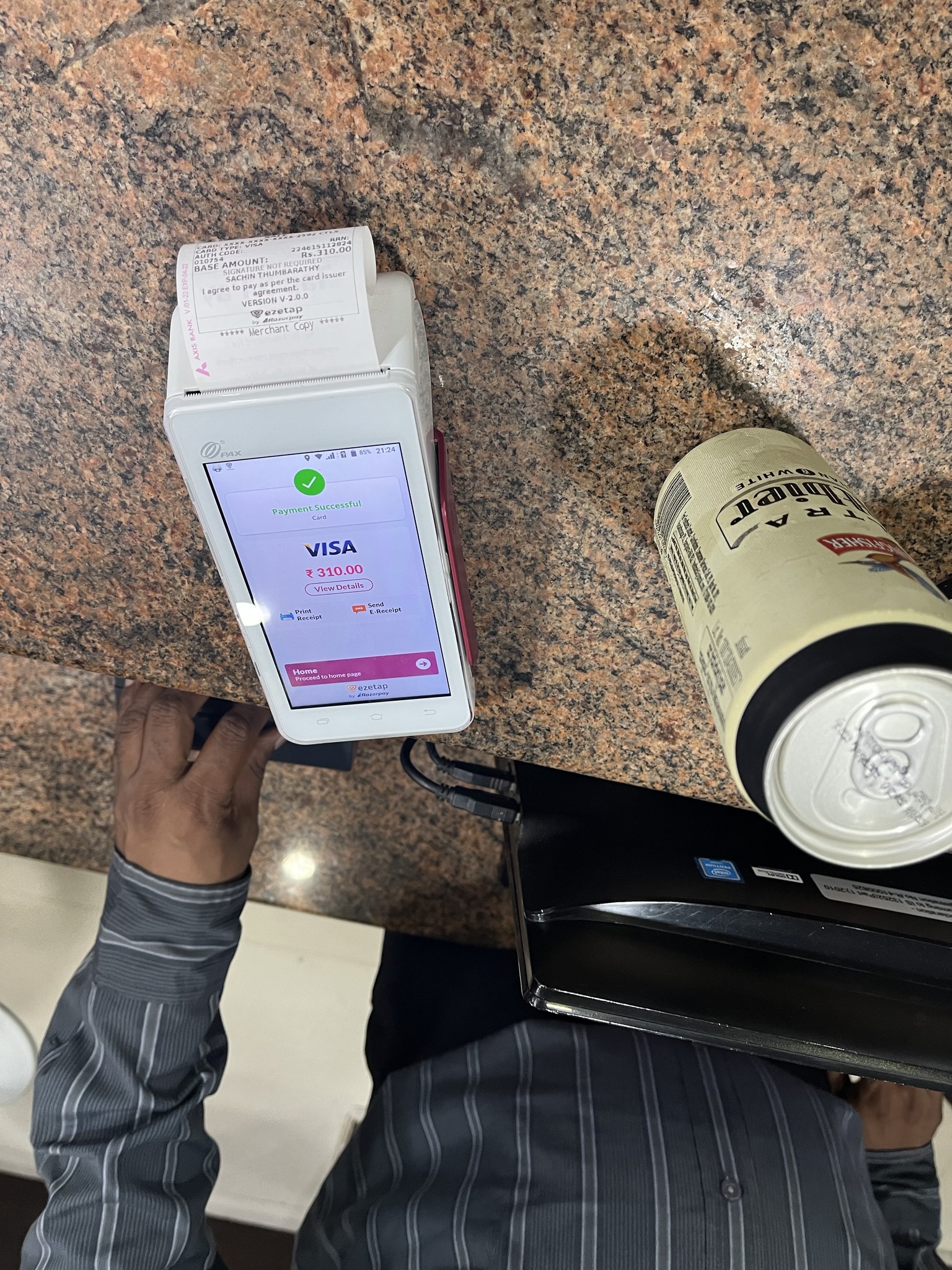

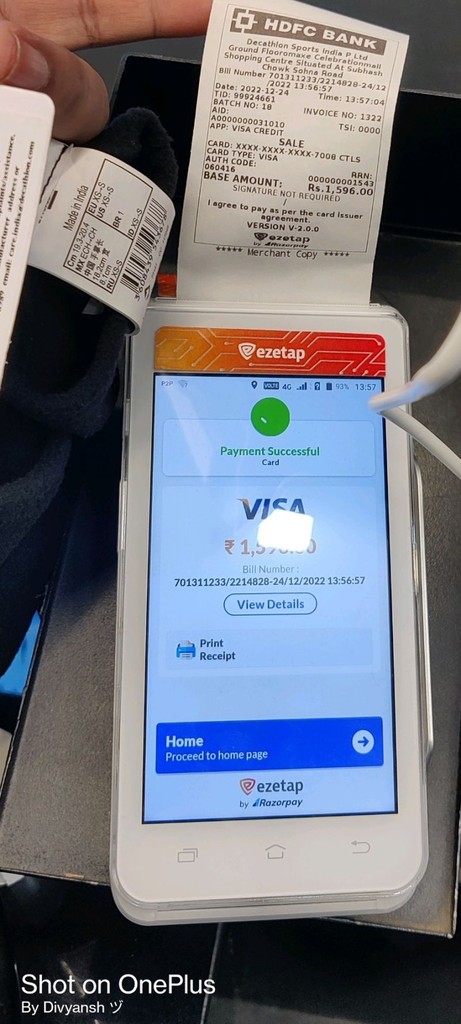

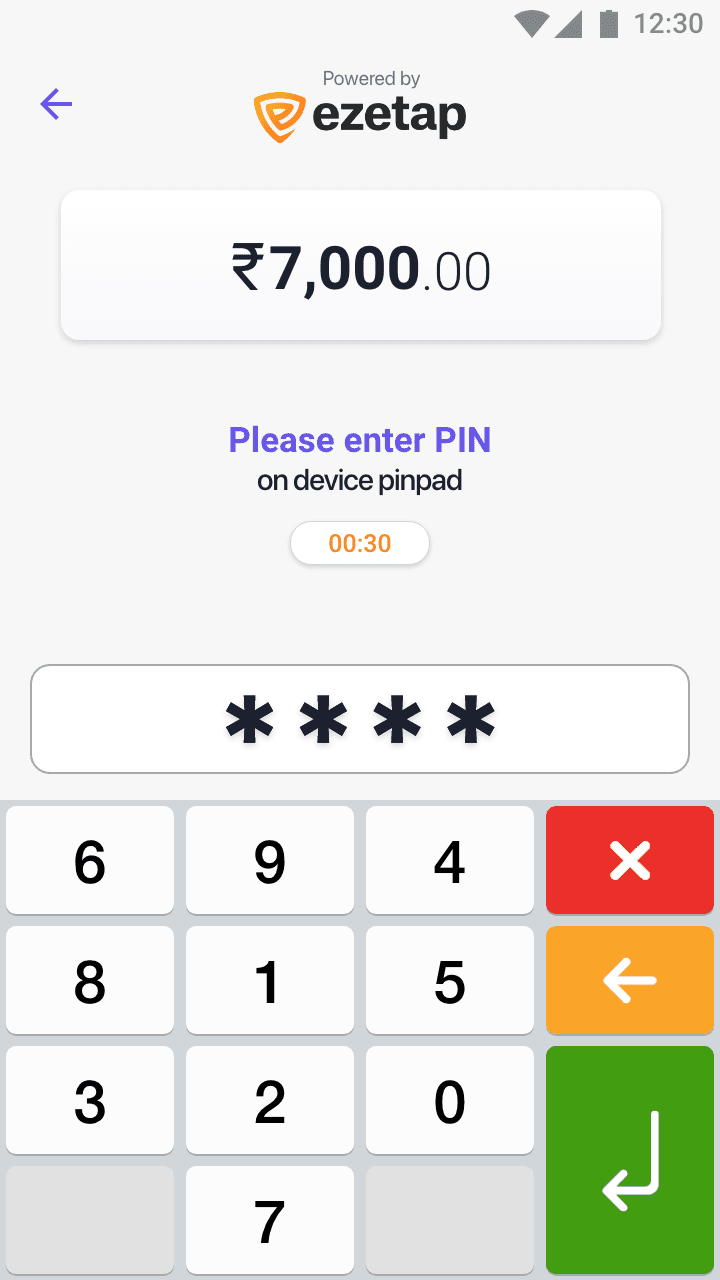

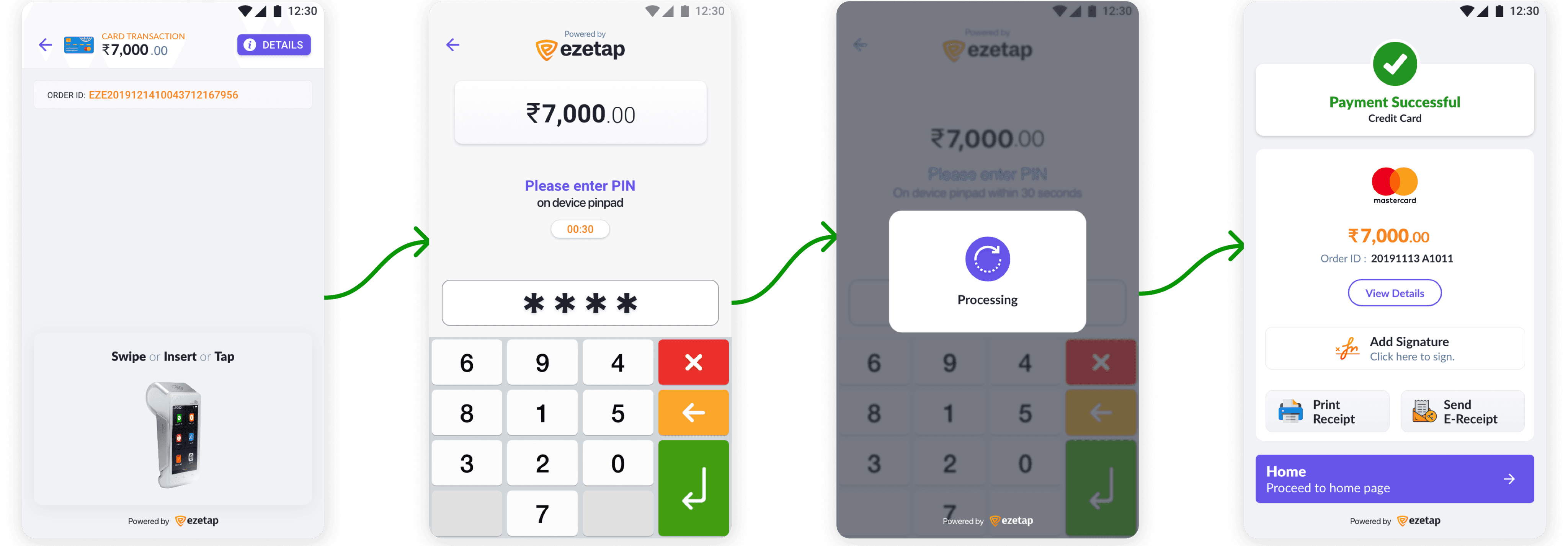

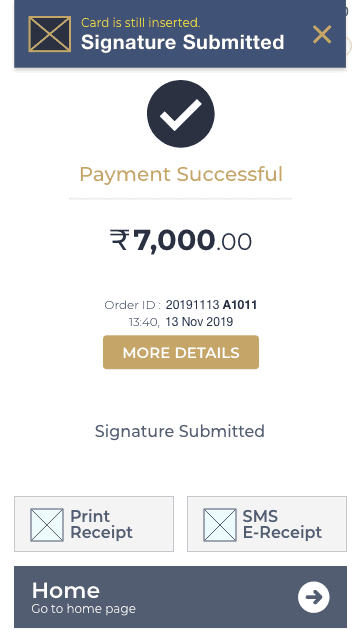

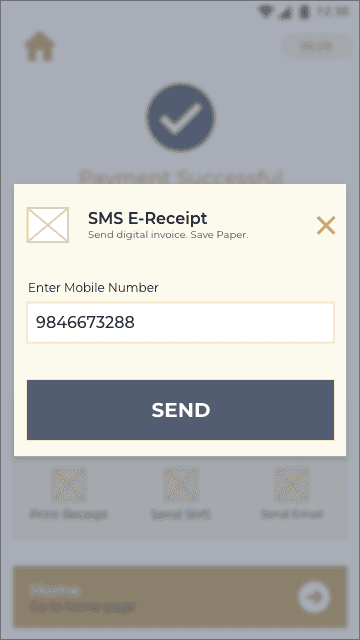

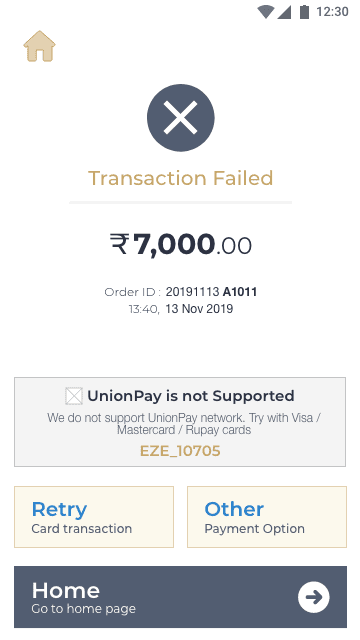

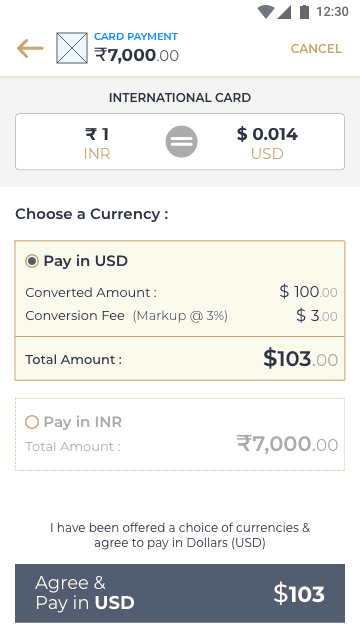

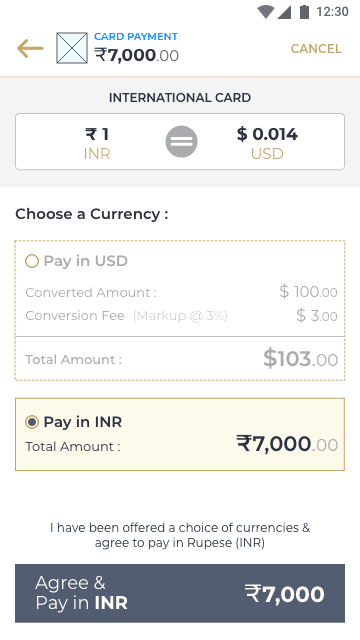

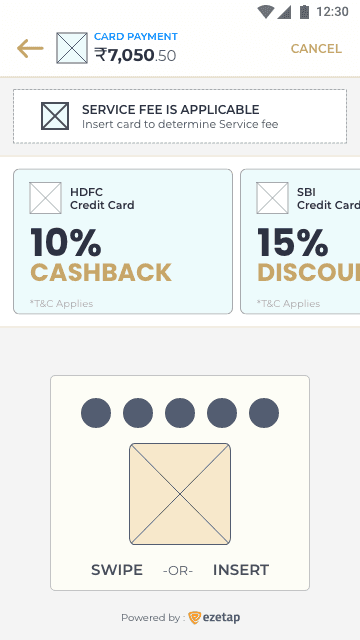

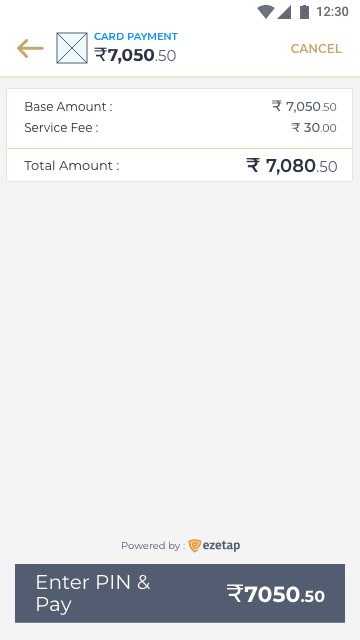

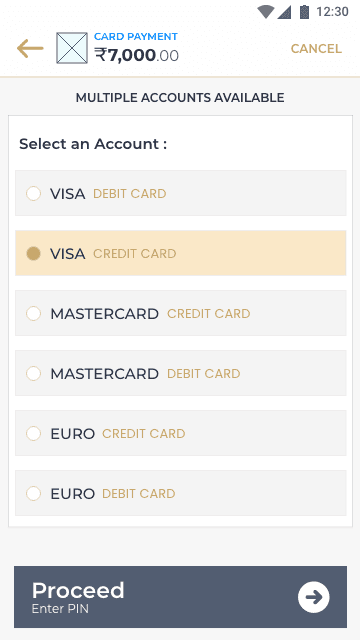

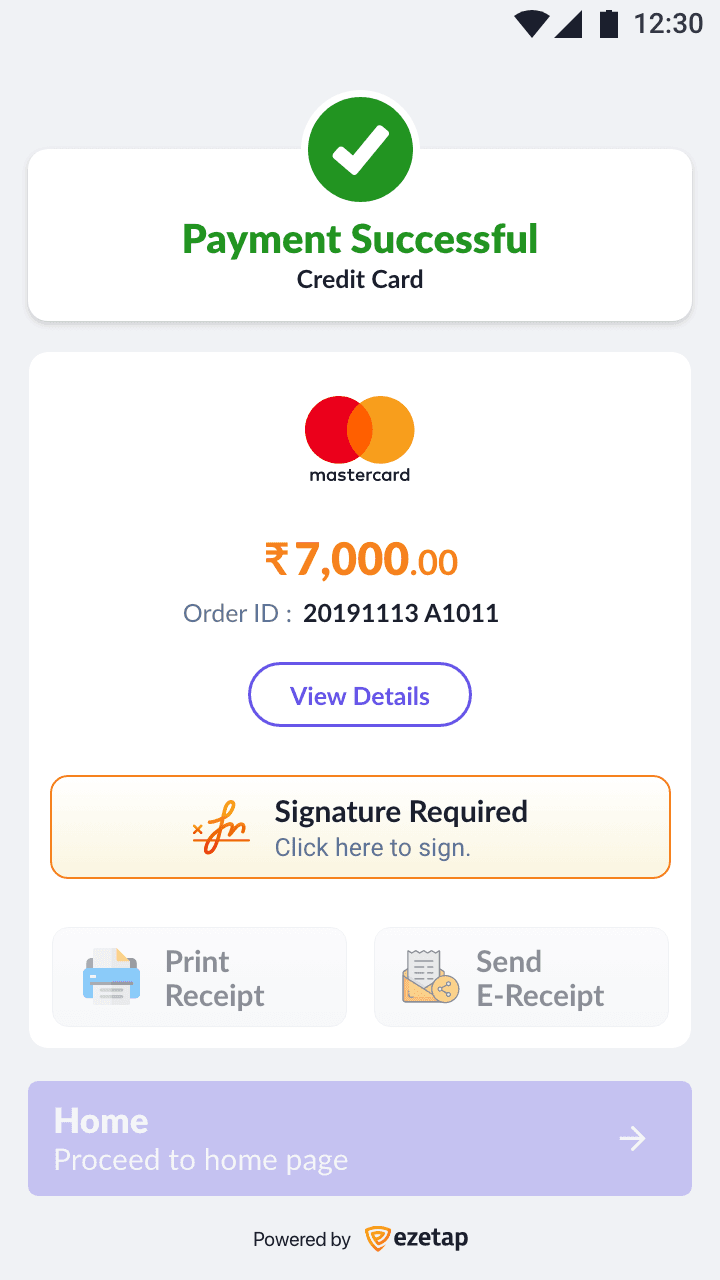

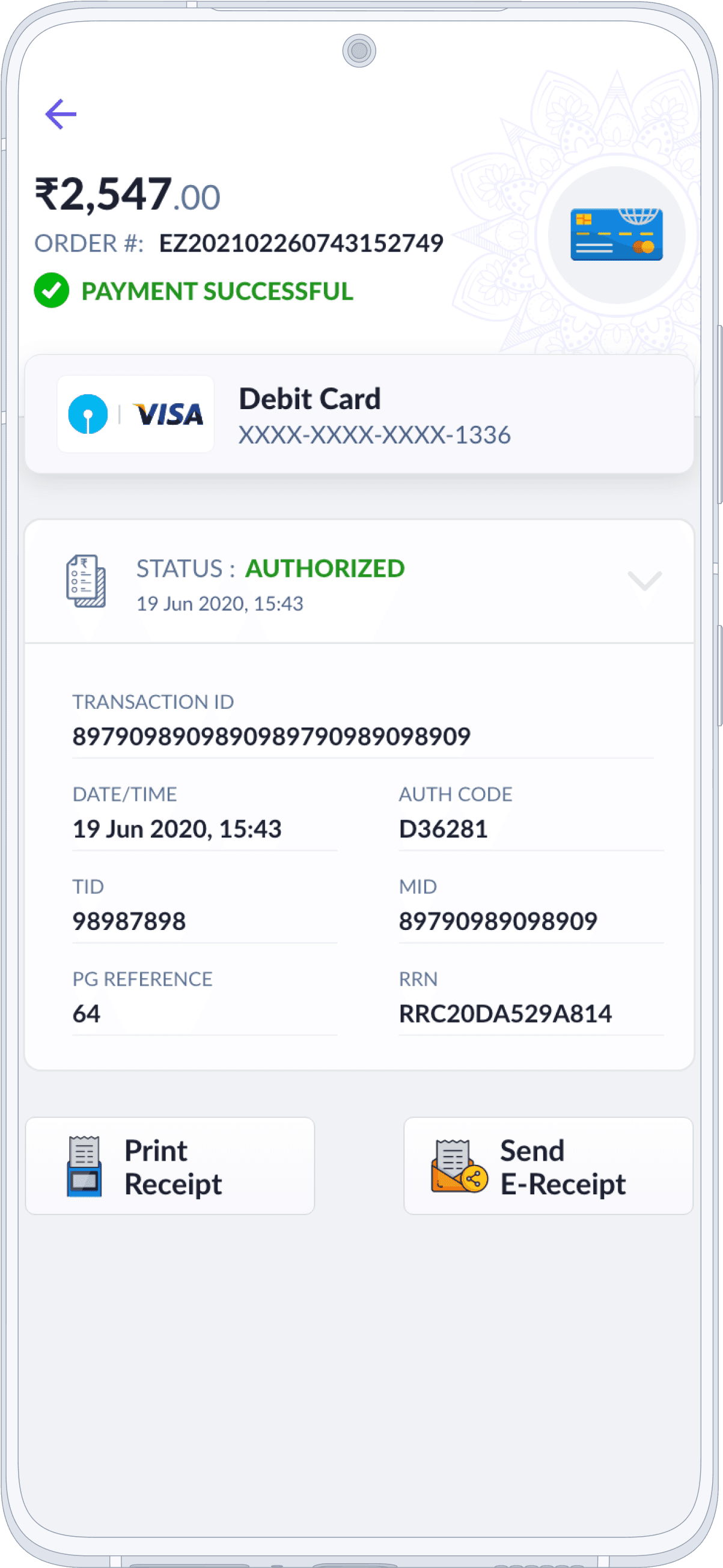

Card Payment

The help and support section encompasses logging support tickets and requesting callbacks.

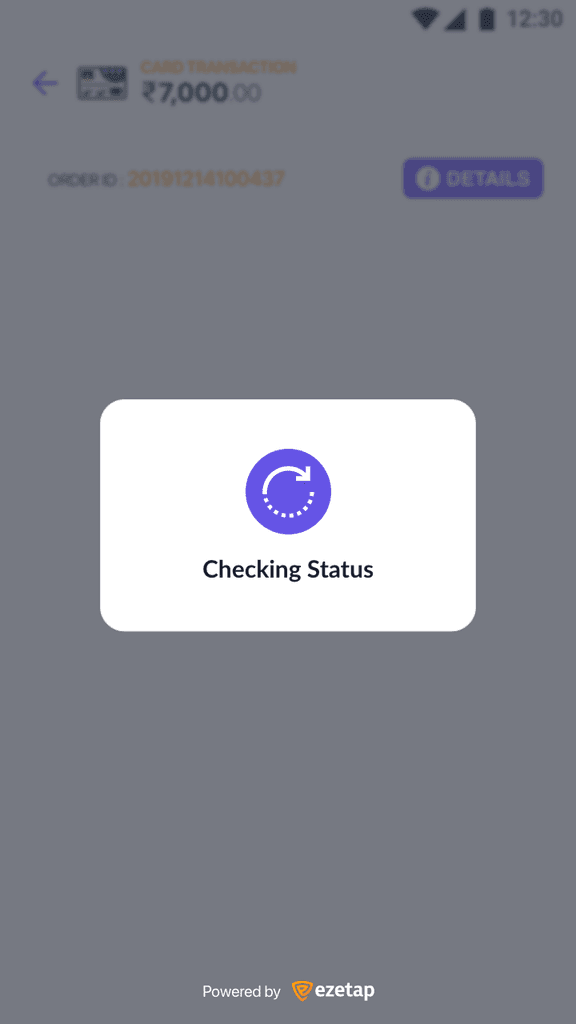

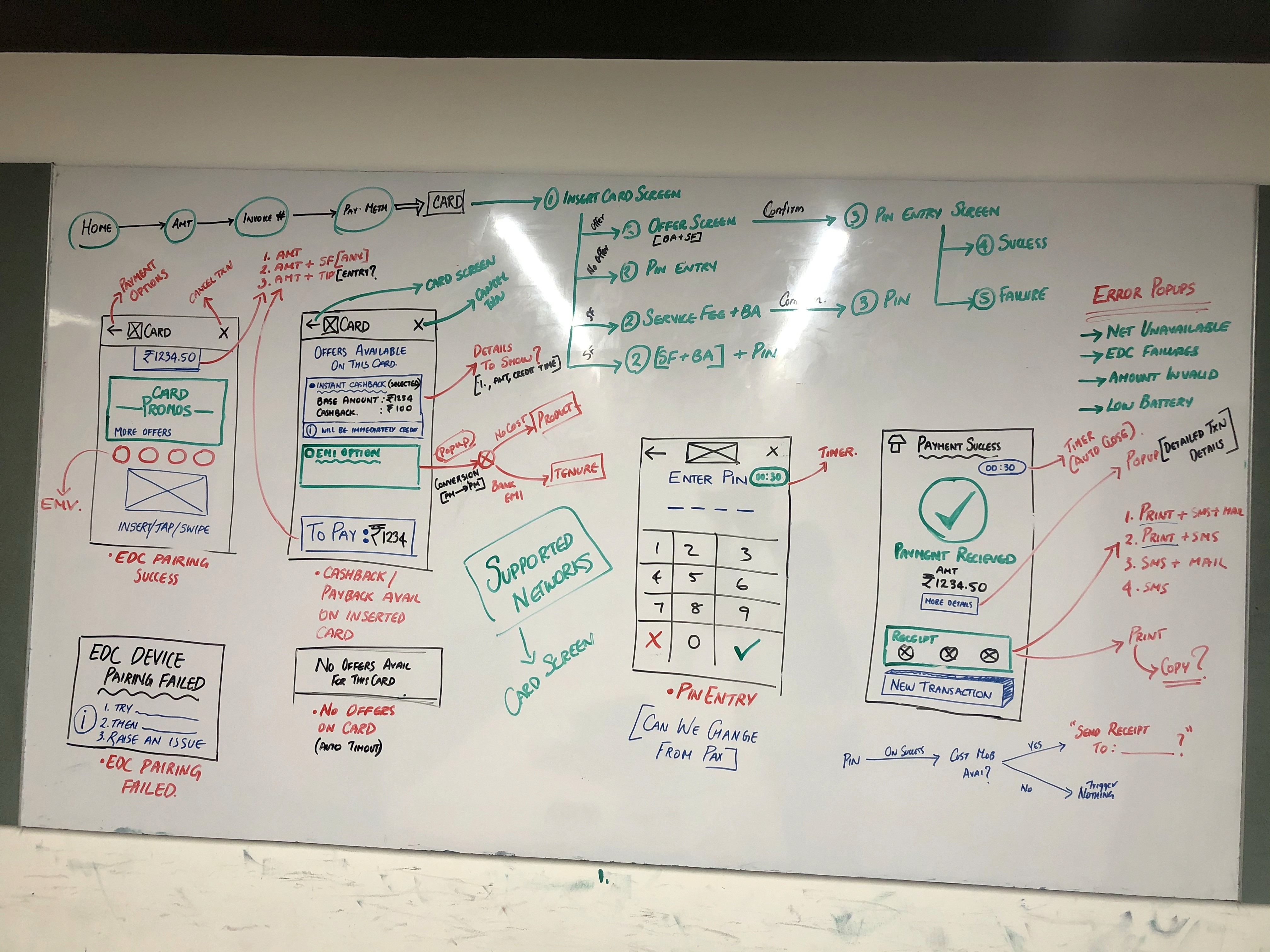

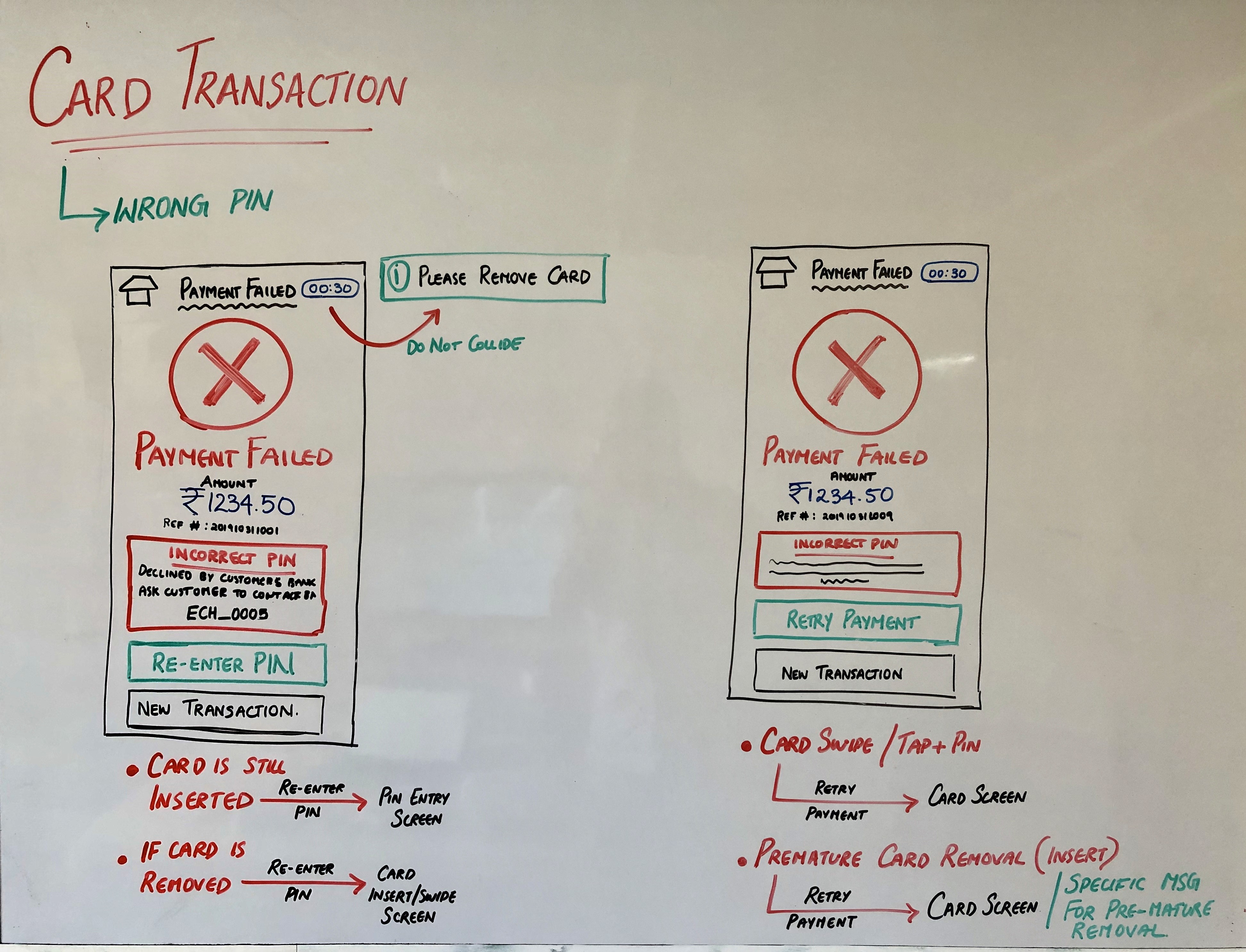

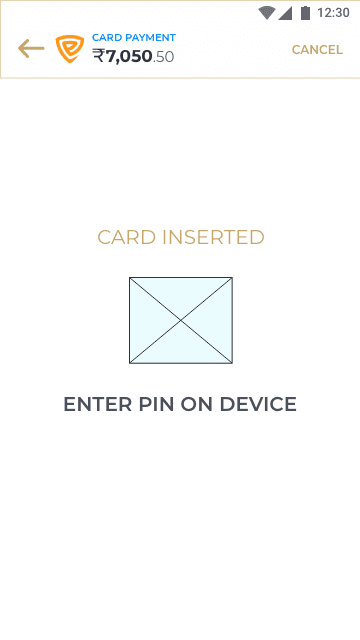

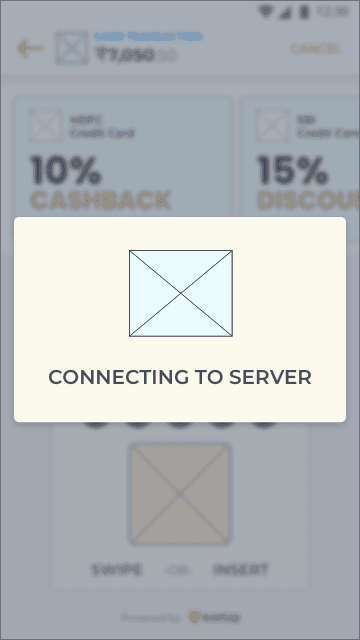

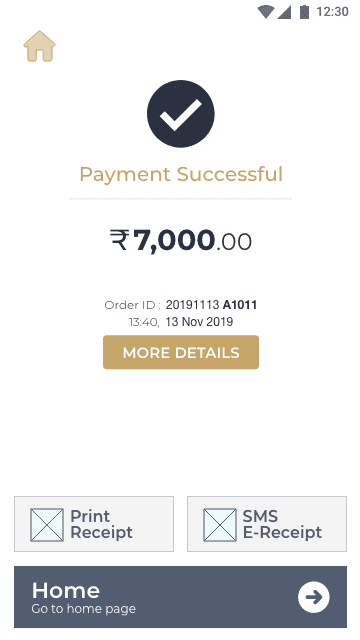

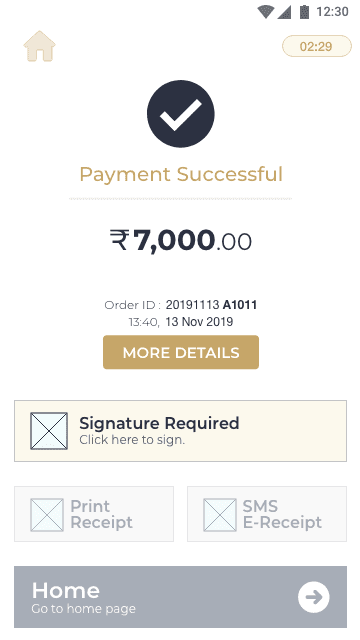

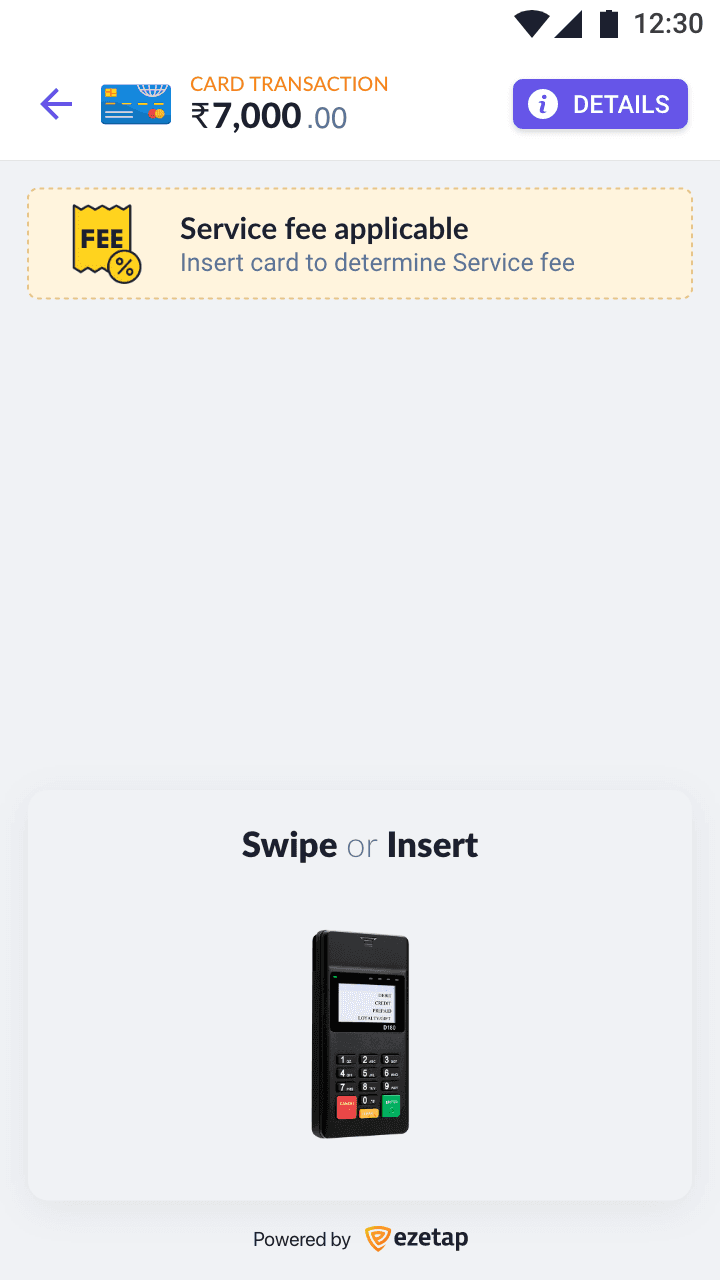

User Flow (Card Insert)

Basic Card Flow

Initial Sketches

Hi-Fi Wireframes

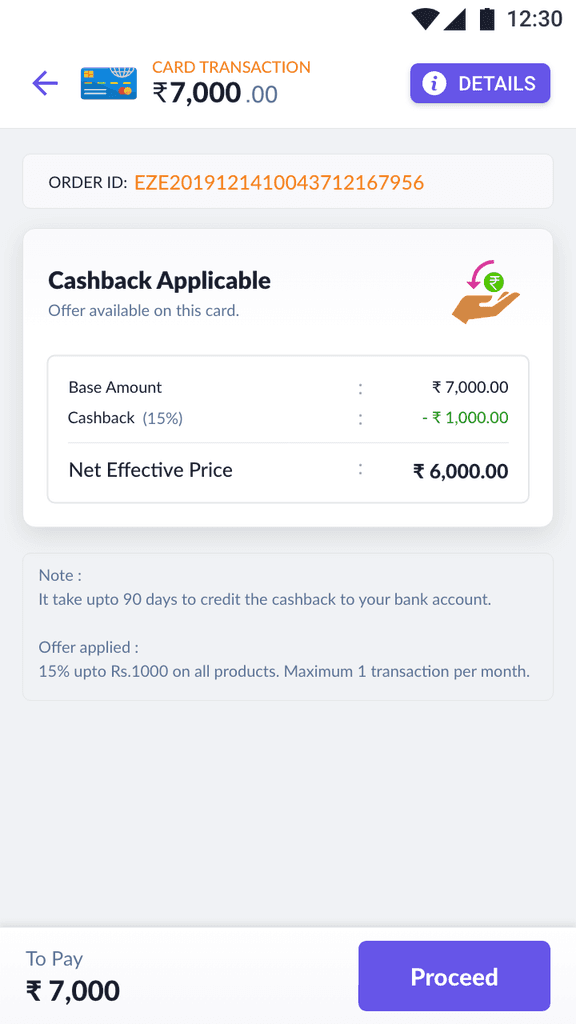

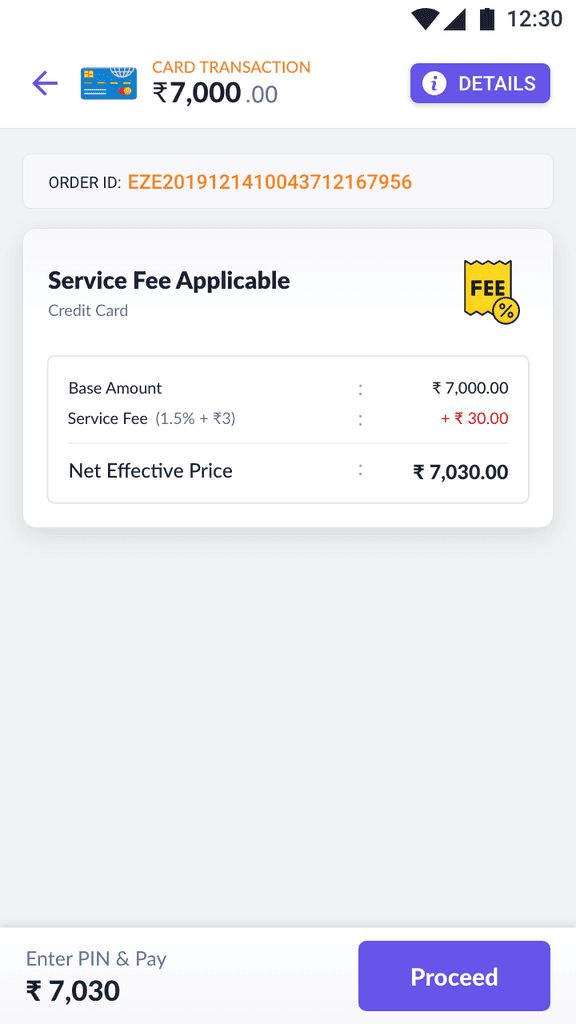

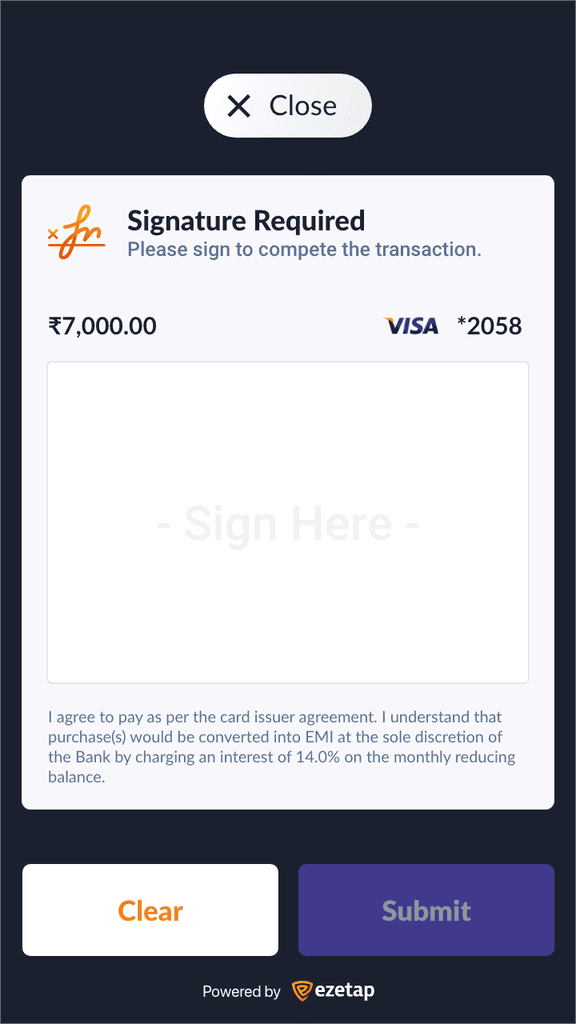

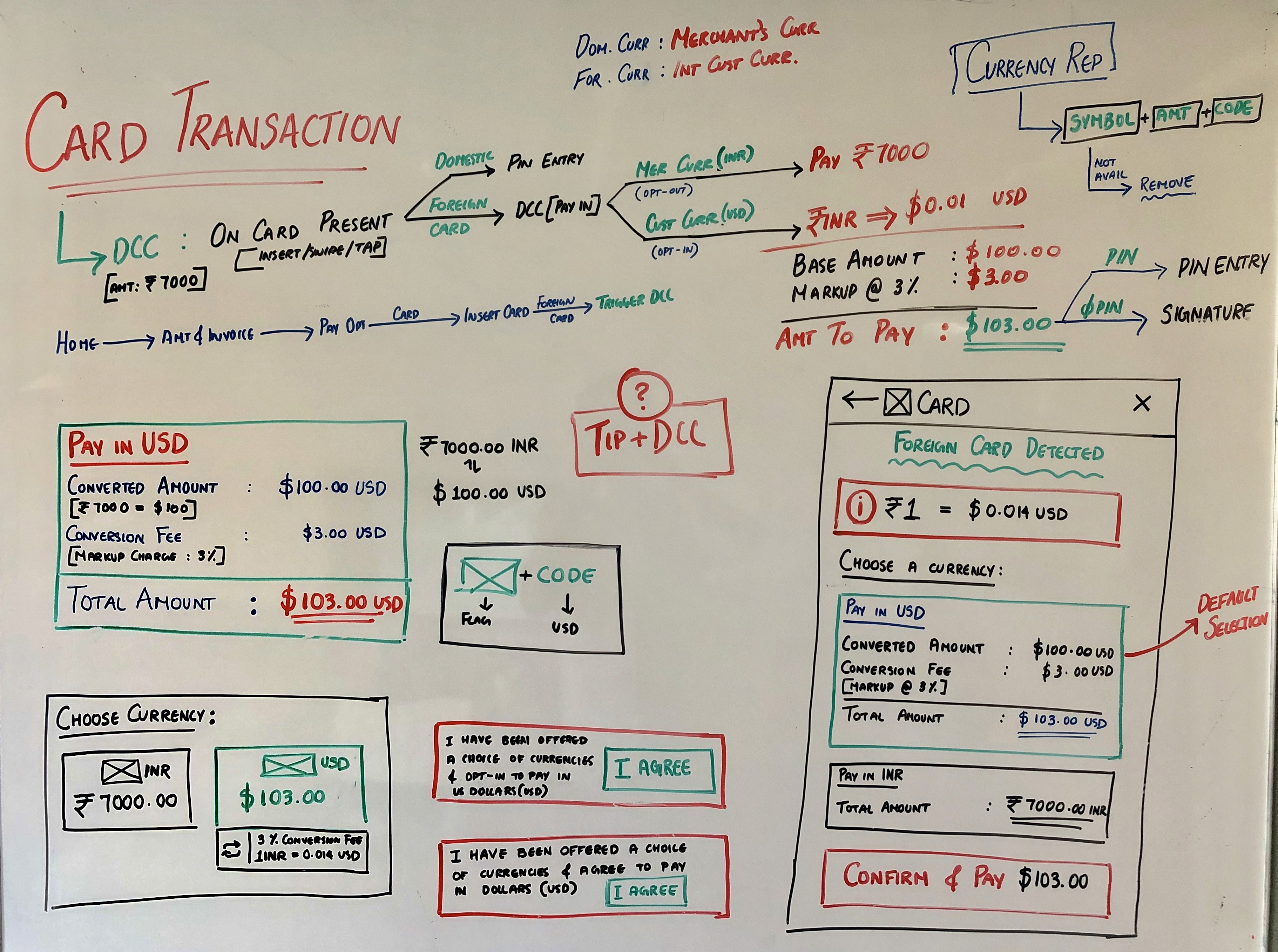

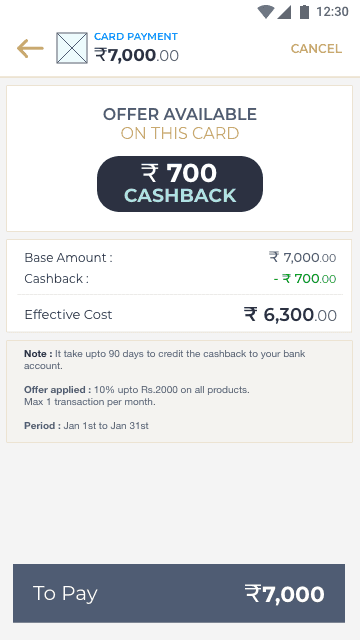

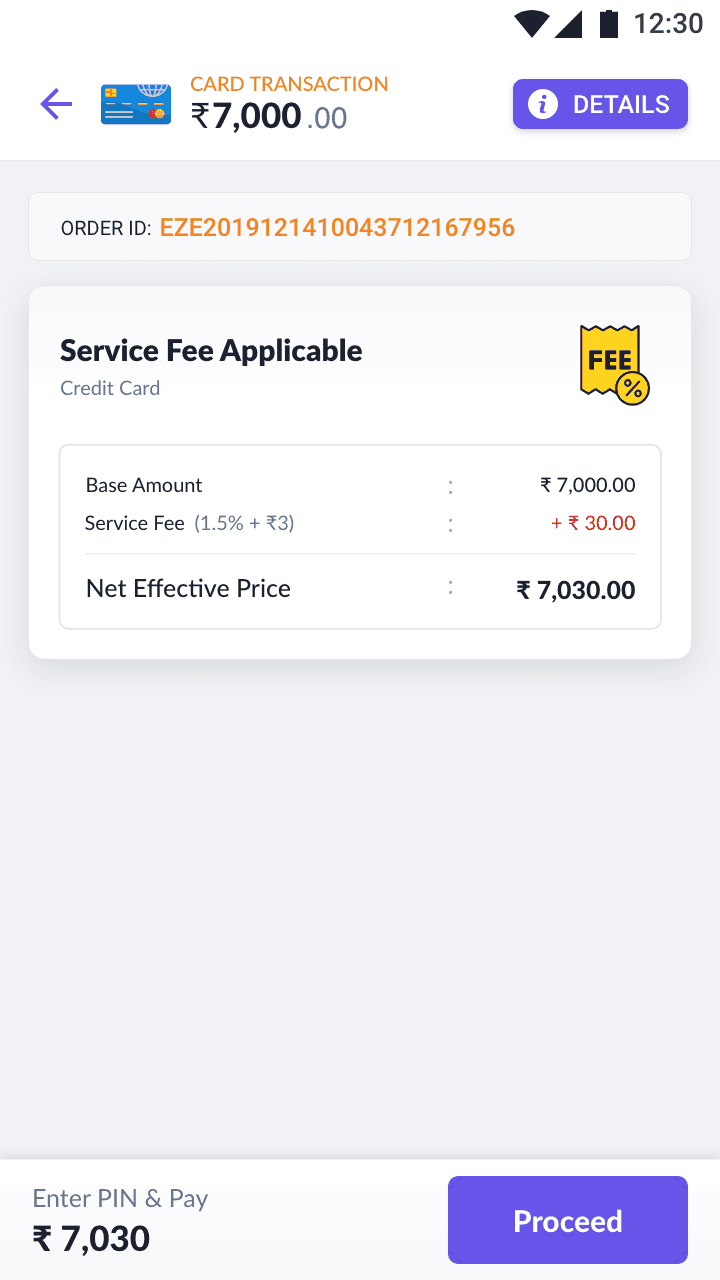

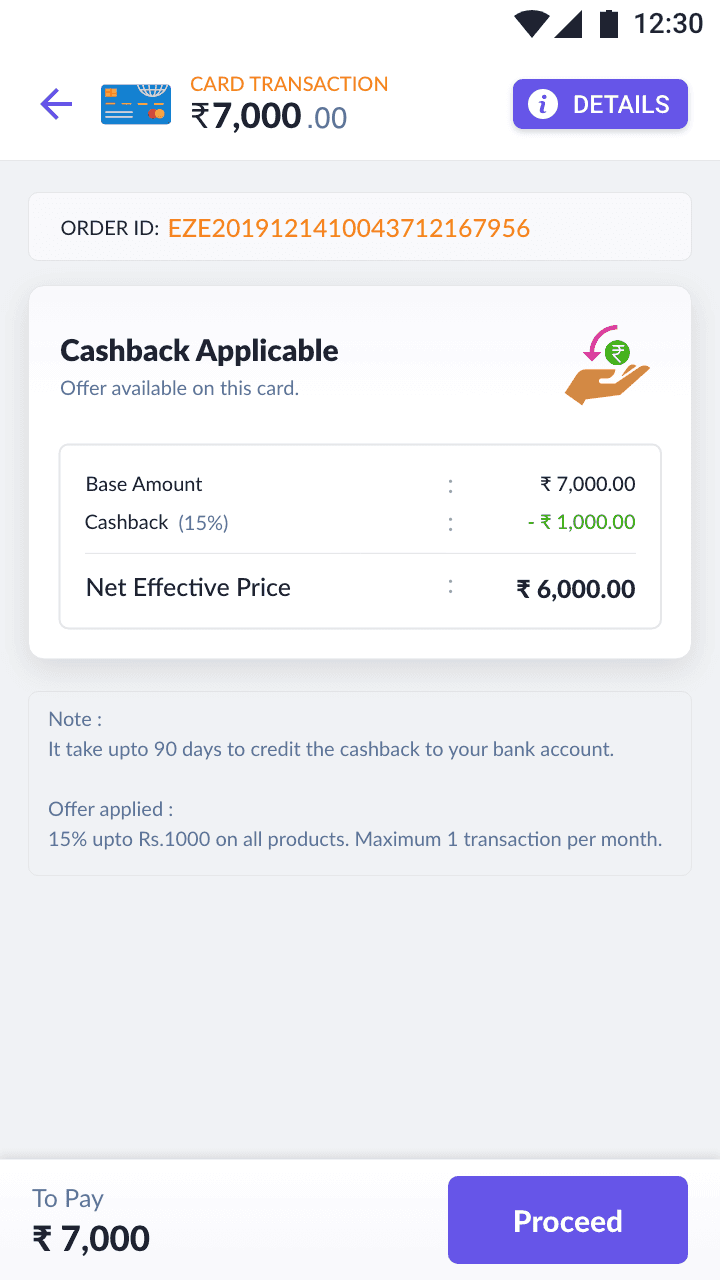

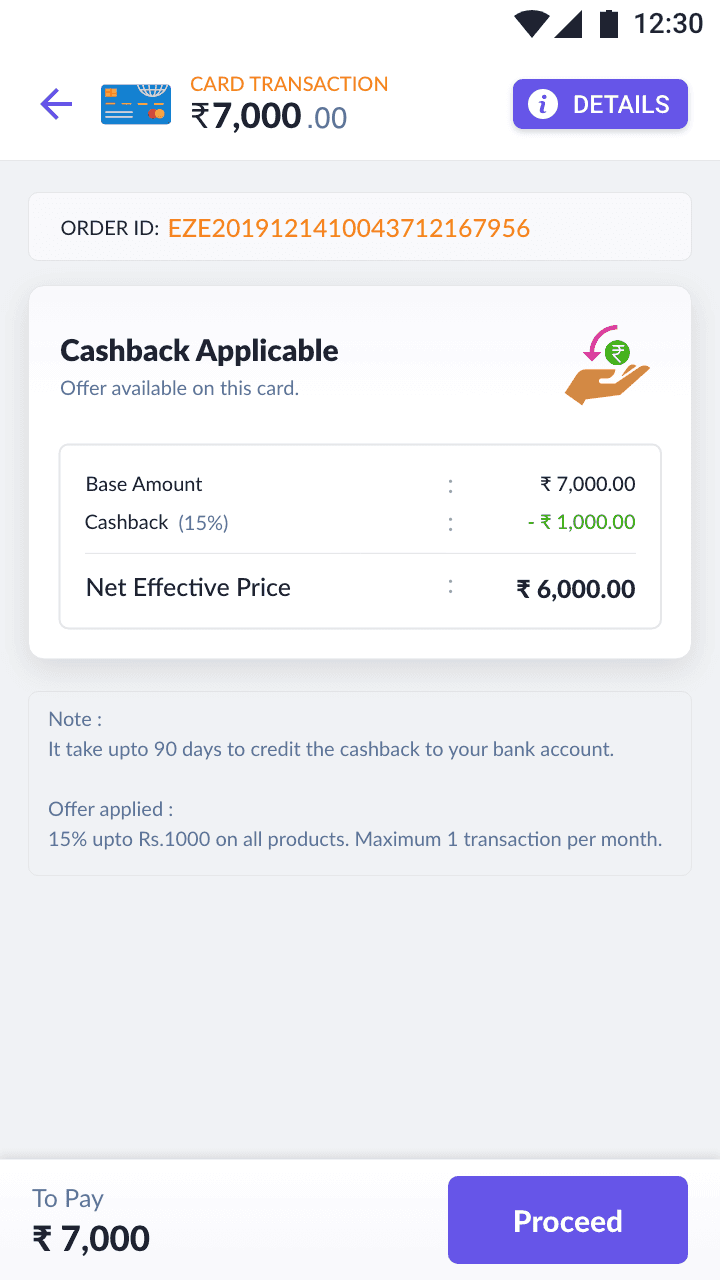

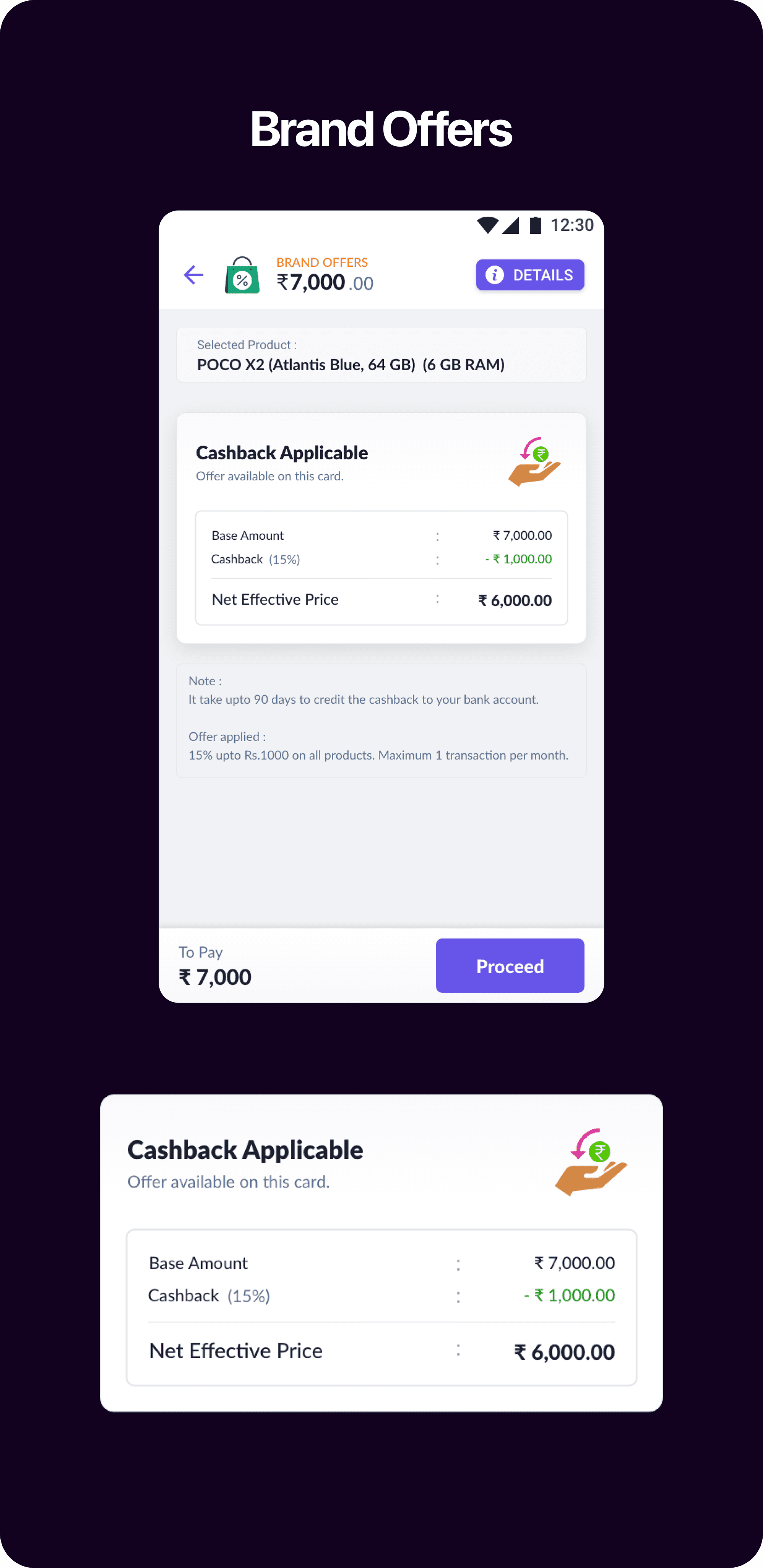

Service Fee & Cashback

Service Fee

Service Fee

Cashback

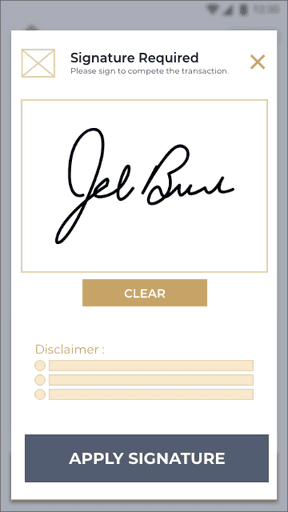

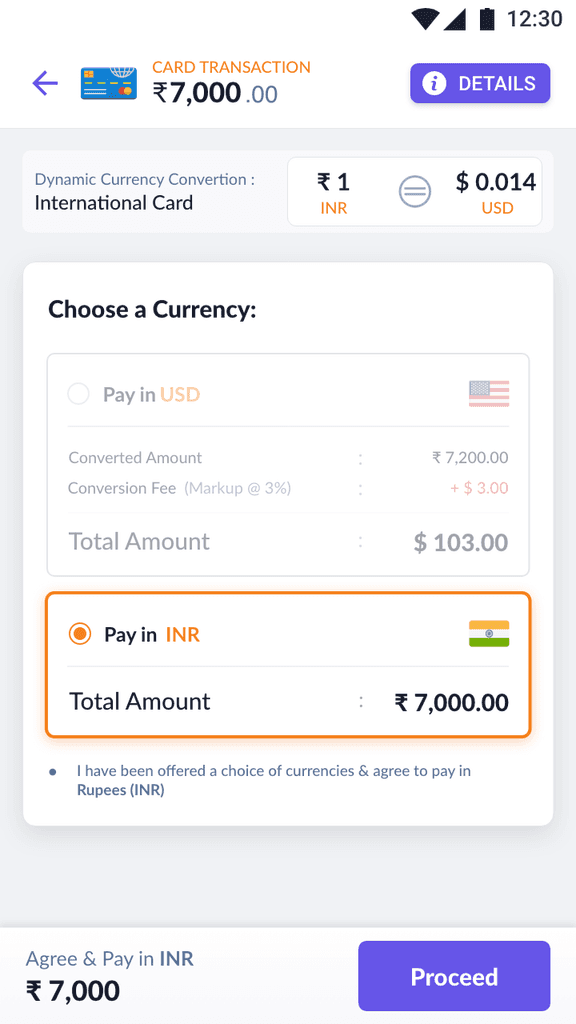

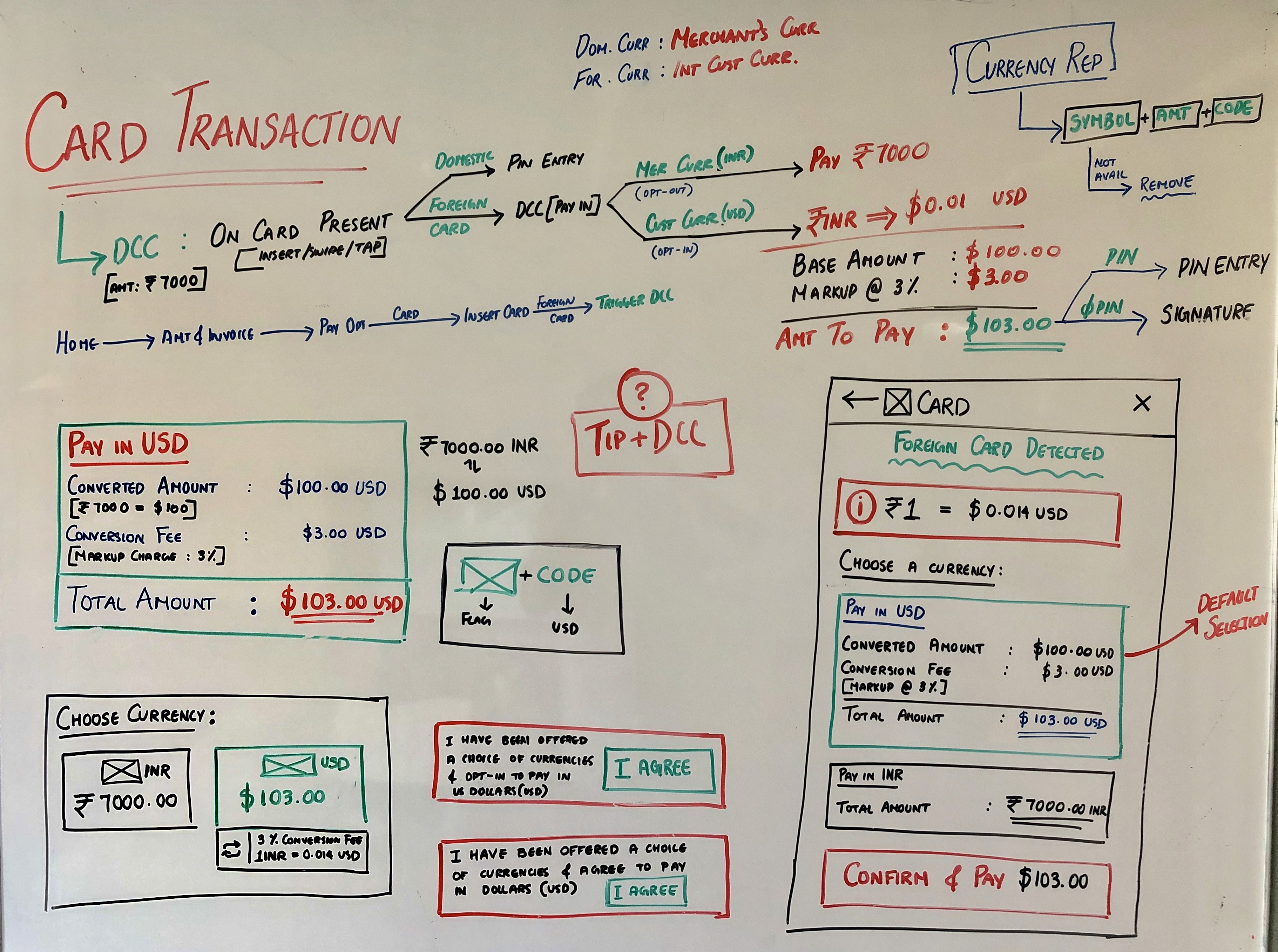

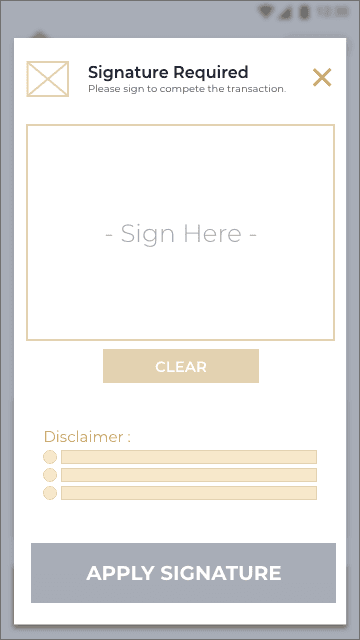

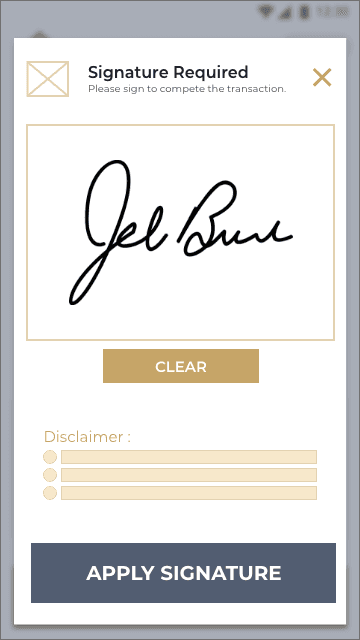

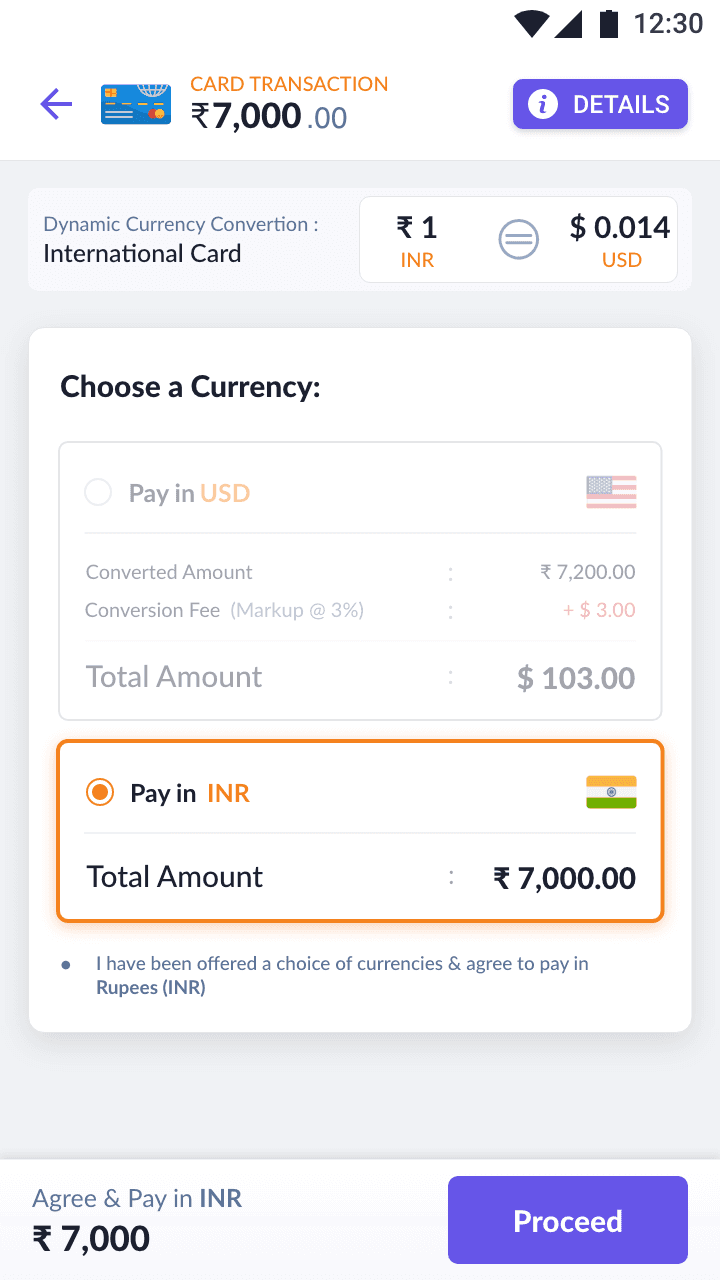

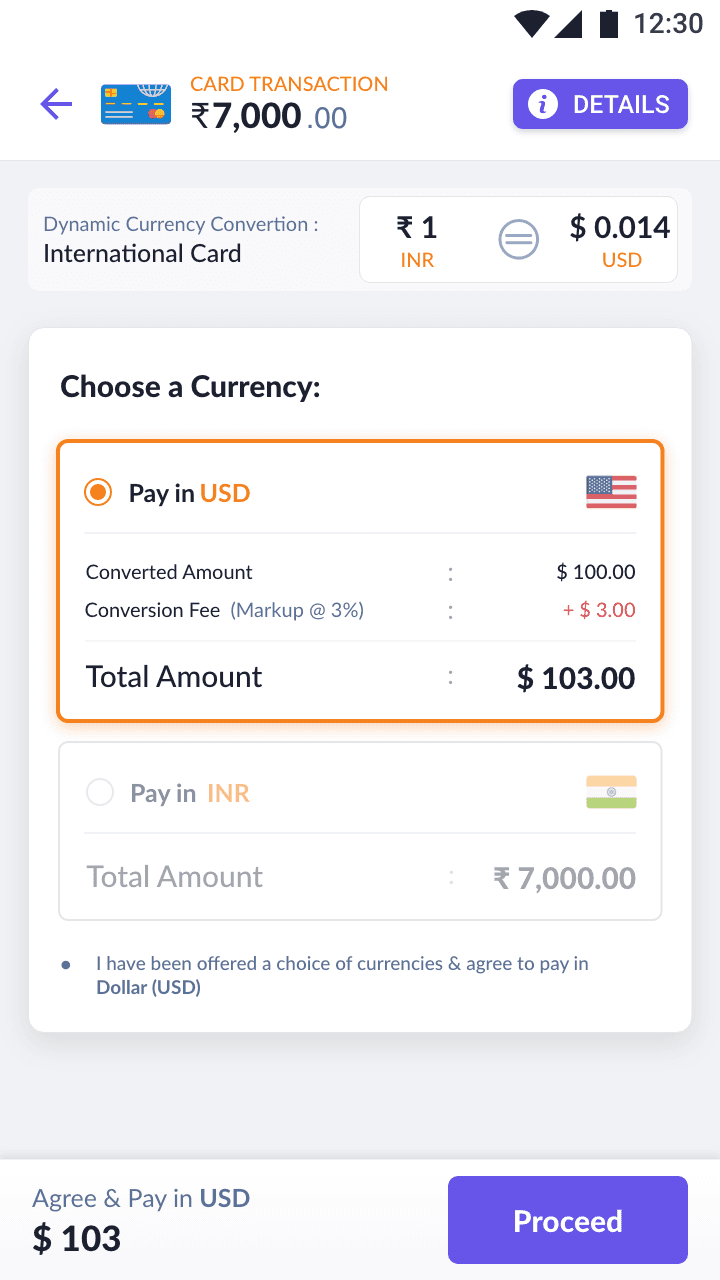

Dynamic Currency Conversion

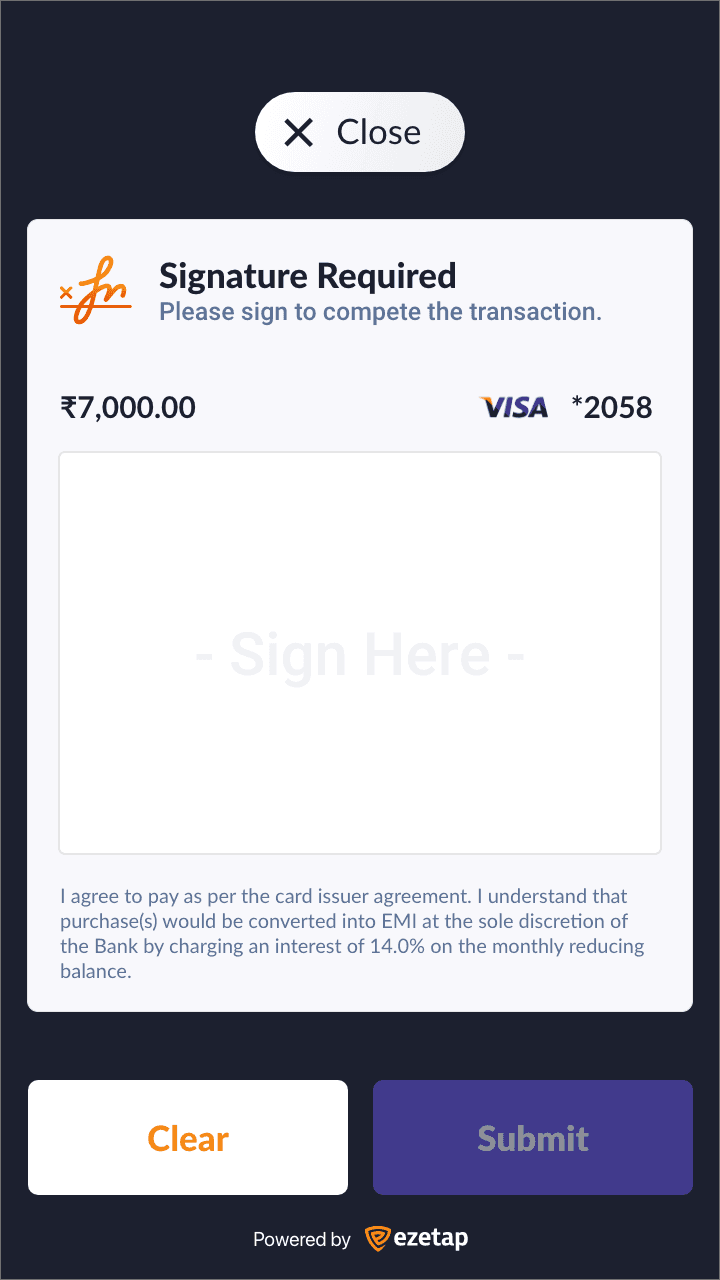

Signature

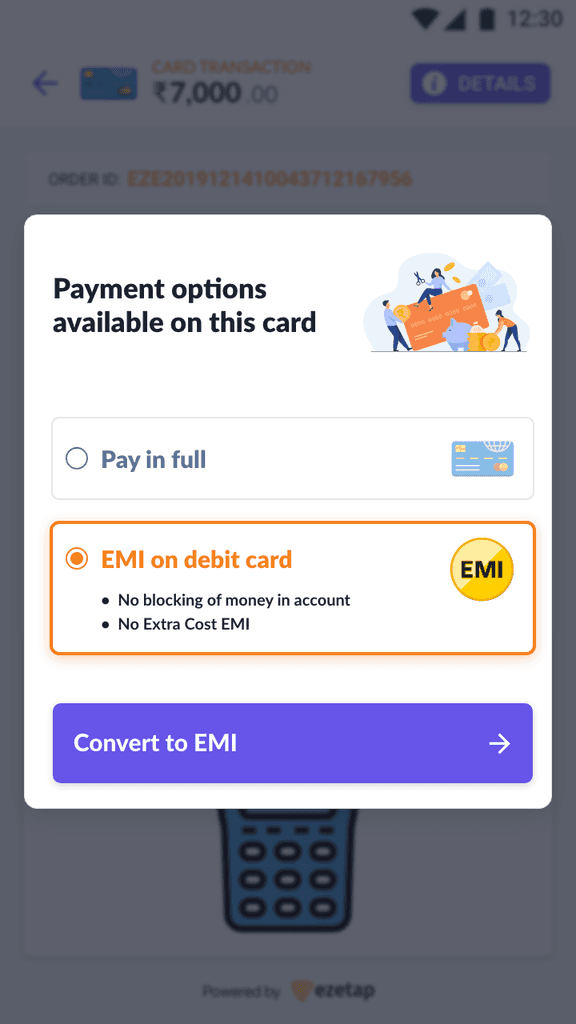

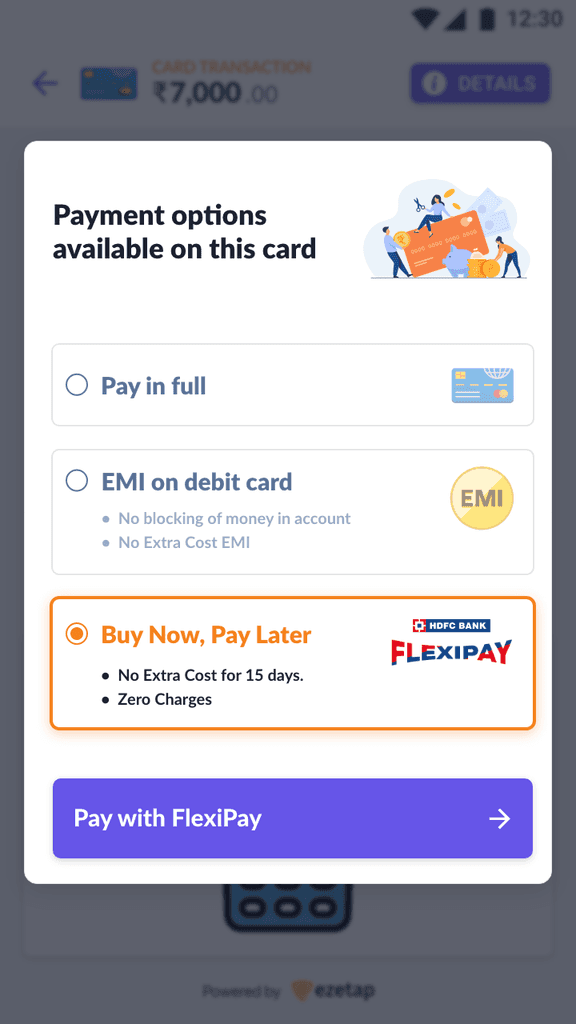

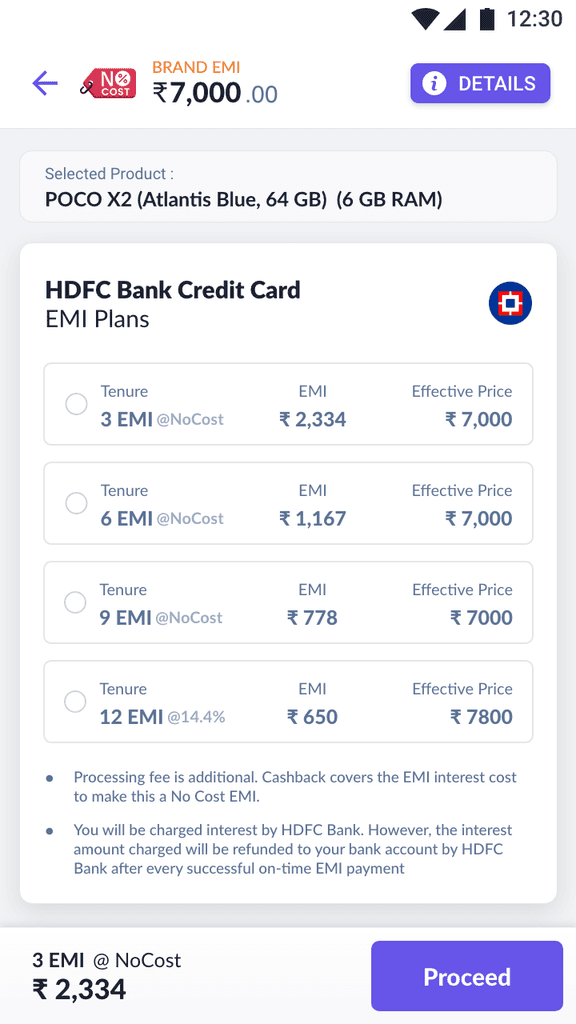

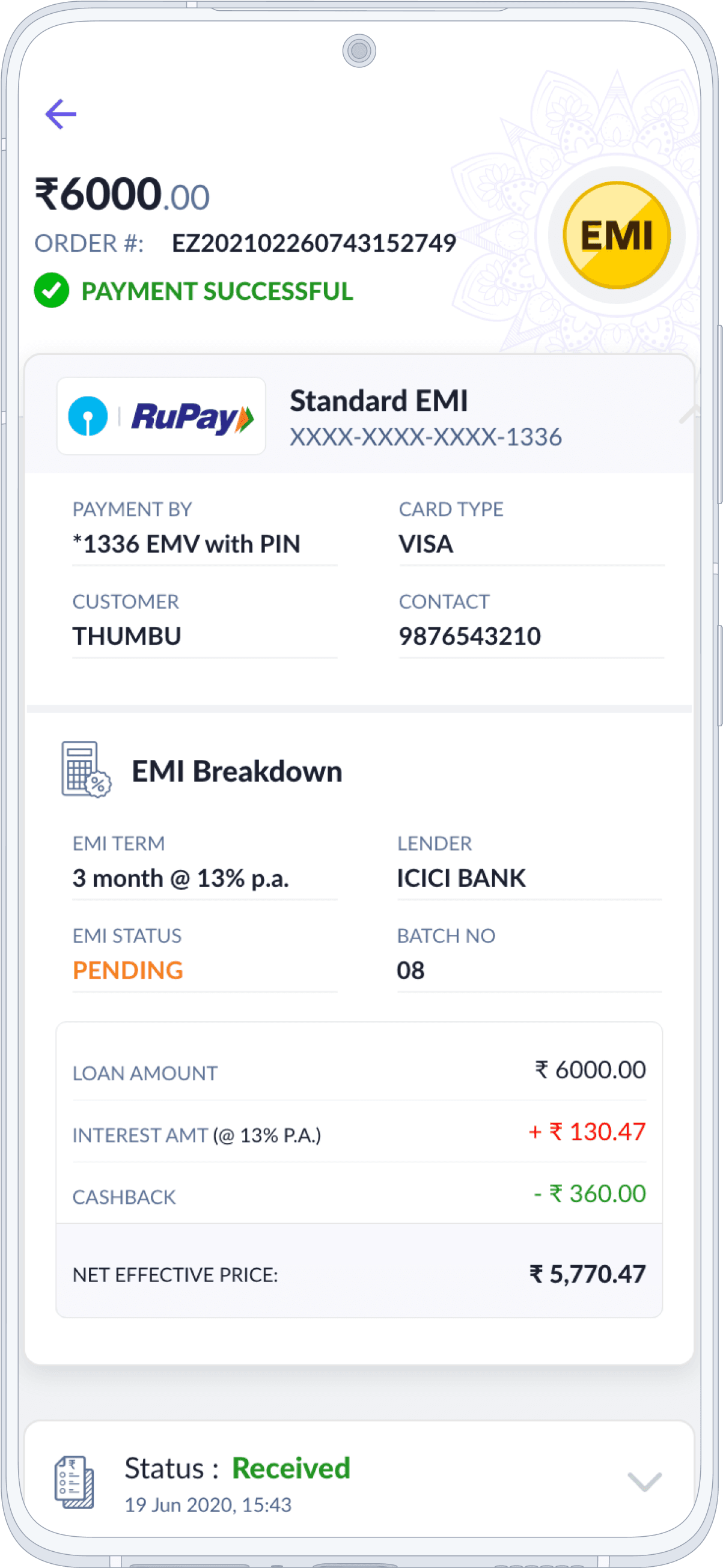

Payment Mode

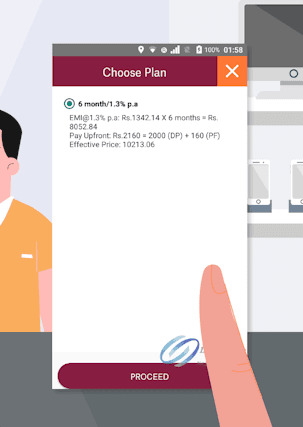

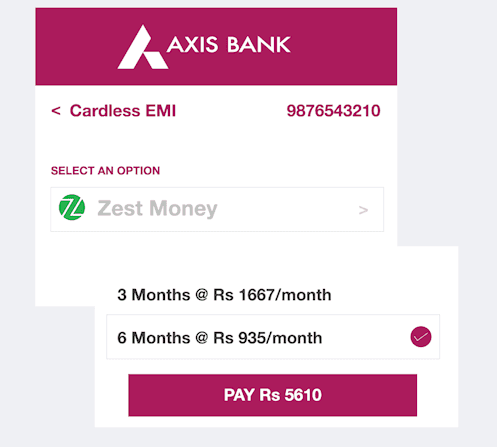

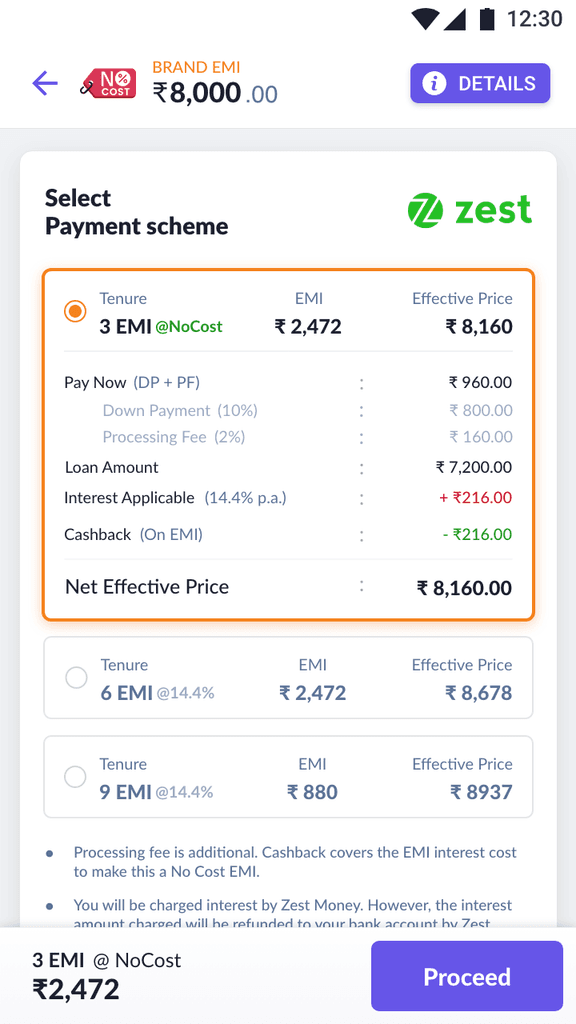

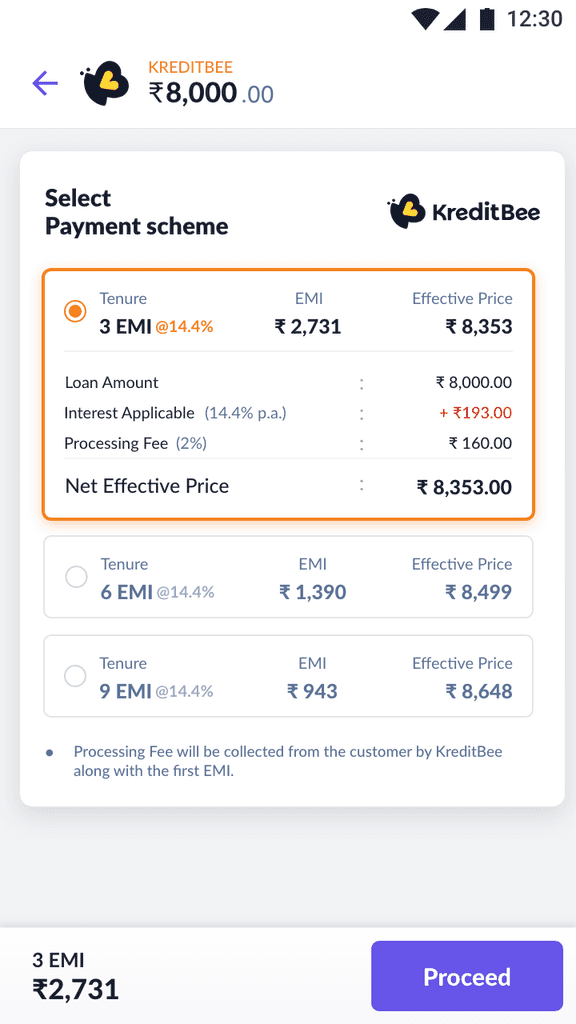

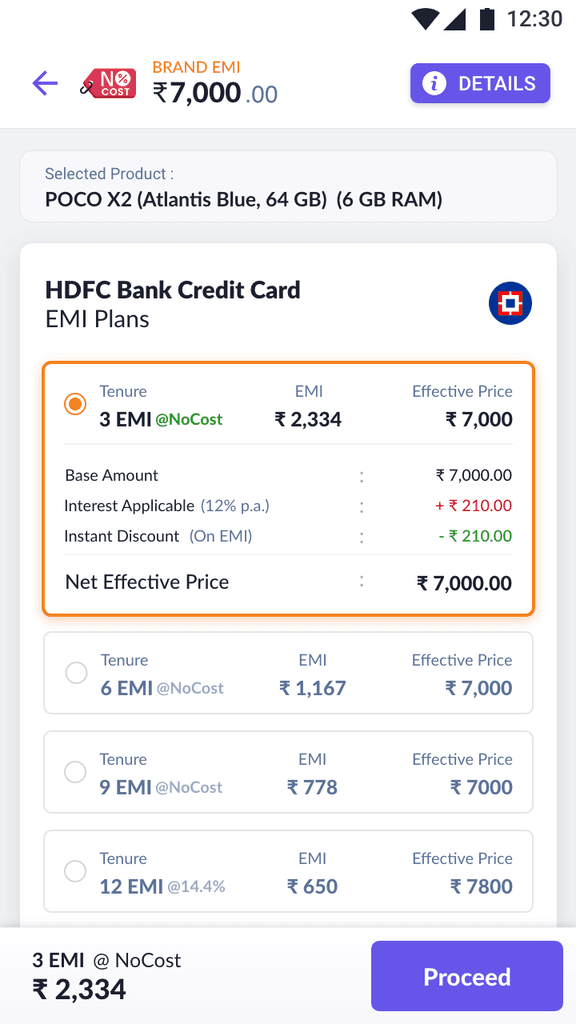

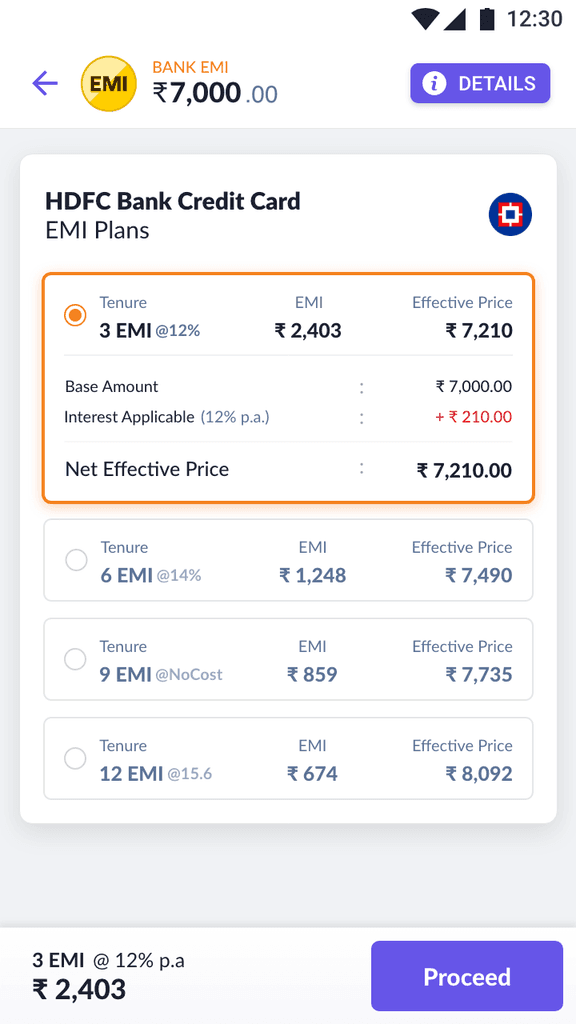

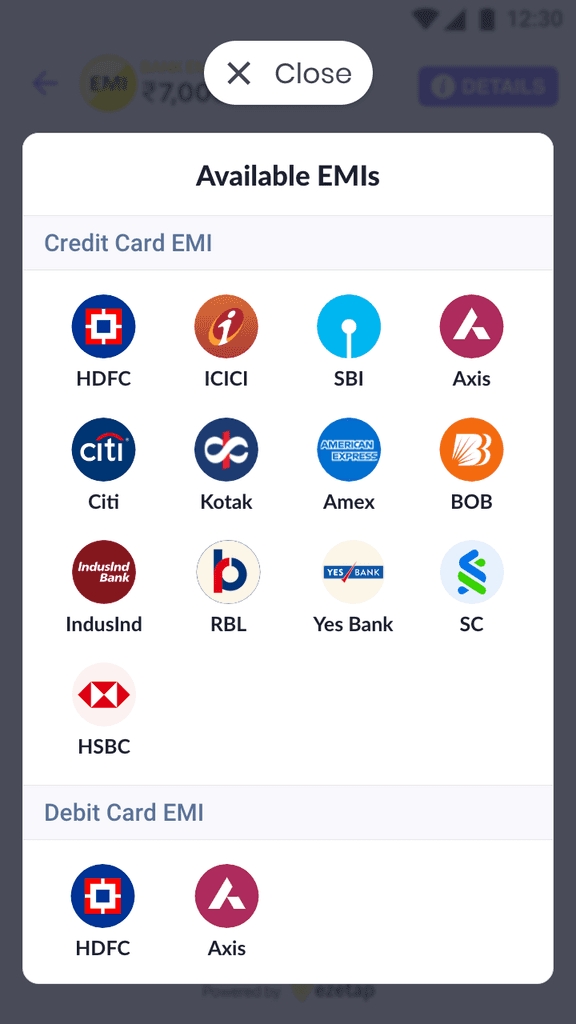

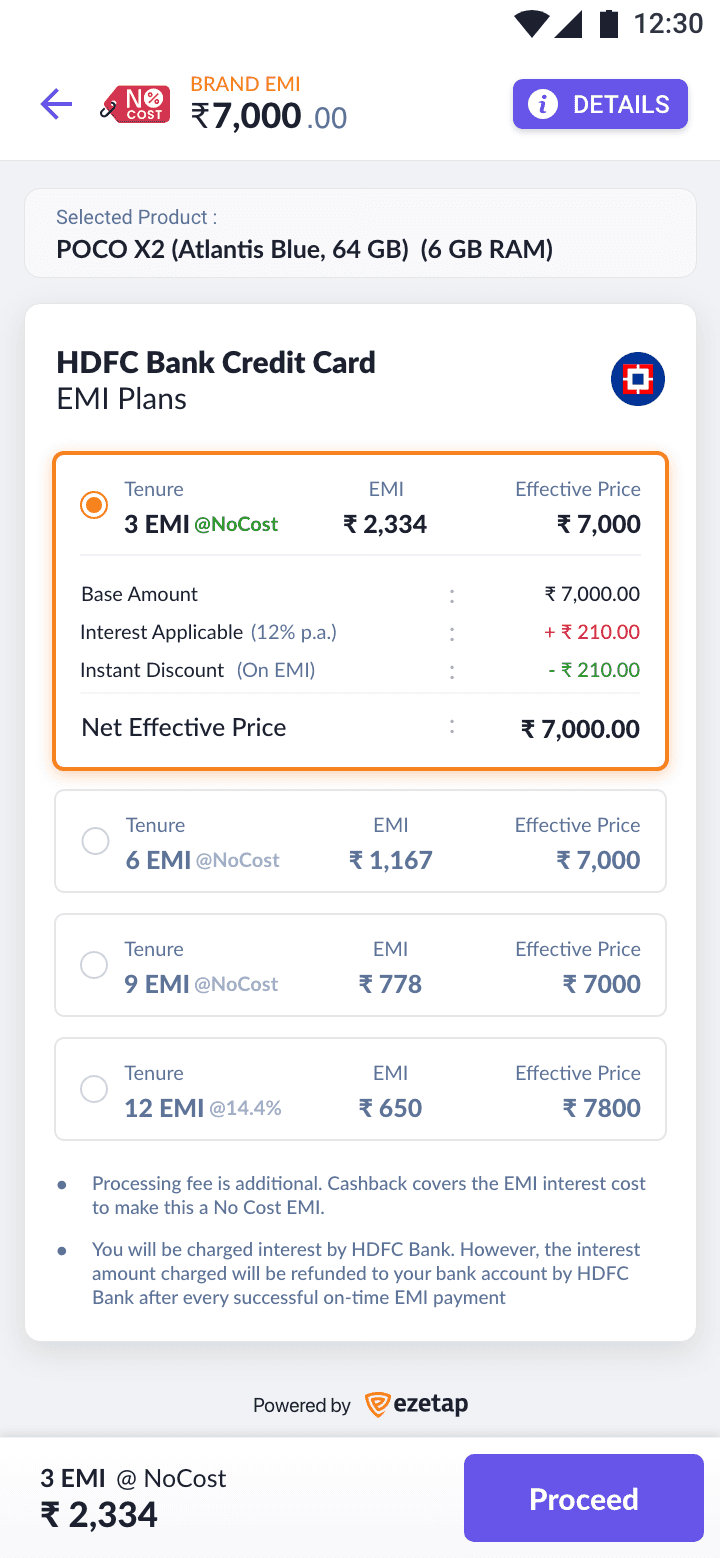

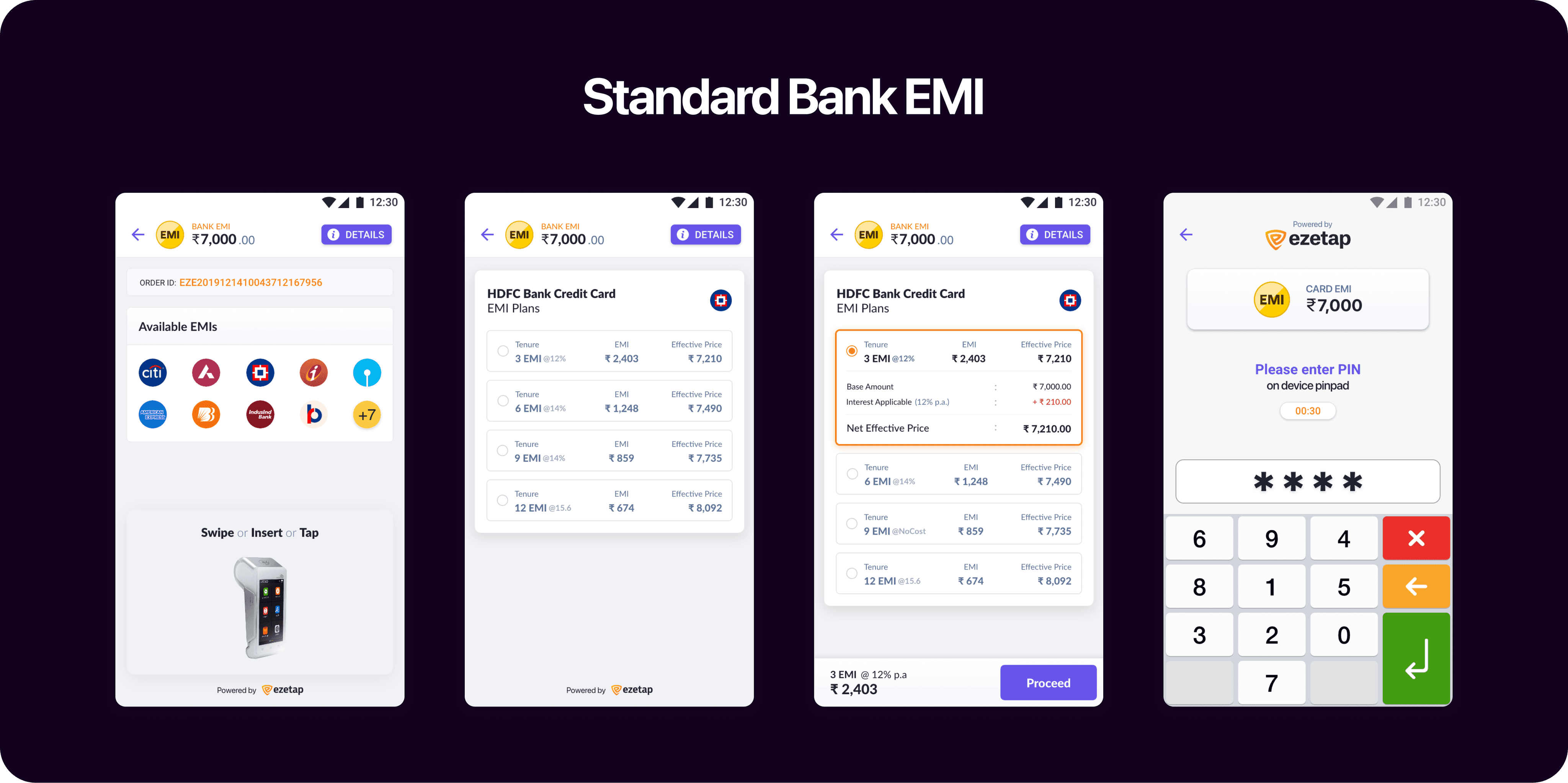

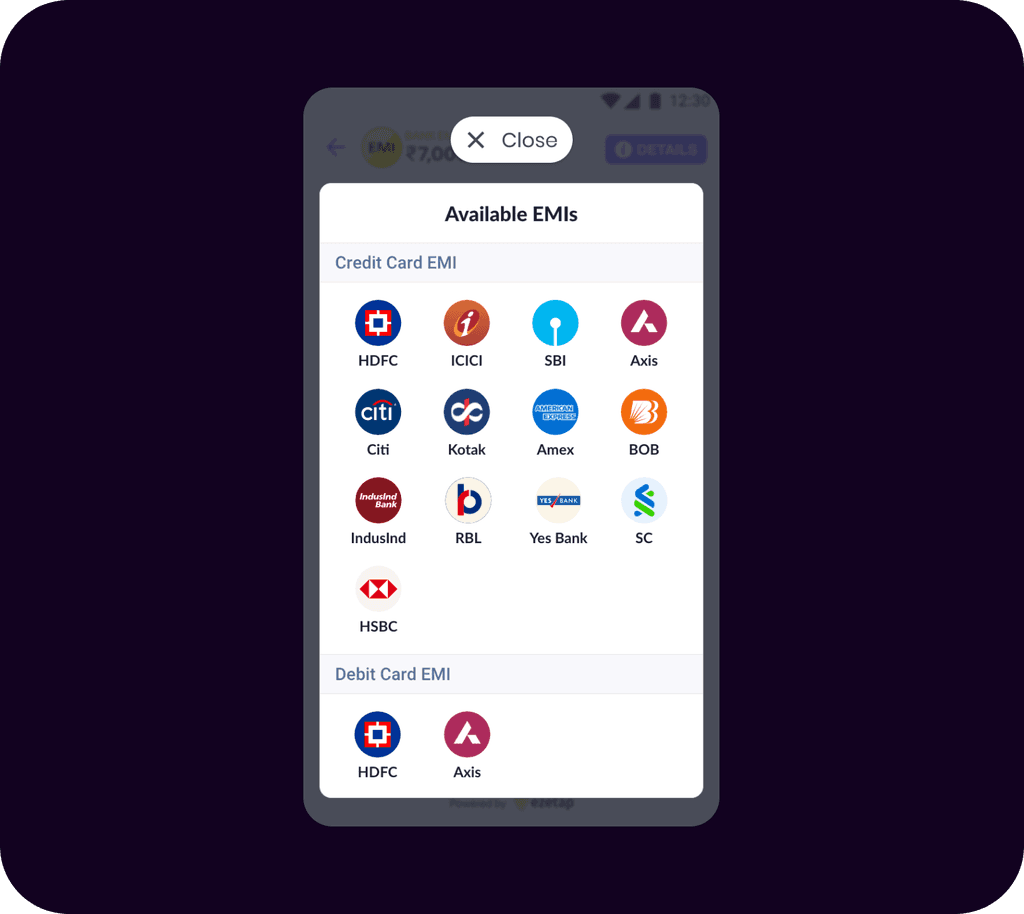

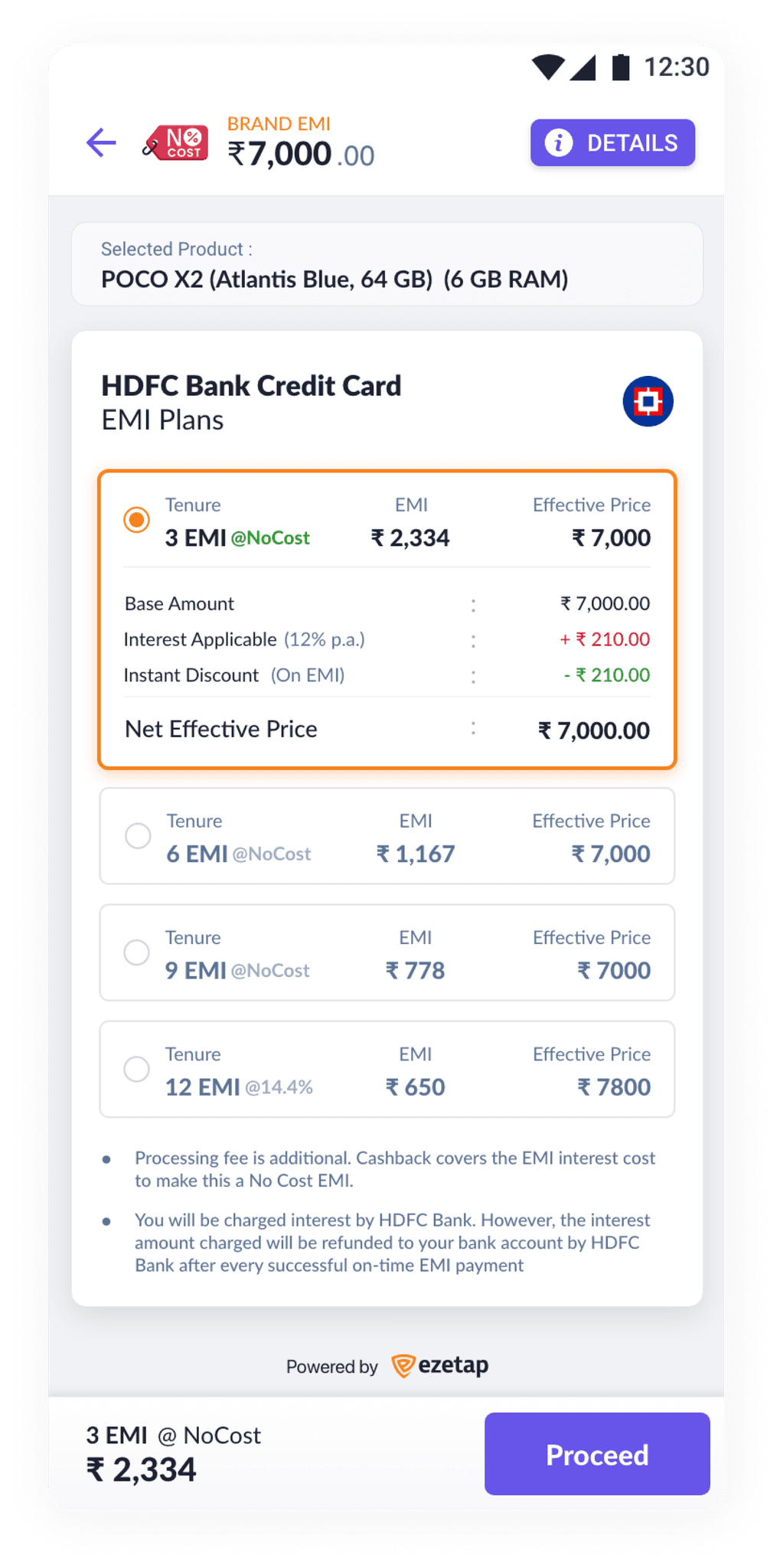

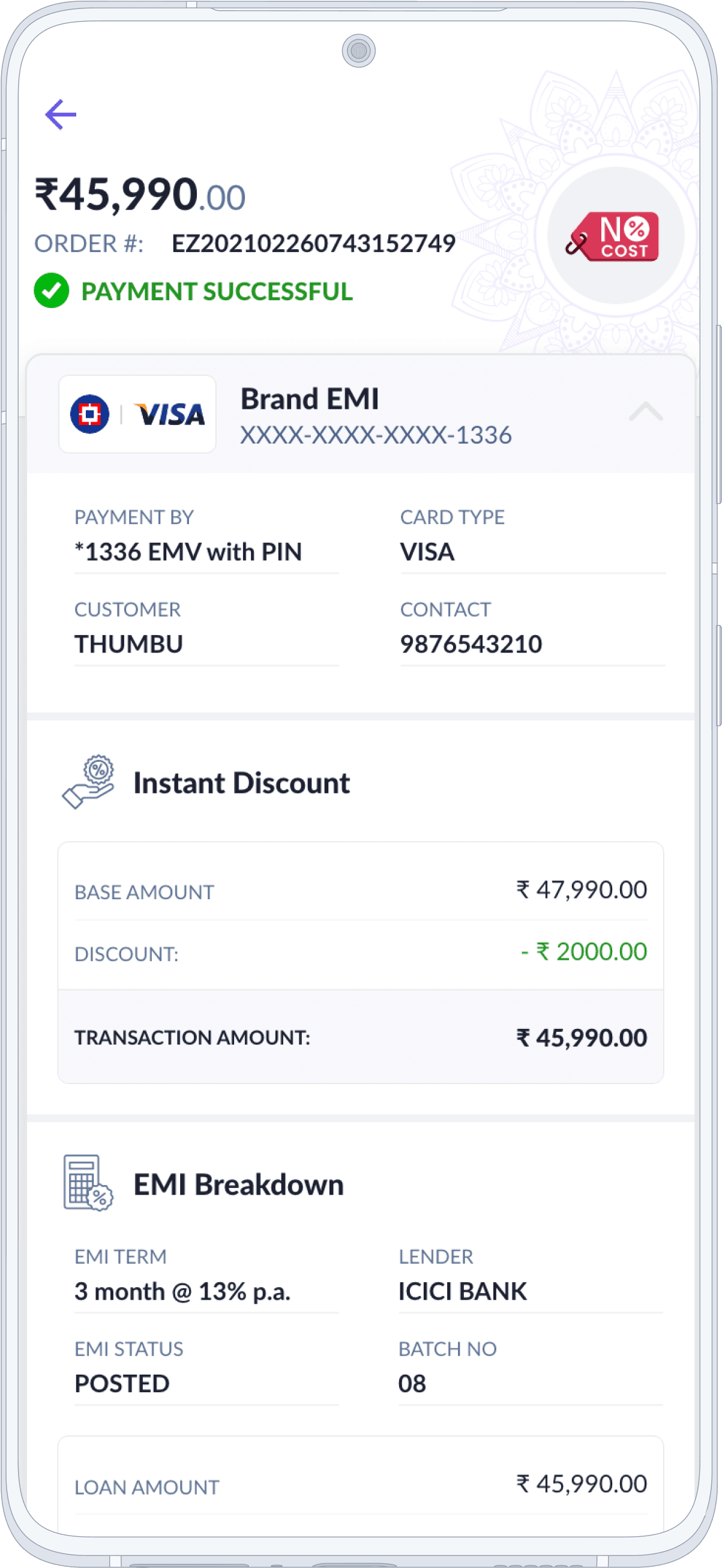

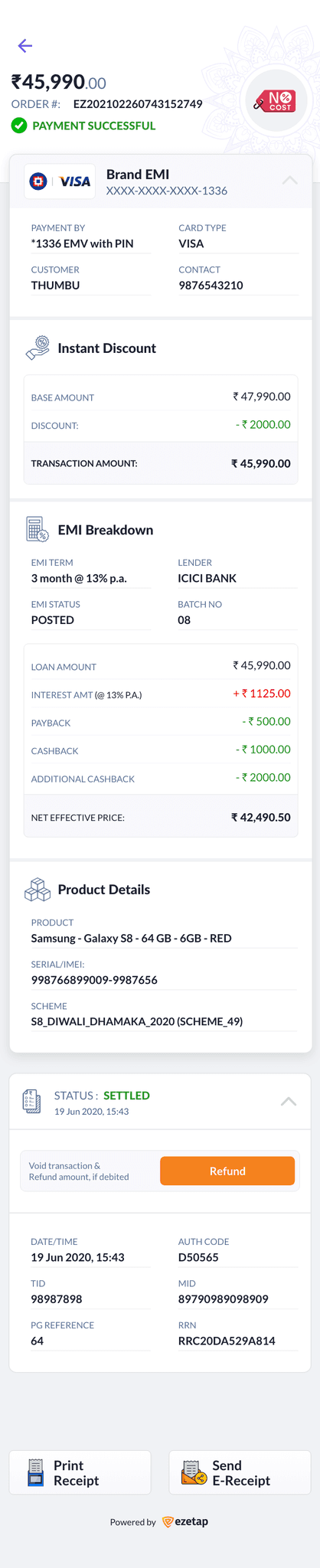

Bank based EMIs

Bank Based EMI

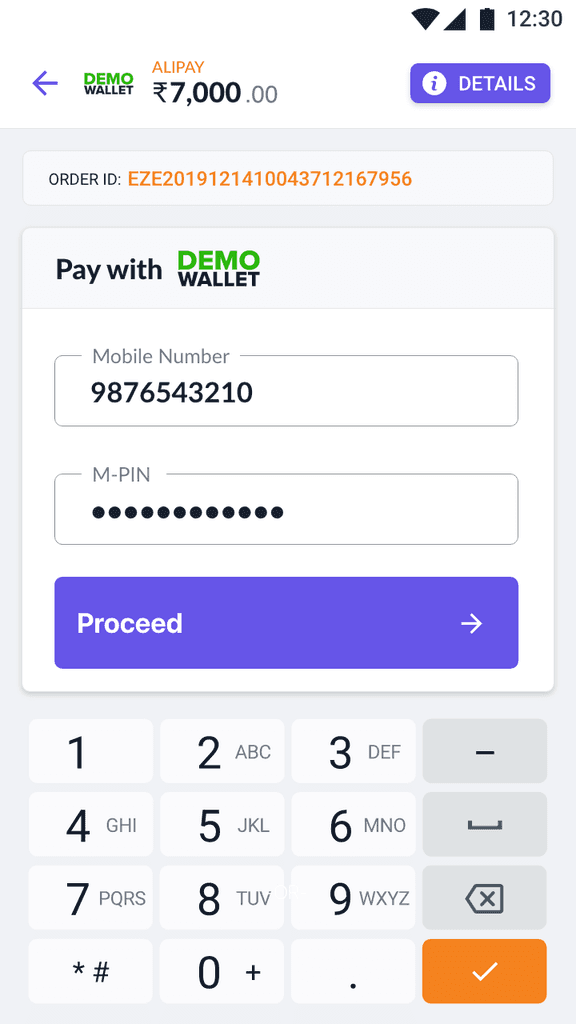

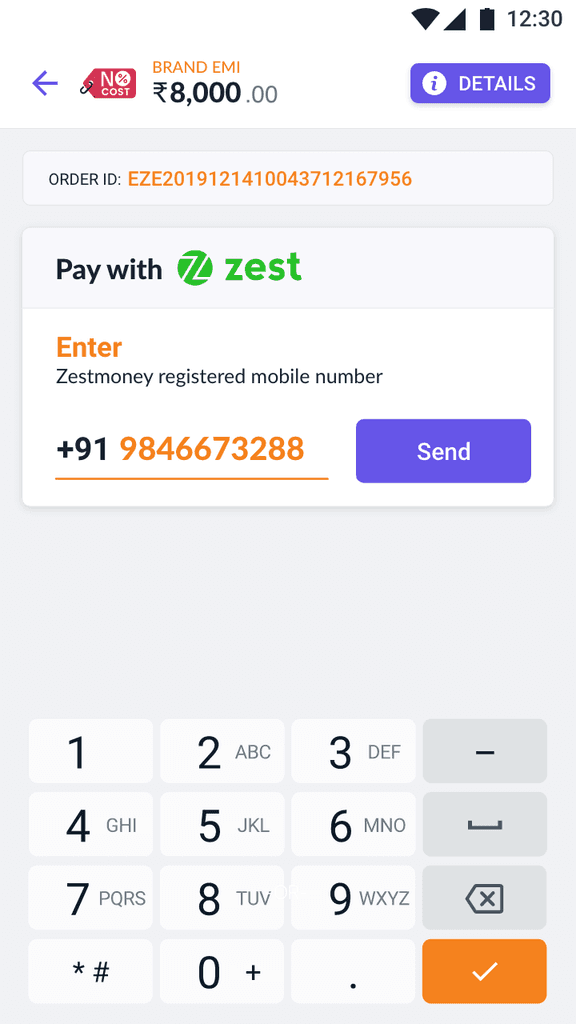

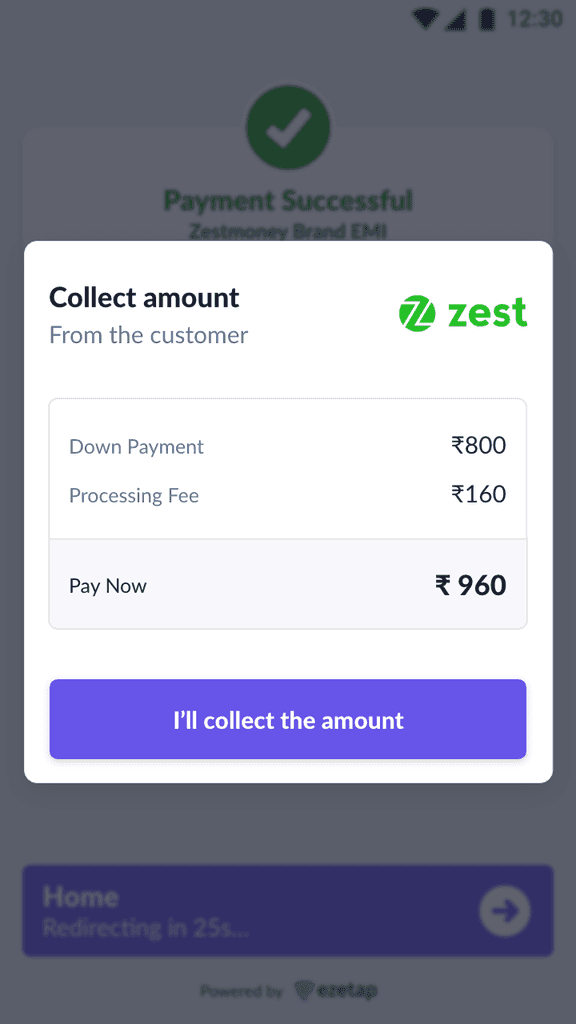

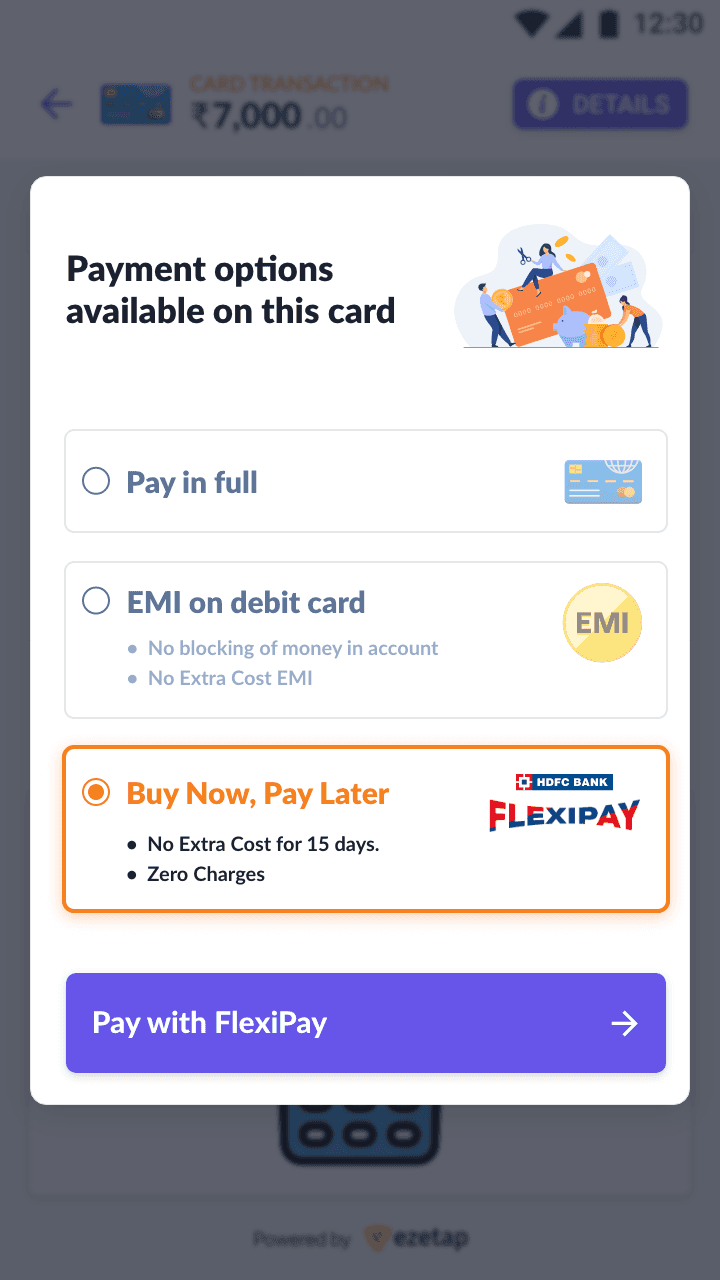

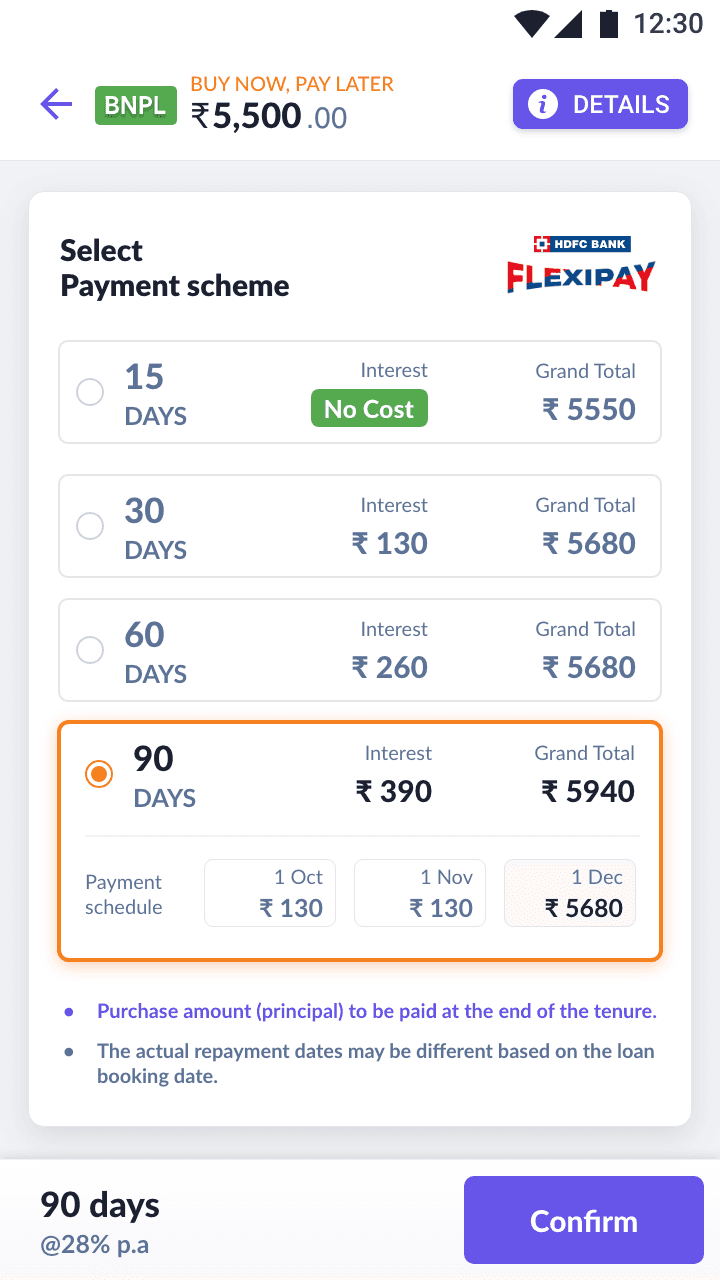

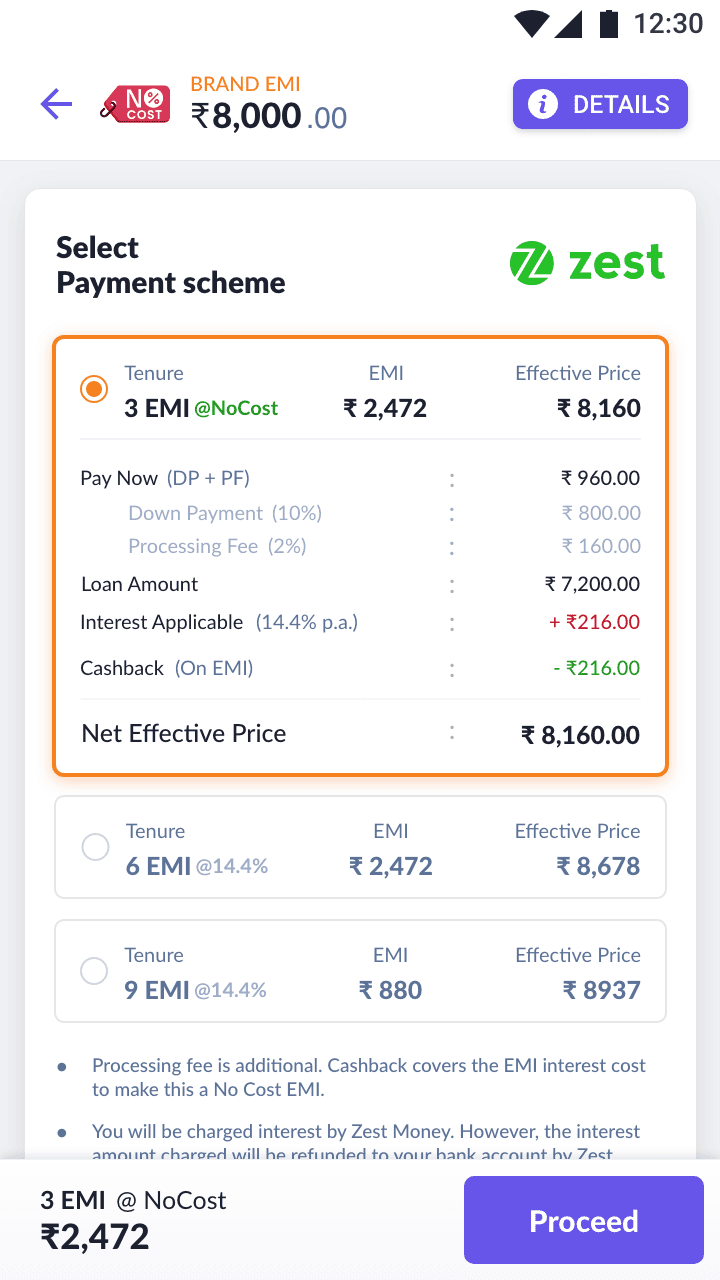

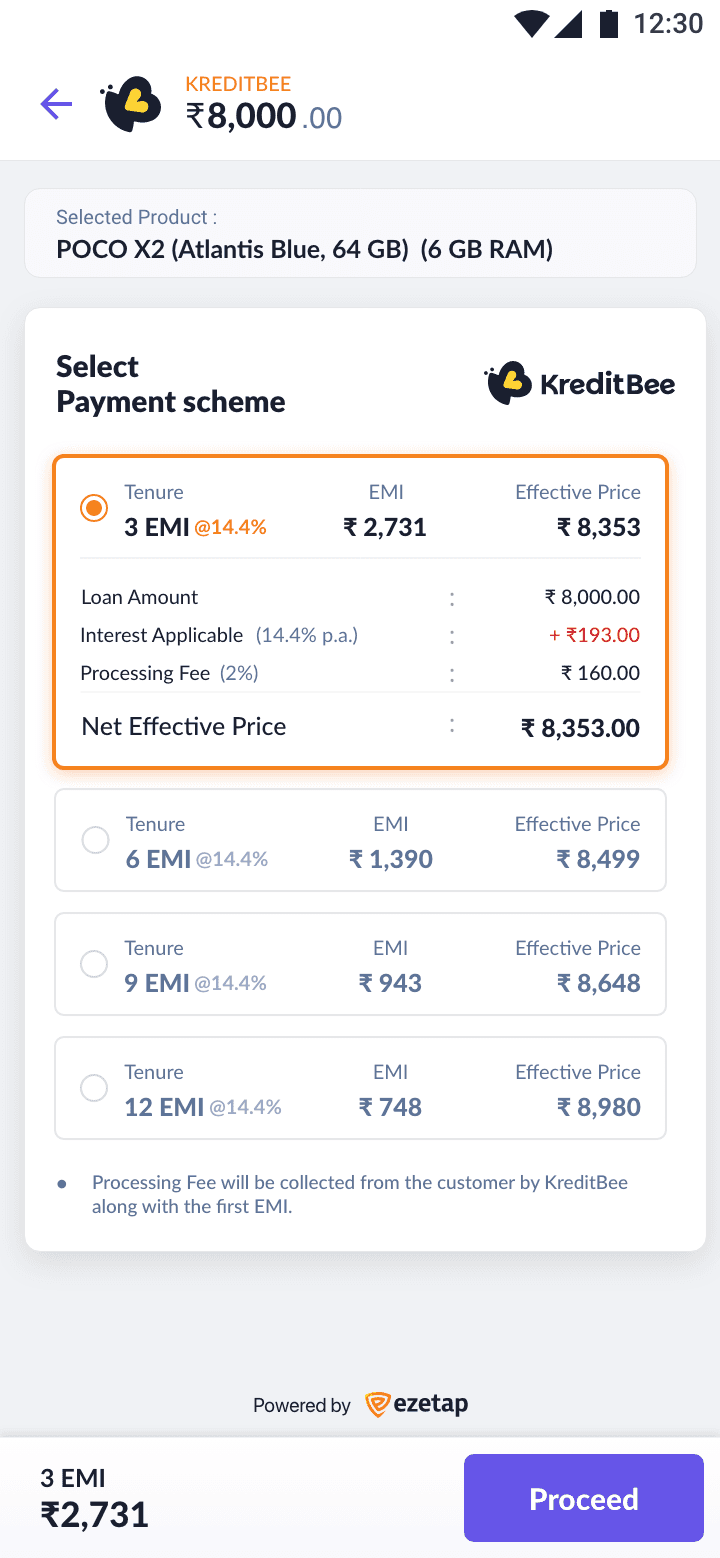

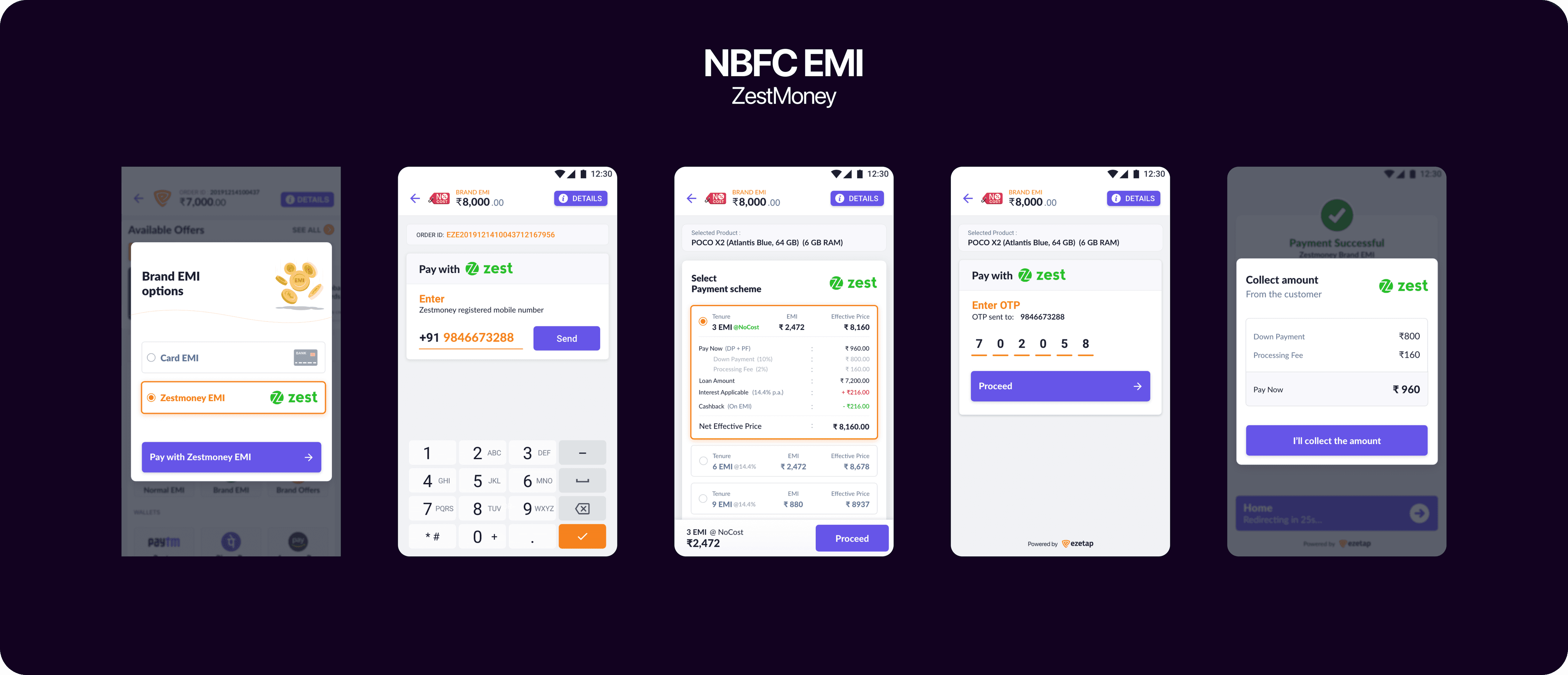

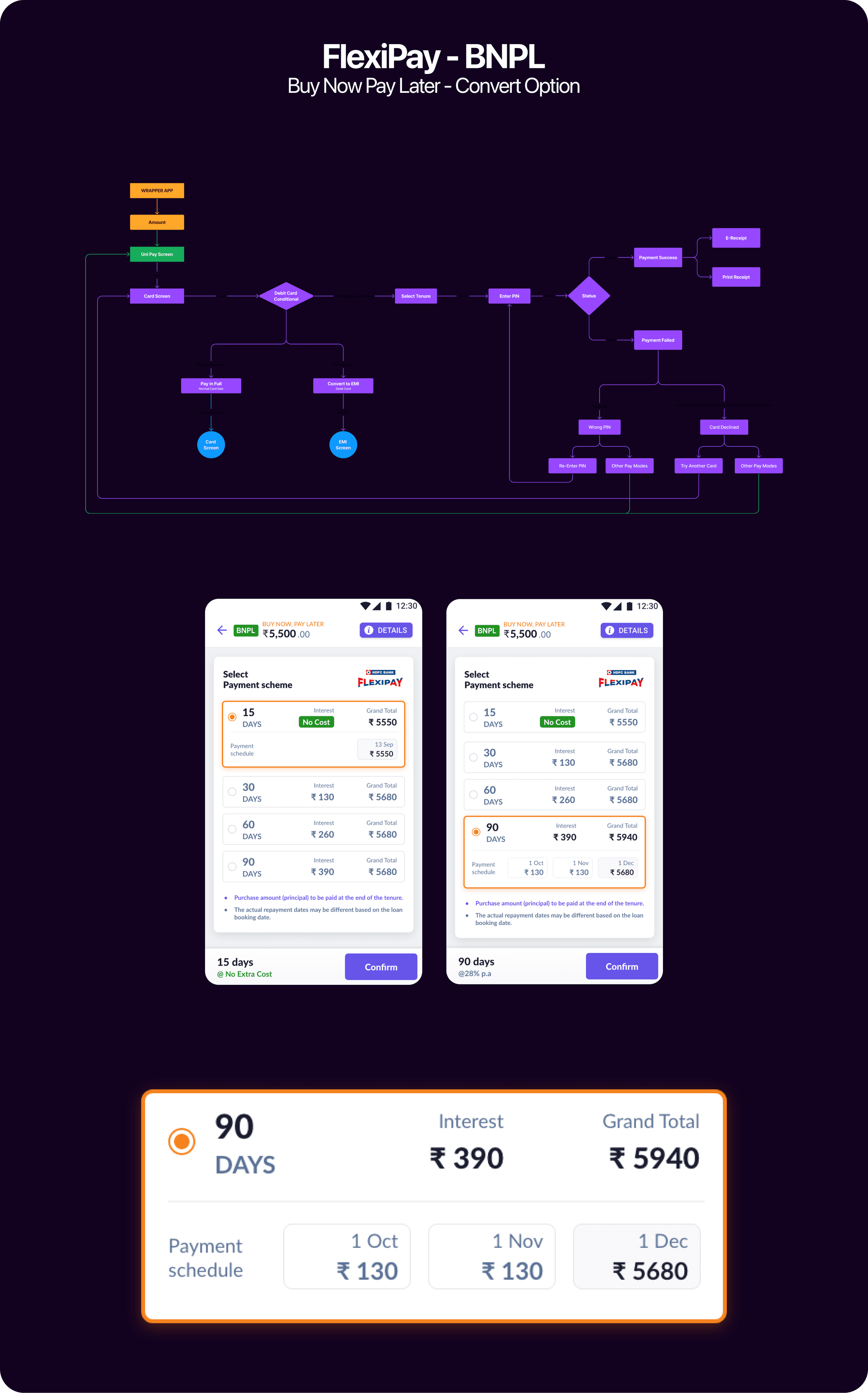

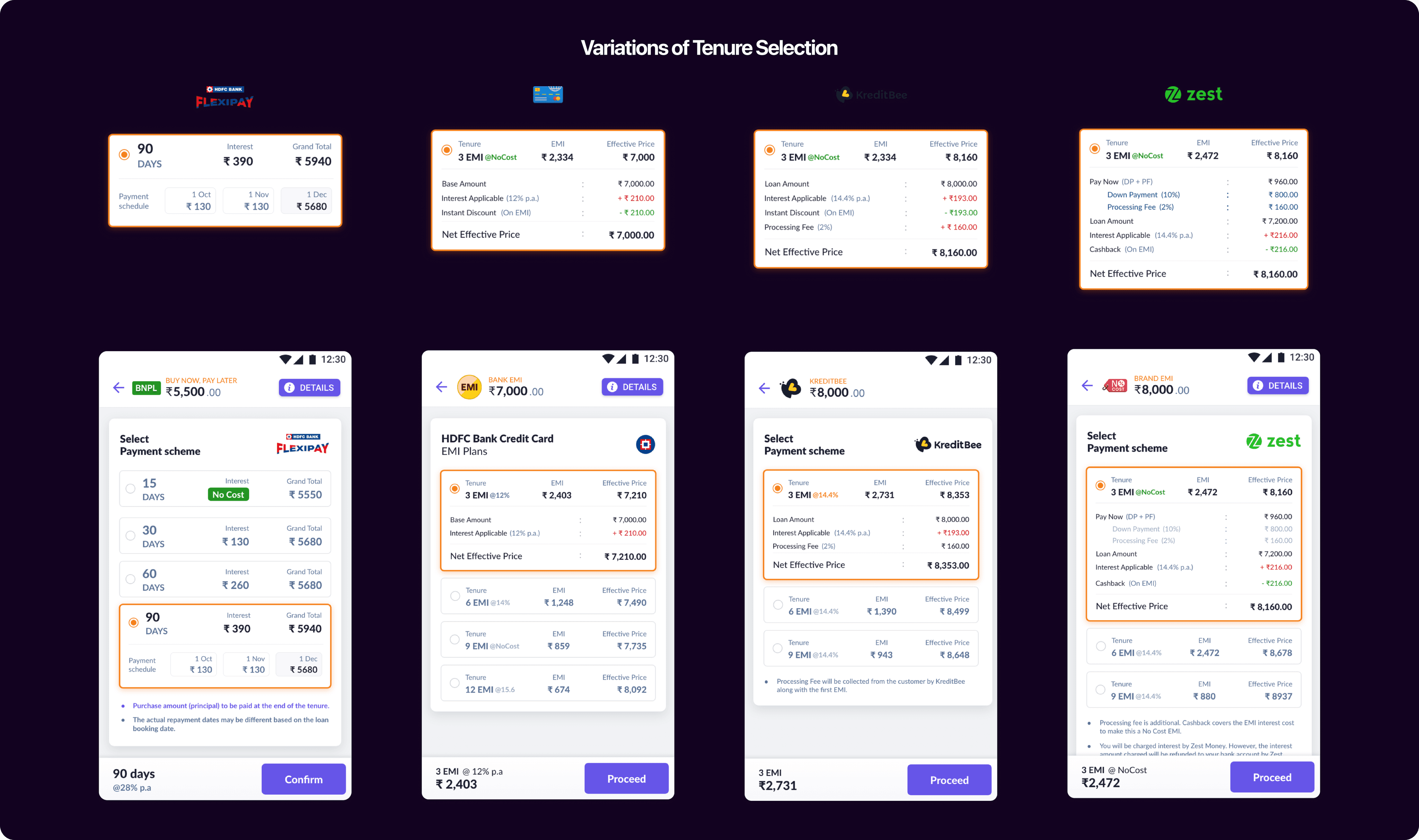

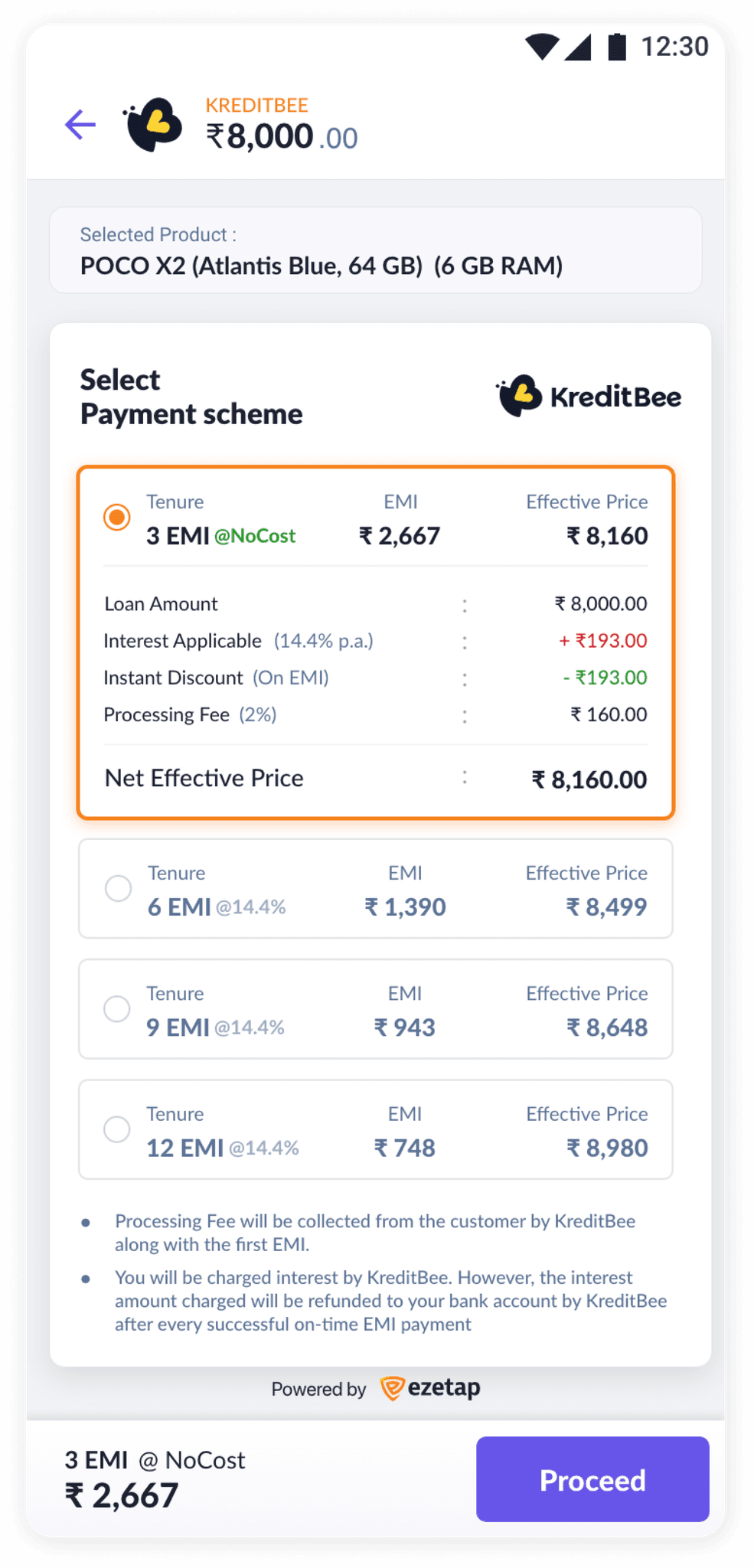

Payment Mode

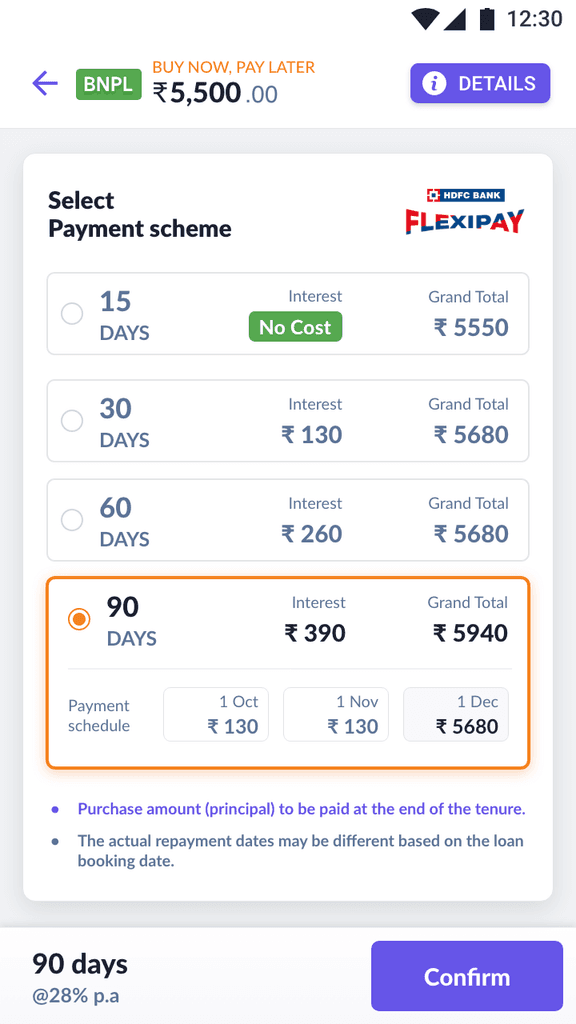

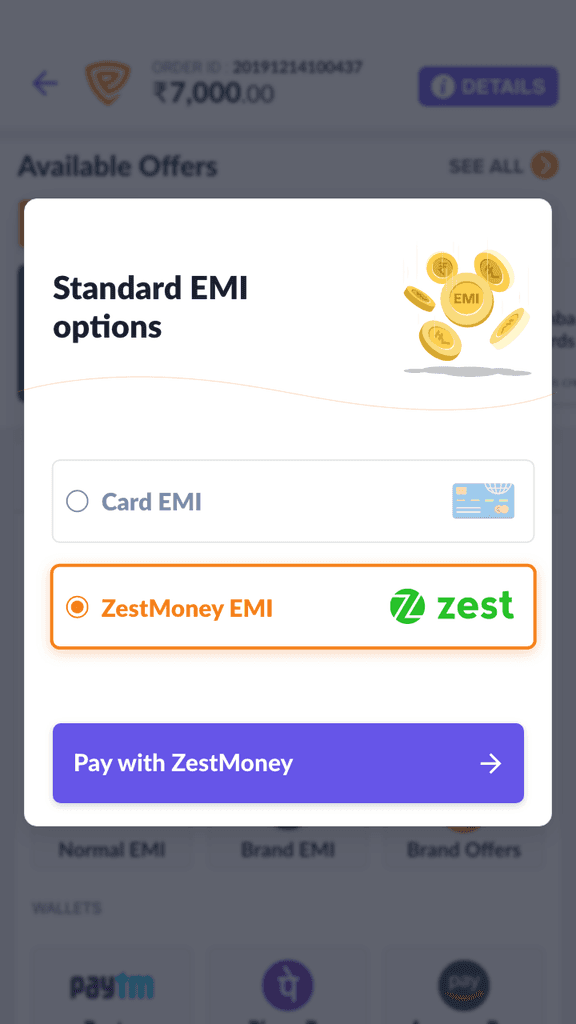

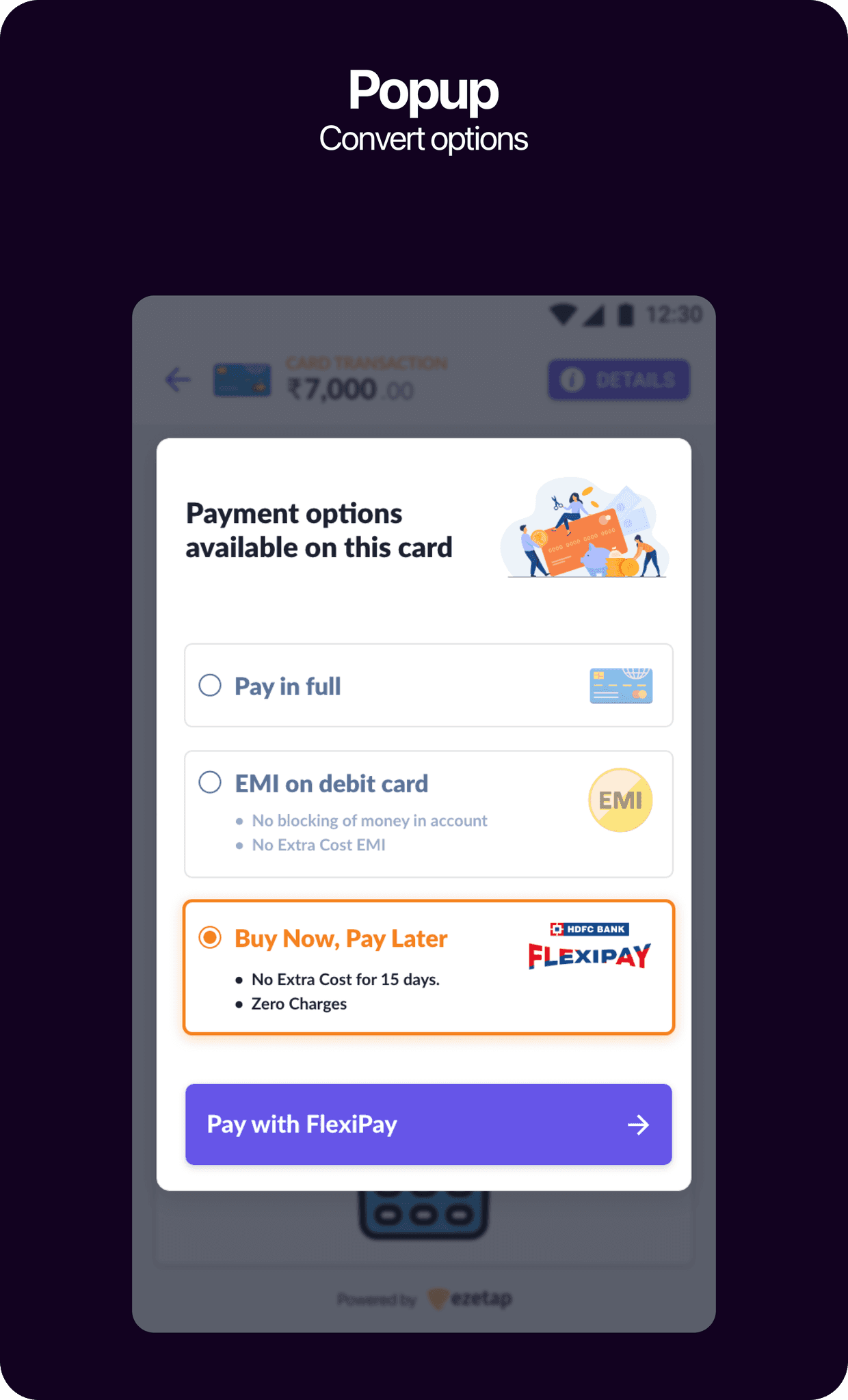

Other Affordabilities

Other affordability options

Payment Mode

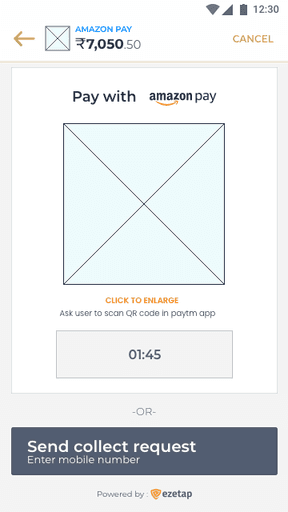

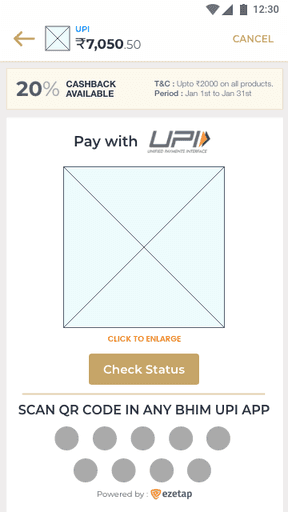

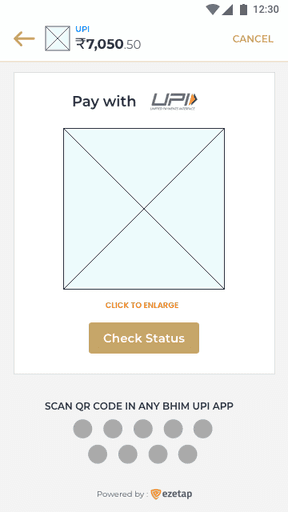

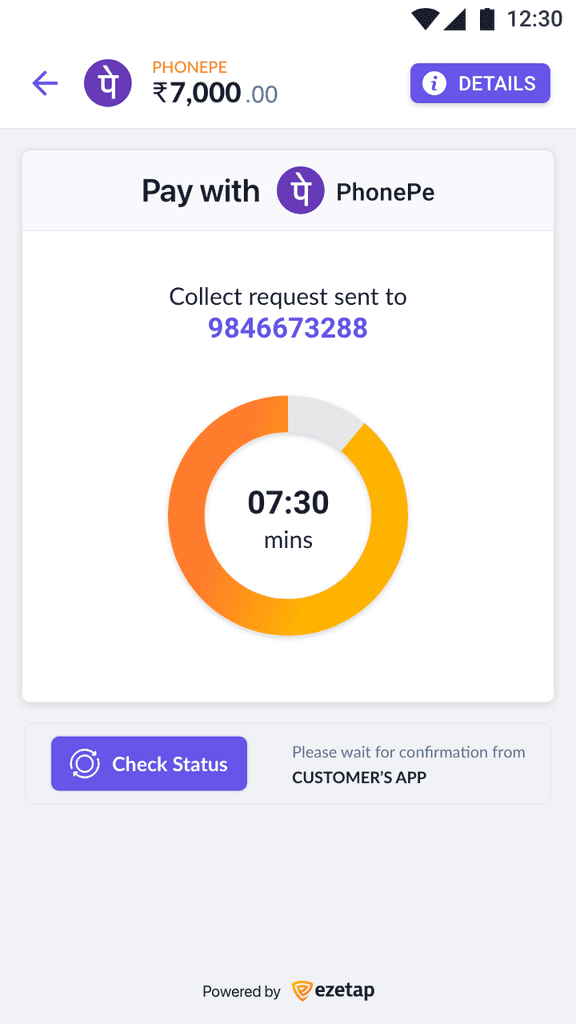

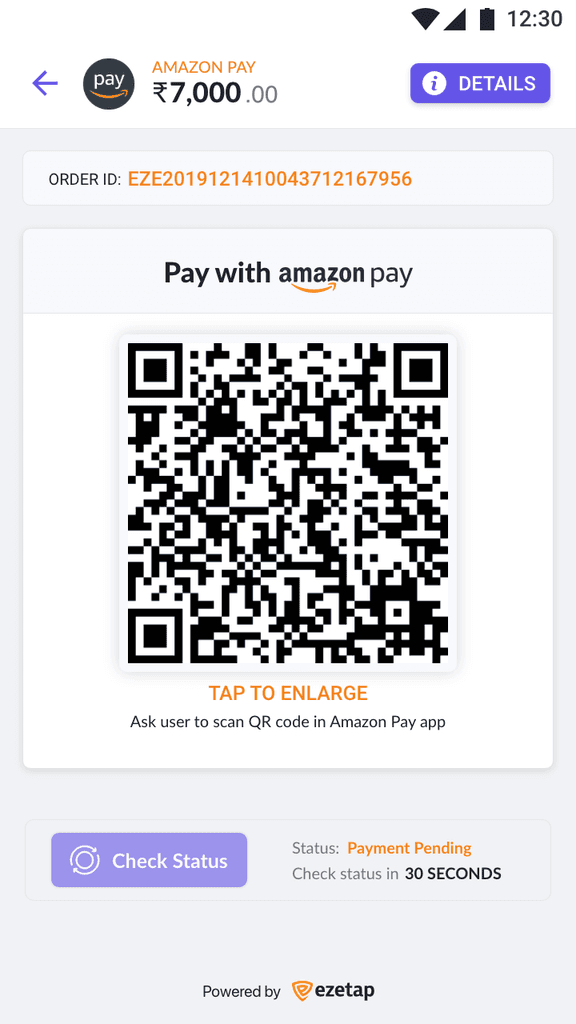

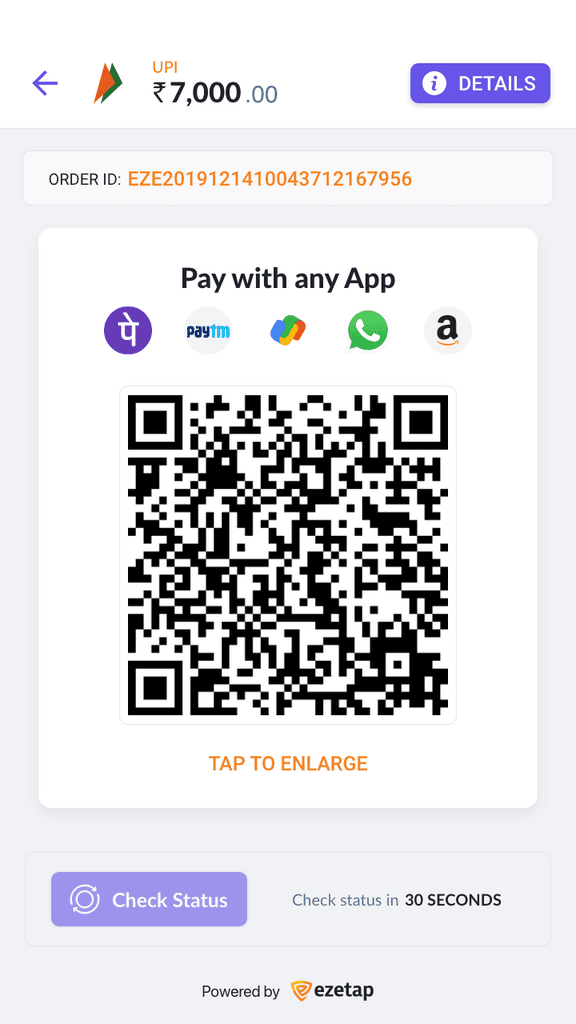

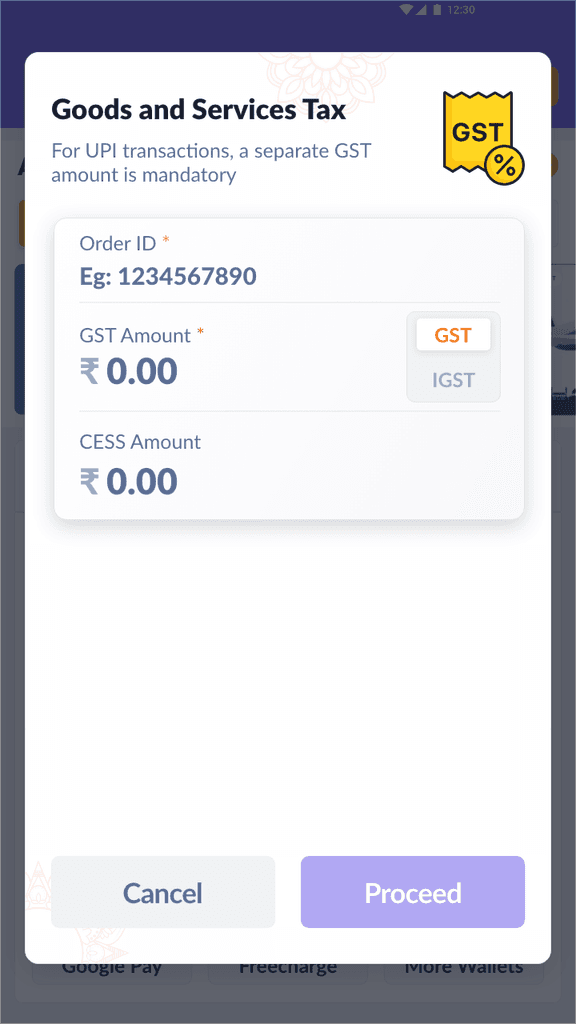

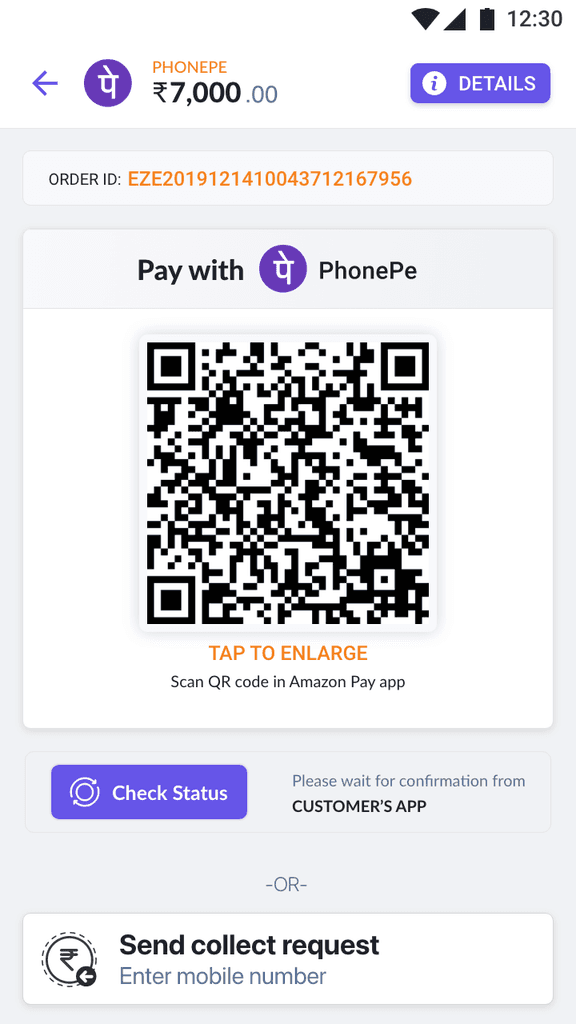

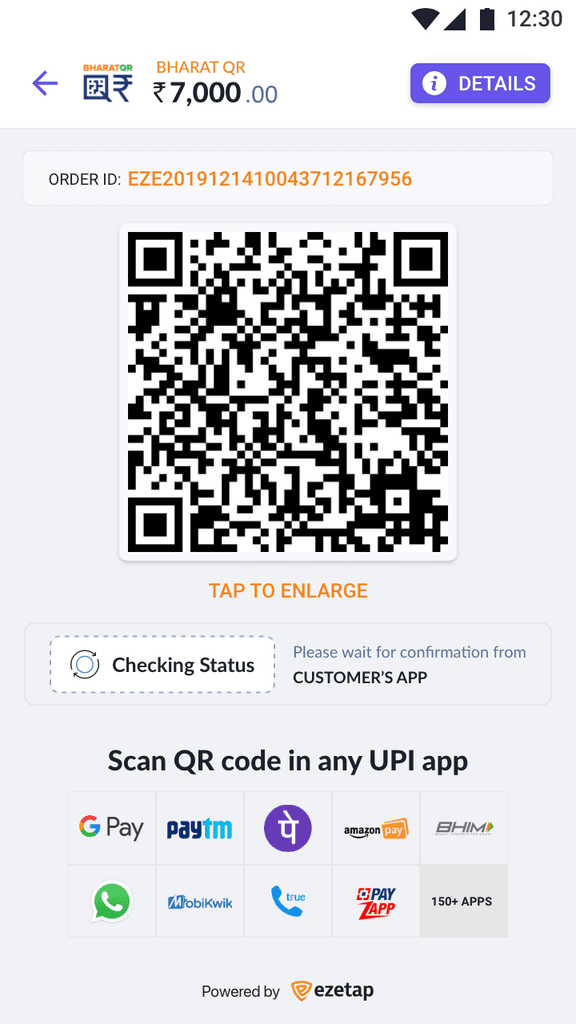

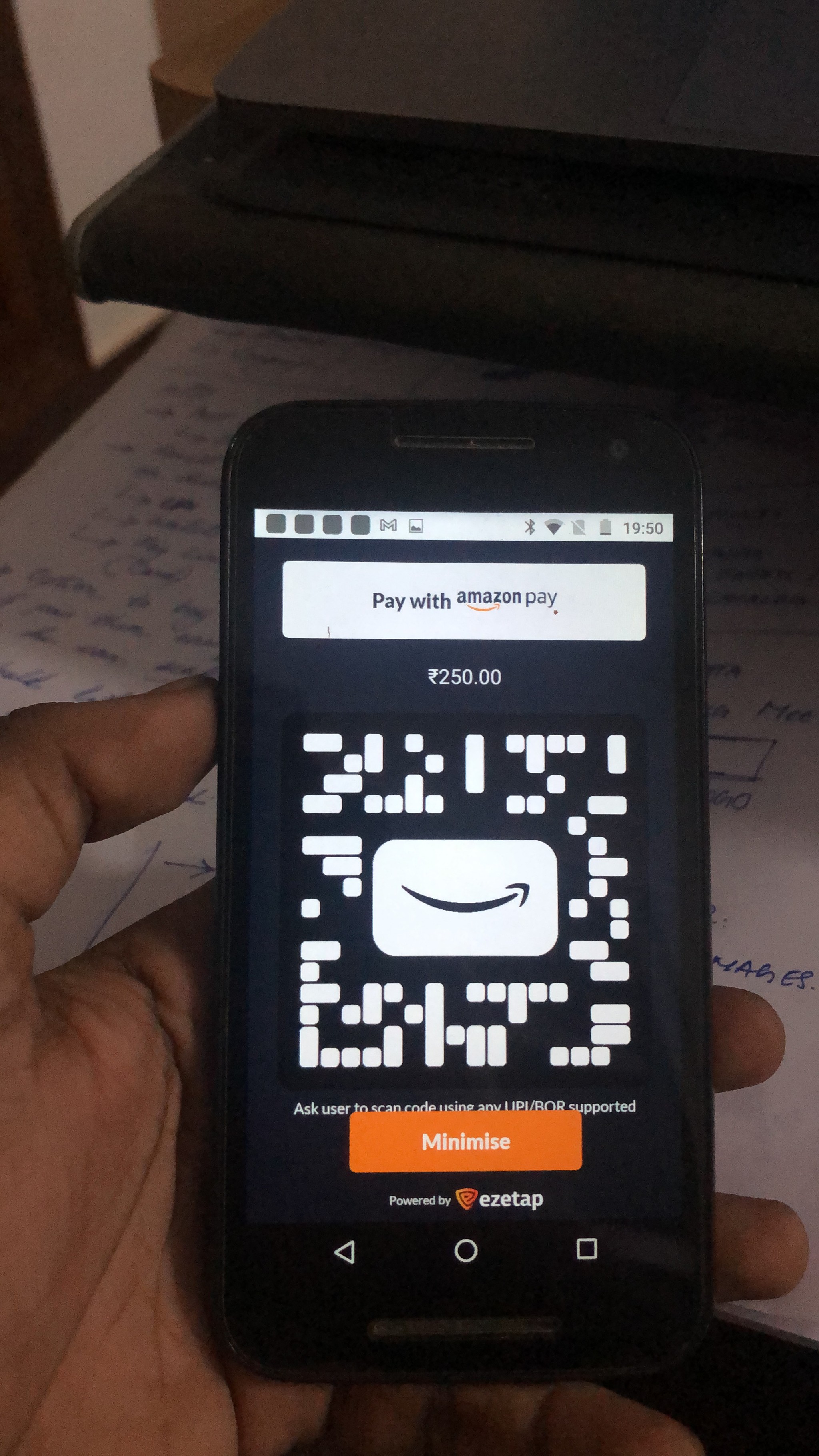

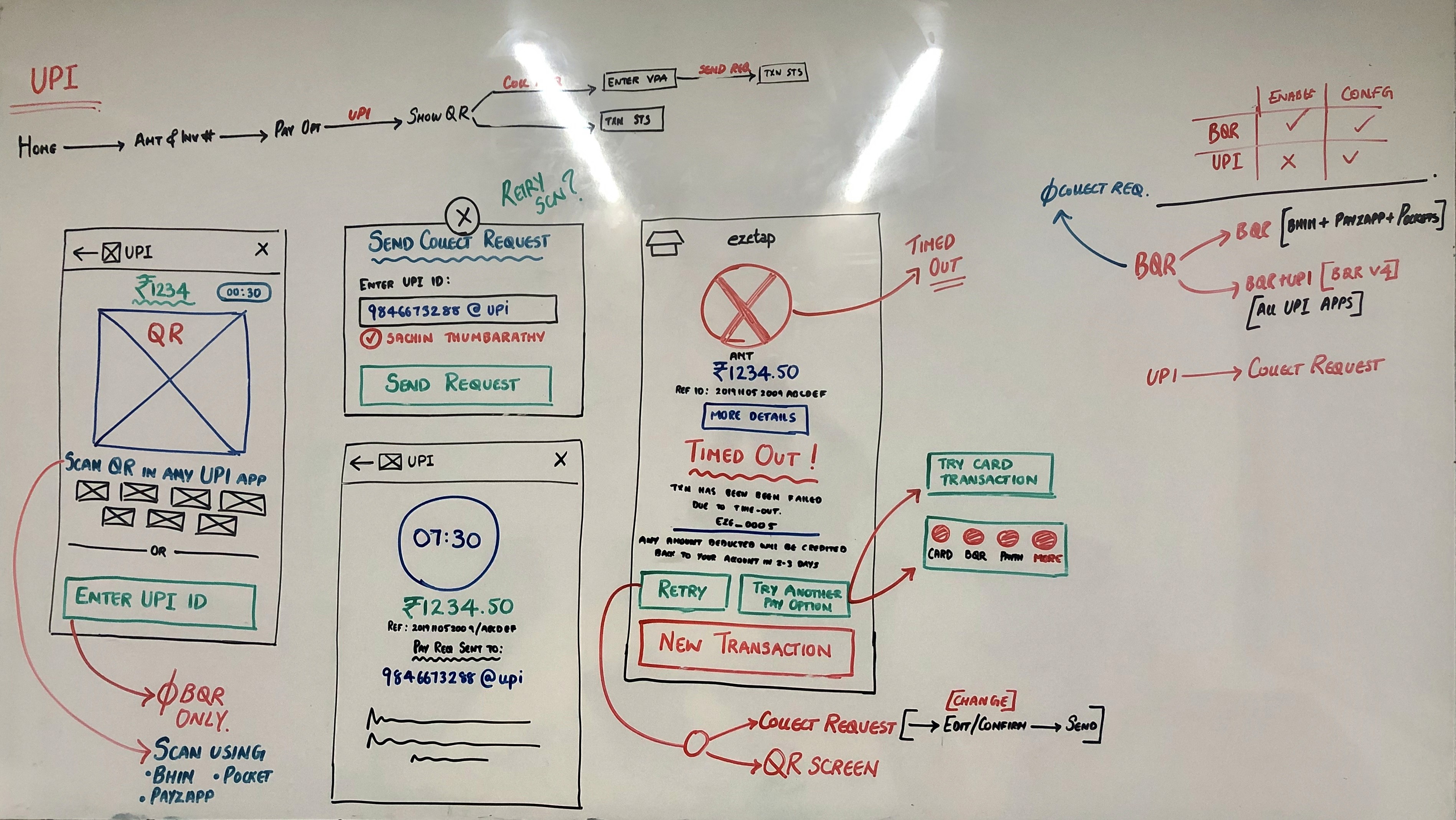

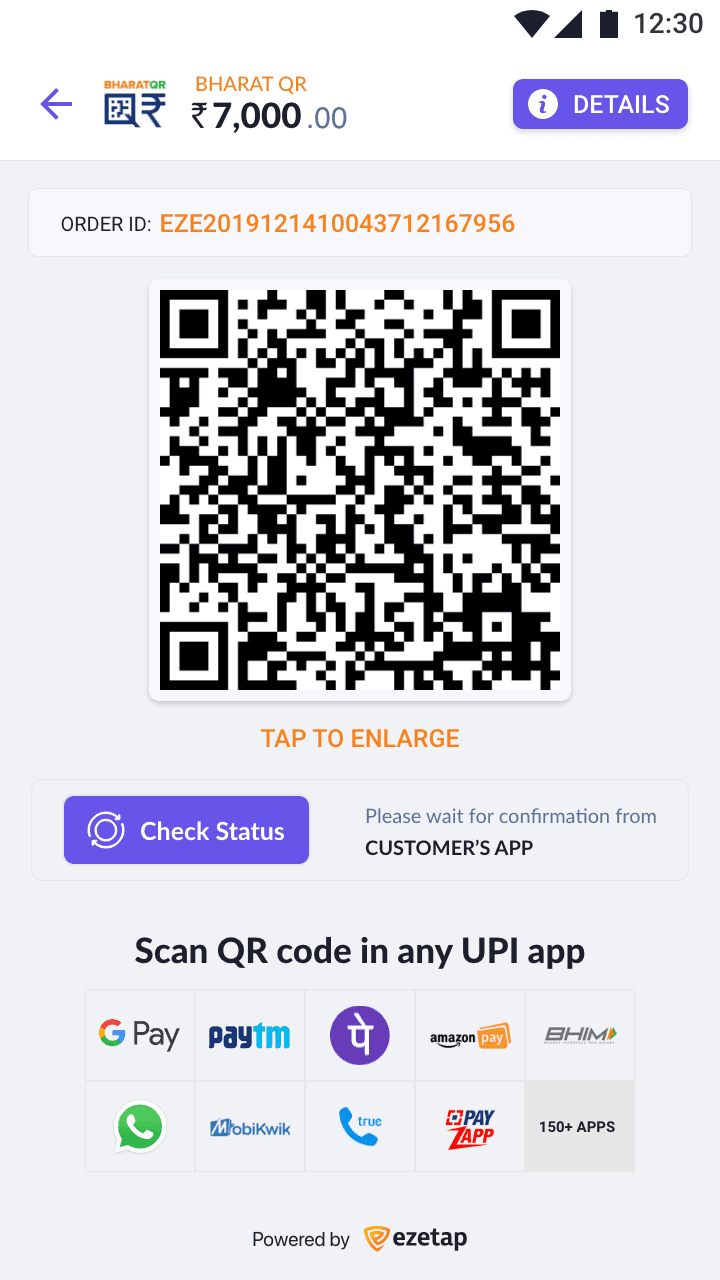

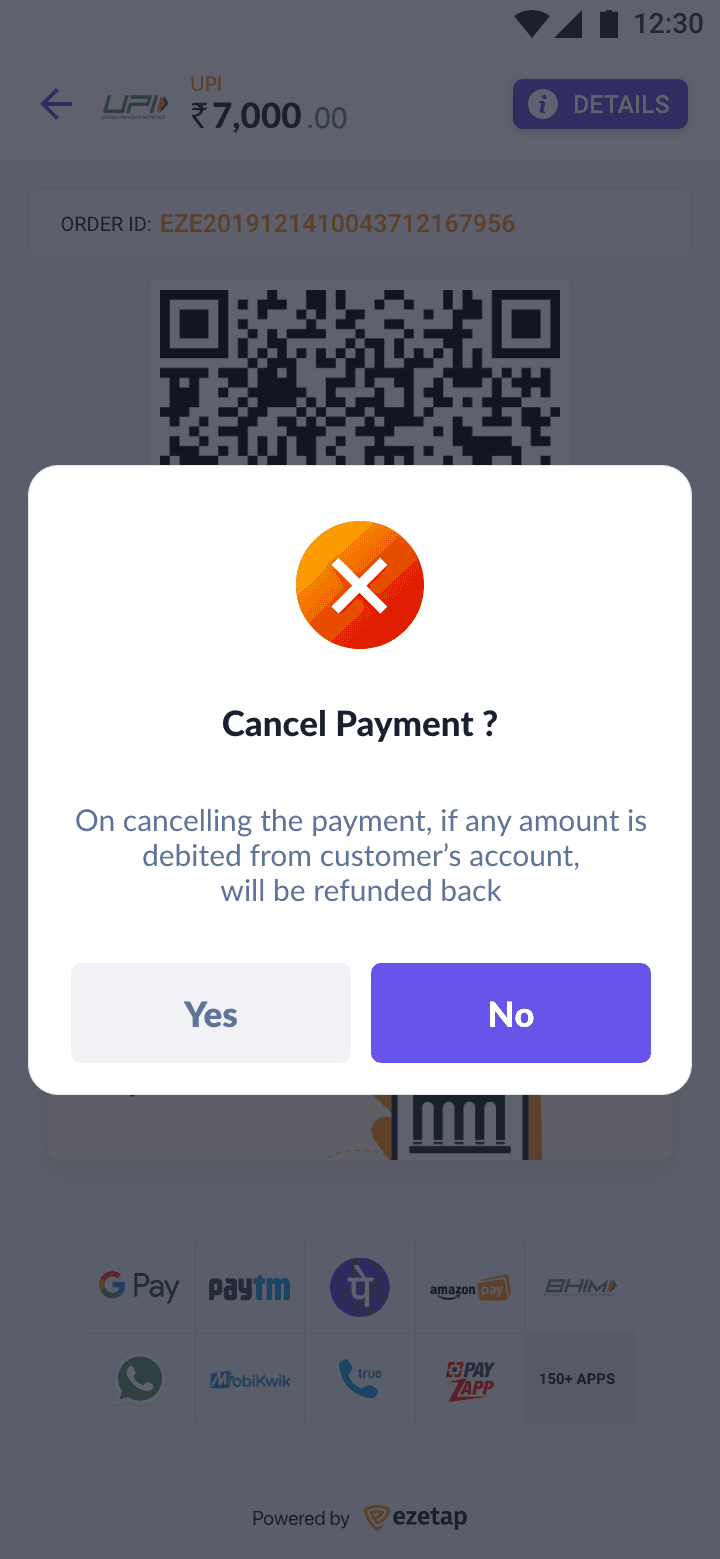

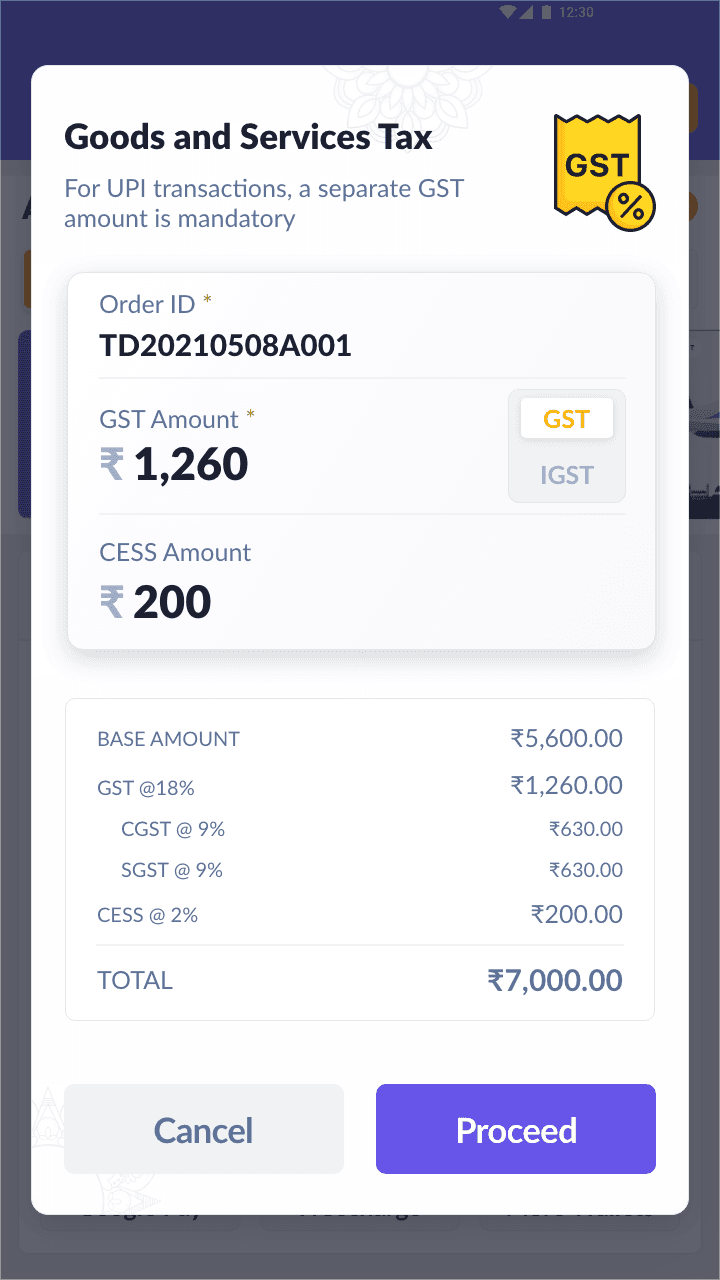

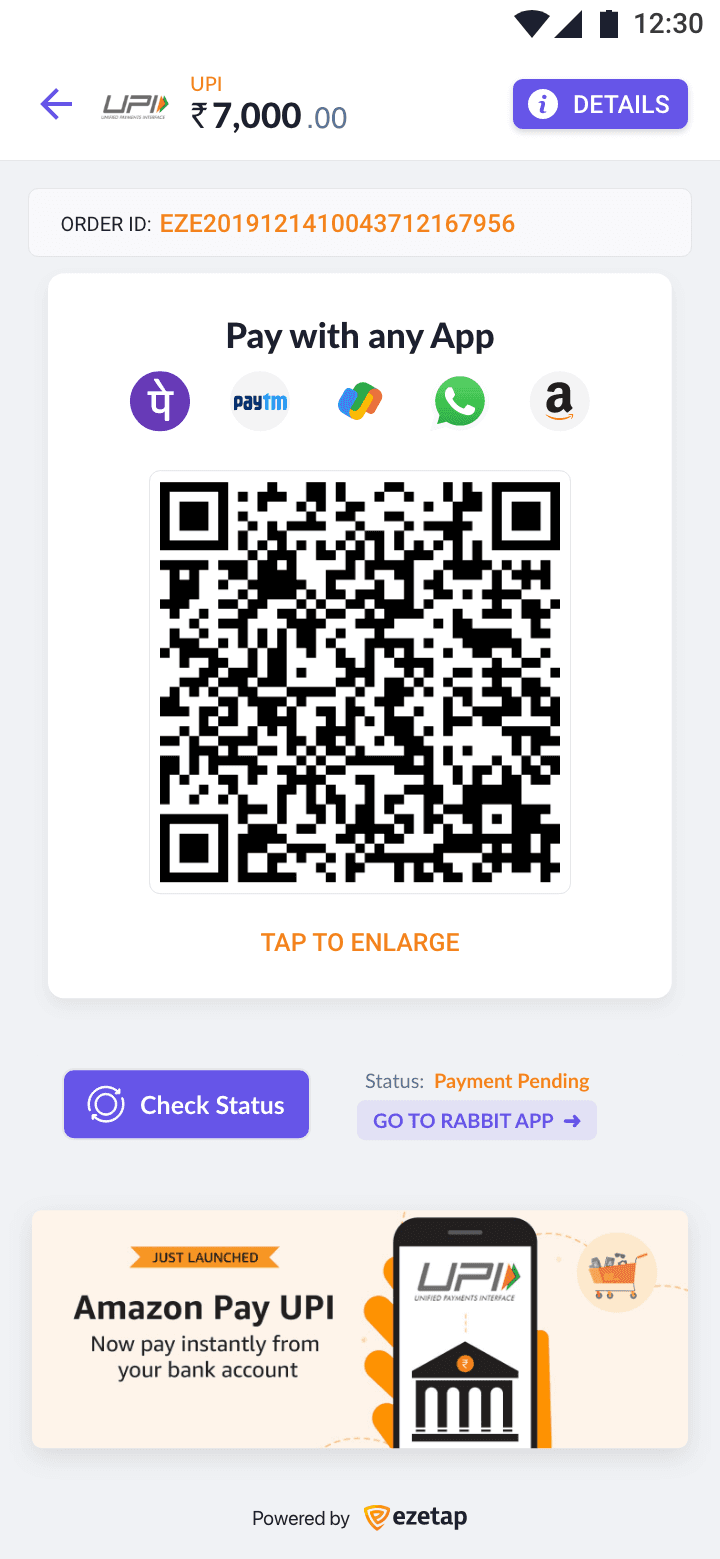

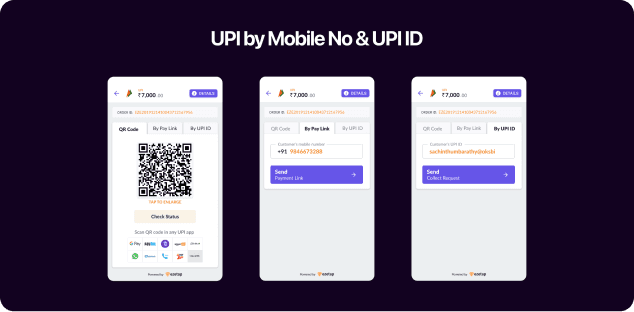

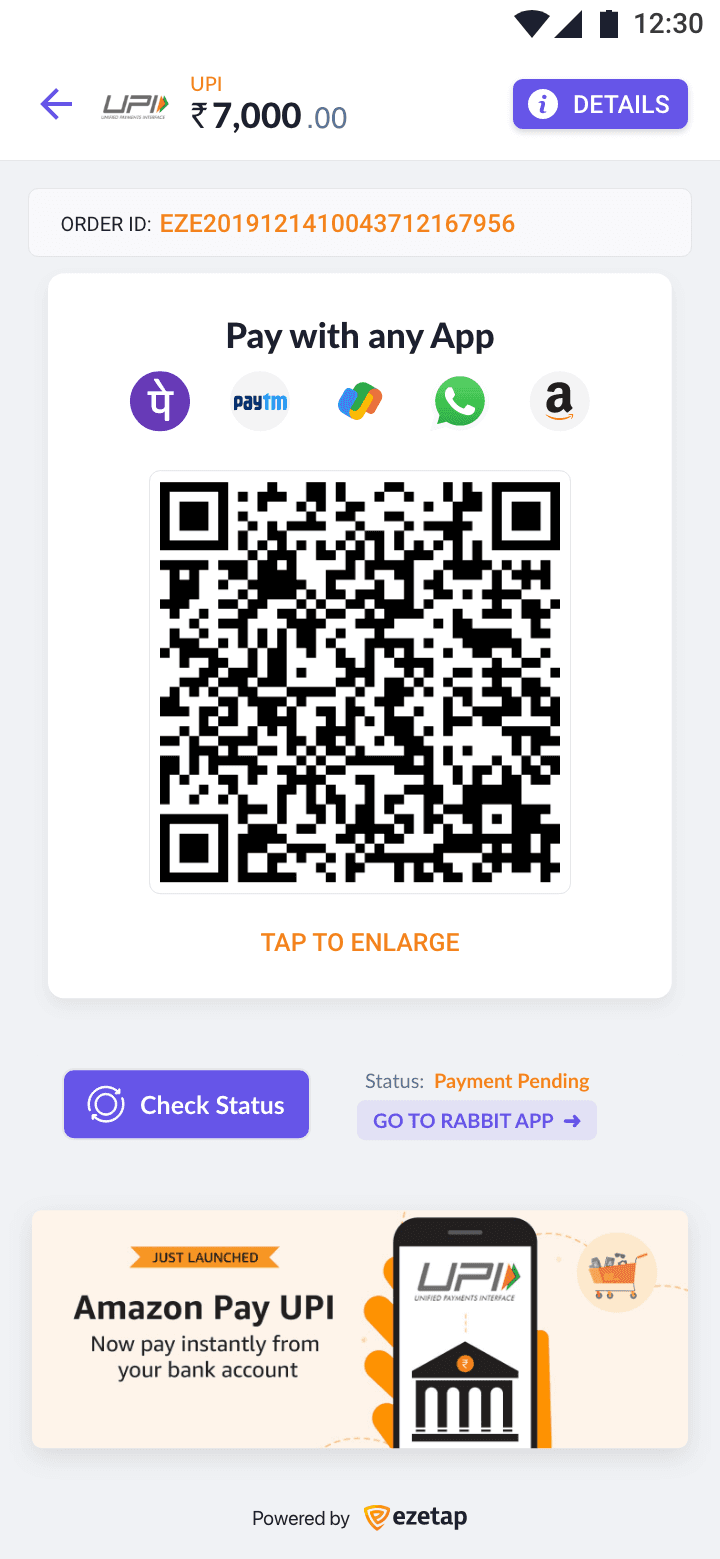

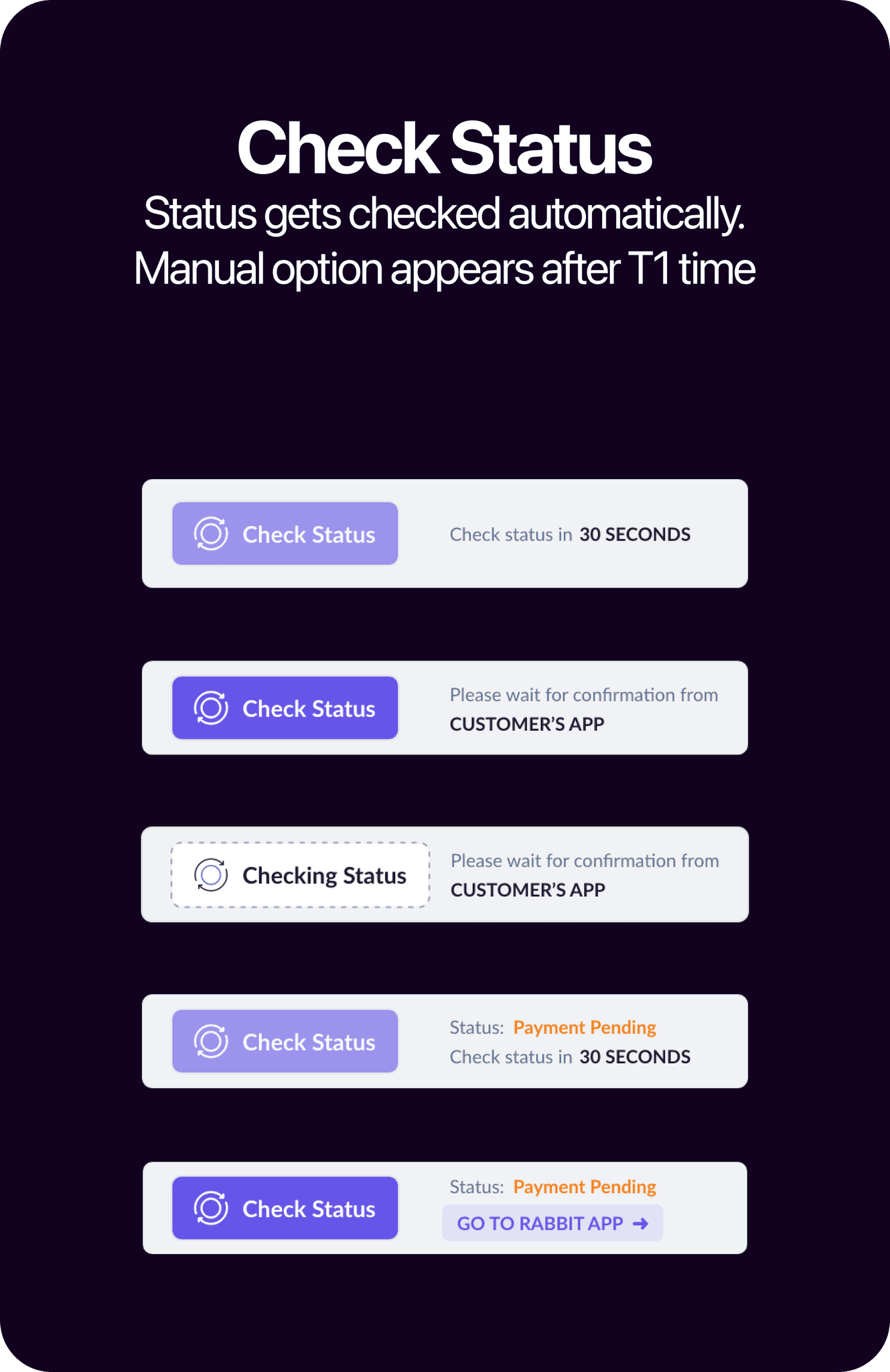

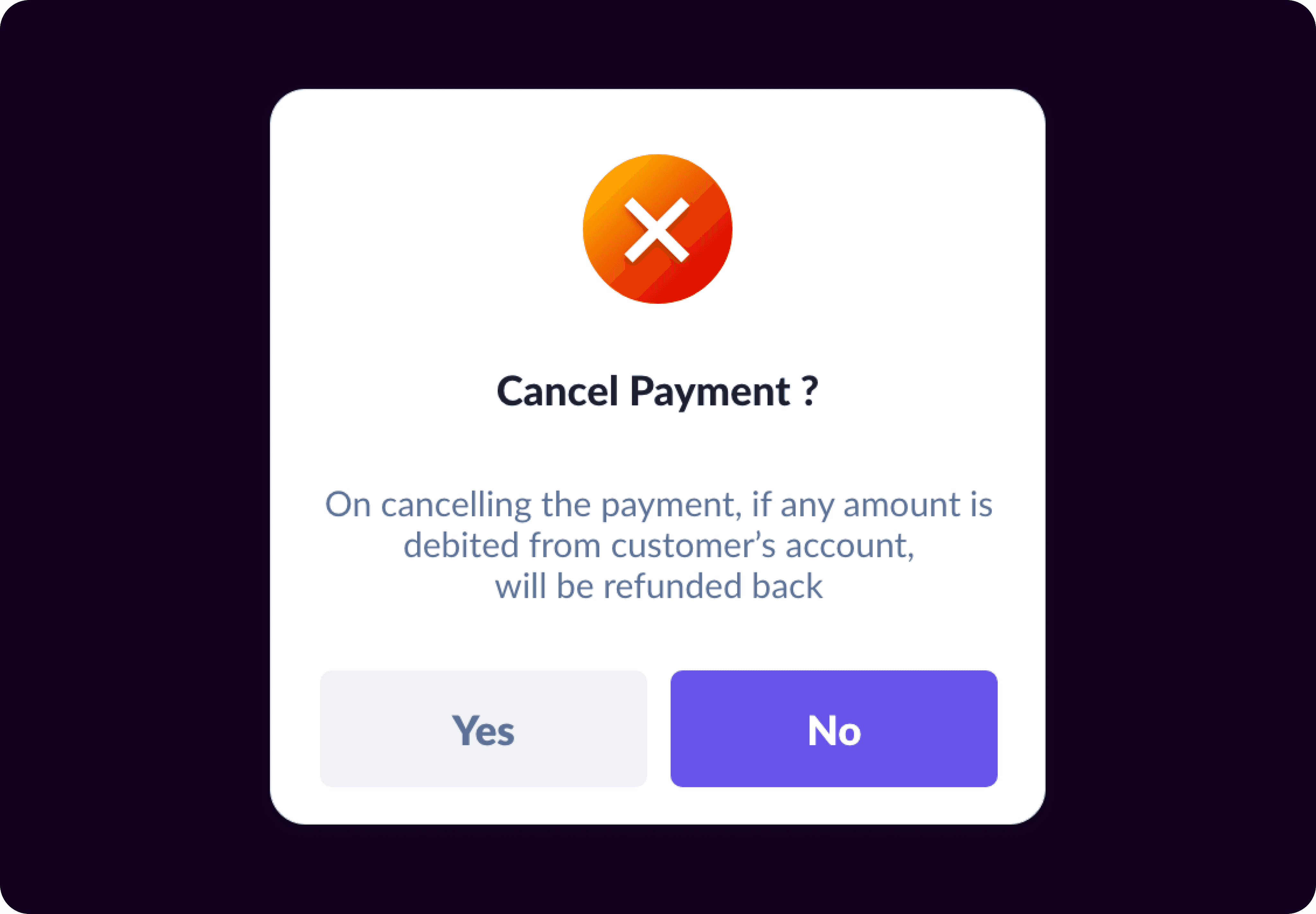

UPI & Bharat QR

UPI | Bharat QR

Payment Mode

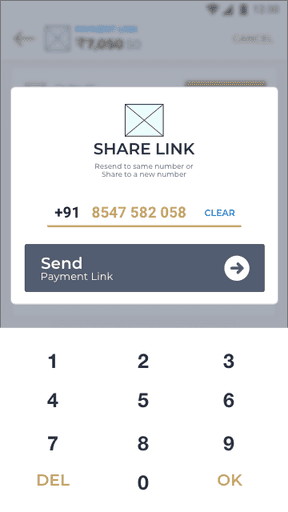

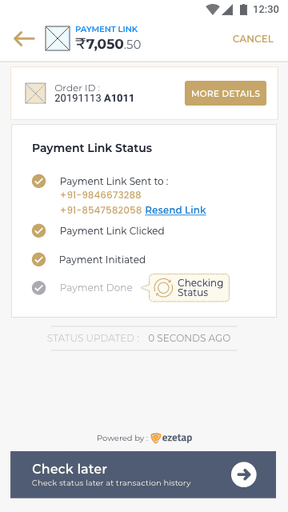

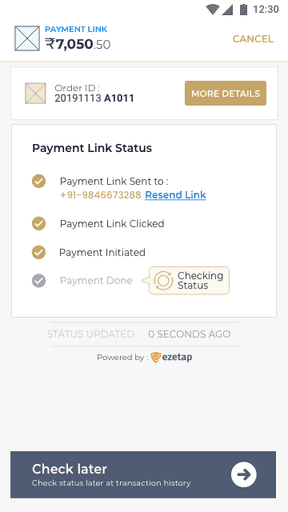

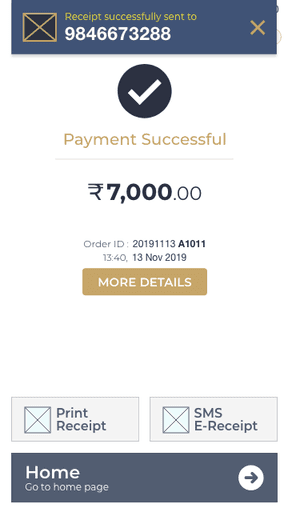

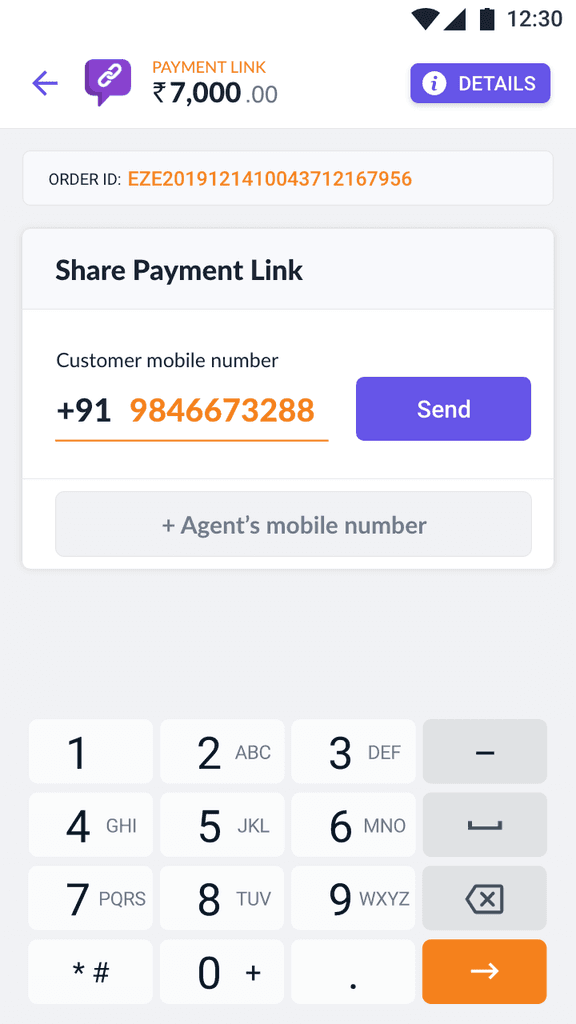

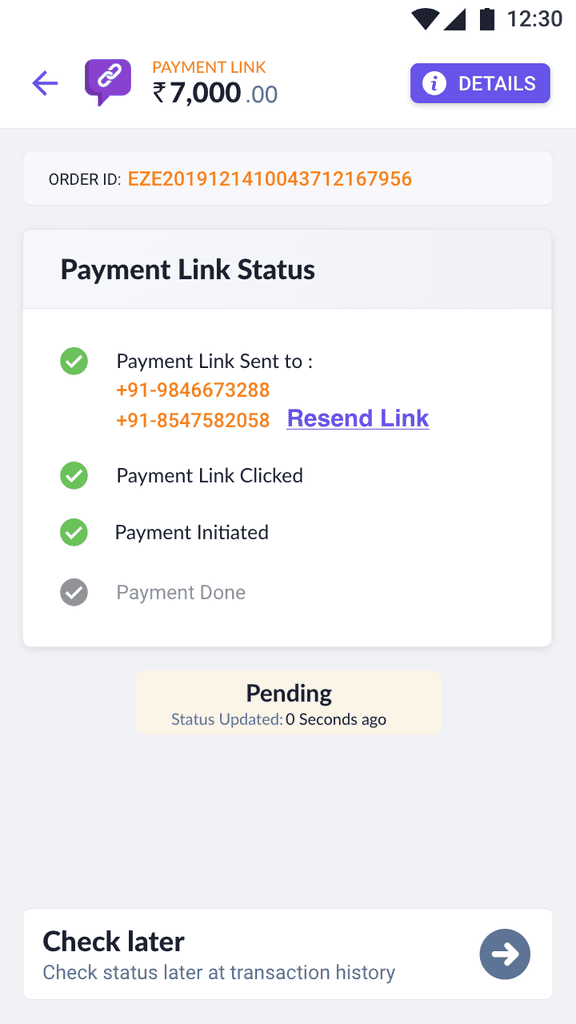

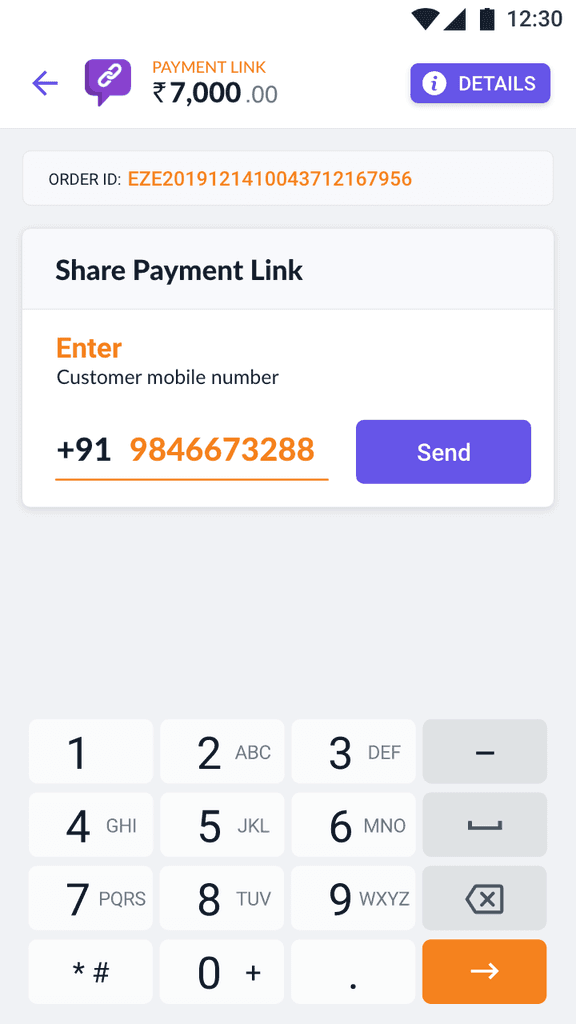

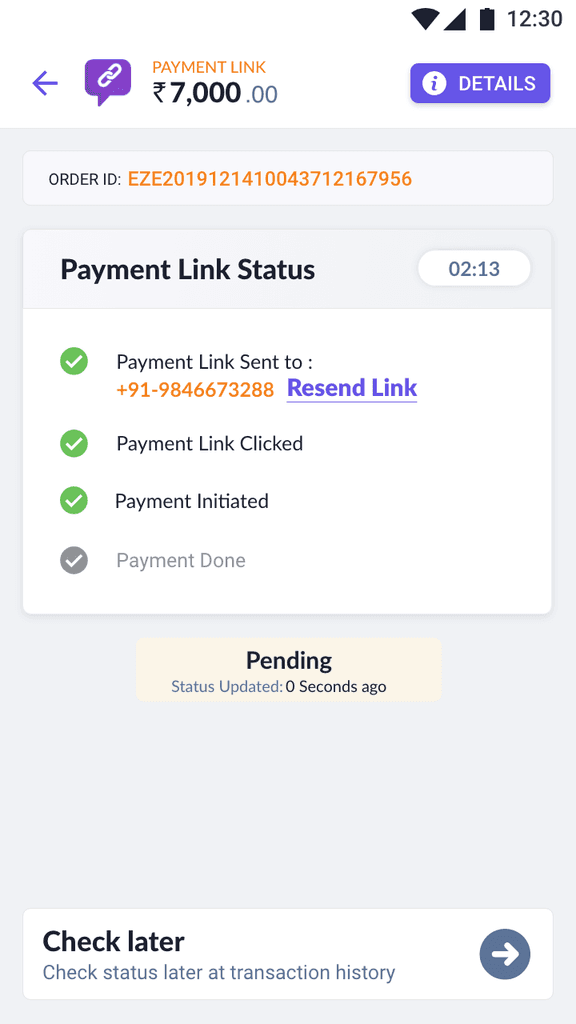

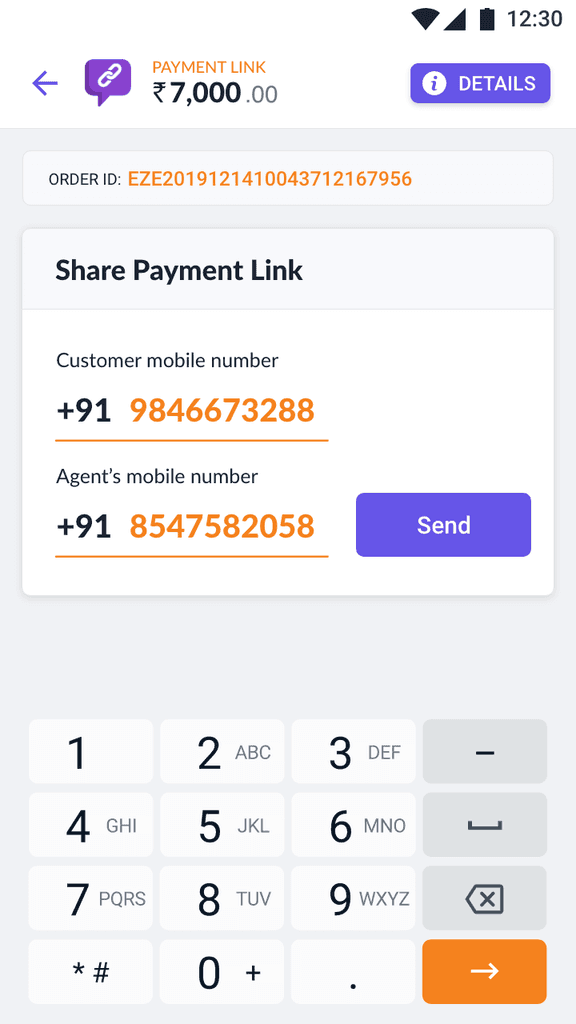

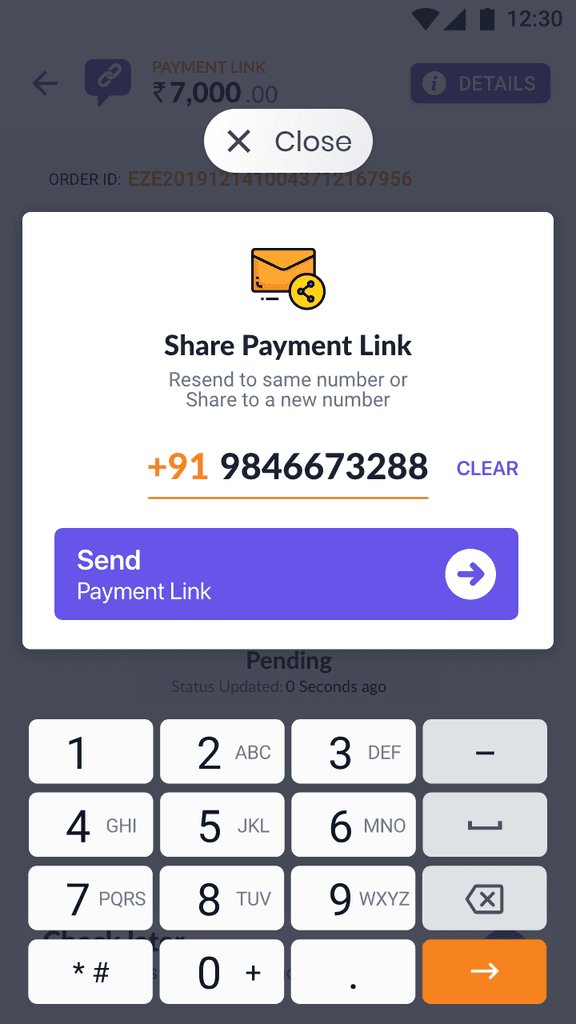

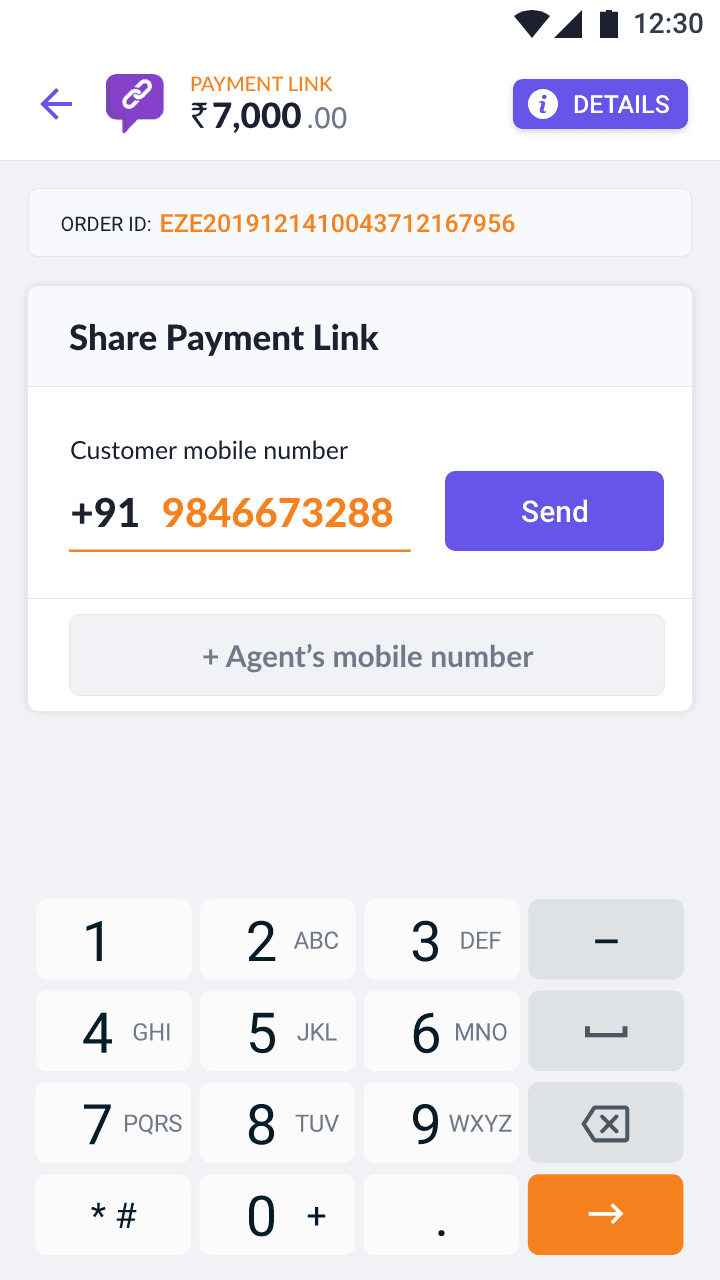

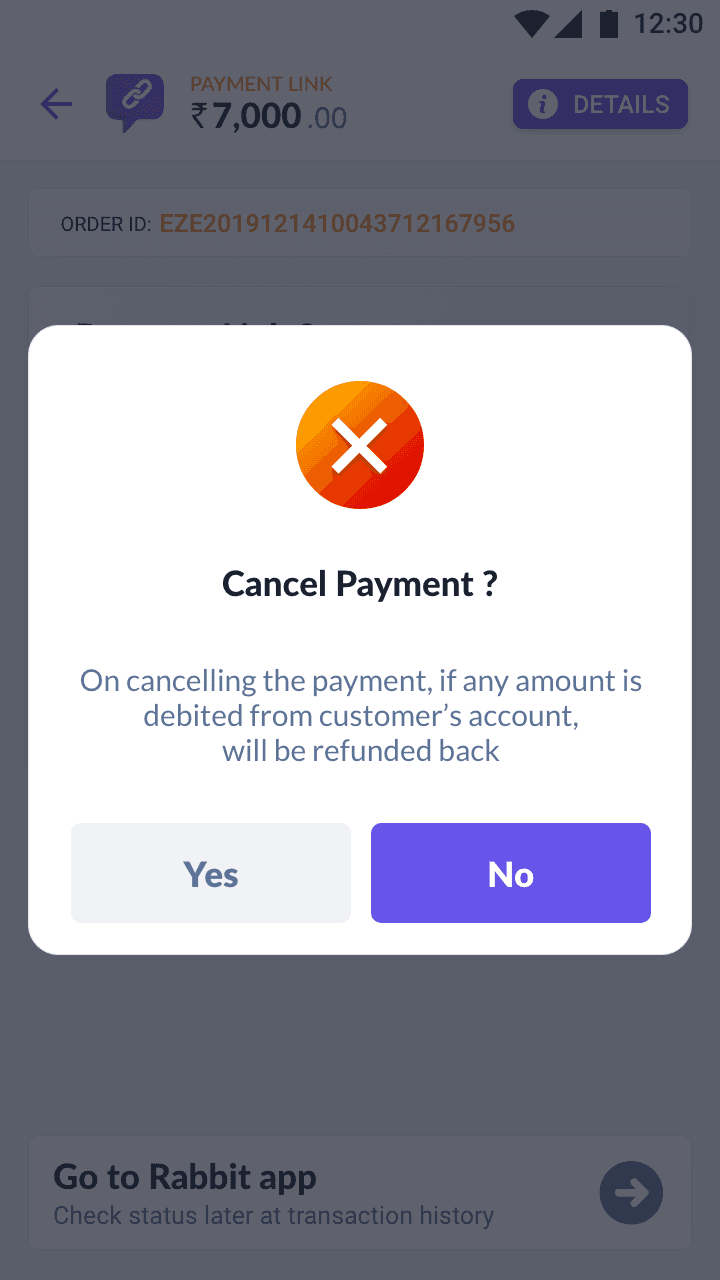

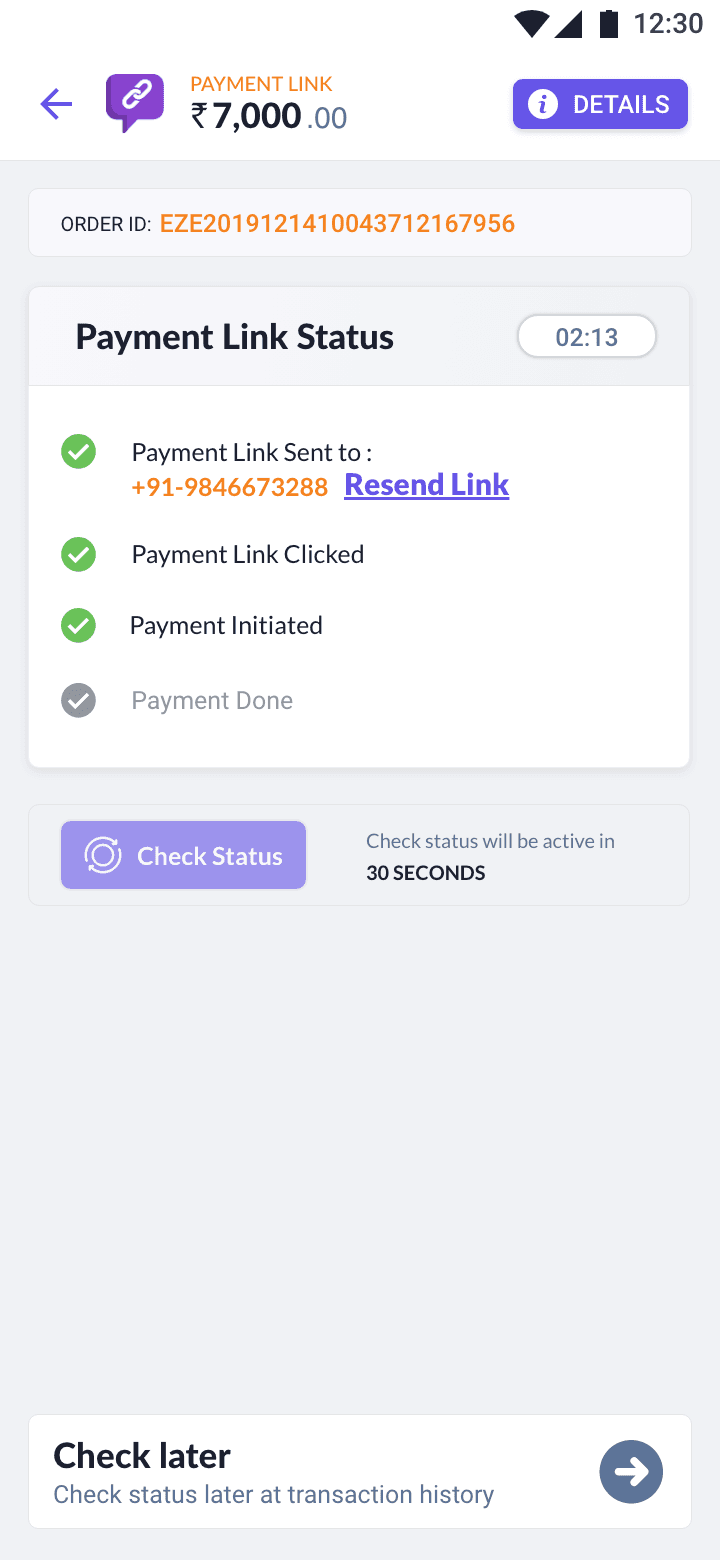

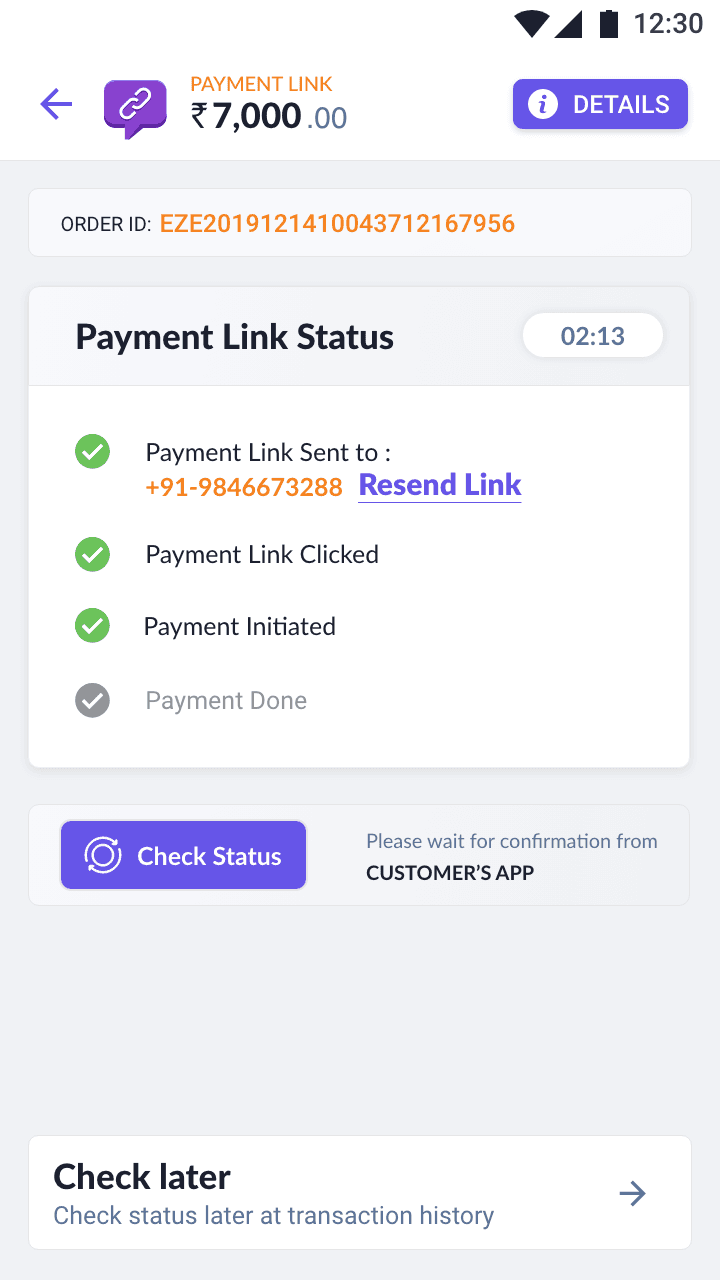

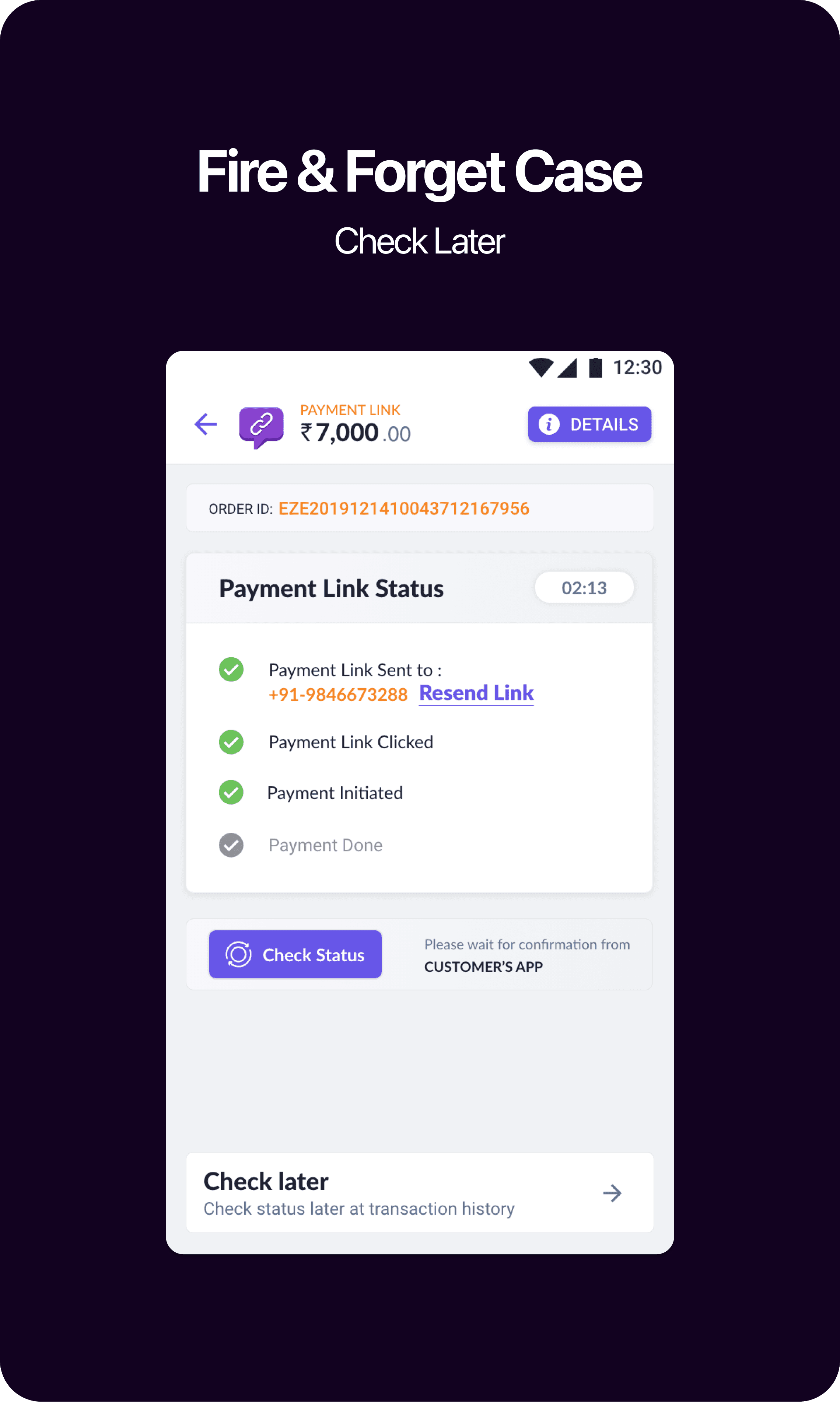

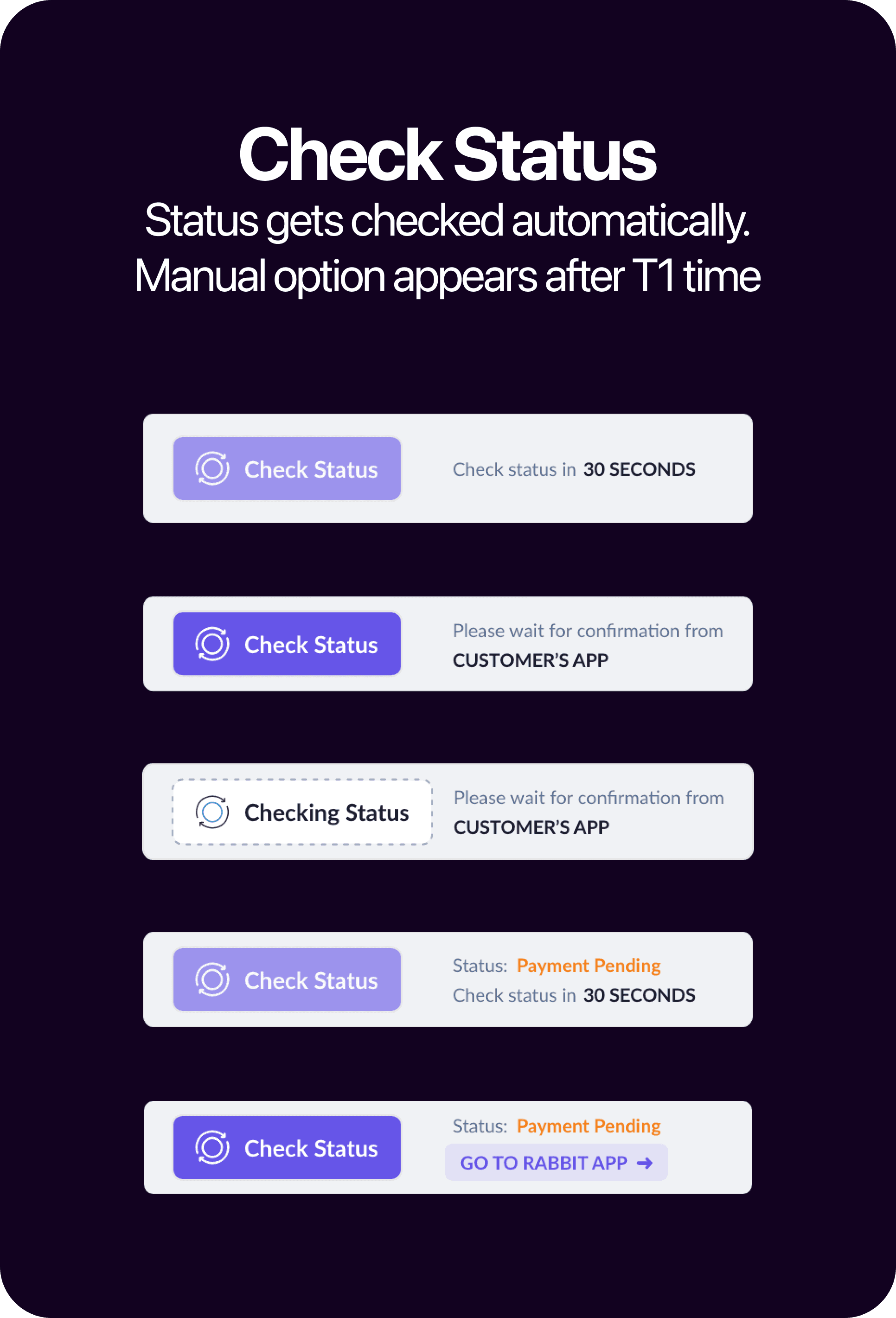

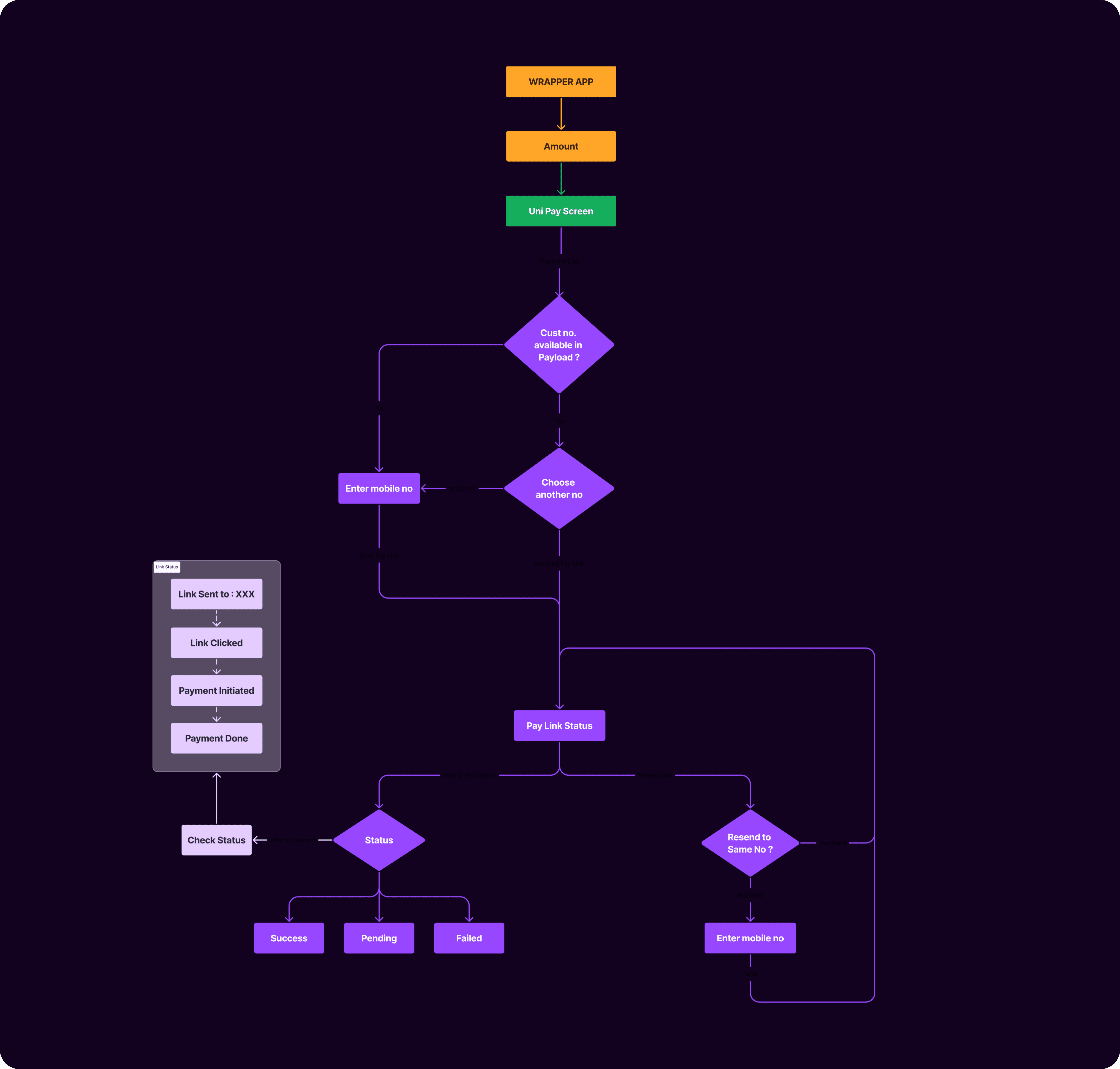

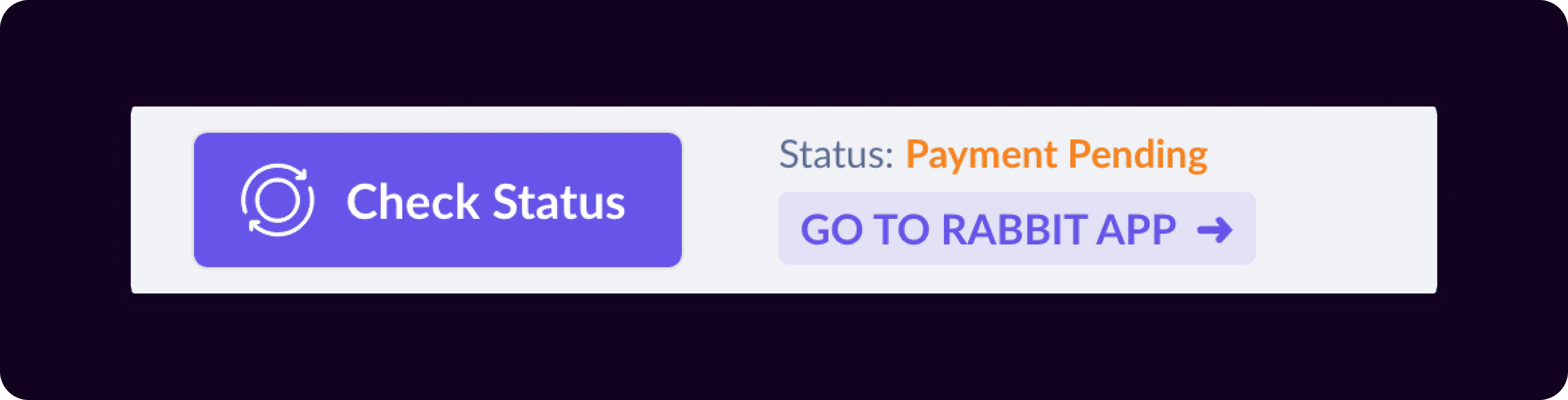

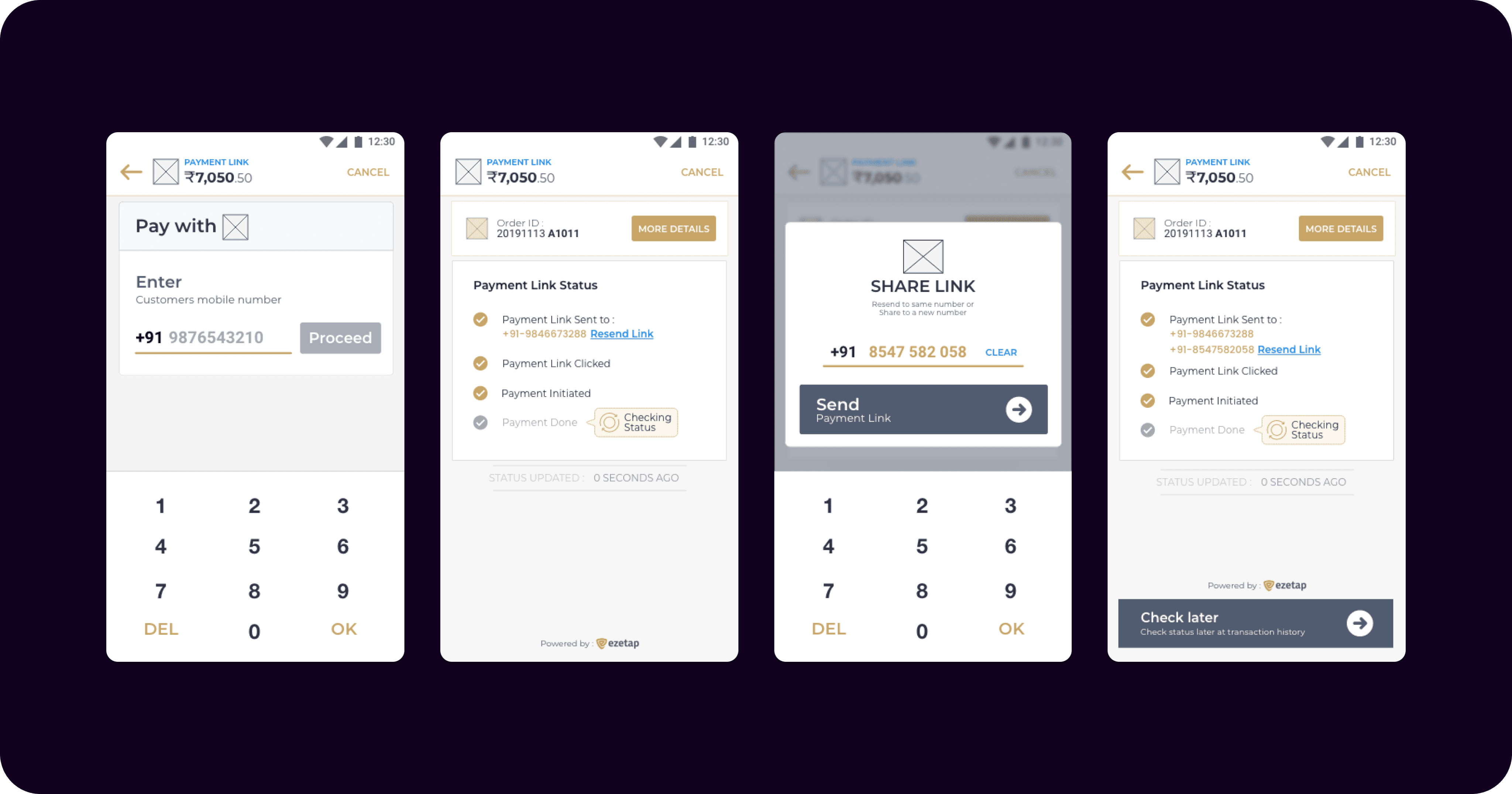

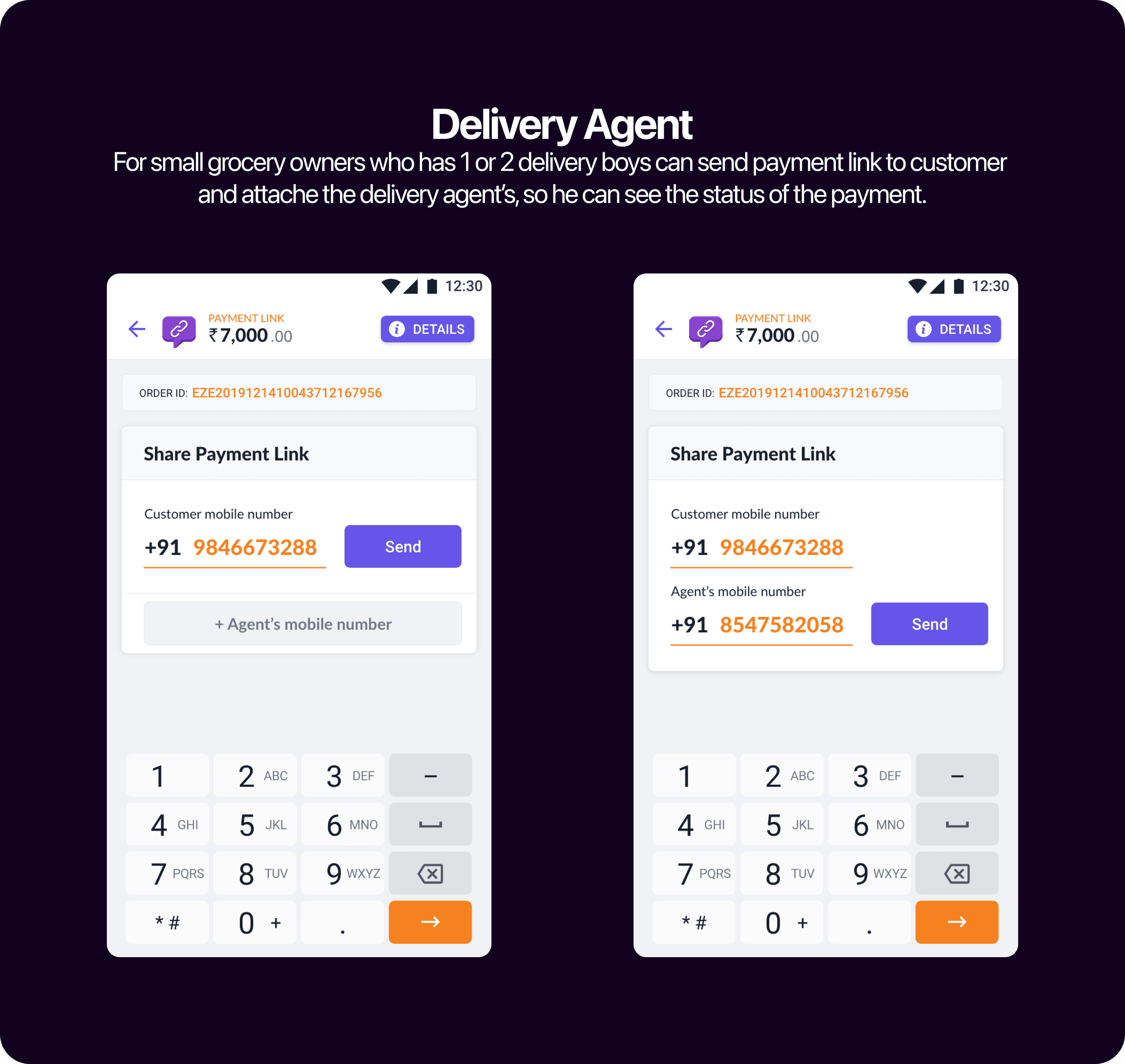

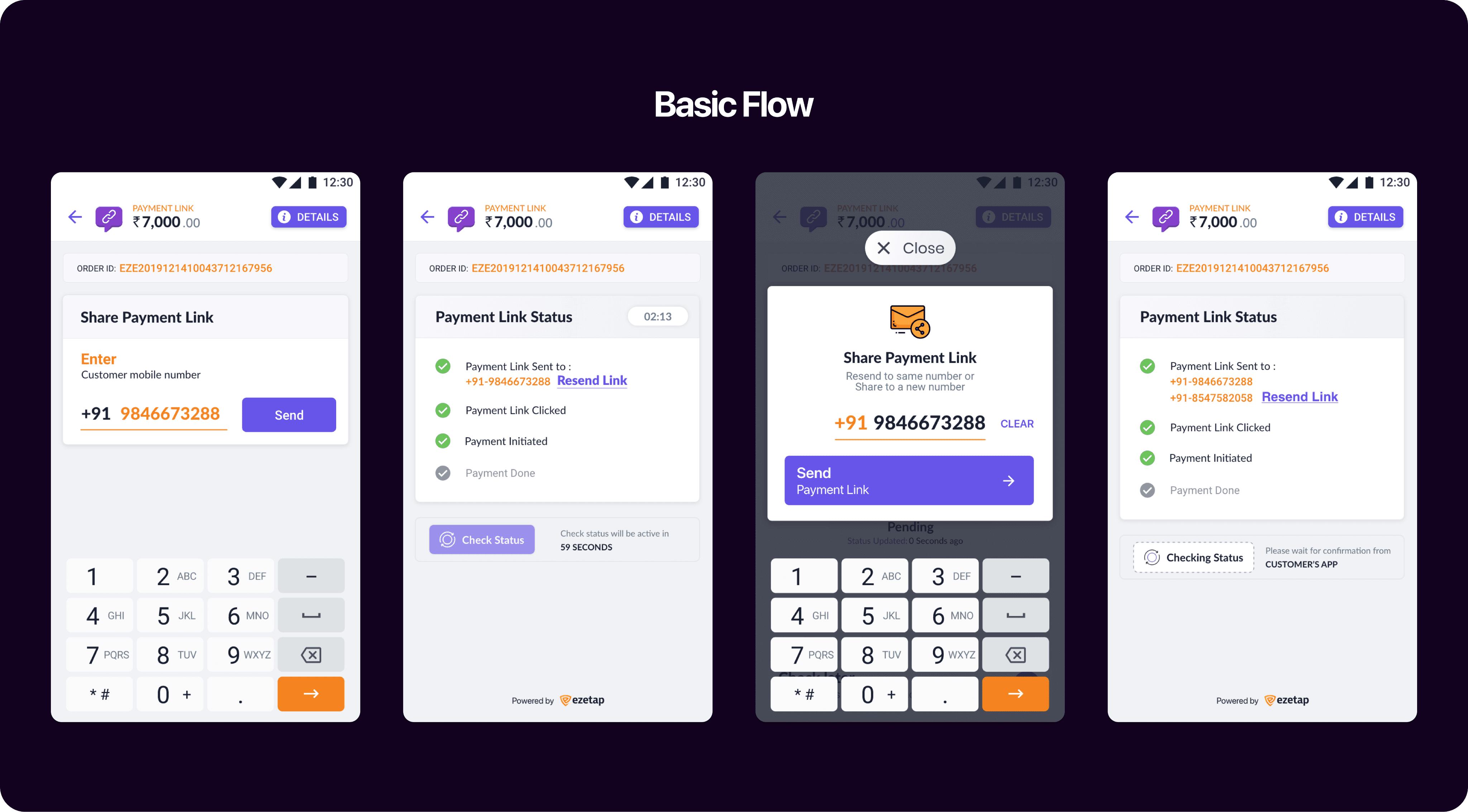

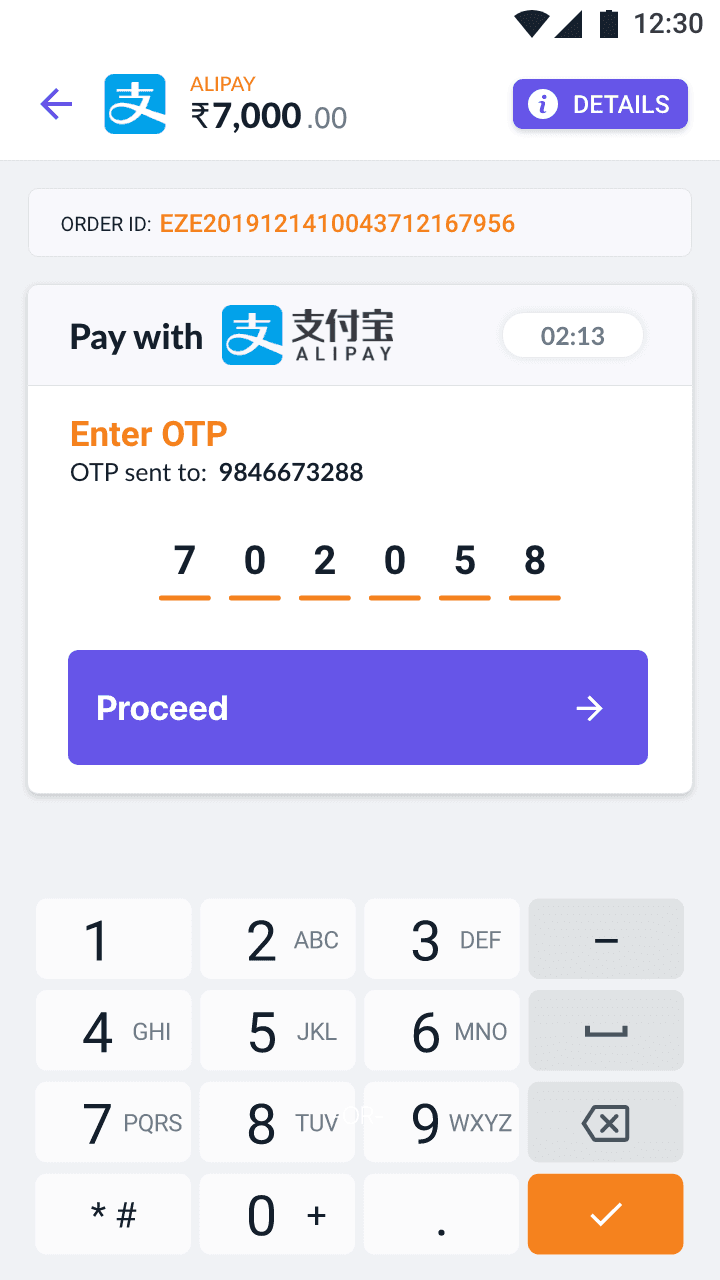

Payment Link

Payment Link

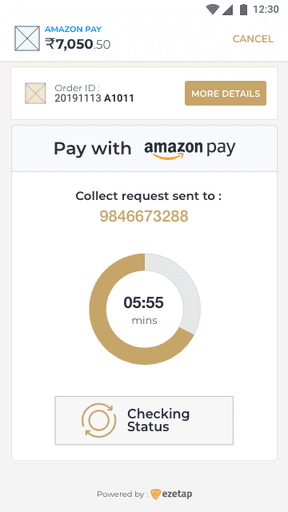

Payment Mode

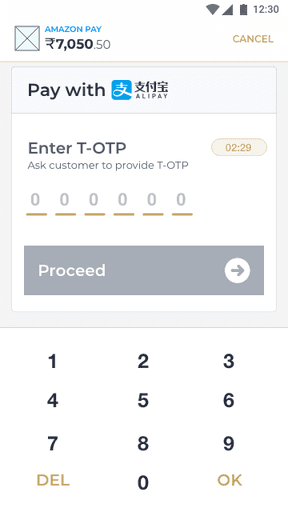

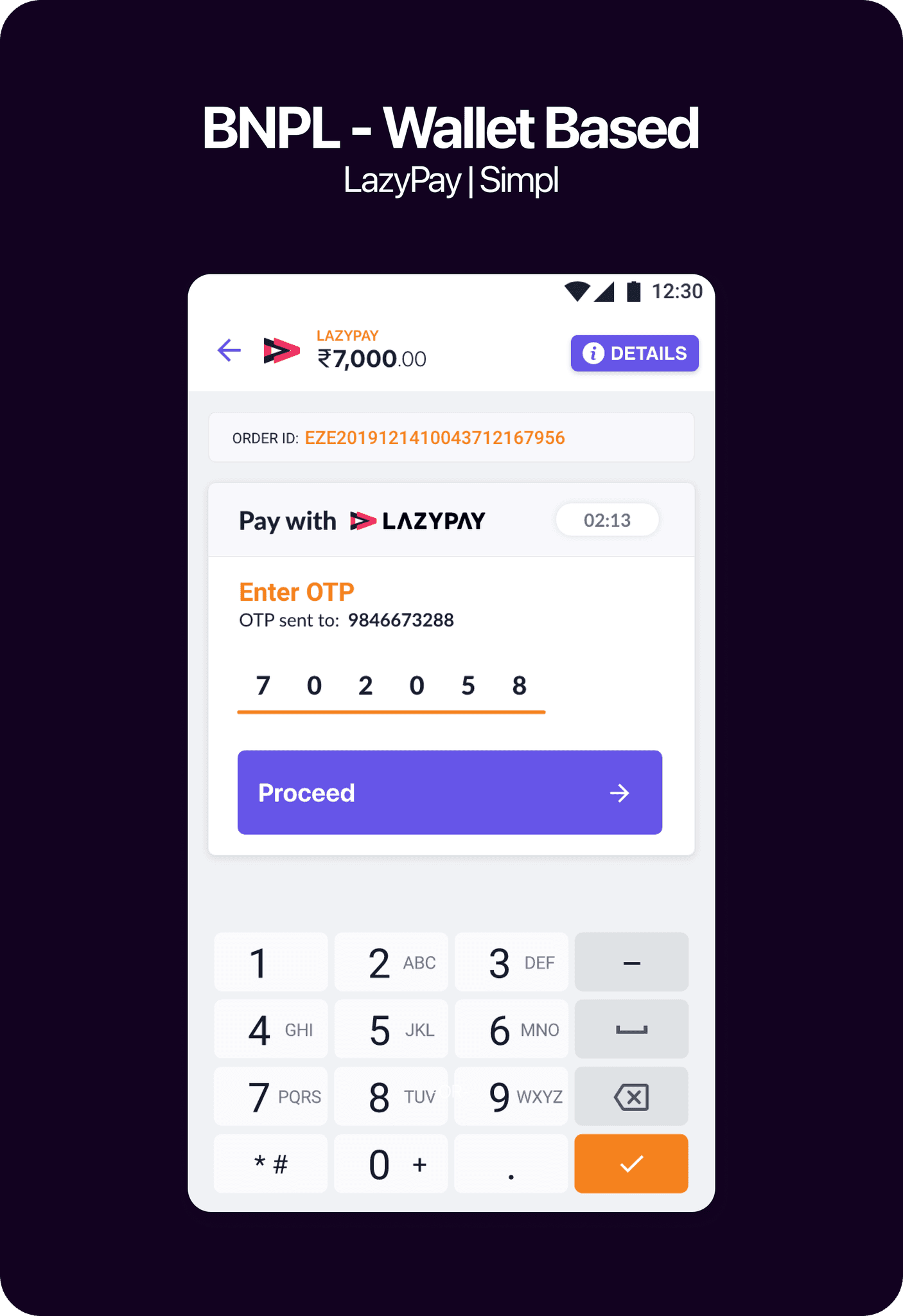

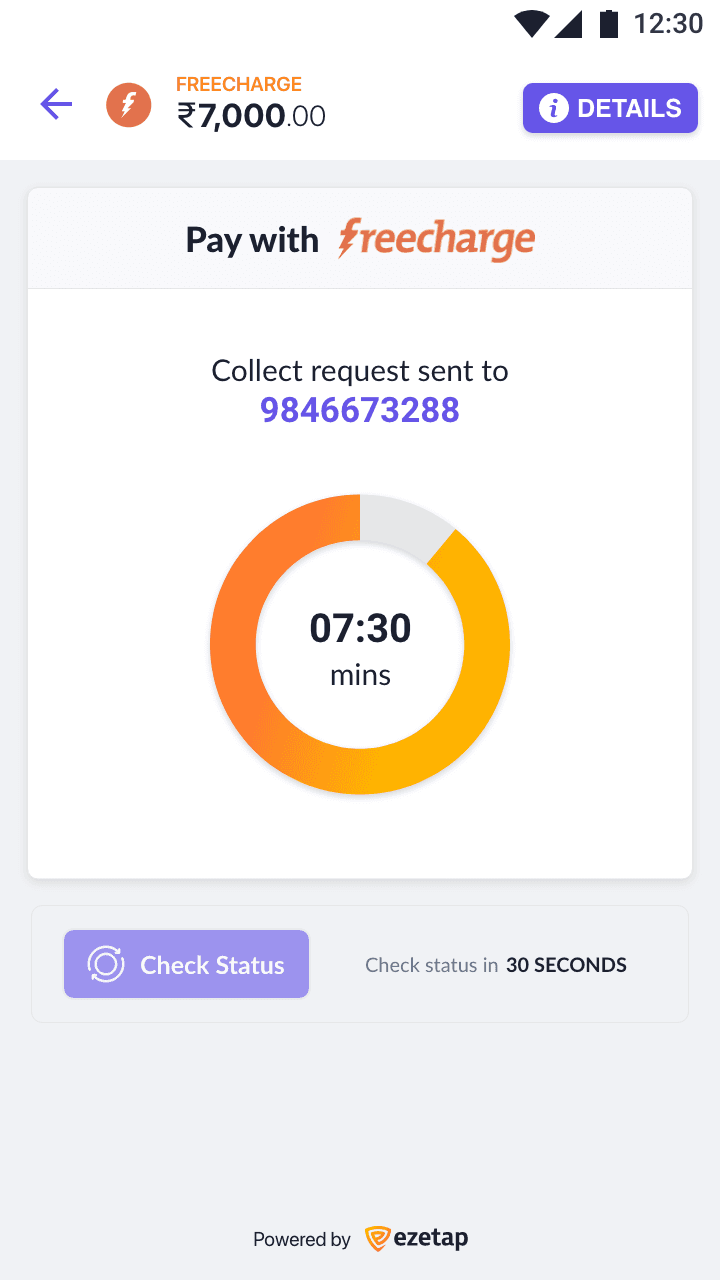

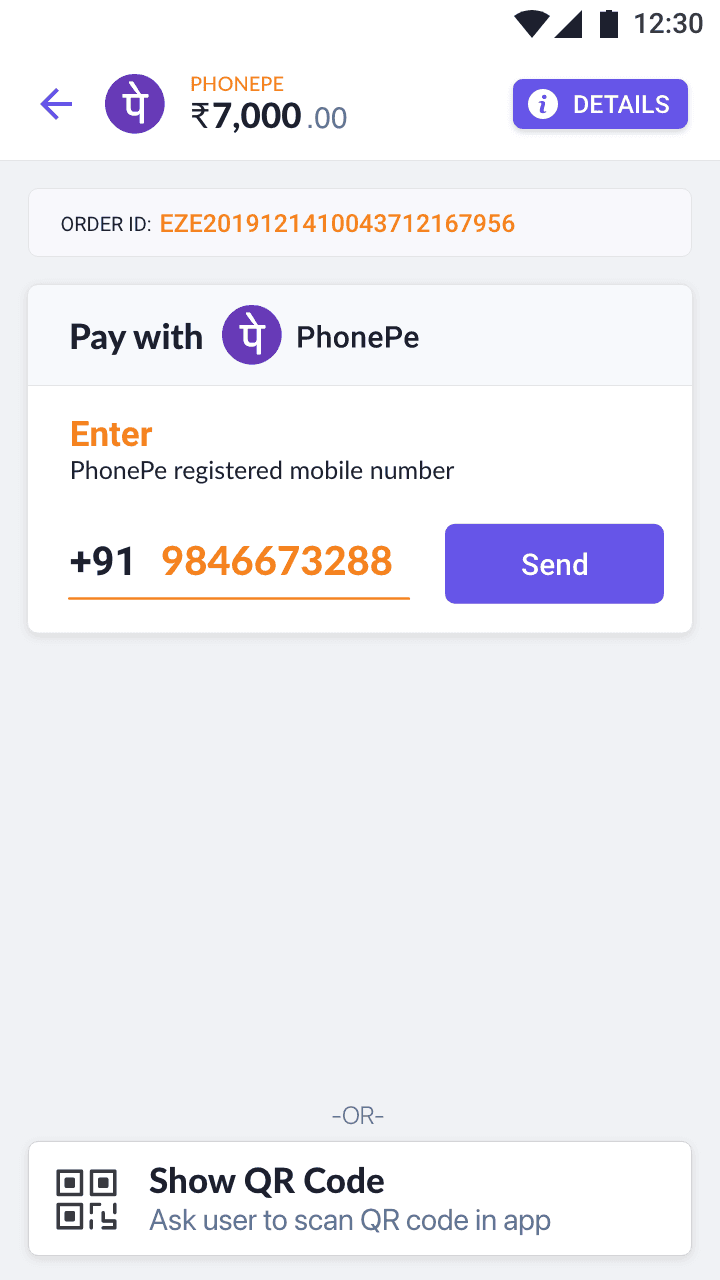

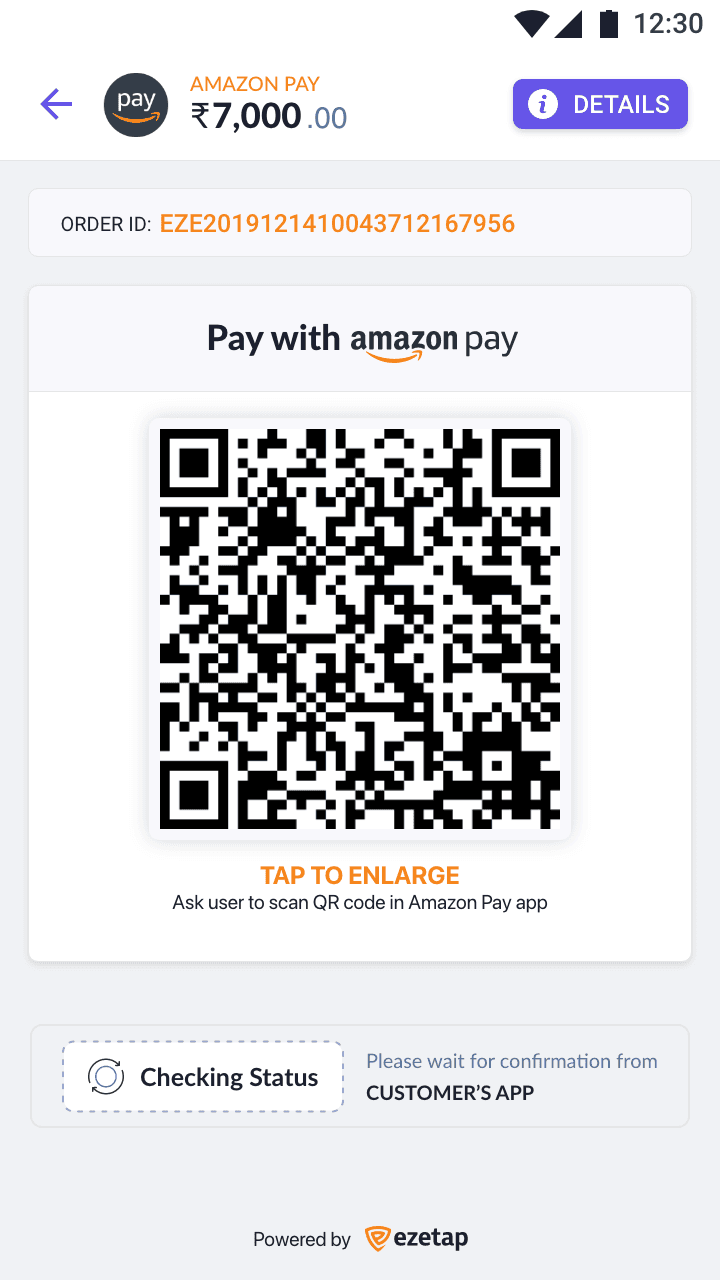

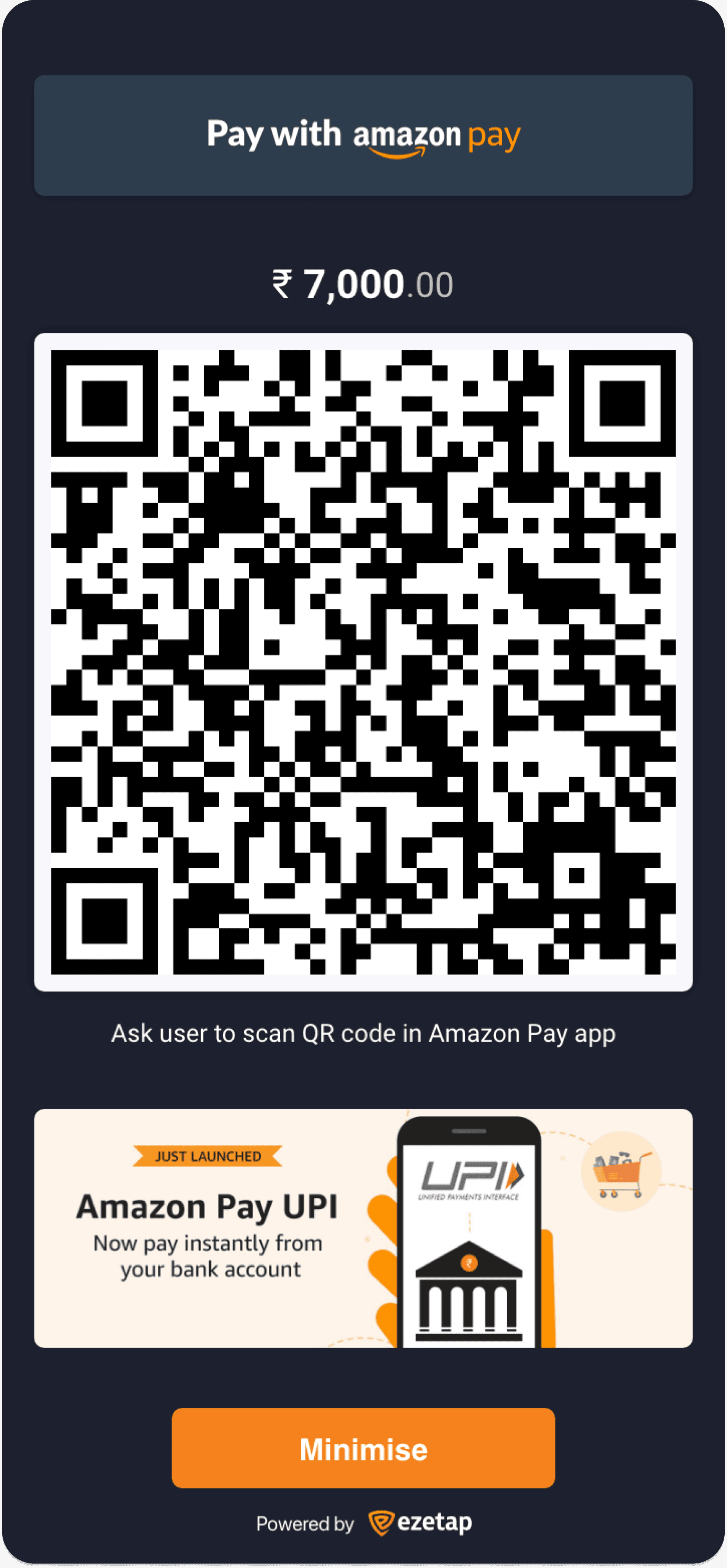

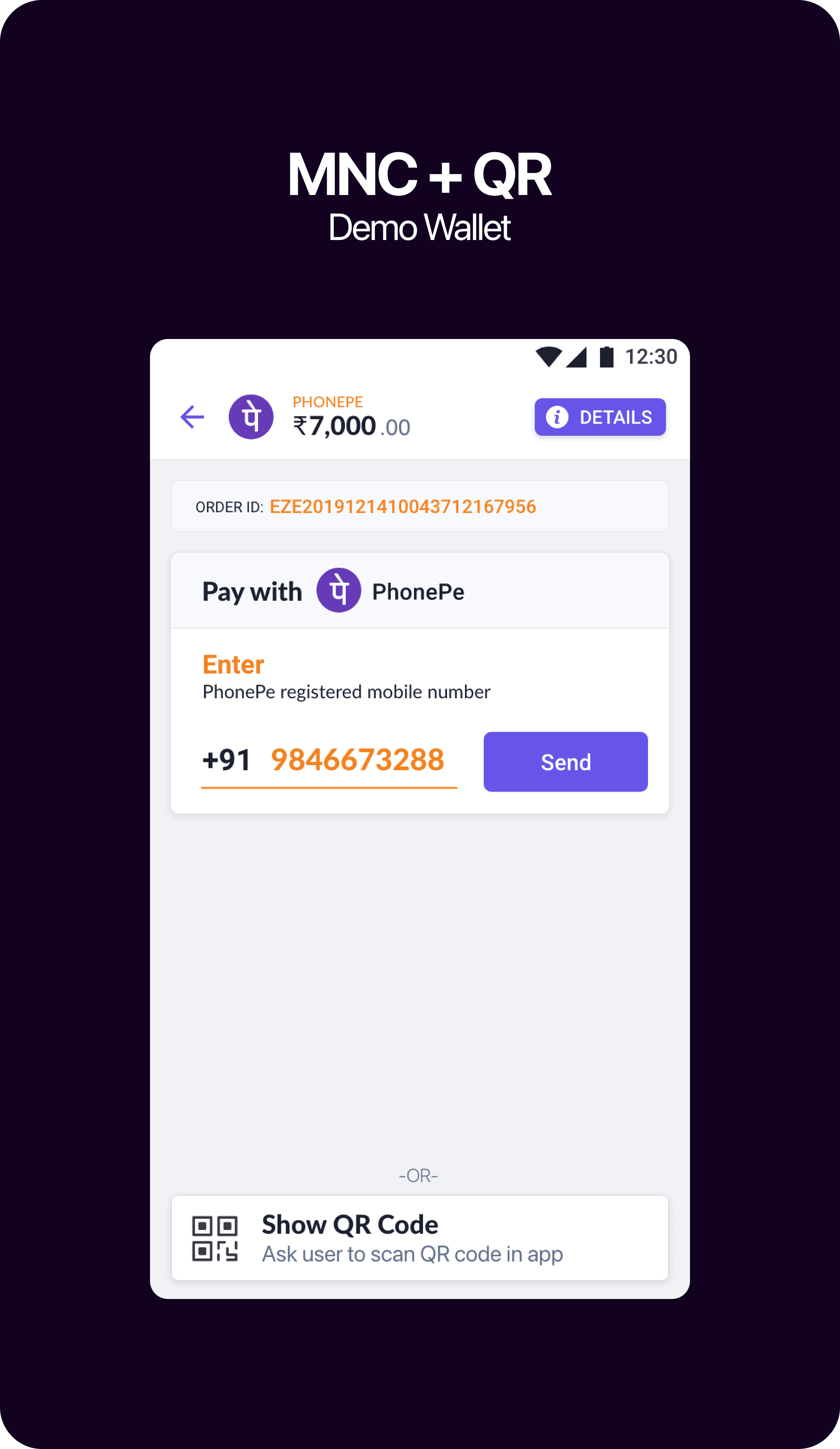

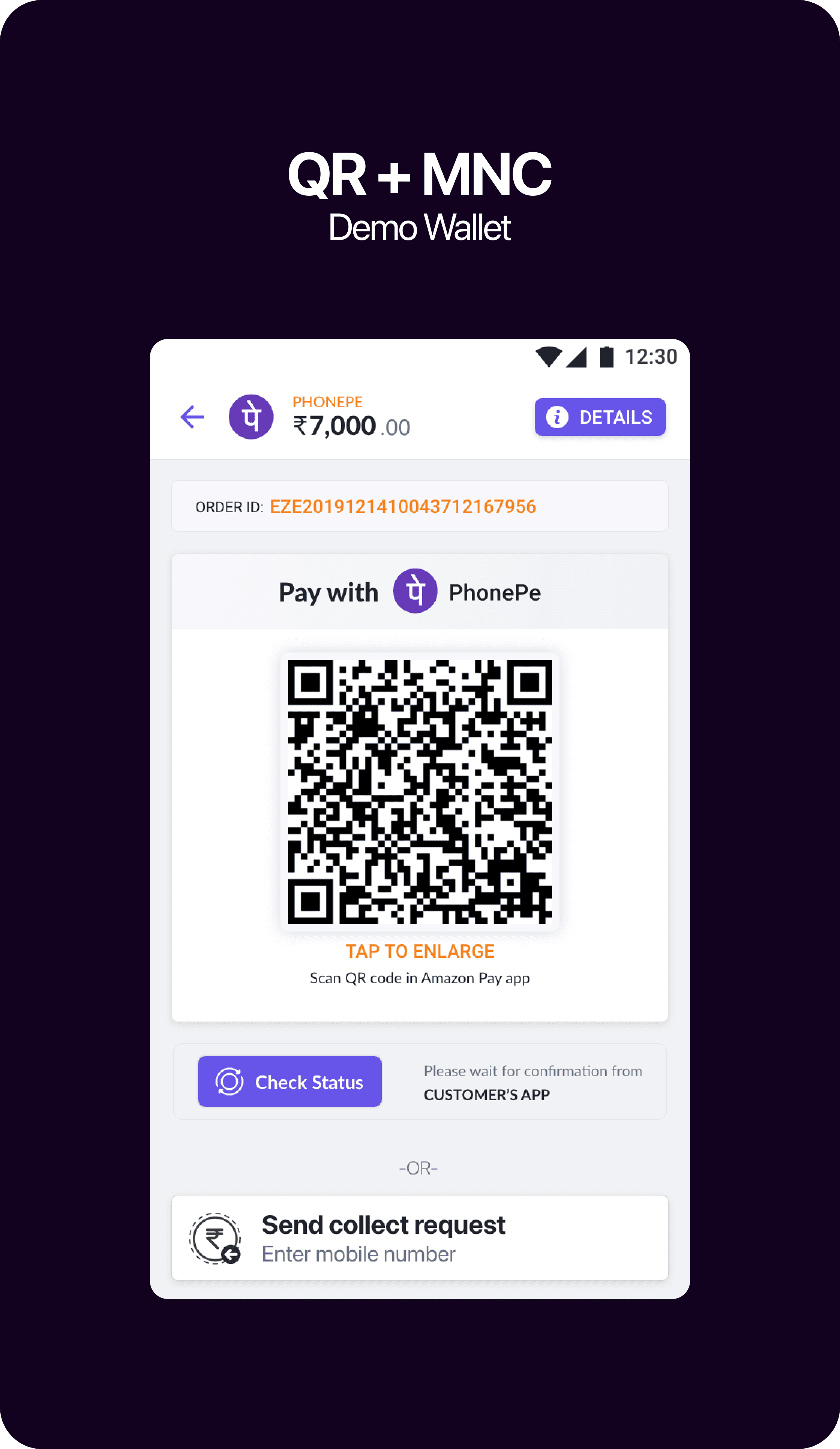

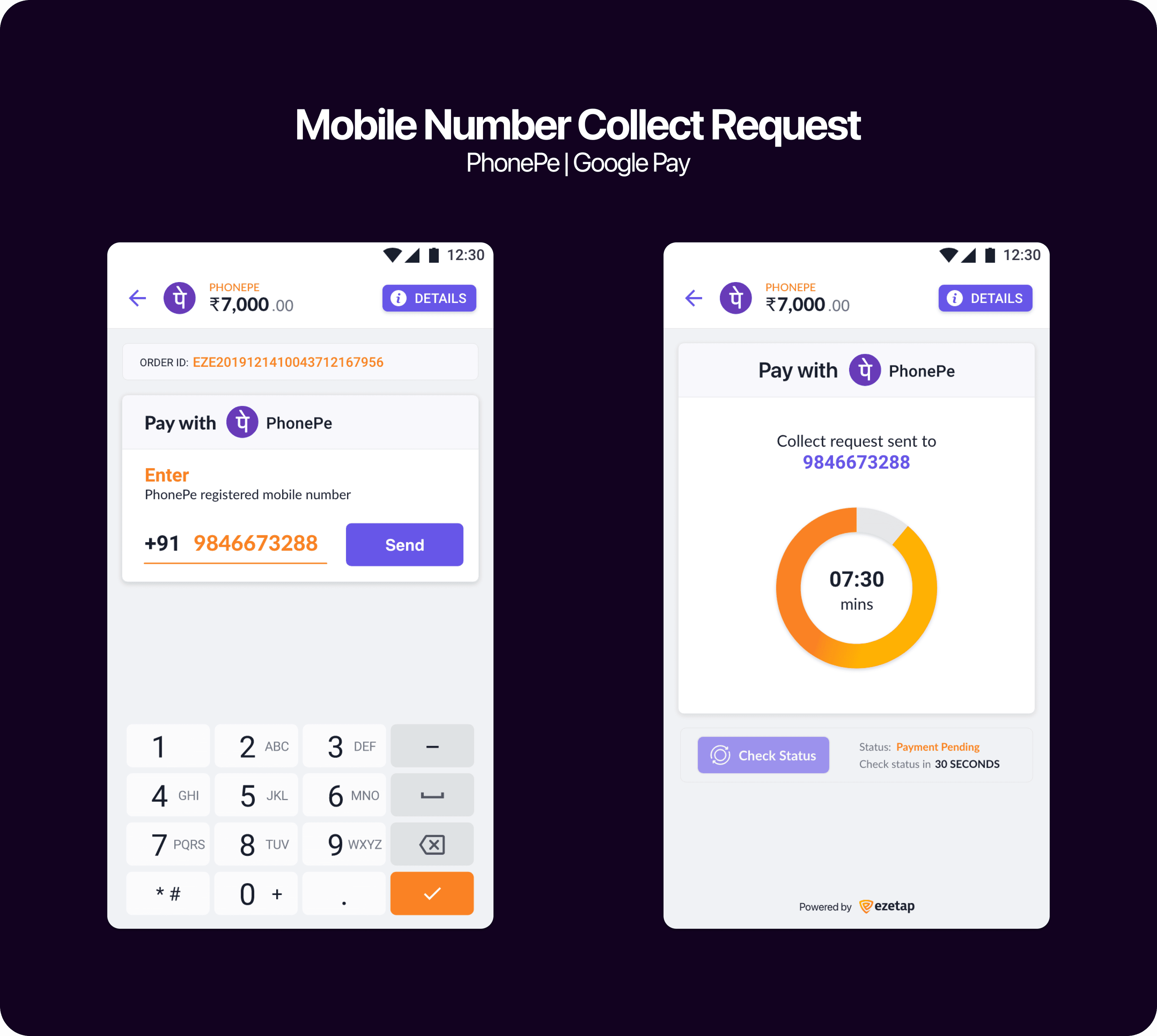

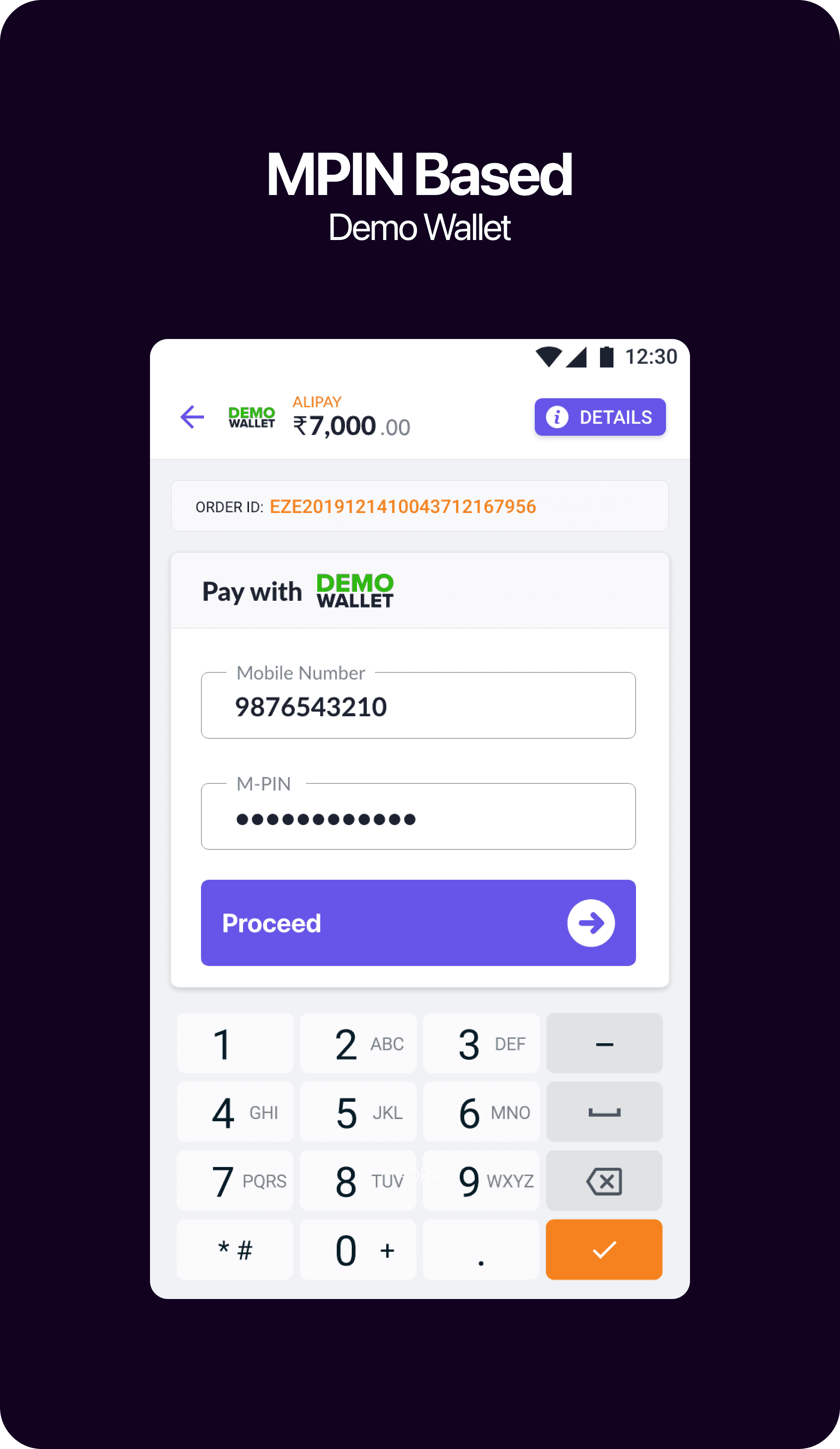

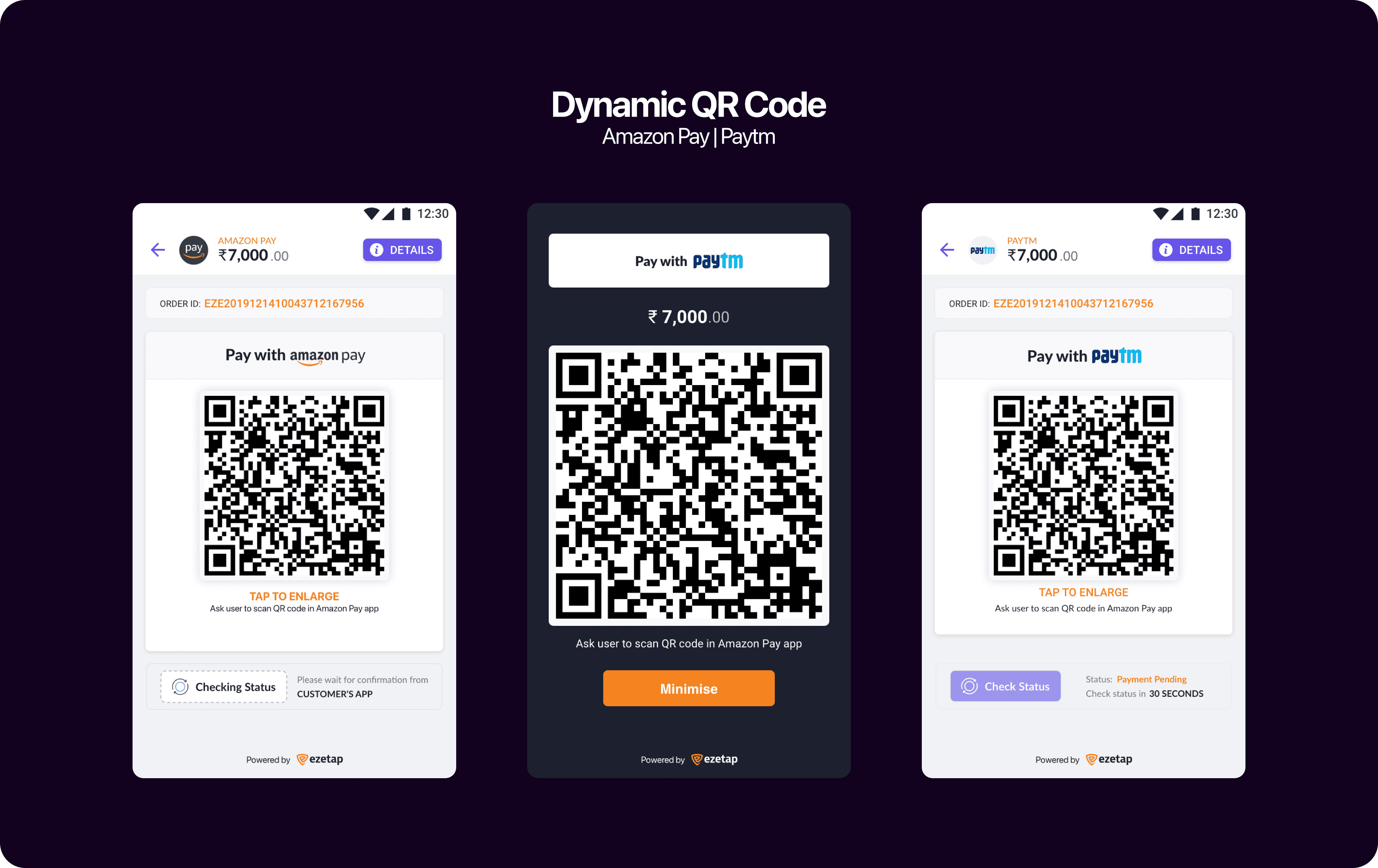

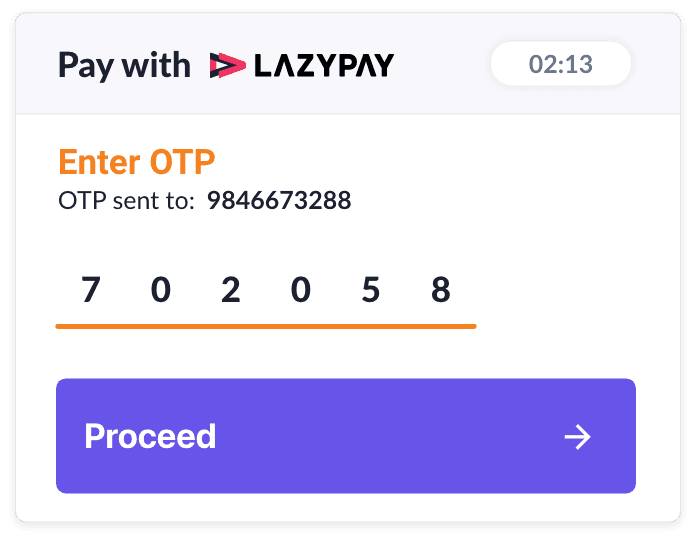

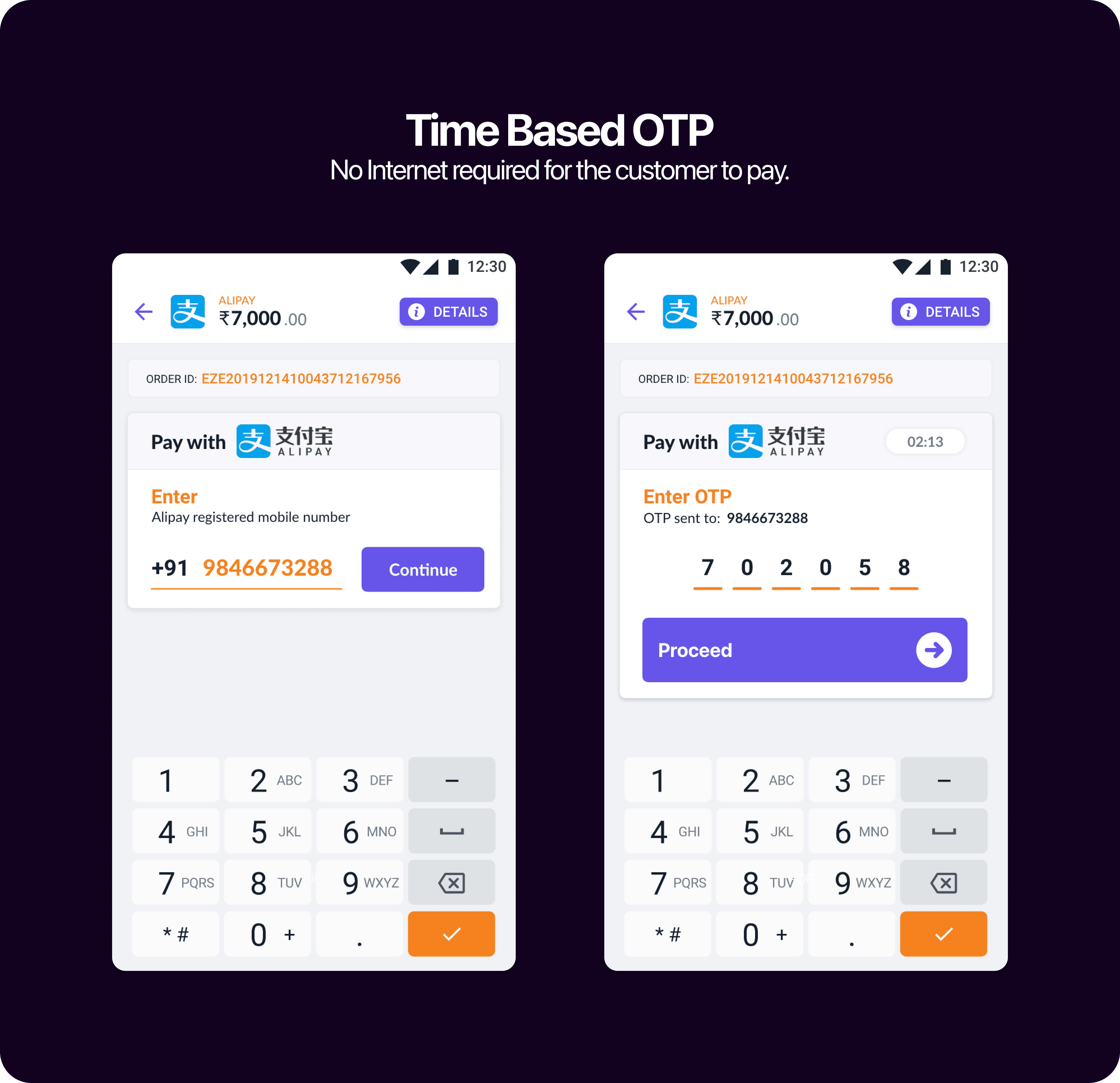

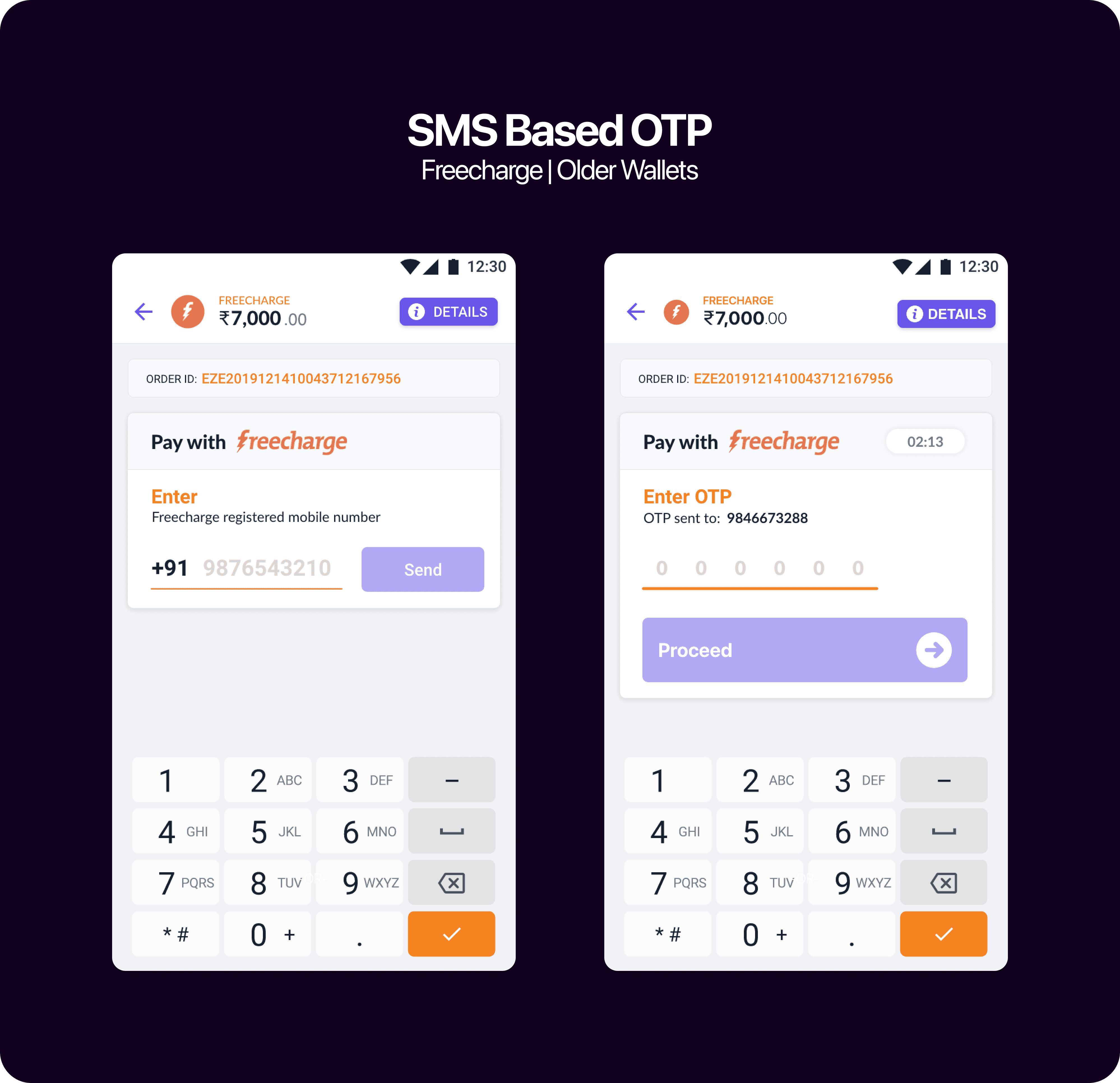

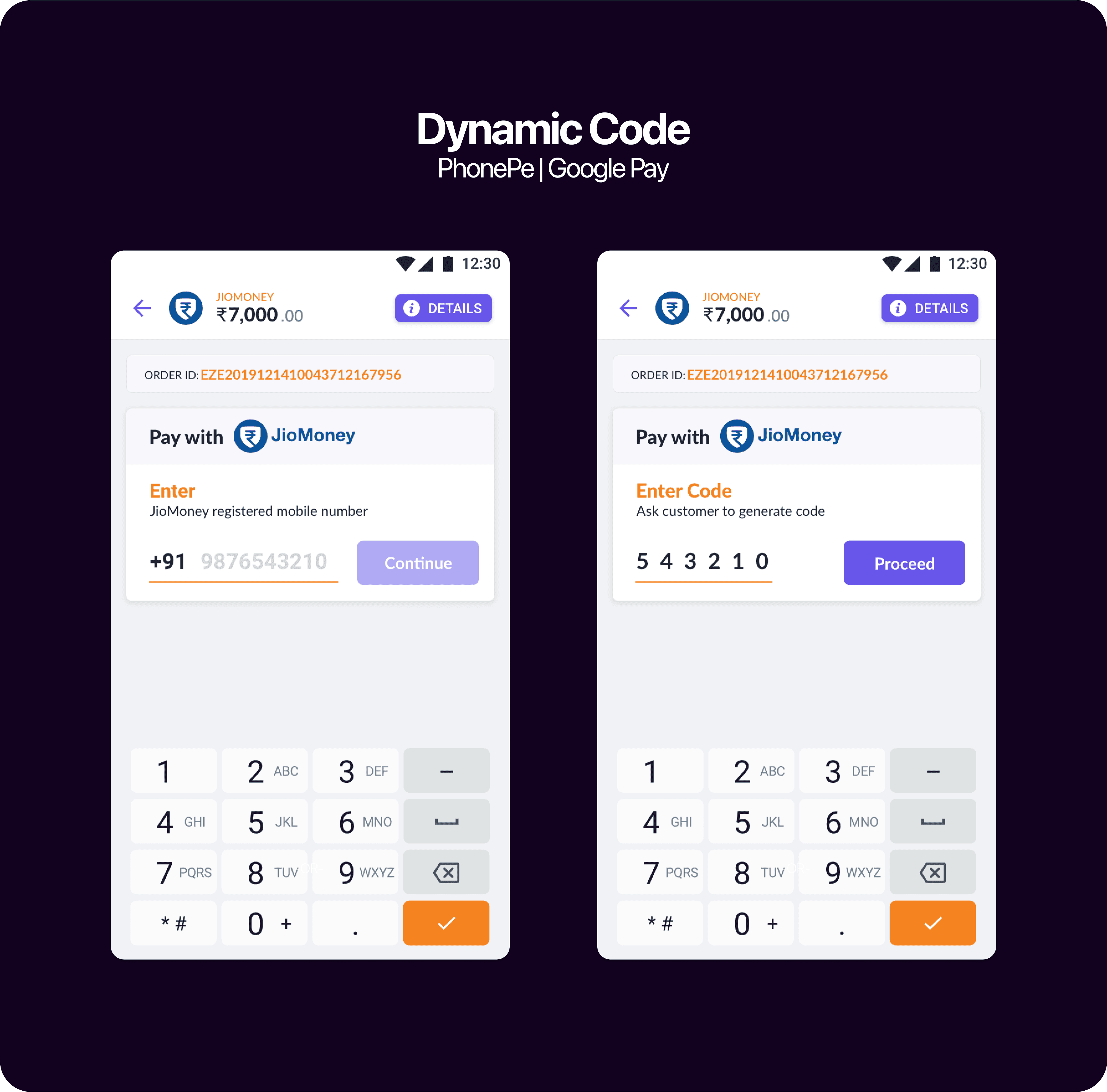

Walletware 2.0

Walletware 2.0

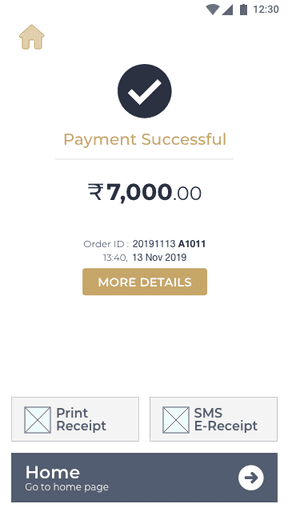

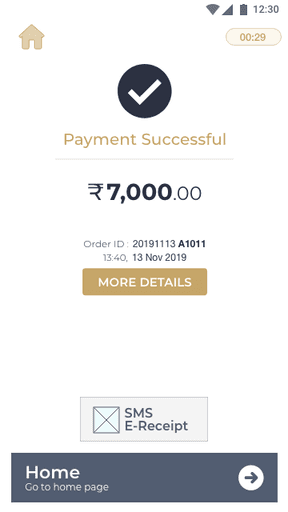

Optimised for Diverse Payments

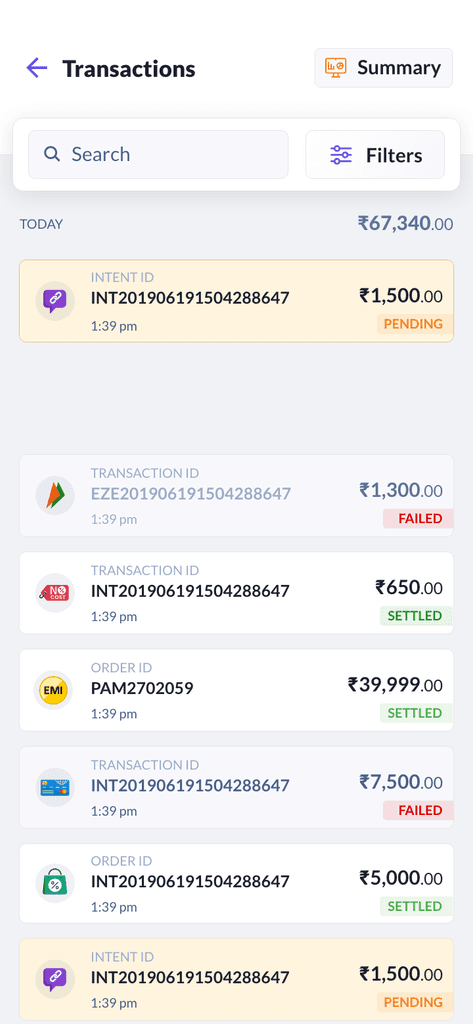

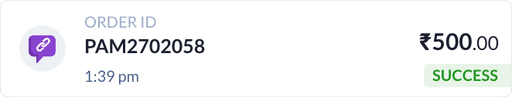

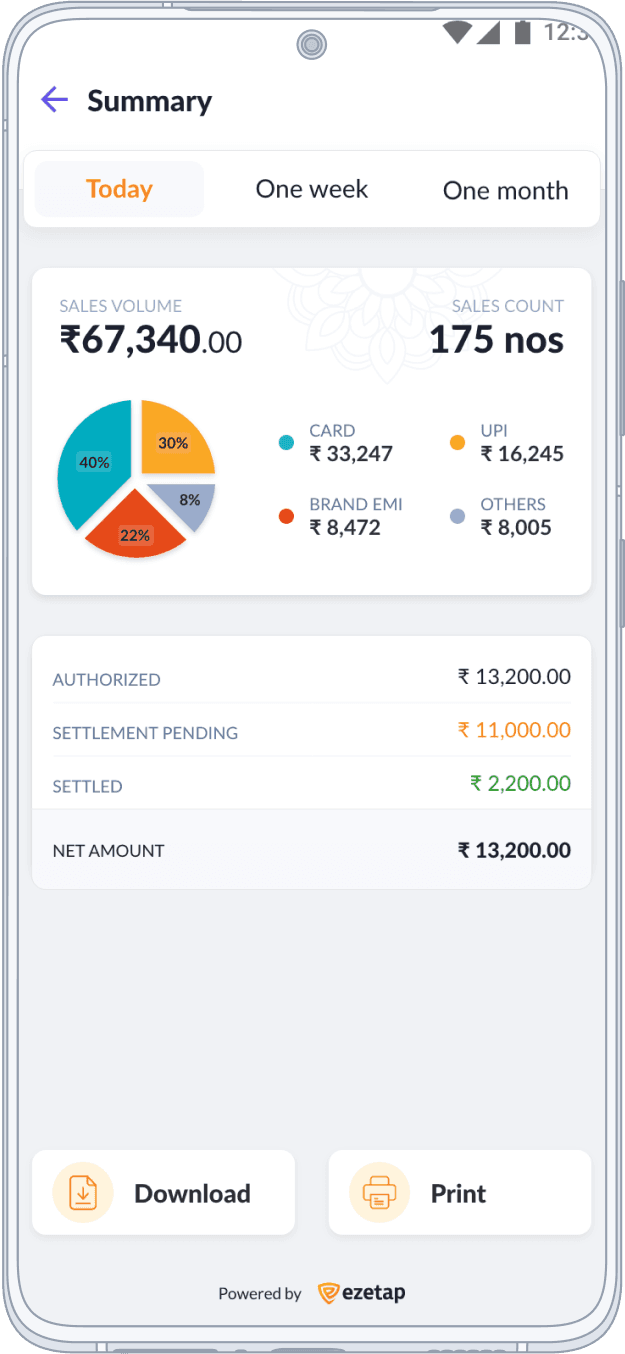

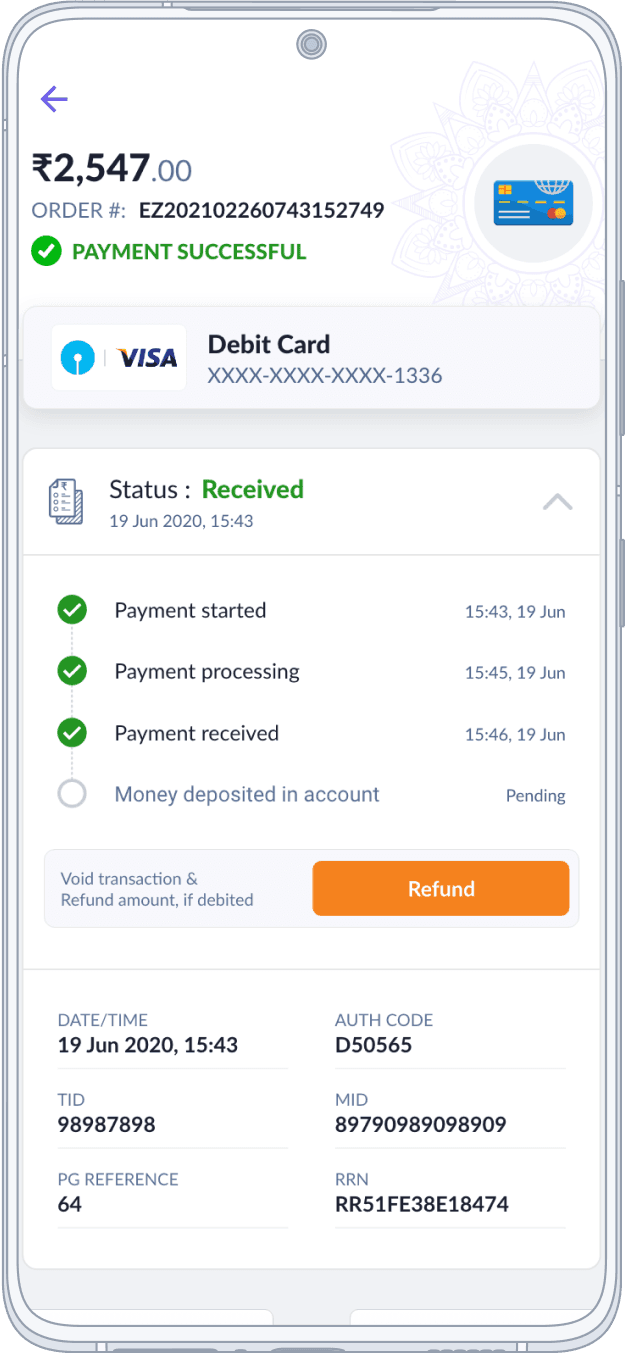

Transaction History

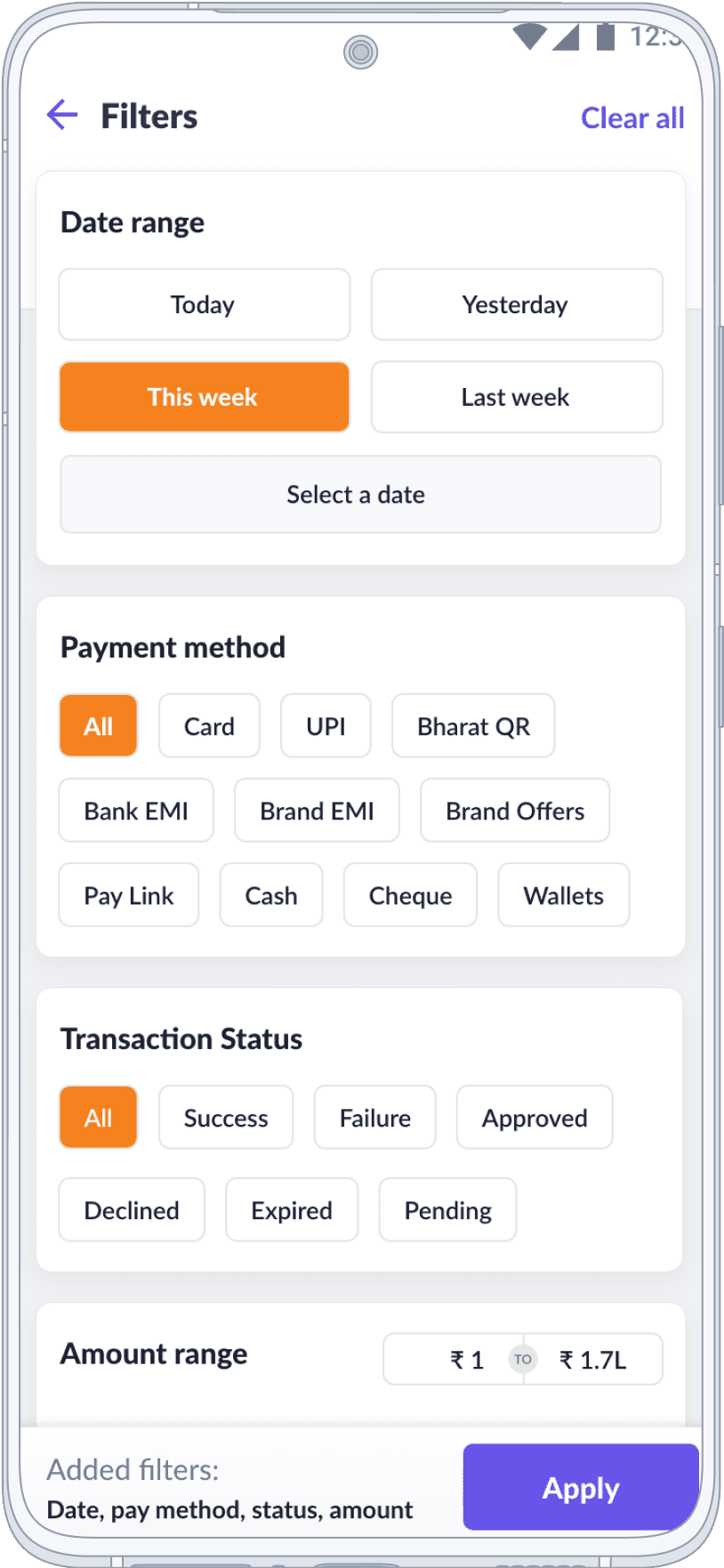

In redesigning the Transaction History section, we tackled the challenge of presenting diverse payment methods cohesively.

Enhanced Transaction History for Diverse Payments

This redesign significantly contributes to providing a streamlined and efficient payment experience for merchants.

An integrated design, logical groupings, and comprehensive transaction insights were the resolution.

Clients can now seamlessly understand their financial activities, whether it's Credit Cards, Wallets, EMIs, Payment Links, or UPI

History

Transaction View

The revamped Transaction History section offers a user-friendly experience tailored to diverse payment methods.

No Cost EMI - Expanded

The revamped Transaction History section offers a user-friendly experience tailored to diverse payment methods.

History

Filters & Summary

With advanced filters, a summary overview, and a detailed transaction view, users can effortlessly track and access their transaction data.

In HDFC Branding

Prototype

XD Prototype of the App branded in HDFC Branding Colors:

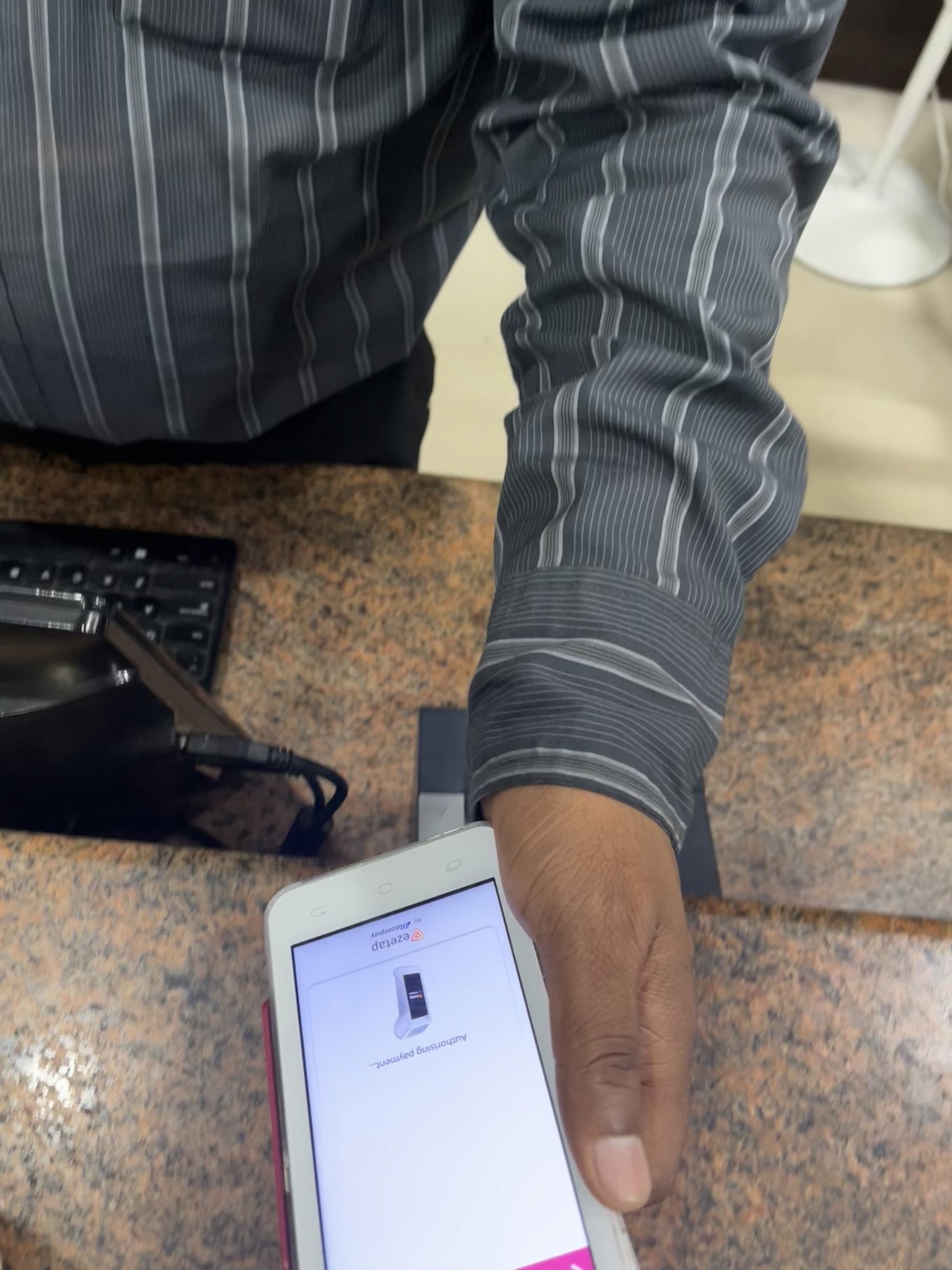

What followed after the release!

Outcomes

Our release had a positive impact, attracting new users and pleasing partner banks with enhanced usability and aesthetics.

It brings me immense satisfaction to realize that the solution I assisted in crafting is now aiding millions of merchants via prominent banks in India and the Middle East.

The new user experience and interface have received widespread acclaim from end-users, partner banks, and enterprises, validating the substantial impact our work has made in the fintech solutions landscape.

End of Case Study

Thank you!

Please open Case Studies on Desktop

UX Designer

Design Manager

Motion GFX Animator

No Code Developer

UX Designer

Design Manager

Motion GFX Animator

No Code Developer

UX Designer

Design Manager

Motion GFX Animator

No Code Developer

UX Designer

Design Manager

Motion GFX Animator

No Code Developer

Crafted with ❤️ & Pixel Alchemy

©️ 2025 Sachin Thumbarathy. All rights reserved.